Global Electronic Logging Device Market Size, Share, and COVID-19 Impact Analysis, by Component (Display, Telematics unit), by Form factor (Embedded, Integrated), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Automotive & TransportationGlobal Electronic Logging Device Market Insights Forecasts to 2033

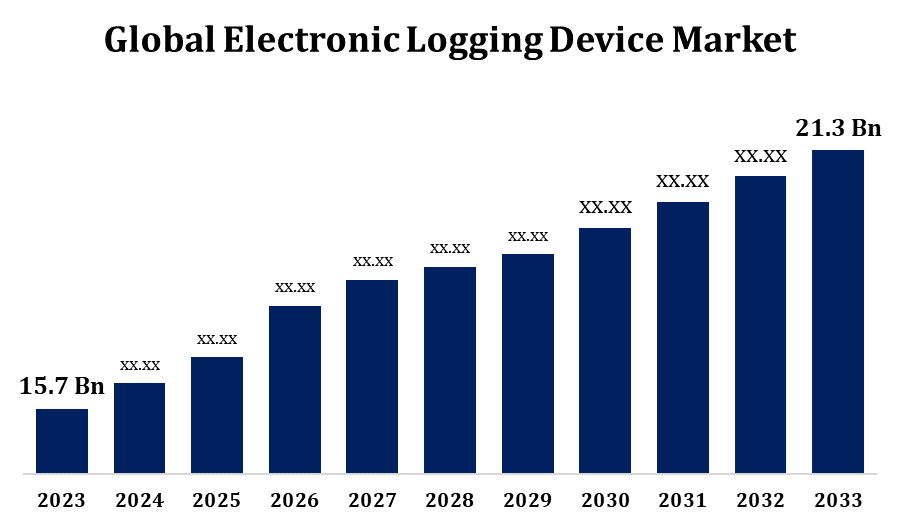

- The Electronic Logging Device Market Size was valued at USD 15.7 Billion in 2023.

- The Market Size is Growing at a CAGR of 3.10% from 2023 to 2033.

- The Global Electronic Logging Device Market Size is expected to reach USD 21.3 Billion By 2033.

- Asia Pacific is Expected to Grow the Fastest during the Forecast period.

Get more details on this report -

The Global Electronic Logging Device Market Size is expected to reach USD 21.3 billion By 2033, at a CAGR of 3.10% during the forecast period 2023 to 2033.

The Electronic Logging Device market is experiencing steady growth, driven by regulatory mandates, fleet management efficiency, and the rising adoption of digital solutions in the transportation industry. Electronic Logging Devices (ELDs) automate driver hours-of-service (HOS) tracking, ensuring compliance with safety regulations like the U.S. FMCSA ELD mandate. The market is fueled by increasing demand for real-time vehicle tracking, data analytics, and fuel management solutions. Key players include Geotab, Omnitracs, Samsara, and Verizon Connect. Small and medium-sized fleets are also adopting ELDs due to cost-effective cloud-based solutions. Challenges include cybersecurity threats and resistance from traditional fleets. However, advancements in AI and telematics integration are expected to drive further market expansion. North America dominates, with Asia-Pacific and Europe witnessing growing adoption.

Electronic Logging Device Market Value Chain Analysis

The Electronic Logging Device market value chain involves multiple stages, from component suppliers to end users. It begins with hardware and software providers, supplying GPS modules, sensors, cloud computing, and telematics solutions. Device manufacturers integrate these components into Electronic Logging Devices (ELDs) with user-friendly interfaces. Software developers create fleet management platforms for data analytics, compliance tracking, and real-time monitoring. System integrators ensure seamless connectivity between ELDs, fleet management systems, and regulatory databases. Distributors and resellers supply ELDs to fleet operators, trucking companies, and independent drivers. End users, including logistics firms, transport operators, and regulatory bodies, utilize ELDs for compliance, safety, and operational efficiency. The value chain is increasingly driven by AI, IoT, and cloud-based innovations, enhancing automation and data-driven decision-making.

Electronic Logging Device Market Opportunity Analysis

The Electronic Logging Device market presents significant opportunities driven by regulatory compliance, technological advancements, and the growing demand for fleet efficiency. The increasing adoption of Electronic Logging Devices (ELDs) among small and medium-sized fleets offers a major growth avenue, as cost-effective and cloud-based solutions become more accessible. The integration of artificial intelligence, IoT, and telematics into ELD systems enhances predictive analytics, fuel optimization, and real-time tracking, creating value for fleet operators. Expanding e-commerce and logistics industries further drive market demand. Emerging markets in Asia-Pacific and Latin America provide untapped potential due to evolving regulations and digital transformation in transportation. Additionally, partnerships between ELD providers and vehicle manufacturers present new revenue streams. Addressing cybersecurity concerns and user adoption resistance will be key to market expansion.

Global Electronic Logging Device Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 15.7 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 3.10% |

| 2033 Value Projection: | USD 21.3 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 220 |

| Tables, Charts & Figures: | 95 |

| Segments covered: | by Component, by Form factor, By Region and COVID-19 Impact Analysis |

| Companies covered:: | Geotab Inc., Verizon Connect, Wabco Holdings Inc., Omnitracs, KeepTruckin, EROAD, Coretex Telematics, GPS Insight, Samsara Inc., Fleetmatics, Eflow, BigRoad, Azuga, Teletrac Navman, Roadtec Solutions, Macmit LLC, Logit Systems Inc., Gurtam, Onfleet, and others key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics

Electronic Logging Device Market Dynamics

The growing adoption of fleet management systems to enhance regulatory compliance

The growing adoption of fleet management systems to enhance regulatory compliance is a key driver in the Electronic Logging Device (ELD) market. With stringent government mandates requiring accurate hours-of-service (HOS) tracking, fleet operators are increasingly integrating ELDs with advanced fleet management solutions. These systems improve compliance by automating recordkeeping, reducing human errors, and ensuring real-time data monitoring. Additionally, they enhance operational efficiency through GPS tracking, fuel optimization, and predictive maintenance. Small and medium-sized fleets are embracing cloud-based ELD solutions for cost-effectiveness and scalability. The rise of IoT, AI-driven analytics, and telematics further strengthens compliance measures while providing actionable insights for fleet managers. As global regulations evolve, the demand for integrated fleet management and ELD solutions continues to grow, driving market expansion.

Restraints & Challenges

High initial costs and ongoing subscription fees can be a barrier, particularly for small and medium-sized fleet operators. Resistance to change from traditional drivers and fleet managers also slows adoption, as some perceive Electronic Logging Devices (ELDs) as intrusive or complex. Cybersecurity risks pose another challenge, as ELDs collect and transmit sensitive data that can be vulnerable to hacking. Technical issues such as device malfunctions, poor connectivity in remote areas, and software compatibility problems can impact reliability. Additionally, evolving regulatory requirements across different regions create compliance complexities for multinational fleet operators.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Electronic Logging Device Market from 2023 to 2033. The Federal Motor Carrier Safety Administration (FMCSA) ELD mandate, which requires commercial motor vehicle operators to use Electronic Logging Devices (ELDs) for hours-of-service (HOS) compliance, has been a major market driver. The U.S. and Canada lead in ELD adoption, with growing interest in Mexico due to evolving transportation regulations. Technological advancements, such as AI-driven analytics, IoT integration, and cloud-based fleet management systems, further boost market growth. Key players, including Samsara, Geotab, Omnitracs, and Verizon Connect, offer advanced solutions to improve fleet efficiency, compliance, and safety.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. Australia, China, India, and Japan are strengthening regulatory frameworks to enhance road safety and ensure accurate hours-of-service (HOS) tracking for commercial drivers. Governments are introducing stricter mandates for Electronic Logging Devices (ELDs) to reduce driver fatigue, prevent accidents, and improve operational transparency. In Australia, the National Heavy Vehicle Regulator (NHVR) is driving ELD adoption, while China is integrating ELDs with its growing smart transportation initiatives. India’s rising logistics sector and evolving transport regulations are fostering demand for digital fleet management solutions. Meanwhile, Japan is leveraging telematics and AI to optimize compliance and efficiency. The rapid expansion of e-commerce and logistics is fueling the need for real-time tracking, automated reporting, and data-driven insights. Advancements in AI, IoT, and cloud-based fleet management systems are further accelerating ELD adoption across the region.

Segmentation Analysis

Insights by Form Factor

The embedded segment accounted for the largest market share over the forecast period 2023 to 2033. Unlike bring-your-own-device (BYOD) solutions, embedded ELDs are permanently installed in vehicles, reducing tampering risks and ensuring compliance with hours-of-service (HOS) regulations. These systems offer enhanced durability, real-time data transmission, and better synchronization with fleet management software, making them a preferred choice for large fleets. The rise of smart transportation, AI-driven analytics, and IoT-based telematics is further driving adoption. Additionally, regulatory bodies across regions are encouraging the use of secure, tamper-proof ELD solutions, boosting demand.

Insights by Component

The telematics unit segment accounted for the largest market share over the forecast period 2023 to 2033. The growth is driven by the increasing demand for real-time fleet monitoring, regulatory compliance, and data-driven decision-making. These units integrate GPS, IoT, and AI-powered analytics to enhance route optimization, fuel efficiency, and driver safety. With government mandates requiring accurate hours-of-service (HOS) tracking, fleet operators are adopting telematics-based ELDs for automated logging and compliance. The rise of connected vehicles, smart logistics, and cloud-based fleet management solutions further accelerates adoption. Additionally, the expansion of e-commerce and long-haul transportation is fueling demand for advanced telematics units.

Recent Market Developments

- In March 2024, Geotab, a leading ELD provider, has partnered with Daimler Trucks North America to integrate its MyGeotab platform with Daimler trucks. This collaboration aims to enhance data connectivity and optimize fleet management for trucking businesses.

Competitive Landscape

Major players in the market

- Geotab Inc.

- Verizon Connect

- Wabco Holdings Inc.

- Omnitracs

- KeepTruckin

- EROAD

- Coretex Telematics

- GPS Insight

- Samsara Inc.

- Fleetmatics

- Eflow

- BigRoad

- Azuga

- Teletrac Navman

- Roadtec Solutions

- Macmit LLC

- Logit Systems Inc.

- Gurtam

- Onfleet

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Electronic Logging Device Market, Component Analysis

- Display

- Telematics unit

Electronic Logging Device Market, Form Factor Analysis

- Embedded

- Integrated

Electronic Logging Device Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Electronic Logging Device Market?The global Electronic Logging Device Market is expected to grow from USD 15.7 billion in 2023 to USD 21.3 billion by 2033, at a CAGR of 3.10% during the forecast period 2023-2033.

-

2. Who are the key market players of the Electronic Logging Device Market?Some of the key market players of the market are Geotab Inc., Verizon Connect, Wabco Holdings Inc., Omnitracs, KeepTruckin, EROAD, Coretex Telematics, GPS Insight, Samsara Inc., Fleetmatics, Eflow, BigRoad, Azuga, Teletrac Navman, Roadtec Solutions, Macmit LLC, Logit Systems Inc., Gurtam, Onfleet.

-

3. Which segment holds the largest market share?The embedded segment holds the largest market share and is going to continue its dominance.

Need help to buy this report?