Global Electronic Brake Force Distribution Market Size, Share, and COVID-19 Impact Analysis, By Type (Drum Brake, and Disc Brake), By Application (Light Commercial Vehicles, Passenger Cars, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

Industry: Automotive & TransportationGlobal Electronic Brake Force Distribution Market Insights Forecasts to 2033

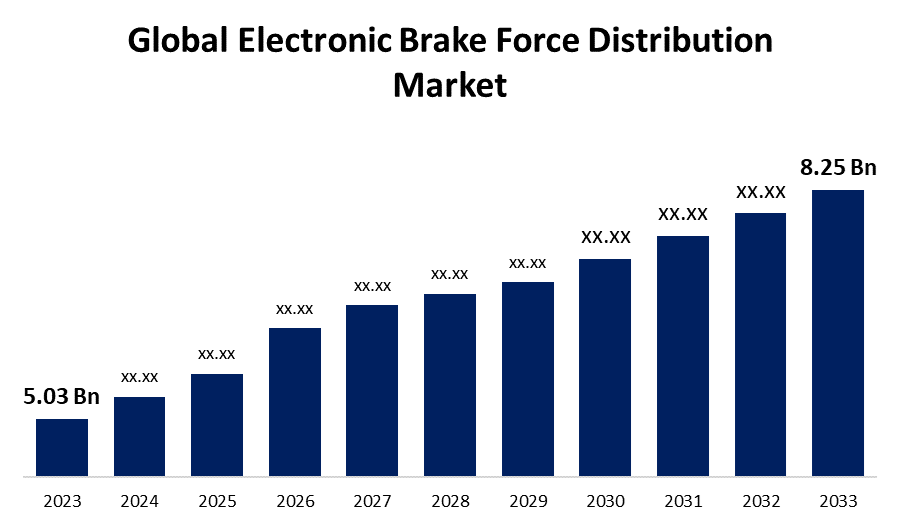

- The Global Electronic Brake Force Distribution Market Size was Valued at USD 5.03 Billion in 2023

- The Market Size is Growing at a CAGR of 5.07% from 2023 to 2033

- The Worldwide Electronic Brake Force Distribution Market Size is Expected to Reach USD 8.25 Billion by 2033

- Europe is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Electronic Brake Force Distribution Market Size is Anticipated to Exceed USD 8.25 Billion by 2033, Growing at a CAGR of 5.07% from 2023 to 2033.

Market Overview

EBD, or electronic brake force distribution, also known as electronic brakeforce limitation, is an automotive brake technology that adjusts the amount of force applied to the vehicle's wheels based on a variety of factors such as road conditions, speed, and load. Electronic brake force distribution is based on the premise that not all wheels bear the same weight, and each wheel requires a varied amount of braking force to come to a stop without losing control of the car. Furthermore, the electronic brake force distribution market's growth is driven by a number of factors, including increased electrification in vehicles, rising demand for improved safety systems in vehicles, and stringent laws and procedures for braking system performance during testing. China, the United States, Japan, India, and Germany are the leading contributors to the automotive electronic brake force distribution (EBD) market growth.

Report Coverage

This research report categorizes the market for the global electronic brake force distribution market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global electronic brake force distribution market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global electronic brake force distribution market.

Global Electronic Brake Force Distribution Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 5.03 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 5.07% |

| 2033 Value Projection: | USD 8.25 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 230 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Application, By Region |

| Companies covered:: | Robert Bosch GmbH, Continental AG, Denso Corporation, WABCO, FTE Automotive, TRW Automotive, Brakes India, Autoliv, Hyundai Mobis, Mando, Knorr Bremse AG, Hitachi Automotive Systems, ABS, Aisin Seiki Co. Ltd., Eaton, Others, and |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Consumers' increasing demand for smooth engine performance around the world, as well as their preference for electronically operated system applications in automotive, are expected to drive market growth. Furthermore, the increasing coupling of ABS systems with EBD and TCS systems by passenger car manufacturers is viewed as a key supporting factor in driving the global electronic brake force distribution market growth. Furthermore, in recent years, the automotive industry has seen an increase in the adoption of electronic brake force distribution systems, driven by a growing demand for safer and more reliable braking solutions. As automakers prioritize safety features to meet stringent regulatory requirements and consumer preferences, EBD systems have emerged as a critical component in modern vehicle design. Furthermore, the growing trend toward electrification and automation in vehicles has accelerated the integration of advanced braking technologies such as EBD, as automakers seek to improve the overall driving experience while reducing the risk of accidents.

Restraining Factors

The high maintenance costs of EBD systems, as well as stringent regulations governing the safety standards of electrical components, are key factors considered to be limiting market growth. Furthermore, the increasing disruption expectancy of brake force modulators at high loads is expected to impede the growth of the electronic brake force distribution market during the forecast period.

Market Segmentation

The global electronic brake force distribution market share is classified into type and application.

- The disc brakes segment is expected to hold the largest share of the global electronic brake force distribution market during the forecast period.

Based on the type, the global electronic brake force distribution market is divided into drum brakes and disc brakes. Among these, the disc brakes segment is expected to hold the largest share of the global electronic brake force distribution market during the forecast period. This is because disc brakes provide superior stopping power, heat dissipation, and responsiveness. They are made up of a rotor attached to the wheel and brake pads clamped onto the rotor by calipers, which creates friction and slows the vehicle. Due to these factors, the disk brake segment is dominating the global electronic brake force distribution market.

- The commercial vehicles segment is expected to grow at the fastest CAGR in the global electronic brake force distribution market during the forecast period.

Based on the application, the global electronic brake force distribution market is divided into light commercial vehicles, passenger cars, and others. Among these, the commercial vehicles segment is expected to grow at the fastest CAGR in the global electronic brake force distribution market during the forecast period. The strict safety regulations that govern commercial vehicle operations, combined with the need to reduce the risks associated with heavy vehicle braking, highlight the importance of EBD technology in this segment. Commercial vehicle manufacturers are thus incorporating advanced EBD systems into their fleet offerings to improve braking performance, stability, and overall safety standards, meeting the needs of both regulatory compliance and fleet operator preferences.

Regional Segment Analysis of the Global Electronic Brake Force Distribution Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the global electronic brake force distribution market over the predicted timeframe.

Get more details on this report -

Asia Pacific is anticipated to hold the largest share of the global electronic brake force distribution market over the predicted timeframe. As the world's largest passenger car market, Asia Pacific accounts for the majority of the electronic brake force distribution system market. Furthermore, increasing automation adoption, which leads to an increase in passenger car and commercial vehicle sales, is a key supporting factor considered to drive regional market growth. Furthermore, the region's market growth is expected to be driven by manufacturers' concern for consumer safety in the face of stringent government regulations. China has the largest market share in the APAC region due to the widespread adoption of automation for mass manufacturing and the growing popularity of electronic car units among regional consumers.

Europe is expected to grow at the fastest pace in the global electronic brake force distribution market during the forecast period. EBD systems are increasingly being integrated into new vehicle models to meet regulatory requirements and satisfy consumer demand for advanced safety features. Furthermore, the region's emphasis on environmental sustainability encourages innovation in regenerative braking technologies, increasing the appeal of EBD systems to European consumers.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global electronic brake force distribution market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Robert Bosch GmbH

- Continental AG

- Denso Corporation

- WABCO

- FTE Automotive

- TRW Automotive

- Brakes India

- Autoliv

- Hyundai Mobis

- Mando

- Knorr Bremse AG

- Hitachi Automotive Systems

- ABS

- Aisin Seiki Co. Ltd.

- Eaton

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In November 2023, Shanghai, China. At its Next Generation Mobility Day in Shanghai, ZF debuts a new, entirely electromechanical brake system for the first time. An electric motor generates braking force at each wheel, which eliminates the need for a hydraulic system or brake fluid. The brake system was developed for the global market by ZF's development centers in China, the United States, and Germany.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global electronic brake force distribution market based on the below-mentioned segments:

Global Electronic Brake Force Distribution Market, By Type

- Drum Brake

- Disc Brake

Global Electronic Brake Force Distribution Market, By Application

- Light Commercial Vehicles

- Passenger Cars

- Others

Global Electronic Brake Force Distribution Market, Regional

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1.Which are the key companies that are currently operating within the market?Robert Bosch GmbH, Continental AG, Denso Corporation, WABCO, FTE Automotive, TRW Automotive, Brakes India, Autoliv, Hyundai Mobis, Mando, Knorr Bremse AG, Hitachi Automotive Systems, ABS, Aisin Seiki Co. Ltd., Eaton, and Others.

-

2.What is the size of the global Electronic Brake Force Distribution market?The Global Electronic Brake Force Distribution Market is expected to grow from USD 5.03 Billion in 2023 to USD 8.25 Billion by 2033, at a CAGR of 5.07% during the forecast period 2023-2033.

-

3.Which region is holding the largest share of the market?Asia Pacific is anticipated to hold the largest share of the global Electronic Brake Force Distribution market over the predicted timeframe.

Need help to buy this report?