Global Empty Capsules Market Size, Share, and COVID-19 Impact Analysis, By Type (Gelatin and Non-Gelatin), By Functionality (Immediate-Release, Sustained-Release, Delayed Release, and Others), By Therapeutic Application (Vitamin & Dietary Supplements, Antibiotic & Antibacterial Drugs, Cardiac Therapy Drugs, Antacids & Anti-flatulent preparations, and Others), By End User (Pharmaceutical, Nutraceutical, Cosmetic, Reference Laboratories, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: HealthcareGlobal Empty Capsules Market Insights Forecasts to 2033

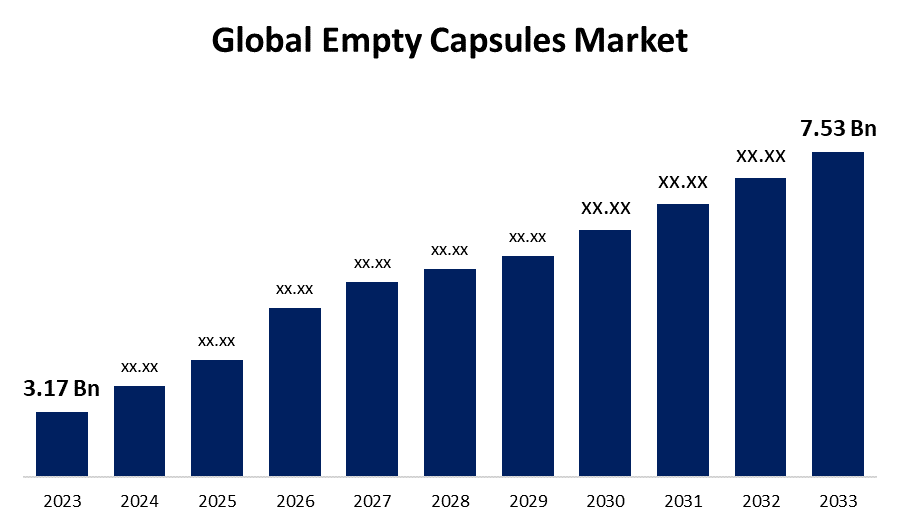

- The Global Empty Capsules Market Size was Valued at USD 3.17 Billion in 2023

- The Market Size is Growing at a CAGR of 9.04% from 2023 to 2033

- The Worldwide Empty Capsules Market Size is Expected to Reach USD 7.53 Billion by 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Empty Capsules Market Size is Anticipated to Exceed USD 7.53 Billion by 2033, Growing at a CAGR of 9.04% from 2023 to 2033.

Market Overview

Capsules are solid oral pharmaceutical dosage forms that contain one or more medications, or a combination of drugs, designed to treat a specific illness or condition in the human body. Gelatin-based and non-gelatin-based empty capsules are two distinct categories. Pharmaceutical companies make their medications and package them in empty capsules for distribution. Pullulan, starch, hydroxypropyl methylcellulose, and other non-gelatinous materials are typically used to make capsule shells. The empty capsules are available in a range of colors, shapes, and forms. Generally tasteless, simpler to chew, and rapidly absorbed are the benefits of capsules. However, compared to tablets, they are more vulnerable to light, heat, and moisture. Additionally, there are hard gelatin capsules composed of pure water and gelatin that are readily available. The majority of customers prefer the capsules because they dissolve quickly, resulting in quicker absorption rates, and because the tasteless and odorless gelatin covering makes the capsules comfortable to swallow. The market is expanding as a result of a rising number of chronic illnesses such as cancer, diabetes, cardiovascular disease, and gastrointestinal disorders. The pharmaceutical industry is receiving empty capsules from growing markets at a reduced cost, which is contributing to the market's expansion.

Report Coverage

This research report categorizes the market for the global empty capsules market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global empty capsules market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global empty capsules market.

Global Empty Capsules Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023 : | USD 3.17 Billion |

| Forecast Period: | 2023 – 2033 |

| Forecast Period CAGR 2023 – 2033 : | 9.04% |

| 023 – 2033 Value Projection: | USD 7.53 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Functionality, By Therapeutic Application, By End User, By Region |

| Companies covered:: | ACG Group, Aenova Group GmbH, Qualicaps, Capscanada Corporation, Suheung Co., Ltd, Bright Pharma Caps Inc., Nectar Lifesciences Ltd., Roxlor, Erawat Pharma Limited, Fuji Capsule Co. Ltd., Ajix Inc., Snail Pharma Industry Co., Ltd., Natural Capsules Limited, Lonza Group AG, and Others key vendors |

| Pitfalls & Challenges: | Covid-19 Impact, Challenge, Future,Growth and Analysis |

Get more details on this report -

Driving Factors

An important factor propelling market expansion is the growing number of uses in the pharmaceutical sector. Driving factors in empty capsules include rising sales of over-the-counter (OTC) medications due to rising healthcare awareness and people's increased knowledge of medicines due to the widespread use of the Internet. Hard and soft gelatin empty capsules are used to encapsulate therapeutic medications, which pushes up the need for capsule production and accelerates the expansion of the empty capsule market.

Restraining Factors

The need for gelatin in the food, pharmaceutical, nutraceutical, and cosmeceutical industries is still growing on a global scale. The manufacturers of gelatin capsules experienced difficulties throughout time as a result of the decreased supply of raw materials. Bovine hide, pigskin, and bones are a few of the raw materials utilized to make gelatin capsules. However, the government's ban on the killing of cattle decreased the amount of raw materials available, which limited the expansion of the industry.

Market Segmentation

The global empty capsules market share is classified into type, functionality, therapeutic application, and end-user.

- The gelatin segment dominates the market with the largest market share through the forecast period.

Based on the type, the global empty capsules market is categorized into gelatin and non-gelatin. Among these, the gelatin segment dominates the market with the largest market share through the forecast period. Gelatin is becoming more widely used in pharmaceutical production due to factors such as simple raw material availability, low cost, and simple manufacturing procedures. Pharmaceutical businesses have been forced to embrace more affordable alternatives, such as gelatin, to cut operating expenses while making capsules.

- The immediate-release segment accounted for the largest revenue share through the forecast period.

Based on the functionality, the global empty capsules market is categorized into immediate-release, sustained-release, delayed-release, and others. Among these, the immediate-release segment accounted for the largest revenue share through the forecast period. Immediate-release capsules start working as soon as they are swallowed. As a result, these capsules are utilized in the manufacturing of numerous pharmaceutical items, including antacids and painkillers. The need for immediate-release capsules is driven worldwide by multiple factors.

- The dietary supplements segment is expected to grow at the highest CAGR during the forecast period.

Based on the therapeutic application, the global empty capsules market is categorized into vitamin & dietary supplements, antibiotic & antibacterial drugs, cardiac therapy drugs, antacids & anti-flatulent preparations, and others. Among these, the dietary supplements segment is expected to grow at the highest CAGR during the forecast period. The market has been expanding since more people are being diagnosed with infectious and inflammatory disorders, which demands the use of capsule medications. The segment is expanding due in part to research and development efforts being made to create antibiotics and antibacterial medications.

- The pharmaceutical segment is predicted to dominate the global empty capsules market during the forecast period.

Based on the end users, the global empty capsules market is categorized into pharmaceutical, nutraceutical, cosmetic, reference laboratories, and others. Among these, the pharmaceutical segment is predicted to dominate the global empty capsules market during the forecast period. The pharmaceutical industry's need for empty capsules is growing quickly as more and more medications are being introduced in pill form to deal with a wider range of illnesses.

Regional Segment Analysis of the Global Empty Capsules Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the global empty capsules market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the global empty capsules market over the predicted timeframe. Due to the cost of conducting research and development for pharmaceuticals has increased. Additionally, throughout the forecast period, the region's empty capsule market is expected to rise at a faster rate due to the rising number of diabetes cases. Owing to the rise in the incidence of chronic illnesses like cancer and cardiovascular disease, the existence of important companies involved in the production of empty capsules, and the volume of capsules produced, developments in the area's capsule medication delivery technology.

Asia Pacific is expected to grow at the fastest CAGR growth of the global empty capsules market during the forecast period. The expansion of pharmaceutical production facilities, rising investments in the pharmaceutical industry, widespread access to raw materials, and growing partnerships between raw material suppliers and pharmaceutical businesses are the main factors driving the growth of this regional market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global empty capsules market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- ACG Group

- Aenova Group GmbH

- Qualicaps

- Capscanada Corporation

- Suheung Co., Ltd

- Bright Pharma Caps Inc.

- Nectar Lifesciences Ltd.

- Roxlor

- Erawat Pharma Limited

- Fuji Capsule Co. Ltd.

- Ajix Inc.

- Snail Pharma Industry Co., Ltd.

- Natural Capsules Limited

- Lonza Group AG

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In Feb 2023, Vivion, Inc., a multinational supplier of ingredient solutions, has declared the opening of a new product line that includes pullulan, HPMC, and empty gelatin capsules.

- In May 2022, in accordance to the European Union's desire for titanium dioxide-free food, Capsugel introduced white hard gelatin capsules devoid of titanium dioxide (TiO2).

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global empty capsules market based on the below-mentioned segments:

Global Empty Capsules Market, By Type

- Gelatin

- Non-Gelatin

Global Empty Capsules Market, By Functionality

- Immediate-Release

- Sustained-Release

- Delayed Release

- Others

Global Empty Capsules Market, By Therapeutic Application

- Vitamin & Dietary Supplements

- Antibiotic & Antibacterial Drugs

- Cardiac Therapy Drugs

- Antacids & Anti-flatulent preparations

- Others

Global Empty Capsules Market, By End User

- Pharmaceutical

- Nutraceutical

- Cosmetic

- Reference Laboratories

- Others

Global Empty Capsules Market, By Regional

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Need help to buy this report?