Global Endpoint Security Market Size, Share, and COVID-19 Impact Analysis, By Component (Software, Services, Others), By Deployment (Cloud, On-premises), By User Type (Commercial, Consumer, Other), By Enterprise Type (Large Enterprises, Small & Medium Enterprises), By End-use (BFSI, Telecom & IT, Retail, Healthcare, Government & Public Sector, Transportation, Others) and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 – 2032.

Industry: Information & TechnologyGlobal Endpoint Security Market Size Insights Forecasts to 2032

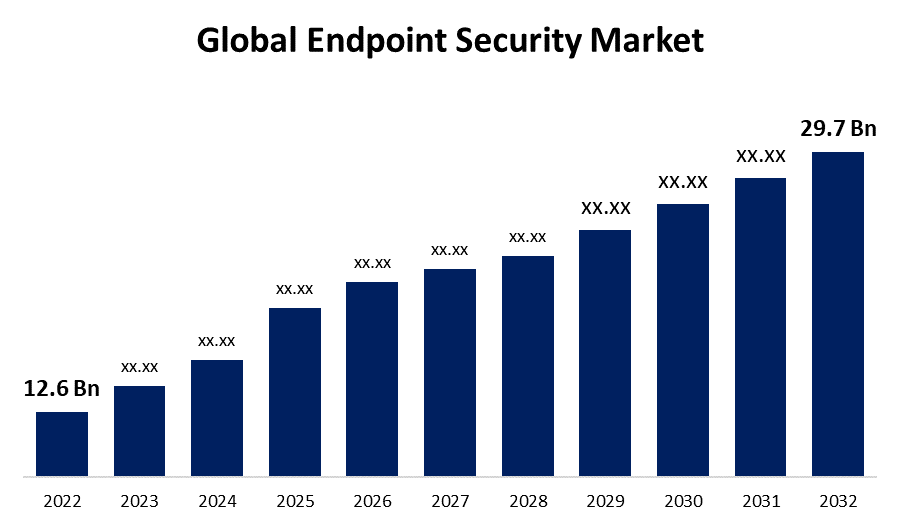

- The Global Endpoint Security Market Size was valued at USD 12.6 Billion in 2022.

- The Market Size is Growing at a CAGR of 8.9% from 2022 to 2032

- The Worldwide Endpoint Security Market Size is expected to reach USD 29.7 Billion by 2032

- Asia Pacific is expected to Grow the fastest during the forecast period

Get more details on this report -

The Global Endpoint Security Market Size is expected to reach USD 29.7 Billion by 2032, at a CAGR of 8.9% during the forecast period 2023 to 2032.

Solutions for endpoint security help businesses protect their networks and the points of entry for internal data. The advanced security solution is regarded as the primary cybersecurity tool used by businesses to protect their internal network infrastructure. The market is anticipated to increase as the Bring-Your-Own-Device (BYOD) policy is increasingly implemented. For instance, FortiXDR, a web threat intelligence detection XDR solution, was introduced by Fortinet, Inc. A similar managed detection and response (MDR) service was introduced by BlackBerry Limited. For endpoint security, Broadcom, Inc. has also introduced Adaptive Protection. Solutions are heavily integrated with new technologies like cloud computing, AI, the Internet of Things (IoT), and others. Additionally, the increasing demand for security solutions across numerous industries has compelled major market participants to create cutting-edge security solutions. Endpoint security guards against hostile activities and campaigns on endpoints, or access points, of end-user devices such as PCs, laptops, and mobile devices. Technologies for endpoint security stop cyber threats from getting to endpoints on a network or in the cloud. As the population Grows and industrial processes become increasingly digital, there are an increasing number of PCs, laptops, cell phones, tablets, and point-of-sale terminals. Global networks' endpoint count will rise in parallel with the spread of smart devices. Security is necessary because there are more endpoint devices now.

Global Endpoint Security Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 12.6 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 8.9% |

| 2032 Value Projection: | USD 29.7 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Component, By Deployment, By User Type, By Enterprise Type, By End-use, By Region and COVID-19 Impact |

| Companies covered:: | BlackBerry Limited, Check Point Software Technologies Ltd., VMware, Inc., Trend Micro Inc., Ivanti, Sophos Ltd., CrowdStrike, Cisco Systems, Inc., Palo Alto Network Inc., Fortinet, Inc., AO Kaspersky Lab, and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth & Analysis. |

Get more details on this report -

Driving Factors

Bring your own devices (BYOD) use is Growing, driving Market Growth. Businesses are implementing a BYOD policy across all of their functional areas to give employees flexibility. Additionally, the number of endpoints in businesses has Grown as a result of the expanding usage of networking, connected devices, and remote location servers. Endpoint solutions help businesses secure their endpoints and monitor unauthorized activity and device behavior. Consequently, the Growing adoption of the BYOD policy is projected to fuel the Growth of the endpoint security market globally. The rise in network attacks across industries, the development of open-source linked devices and solutions, and the rising digitization are to blame. Similar to this, other endpoint attacks are projected to become more prevalent as solutions like the Internet of Things, industrial control systems, and smart sensors become more widely adopted. Network assaults have increased across all industries as a result of increased digitization and connected devices. To get access to a company's protected network, the attackers choose endpoints. To circumvent the protected corporate network, these attackers can employ laptops, smartphones, wearable technologies, and other similar devices. Additionally, as more solutions like the Internet of Things (IoT), industrial control systems, and smart sensors are used, endpoint assaults are anticipated to rise. Many businesses have recently reported endpoint data breach attacks. However, these are only the attacks that were reported; in truth, there were many more than these numbers indicate. These fast detection and reaction technologies are hastening the adoption of endpoint security solutions. Thus, the growth of the endpoint security industry has been greatly accelerated in recent years by the rise in connected devices and security breaches.

Restraining Factors

Endpoint security solutions are used by businesses to protect their network infrastructure from numerous threats. However, several firms are having trouble finding qualified technical personnel to maintain and run the security systems made possible by developing technology. Keeping technical workers up to date on new developments in technology is expensive, especially for SMEs. Therefore, this may prevent endpoint protection solutions from being adopted. However, firms must regularly undergo digital skills training if they want to get past these obstacles.

Market Size Segmentation

By Component Insights

The Software segment dominates the Market Sizewith the largest revenue share over the forecast period.

Based on components, the global endpoint security Market Sizeis segmented into Software and Services. Among these, the Software segment is dominating the market with the largest revenue share over the forecast period. It is anticipated that the software sector will hold the biggest market share. The increase is the result of an increase in the demand for cutting-edge software to counter the growing number of unidentified cyberattacks. Additionally, managed services are becoming a more important source of immediate support for businesses with limited IT expertise. As the endpoint system is improved and developed, there is an increasing requirement for expert services. Endpoint services are therefore becoming more and more crucial to maintain compliance with security technology.

By Deployment Insights

The on-premises segment is witnessing significant CAGR growth over the forecast period.

Based on deployment, the global endpoint security Market Sizeis segmented into cloud, and on-premises. Among these, the on-premises segment is witnessing significant CAGR growth over the forecast period. The growth of on-premise is anticipated to be fueled by large companies that use internal IT solutions. Due to its simplicity of use and scalability, the cloud segment is predicted to expand. Additionally, SMEs are moving away from cloud deployment security, which will undoubtedly restrict cloud solutions. Cloud-based endpoint security solutions are provided by the majority of manufacturers in the endpoint security market. Because of advantages including simple data upkeep, cost-effectiveness, scalability, and efficient management, cloud-based endpoint security solutions are predicted to become more widely used. With the cloud deployment approach, web-based management and enterprise-level endpoint protection are possible.

User Type Insights

The commercial segment is expected to hold the largest share of the global endpoint security market during the forecast period.

Based on the user type, the global endpoint security Market Sizeis classified into commercial and consumer. Among these, the commercial segment is expected to hold the largest share of the global endpoint security market during the forecast period. Due to the increasing adoption of endpoint security software by small and medium-sized businesses to protect the corporate operational system, the commercial category is anticipated to hold the biggest market share.

By Enterprise Type Insights

The large enterprises segment accounted for the largest revenue share over the forecast period.

Based on enterprise type, the global endpoint security market is segmented into large enterprises and small & medium enterprises. Among these, the large enterprises segment dominates the market with the largest revenue share over the forecast period. Software providers, on the other hand, are creating specialized security solutions for SMEs. These security options were created to meet the industry's safety standards at a significantly cheaper price. Small and medium-sized firms anticipate an increase in product demand as a result of this. The market is expanding as people become more aware of cutting-edge security options.

By End-use Insights

The healthcare segment accounted for the largest revenue share over the forecast period.

Based on end-uses, the global endpoint security market is segmented into BFSI, telecom & IT, retail, healthcare, government & public sector, transportation, and others. Among these, the healthcare segment dominates the market with the largest revenue share over the forecast period. Due to the growing amount of data, endpoint protection solutions are highly sought after in the healthcare industry. The most important data is considered to be related to healthcare, and assaults are on the rise globally. The number of endpoint devices in the healthcare industry is also expanding as a result of the increased usage of wearable technology, electronic data, and improved medical equipment. The requirement for endpoint solutions is being driven by this. Similar to how the private and public sectors are expanding rapidly, the industry is becoming increasingly automated and digital. Additionally, as the demand for BYOD and work-from-home policies increases, IT companies are facing several challenges in terms of delivering a secure network, which is expected to drive market growth. In the BFSI sector, endpoint software helps protect various important data and information that, if misused by hackers, can lead to significant losses.

Regional Insights

North America dominates the market with the largest market share over the forecast period.

Get more details on this report -

The demand for security solutions is increasing as more firms in the area use connected devices and the Internet of Things. Additionally, it is anticipated that the number of security solution providers in the U.S. will increase over the forecasted time frame. The largest source of income for the global endpoint security industry is North America. The endpoint security sector is experiencing substantial growth in the region. The increased adoption of this technology in North America can be ascribed to the expanding use of automation and behavioral analysis for threat detection, the expansion of data across industries, and the growth of corporate investments in real-time security solutions.

Europe is anticipated to experience considerable market expansion throughout the projection period as a result of increased focus on upgrading cyber security infrastructure in the coming years. To combat the rising number of cyberattacks, Germany and the U.K. are expected to dominate the market, and German businesses have raised their IT budgets. Similar to this, the UK government has advised companies that offer external device deployment to employ end-user devices.

Asia Pacific, on the contrary, is expected to grow the fastest during the forecast period. With rising IT investment across businesses, Asia Pacific is predicted to rise quickly during the projected period. To create cutting-edge security solutions, businesses are quickly embracing AI, the Internet of Things, cloud computing, and other technologies. The Asia Pacific market is projected to be dominated by China. The use of endpoint solutions in China is accelerating due to the 5G infrastructure's quick expansion. The Indian government is focusing on data protection as well due to growing national security concerns.

List of Key Market Players

- BlackBerry Limited

- Check Point Software Technologies Ltd.

- VMware, Inc.

- Trend Micro Inc.

- Ivanti

- Sophos Ltd.

- CrowdStrike

- Cisco Systems, Inc.

- Palo Alto Network Inc.

- Fortinet, Inc.

- AO Kaspersky Lab

Key Market Developments

- On April 2023: Syxsense, a provider of Unified Security and Endpoint Management (USEM) solutions teamed up with EVOTEK to offer customers using several Syxsense products, such as Syxsense Secure, Syxsense Manage, and Syxsense Enterprise, endpoint management and security services.

- On February 2023: To provide security to companies of all sizes, ESET and Intel collaborated to improve ESET endpoint security software solutions using Intel hardware-based ransomware protection.

- In November 2022: To ensure that the equipment used by employees at work is secure and adheres to cybersecurity best practices, Mosyle introduced the first endpoint security solution for iPhone and iPad devices.

- In August 2022: Huntress, new managed endpoint detection & response capabilities have been introduced by a provider of managed security platforms for small and medium-sized organizations to help identify active cyberattacks and defend the firm at all stages of a cyberattack.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2021 to 2031. Spherical Insights has segmented the global endpoint security market based on the below-mentioned segments:

Endpoint Security Market, Component Analysis

- Software

- Services

- Others

Endpoint Security Market, Deployment Analysis

- Cloud

- On-premises

Endpoint Security Market, User Type Analysis

- Commercial

- Consumer

- Other

Endpoint Security Market, Enterprise Type Analysis

- Large Enterprises

- Small & Medium Enterprises

Endpoint Security Market, End-use Analysis

- BFSI

- Telecom & IT

- Retail

- Healthcare

- Government & Public Sector

- Transportation

- Others

Endpoint Security Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Need help to buy this report?