Global EMI Shielding Materials Market Size, Share, and COVID-19 Impact Analysis, By Components (Conductive Coatings and Paints, EMI Shielding Tapes & Laminates, Conductive Polymers, Metal Shielding Products, and EMI Filters), By Application (Consumer Electronics, Telecommunication and IT, Automotive, Healthcare, and Aerospace and Defense), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

Industry: Advanced MaterialsGlobal EMI Shielding Materials Market Insights Forecasts to 2033

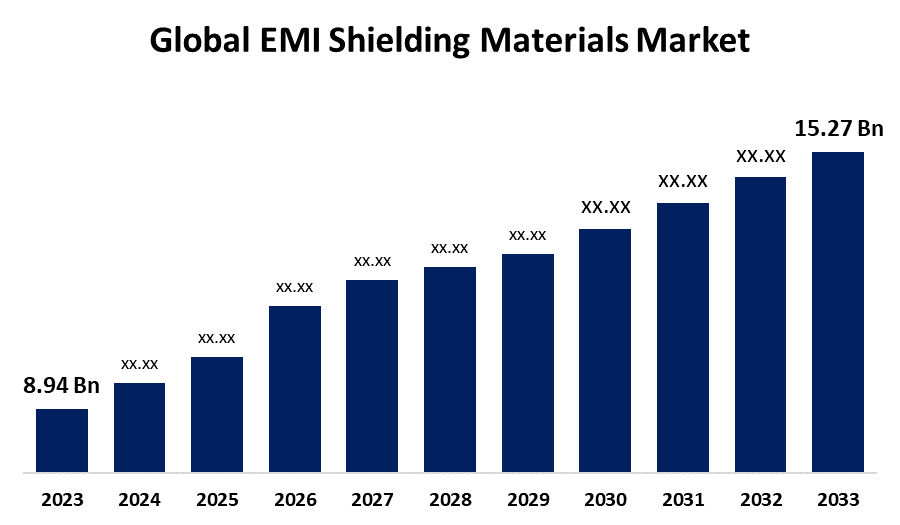

- The Global EMI Shielding Materials Market Size was Valued at USD 8.94 Billion in 2023

- The Market Size is Growing at a CAGR of 5.50% from 2023 to 2033

- The Worldwide EMI Shielding Materials Market Size is Expected to Reach USD 15.27 Billion by 2033

- North America is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global EMI Shielding Materials Market Size is Anticipated to Exceed USD 15.27 Billion by 2033, Growing at a CAGR of 5.50% from 2023 to 2033.

Market Overview

EMI shielding materials are substances or coatings that block or reduce electromagnetic interference (EMI), which might affect the performance of electronic devices and systems. EMI can occur from different sources, such as electrical circuits, radio waves, or other electronic equipment. The ultimate purpose of EMI shielding is to protect your device's circuitry. EMI shields typically consist of a metallic screen that protects your sensitive electronics or gadget insides and absorbs interference transferred through the air. They are emphasized in consumer electronics, automotive systems, telecommunications, medical devices, aerospace, and industrial equipment to ensure reliable operation and signal integrity. EMI shielding materials come in different forms, including conductive metals, absorptive composites, and hybrid solutions, and are used to shield components, enclosures, and connectors. EMI shielding materials help maintain the performance, safety, and efficiency of electronic systems across a wide range of applications.

For Instance, In August 2022, Panasonic Industry Co., Ltd. announced that launched a joint research project on ultra-light EMC shielding material technology with the Japan Aerospace Exploration Agency and the National Research and Development Agency.

Report Coverage

This research report categorizes the market for EMI shielding materials based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the EMI shielding materials market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the EMI shielding materials market.

Global EMI Shielding Materials Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 8.94 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 5.50% |

| 2033 Value Projection: | USD 15.27 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 204 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Components, By Application, By Region |

| Companies covered:: | Schaffner Holding AG, Tech-Etch Inc., Laird Plc., Parker Chomerics, Henkel AG & Co. KGaA, 3M Company, Leader Tech Inc., Kitagawa Industries Co., Ltd., ETS-Lindgren, RTP Company, PPG Industries Inc., and Others |

| Pitfalls & Challenges: | Covid 19 Impact Challanges, Future, Growth and Analysis |

Get more details on this report -

Driving Factors

The EMI shielding materials market is propelled by several key factors, including the growing electronics industry, which drives the need for effective shielding in devices like smartphones and laptops. Technological advancements and the rise of electric and autonomous vehicles further increase demand for high-performance shielding solutions. Stringent regulatory standards related to electromagnetic interference and the growing connectivity of IoT devices also contribute to market growth. Additionally, the aerospace and defense sectors require advanced EMI shielding for crucial systems, while rising consumer awareness about device performance enhances the demand for EMI shielding materials.

Restraining Factors

The EMI shielding materials market faces several restraining factors, including high costs associated with advanced materials like metals and complex manufacturing processes, which can limit adoption. Additionally, the emergence of alternative technologies and materials might reduce the demand for traditional shielding solutions. Environmental and regulatory concerns surrounding material composition and disposal, along with rapid technological advancements, can also impact market growth worldwide.

Market Segmentation

The EMI shielding materials market share is classified into components and application.

- The metal shielding products segment is estimated to hold the highest market revenue share through the projected period.

Based on the components, the EMI shielding materials market is classified into conductive coatings and paints, EMI shielding tapes & laminates, conductive polymers, metal shielding products, and EMI filters. Among these, the metal shielding products segment is estimated to hold the highest market revenue share through the projected period. This dominance is due to the superior effectiveness of metals such as aluminum, copper, and steel in blocking electromagnetic interference, making them a preferred choice for a wide range of applications. Metal shielding products offer robust protection and are widely used across industries, including consumer electronics, telecommunications, and aerospace. Their established performance and broad applicability contribute to their leading position in the market.

- The consumer electronics segment is anticipated to hold the largest market share through the forecast period.

Based on the application, the EMI shielding materials market is divided into consumer electronics, telecommunication and IT, automotive, healthcare, and aerospace and defense. Among these, the consumer electronics segment is anticipated to hold the largest market share through the forecast period. This dominance is driven by the widespread use of electronic devices such as smartphones, laptops, tablets, and wearables, which require effective EMI shielding to ensure their functionality and compliance with electromagnetic compatibility (EMC) standards. The rapid technological advancements and increasing consumer demand for high-performance electronics further bolster the significance of this segment in the EMI shielding materials market.

Regional Segment Analysis of the EMI Shielding Materials Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

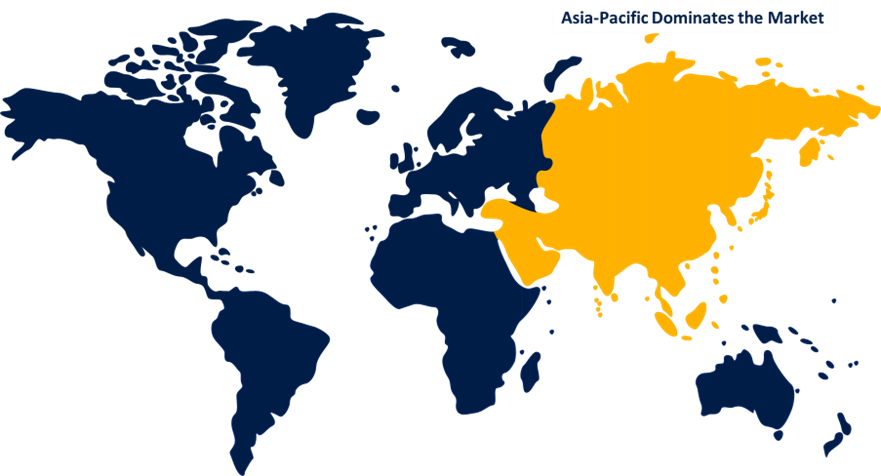

Asia Pacific is anticipated to hold the largest share of the EMI shielding materials market over the predicted timeframe.

Get more details on this report -

Asia Pacific is anticipated to hold the largest share of the EMI shielding materials market over the predicted timeframe. Asia Pacific is dominated by rapid industrialization, significant growth in the electronics sector, and expanding automotive industry. Countries like China, India, and South Korea are at the forefront of technological advancements and manufacturing, which drive the demand for effective EMI shielding solutions. The region's strong focus on electronic device production, coupled with stringent regulatory standards for electromagnetic compatibility and increased investment in research and development, further solidifies its dominant position in the market.

North America is expected to grow at the fastest CAGR growth of the EMI shielding materials market during the forecast period. This fastest expansion is due to its leadership in technological innovation, high demand for consumer electronics, and stringent regulatory standards. The region’s strong focus on technological advancements in sectors like telecommunications, aerospace, and defense drives the demand for advanced EMI shielding solutions. Additionally, significant investments in research and development and the expansion of the automotive and aerospace industries further boost market growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the EMI shielding materials market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Schaffner Holding AG

- Tech-Etch Inc.

- Laird Plc.

- Parker Chomerics

- Henkel AG & Co. KGaA

- 3M Company

- Leader Tech Inc.

- Kitagawa Industries Co., Ltd.

- ETS-Lindgren

- RTP Company

- PPG Industries Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In May 2024, DuPont announced showcasing its comprehensive range of advanced circuit materials and solutions at the 2024 International Electronic Circuits Exhibition in Shanghai.

- In September 2023, Henkel launched its first silicone-free multifunctional EMI thermal gap pad TGP EMI4000 that offers both thermal conductivity (4W/mK) and EMI shielding at frequencies up to 77 GHz.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the EMI shielding materials market based on the below-mentioned segments:

Global EMI Shielding Materials Market, By Components

- Conductive Coatings and Paints

- EMI Shielding Tapes & Laminates

- Conductive Polymers

- Metal Shielding Products

- EMI Filters

Global EMI Shielding Materials Market, By Application

- Consumer Electronics

- Telecommunication and IT

- Automotive

- Healthcare

- Aerospace and Defense

Global EMI Shielding Materials Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Need help to buy this report?