Global Electronic Gastroscope Market Size, Share, and COVID-19 Impact Analysis, by Product (Endoscope, Visualization Systems, Accessories, Others), by Application (GI Endoscopy, Laparoscopy, Obstetrics/ Gynecology Endoscopy, Arthroscopy, Urology Endoscopy (Cystoscopy), Bronchoscopy, Ent Endoscopy, Mediastinoscopy, Others), by End User (Hospitals, Ambulatory Surgery centers/Clinics, Others), and by Region (North America, Europe, Asia-Pacific, South America, Middle East and Africa) Analysis and Forecast 2021 – 2030

Industry: HealthcareMARKET OVERVIEW

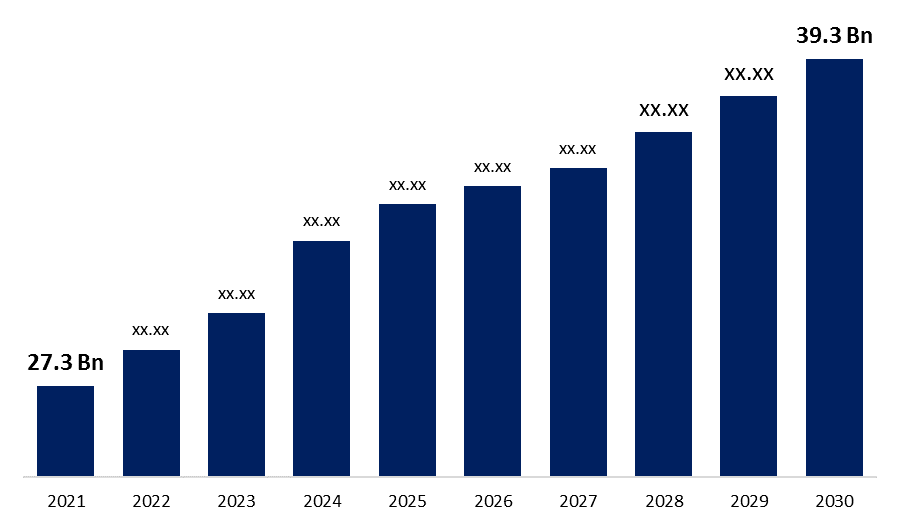

The Global Electronic Gastroscope Market Size was valued at USD 27.3 Bn in 2021. The market is projected to grow USD 39.3 Bn in 2030, at a CAGR of 7.5%. Endoscopic procedures are non-surgical or minimally invasive treatments that involve the use of endoscopy devices and supplies to inspect a patient's internal organ or tissue in great detail. Many tools and equipment are used during endoscopy to ensure a safe and successful procedure, including procedure-specific scopes, video monitors, imaging devices, anesthetic equipment, monitoring equipment, light sources, video processors, insufflators, endoscope cabinets, and an endoscopy cart or trolley. Gastroenterologists, gynecologists, nephrologists, neurologist, cardiologist, hepatologist, and liver transplant surgeons are the most common users of endoscopy equipment.

Get more details on this report -

The less intrusive qualities of endoscopic equipment, as well as their low post- and pre-procedure costs, are expected to drive market expansion over the projection period. Furthermore, a shift in trend toward the usage of disposable endoscopic components to reduce procedure costs and the risk of cross-contamination is likely to fuel market expansion in the coming years.

COVID-19 ANALYSIS

The COVID-19 epidemic has triggered a global emergency. COVID-19 infection is more likely to affect surgeons and patients who frequent hospitals for various procedures. COVID-19 cases have overwhelmed German hospitals; as a result, all elective procedures have been cancelled or postponed. In large hospitals across Germany, approximately 40–50 percent of endoscopic procedures were cancelled. In the second and third quarters of 2020, sales of endoscopic equipment downfalls. As many hospitals and clinics lack the resources and manpower to adhere to and implement the stringent COVID-19 guidelines put forth by the European Society for Gastrointestinal Endoscopy (ESGE) and the German Respiratory Society (Deutsche Gesellschaft für Pneumologie und Beatmungsmedizin or DGP), disposable endoscope sales have increased. To reduce the risk of infection, negative pressure suites and personal protective kits should be used, as well as ward isolation. As a result, endoscopic therapy has become more expensive overall. These issues will limit the endoscopy market's growth in 2020. With the global distribution of vaccines, the industry is expected to recover in the future years.

The rising global burden of chronic disease and the growing geriatric population are also expected to drive endoscopic device use in the coming years. Furthermore, as the ageing population grows, more medical disorders that require endoscopic intervention, such as liver abscess, gall stones, endometriosis, and intestinal perforation, are expected to boost the market for endoscopy devices in the coming years. According to the Administration on Aging (AoA) of the United States Department of Health and Human Services, around 16% of the population was over 65 years old in 2019. By 2040, this figure is predicted to rise to 21.6 percent.

The decrease in endoscopic procedures during the COVID-19 pandemic was mostly due to a fall in patient volume in hospitals as a result of procedure rescheduling and delaying for safety concerns. Furthermore, these delays occurred after a thorough examination of the patient's medical history, and if possible, healthcare practitioners rescheduled endoscopic treatments to reduce the risk of COVID-19 exposure during hospital visits. All of these variables are expected to have an impact on the endoscopic equipment market in the future.

Global Electronic Gastroscope Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2021 |

| Market Size in 2021: | USD 27.3 Billion |

| Forecast Period: | 2021-2030 |

| Forecast Period CAGR 2021-2030 : | 7.5% |

| 2030 Value Projection: | USD 39.3 Billion |

| Historical Data for: | 2017-2020 |

| No. of Pages: | 140 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | COVID-19 Impact Analysis, By Product, By Application, By End User, By Region |

| Companies covered:: | Olympus Corporation, Ethicon Endo-surgery, LLC., FUJIFILM Holdings Corporation, Stryker Corporation, Boston Scientific Corporation, Karl Storz GmbH & Co. KG, Smith & Nephew Inc., Richard Wolf GmbH, Medtronic Plc (Covidien), PENTAX Medical, Machida Endoscope Co., Ltd., Others |

Get more details on this report -

SEGMENTATION

The global electronic gastroscope market is segmented by Product (Endoscope, Visualization Systems, Accessories, Others), by Application (GI Endoscopy, Laparoscopy, Obstetrics/ Gynecology Endoscopy, Arthroscopy, Urology Endoscopy (Cystoscopy), Bronchoscopy, Ent Endoscopy, Mediastinoscopy, Others), by End User (Hospitals, Ambulatory Surgery centers/Clinics, Others) and region. Based on the application type, the market is categorized into endoscope, visualization systems, accessories, others. Based on connectivity, the market is categorized into GI endoscopy, laparoscopy, obstetrics/ gynecology endoscopy, arthroscopy, urology endoscopy (cystoscopy), bronchoscopy, ENT endoscopy, mediastinoscopy, others. Based on end user, the market is categorized into hospitals, ambulatory surgery centers/clinics, others. Based on the region, the market is categorized into North America, Europe, Asia-Pacific, South America, Middle East and Africa.

Product Insights

Based on the product type segment, the global electronic gastroscope market is categorized into endoscope, visualization systems, accessories, others. The endoscope segment has dominated the market share of the global electronic gastroscope market in 2020 owing to higher adoption rate of these equipment by end users, rising preference of patients and doctors for minimally invasive procedures, and ongoing advancements in endoscopy technologies.

The visualization systems are anticipated to experience significant growth during the forecast period owing to wide applicability for the imaging and diagnosis of complex medical conditions such as cancer, GI diseases, urinary disorders, and lung problems during endoscopy operations. Furthermore, the emergence of next-generation endoscopic visualisation technologies, which allow surgeons to visualise the internal organ of choice with a minimally invasive procedure, is encouraging adoption and indicating a higher market share for the category.

Application Insights

Based on the application segment, the global electronic gastroscope market is categorized into GI Endoscopy, Laparoscopy, Obstetrics/ Gynecology Endoscopy, Arthroscopy, Urology Endoscopy (Cystoscopy), Bronchoscopy, Ent Endoscopy, Mediastinoscopy, Others. The gastrointestinal endoscopy held the largest market share in 2020 of the global electronic gastroscope market attributing to the rising prevalence of colorectal cancer (CRC) in younger adults, as well as the growing geriatric population in the United States, China, Japan, and India, has resulted in a greater awareness of the target demographic for CRC screening.

The urology endoscopy (cystoscopy) is anticipated to experience significant growth during the forecast period owing to increasing emergence of chronic urological disorders such as cancer and tumours are becoming more common, as is the number of cystoscopy procedures. According to a research issued by Cancer Research UK, roughly 10,300 new cases of bladder cancer are diagnosed in the United Kingdom each year, making it the 11th most frequent cancer in the country. Because cystoscopy is the most common way to diagnose bladder cancer, it is expected to drive segment development in the coming years.

End User Insights

Based on the end user segment, the global electronic gastroscope market is categorized into hospitals, Ambulatory Surgery centers/Clinics, & online. The hospitals segment is dominated the market share in 2020 owing to the endoscopy equipment is becoming more widely used in hospitals, and government and private financing for healthcare is expanding, as is the availability of competent healthcare personnel and technologically advanced facilities.

REGIONAL INSIGHTS

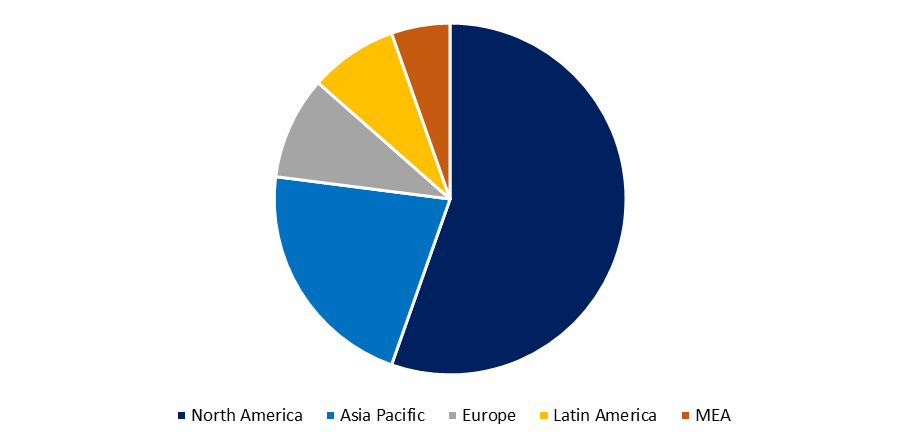

The global electronic gastroscope market is categorized into North America, Europe, Asia-Pacific, Latin America, Middle East and Africa.

Get more details on this report -

North America region is dominating the market share of global electronic gastroscope market owing to the favourable reimbursement policies for endoscopic procedures in the United States, increased awareness of cancer, high hospital investments in new endoscopic equipment, a strong focus on research activities to improve endoscopy techniques, and the implementation of a new funding model by Canadian hospitals are all factors to consider. However, Asia Pacific is expected to witness highest growth rate during the forecast period of beverage Visualization System market due to the rising population and urbanization activities. Increased number of athletes and the growing popularity of various exercise activities are fueling the growth of the global electronic gastroscope market. According to the Special Olympics, India saw the most growth in 2018, with around 80,000 new child athletes. However, rising middle-class customers with changing lifestyles, particularly in emerging nations like China and India, are driving demand for naturally flavored sports drinks and in turn creating the demand for the growth of the global electronic gastroscope market.

INDUSTRY PLAYERS

- Olympus Corporation

- Ethicon Endo-surgery, LLC.

- FUJIFILM Holdings Corporation

- Stryker Corporation

- Boston Scientific Corporation

- Karl Storz GmbH & Co. KG

- Smith & Nephew Inc.

- Richard Wolf GmbH

- Medtronic Plc (Covidien)

- PENTAX Medical

- Machida Endoscope Co., Ltd.

- Others

KEY INDUSTRY DEVELOPMENTS:

September 2020- PENTAX Medical announced to launch new Ultrasound Video Gastroscopes J10 Series in the U.S. These advanced gastroscopes enable better image quality, increase diagnostic capabilities, and help in effective disease management of the patient.

SEGMENTATION

By Product

- Endoscope

- Visualization System

- Accessories

- Others

By Application

- Gastrointestinal Endoscopy

- Laparoscopy

- Obstetrics/ Gynecology Endoscopy

- Arthroscopy

- Urology Endoscopy (Cystoscopy)

- Bronchoscopy

- Ent Endoscopy

- Mediastinoscopy

- Others

By End User

- Hospitals

- Ambulatory Surgery centers/Clinics

- Others

By Region

- North America- U.S., Mexico, Canada

- Europe- UK, France, Germany, Italy

- Asia-Pacific- China, Japan, India

- Latin America- Brazil, Argentina, Colombia

The Middle East and Africa- United Arab Emirates, Saudi Arabia

Need help to buy this report?