Global Embedded Finance Market Size, Share, and COVID-19 Impact Analysis, By Finance Type (Embedded Payment, Embedded Insurance, Embedded Investment, Embedded Lending, Embedded Banking), By Business Model, (B2B, B2C, B2B2B, B2B2C), By End-Use (Retail, Healthcare, Logistics, Manufacturing, Travel & Entertainment), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

Industry: Banking & FinancialGlobal Embedded Finance Market Insights Forecasts to 2033

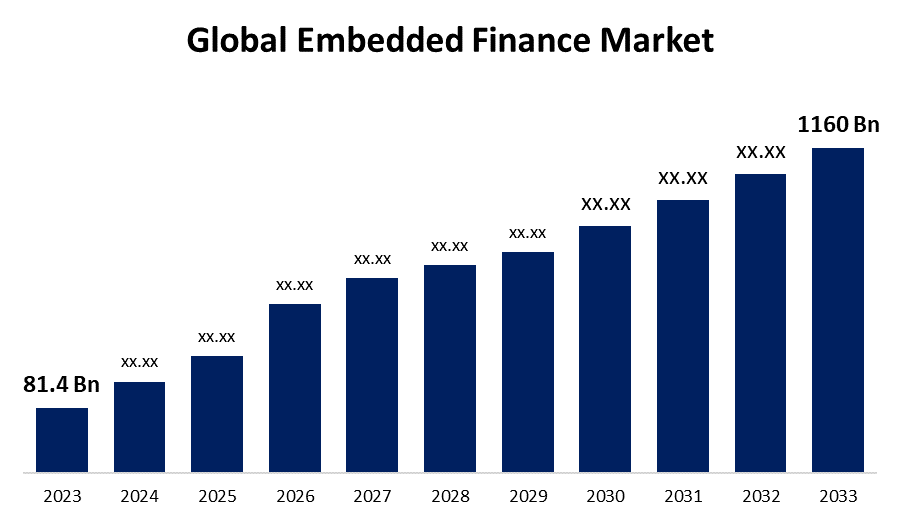

- The Global Embedded Finance Market Size was Valued at USD 81.4 Billion in 2023

- The Market Size is Growing at a CAGR of 30.43% from 2023 to 2033

- The Worldwide Consumer Finance Market Size is Expected to Reach USD 1160 Billion by 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Embedded Finance Market Size is Anticipated to Exceed USD 1160 Billion by 2033, Growing at a CAGR of 30.43% from 2023 to 2033.

Market Overview

Embedded finance is the integration of financial services with non-financial services. Some examples of embedded finance are an e-commerce platform providing insurance or credit for shopping on their online store, a coffee shop app that offers one-click payments, or a departmental store’s own branded credit card. Embedded finance is considerably changing how, when, and where people utilize financial services. It is creating substantial opportunities for both financial and non-banking financial companies to serve a broader market. Companies that implement embedded finance have reported an increase in customer engagement, and most of them said it helped them acquire new customers.

Companies are merging banking, lending, insurance, and investment services with the services or products that they offer through their financial partners like banks. This enables them to offer services like credit at point of sale, and buy now pay later (BNPL). Embedded finance solutions provide various financial options to their customers like a loan, payment program, insurance plan, or an easier way to make a payment.

There already have been some embedded financial services in the market like airline credit cards, car rental insurance, and Equated Monthly Instalment (EMI) payment options for high-value items. But now, embedded finance is shifting to online services, as e-commerce companies are providing banking and payment services directly on their websites without re-directing customers to a bank. This service is backed by third-party ‘banking-as-a-service’ companies that use Application Programming Interface (API) integrations to embed financial services into the apps or websites of non-financial companies. Embedded finance improves the customer experience unlocks a huge opportunity for businesses, and is expected to rise dramatically in the coming years.

Report Coverage

This research report categorizes the market for the global embedded finance market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global embedded finance market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global embedded finance market.

Global Embedded Finance Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 81.4 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 30.43% |

| 2033 Value Projection: | Reach USD 1160 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 220 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Finance Type, By Business Model, By Region |

| Companies covered:: | Zopa Bank Limited, Additiv AG, Plaid, Inc., Fortis Payment Systems, Wise Payments Limited, Stripe, Inc., Alipay+, PayPal Holdings, Inc., Fluenccy Pty Limited, Walnut Insurance Inc., Transcard Payments, Galileo Financial Technologies, Cross River Bank, Tint Technologies Inc., JPMorgan Chase & Co., Amazon.com, Inc., Finastra, Fluenccy Pty Limited, Zeta Services Inc., PAYRIX, Parafin, Inc., Goldman Sachs, and other key companies. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

One of the major factor driving the market is rise in the number of digital payments. It provides seamless integration of financial services into non-financial platforms. Consumers are increasingly switching to digital transactions, and businesses are leveraging this trend and integrating financial services directly into their applications, to offer financial services like digital wallets, instant loans, lending services, and payment gateways, within their applications.

Technological advancements and changing customer preferences are causing big shifts in the embedded finance market. The access and use of financial services are being completely changed due to the digitalization of transactions, with a rise in mobile payments, online banking, and customized financial management tools. The rise of financial technology (Fintech) products and services is another market driving factor.

Restraining Factors

Some of the challenges are anticipated to restrain the growth of the global embedded finance market. Embedding financial services into different applications involves managing sensitive customer data, including personal and financial details. The financial sector is a significant target for hackers as it involves a lot of valuable information. To avoid cyber attacks, companies involved in embedded finance must have firewalls, intrusion detection systems, encryption, data masking, and secure APIs like multi-factor authentication (MFA) to identify and solve vulnerabilities in the system. Maintaining such a high degree of cyber security is a big challenge for new start-ups and small businesses.

Market Segmentation

The global embedded finance market share is classified into finance type, business model, and end-use.

- The embedded payment segment is expected to hold the largest share of the global embedded finance market during the forecast period.

Based on the finance type, the global embedded finance market is divided into embedded payment, embedded insurance, embedded investment, embedded lending, embedded banking. Among these, the embedded payment segment is expected to hold the largest share of the global embedded finance market during the forecast period. This is due to the rising demand of consumers for smoother transactions and improved security. Since businesses don’t want customers to leave their platform, they integrate payment services such as digital wallets, instant loans, and streamlined payment gateways directly into their platforms. The Click to Pay feature is an excellent example of innovation in e-commerce sector, offering consumers to make payments without entering their card details or permanently storing sensitive information on the platform. The focus on enhancing user experience and satisfaction is boosting the market growth.

- The B2C segment is expected to grow at the fastest CAGR in the global embedded finance market during the forecast period.

Based on the business model, the global embedded finance market is divided into B2B, B2C, B2B2B, and B2B2C. Among these, the B2C segment is expected to grow at the fastest CAGR in the global embedded finance market during the forecast period. One of the major reasons is the availability of financial services on B2C platforms. It gives convenience to consumers for performing transactions by operating in familiar apps. Integrating financial services like payment options, loans, and insurance into the non-financial products makes them easier to use and increases the usage time of the app. There is a lot of room for innovation and the addition of more financial utilities in the B2C embedded finance sector. Additionally, many e-commerce companies like Shopify, Flipkart, and Amazon, Inc. have started offering embedded finance services like buy now pay later, credit limit, and wallet payment services.

- The retail segment is expected to hold the largest share of the global embedded finance market during the forecast period.

Based on the end-use, the global embedded finance market is divided into retail, healthcare, logistics, manufacturing, travel & entertainment. Among these, the retail segment is expected to hold the largest share of the global embedded finance market during the forecast period. The need for cost-effective and convenient credit solutions is fuelling the retail segment’s growth. For instance, in India, MyShubhLife's NBFC Ekagrata has started using its embedded finance platform to offer PayWorld's Indian retail businesses seamless, and cost-effective credit solutions, by leveraging widespread network of PayWorld. Additionally, embedded finance services like cashback offers, coupons, and credit & debit card payments also helps retailers attract more repeat customers.

Regional Segment Analysis of the Global Embedded Finance Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the global embedded finance market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the global embedded finance market over the predicted timeframe. This is because the region has a well-established and strong financial infrastructure, with a deep-rooted banking system and a wide range of financial organizations. This gives easy and faster access to credit and other financial services which further drives consumer spending and market growth. The region’s growth is also because of the global leaders of the BFSI sector in the USA and Canada, high-income levels, high spending capacity, and high standard of living.

Additionally, the demand for integrated payment solutions in the retail sector is fuelling the region’s market growth. According to a survey report by State of Payment, 86% of US mobile wallet users had made a purchase via a retailer’s embedded finance mobile application in the year 2023. The embedded finance market in Canada is also expected to grow at a significant CAGR in the forecasted period. The rising number of small and medium-sized enterprises (SMEs) is anticipated to fuel the market growth as embedded finance solutions could provide valuable financial support to these businesses. Also, the rising number of foreign population migrating and settling in Canada is expected to boost the market growth.

Asia Pacific is expected to grow at the fastest pace in the global embedded finance market during the forecast period. The adoption of embedded financial services in mobile apps is fuelled by high number of smartphone and internet users in the region, especially in India, China Indonesia, and Vietnam. Payment apps and mobile wallets have become crucial for day-to-day purchases. For instance, in India, the total digital payment transactions volume touched 13,462 crore in FY 2022-23 according to the Ministry of Finance. The region has also witnessed rapid economic and GDP growth in recent years, leading to a rise in disposable income, and change in spending habits boosting the market growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global embedded finance market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Zopa Bank Limited

- Additiv AG

- Plaid, Inc.

- Fortis Payment Systems

- Wise Payments Limited

- Stripe, Inc.

- Alipay+

- PayPal Holdings, Inc.

- Fluenccy Pty Limited

- Walnut Insurance Inc.

- Transcard Payments

- Galileo Financial Technologies

- Cross River Bank

- Tint Technologies Inc.

- JPMorgan Chase & Co.

- Amazon.com, Inc.

- Finastra

- Fluenccy Pty Limited

- Zeta Services Inc.

- PAYRIX

- Parafin, Inc.

- Goldman Sachs

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In July 2024, Stripe partnered with Newline by Fifth Third Bank to expand their embedded financial services offering.

- in February 2024, Alloy for Embedded Finance launched for banks and fintechs to help sponsor banks, BaaS providers, and their fintech partners manage identity risk.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global embedded finance market based on the below-mentioned segments:

Global Embedded Finance Market, By Type

- Embedded Payment

- Embedded Insurance

- Embedded Investment

- Embedded Lending

- Embedded Banking

Global Embedded Finance Market, By Business Model

- B2B

- B2C

- B2B2B

- B2B2C

Global Embedded Finance Market, By End-Use

- Retail

- Healthcare

- Logistics

- Manufacturing

- Travel & Entertainment

Global Embedded Finance Market, Regional

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. Which are the key companies that are currently operating within the market?Zopa Bank Limited, Additiv AG, Plaid, Inc., Fortis Payment Systems, Wise Payments Limited, Stripe, Inc., Alipay+, PayPal Holdings, Inc., Fluenccy Pty Limited, Walnut Insurance Inc., Transcard Payments, Galileo Financial Technologies, Cross River Bank, Tint Technologies Inc., JPMorgan Chase & Co., Amazon.com, Inc., Finastra, Zeta Services Inc., PAYRIX, Parafin, Inc., Goldman Sachs, and Others.

-

2. What is the size of the global embedded finance market?The Global Embedded Finance Market is expected to grow from USD 81.4 Billion in 2023 to USD 1160 Billion by 2033, at a CAGR of 30.43% during the forecast period 2023-2033.

-

3. Which region is holding the largest share of the market?North America is anticipated to hold the largest share of the global embedded finance market over the predicted timeframe.

Need help to buy this report?