Global Energy and Utility Analytics Market Size, Share, and COVID-19 Impact Analysis, By Component (Solutions and Services), By Deployment Mode (Cloud and On-Premises), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

Industry: Energy & PowerGlobal Energy And Utility Analytics Market Insights Forecasts to 2033

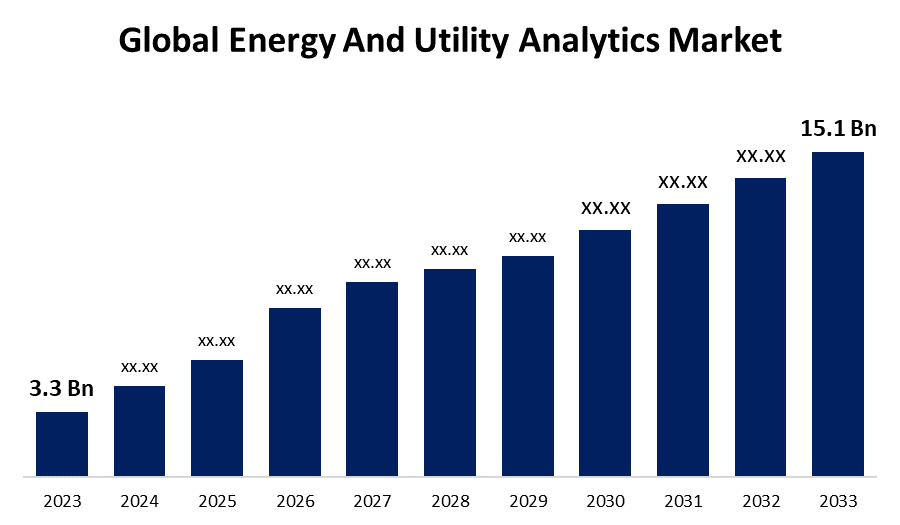

- The Global Energy And Utility Analytics Market Size was Valued at USD 3.3 Billion in 2023

- The Market Size is Growing at a CAGR of 16.43% from 2023 to 2033

- The Worldwide Energy And Utility Analytics Market Size is Expected to Reach USD 15.1 Billion by 2033

- Europe is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Energy And Utility Analytics Market Size is Anticipated to Exceed USD 15.1 Billion by 2033, Growing at a CAGR of 16.43% from 2023 to 2033.

Market Overview

The process of energy and utility analytics involves the collection, analysis, and visualization of energy data in order to obtain insights that can assist energy and utility companies in enhancing their business performance. The use of analytics can enhance customer support and rapidly provide feedback on power outages, infrastructure vulnerabilities, and crew status. Analytics can also forecast future business trends and demand, as well as identify and prevent revenue loss from energy theft. In addition, analytics can aid in cost management and inform business expansion decisions. By comparing consumption across different units and forecasting consumption patterns, analytics can also help efficiently manage power distribution. Energy and utility analytics make use of artificial intelligence, machine learning, and statistics to monitor and analyze energy usage across all generation and distribution facilities.

According to the Department Of Energy, The MAPLE LEAF project is using aggregated, anonymous smart meter data at the feeder level to research the effectiveness of under-frequency load shedding (UFLS) as a safeguard for the bulk power system during emergencies. NERC has noted that the current design practices may make UFLS ineffective with the increasing amount of DERs. The MAPLE BRANCH project is exploring new methods to enhance the load power factor at the transmission-distribution boundary. The project team will compare traditional infrastructure upgrades with solutions that involve grid-friendly inverter behavior, focusing on the development of volt-VAR curves to enhance system flexibility.

Report Coverage

This research report categorizes the market for energy and utility analytics based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the energy and utility analytics market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the energy and utility analytics market.

Global Energy And Utility Analytics Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 3.3 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 16.43% |

| 2033 Value Projection: | Reach USD 15.1 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 243 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Component, By Deployment Mode, By Region |

| Companies covered:: | Infor, Microsoft, Eaton, IBM, SAP, Intel, GE, Schneider Electric, Siemens, Cisco, Google, Oracle, SAS Institute, and Others |

| Pitfalls & Challenges: | Covid 19 Impact Challanges, Future, Growth and Analysis |

Get more details on this report -

Driving Factors

The increasing need for effective energy management and operational optimization is the primary driving force behind the energy and utilities analytics market. Utilities are adopting advanced analytics solutions to boost operational efficiency and cut costs due to the rising global energy consumption. The integration of analytics into energy management systems is encouraged by regulatory demands for sustainability and reduced carbon emissions. Real-time data collection and analysis are made possible by the proliferation of smart grid technologies and IoT devices, allowing utilities to make well-informed decisions. Predictive maintenance is also on the rise, minimizing downtime and extending the life of infrastructure assets, further supporting the market.

Restraining Factors

The energy and utilities analytics market faces several restraining factors. Small utilities may be discouraged from investing in these technologies due to high implementation costs. Integrating new analytics systems with existing infrastructure is a complex process, posing significant challenges. Data privacy and cybersecurity concerns also serve as barriers, as utilities must protect sensitive information from potential breaches.

Market Segmentation

The energy and utility analytics market share is classified into component and deployment modes.

- The solutions segment is estimated to hold the highest market revenue share through the projected period.

Based on the component, the energy and utility analytics market is classified into solutions and services. Among these, the solutions segment is estimated to hold the highest market revenue share through the projected period. The increasing demand for comprehensive analytics solutions that can transform raw data into actionable insights drives the dominance of the market. Integrated solutions that encompass data management, predictive analytics, and visualization tools are increasingly valued by utilities. Smart technologies and IoT devices further fuel the demand for sophisticated analytics solutions capable of handling large volumes of data. As regulatory pressures mount for sustainability, utilities are seeking solutions that can help them comply with regulations while maximizing operational efficiency. Consequently, the solutions segment is expected to maintain a significant revenue share in the energy and utilities analytics market.

- The cloud segment is anticipated to hold the largest market share through the forecast period.

Based on the deployment mode, the energy and utility analytics market is divided into cloud and on-premises. Among these, the cloud segment is anticipated to hold the largest market share through the forecast period. The growing adoption of cloud-based analytics solutions, which offer scalability, flexibility, and cost-effectiveness, drives market growth. Cloud platforms enable utilities to store and analyze vast amounts of data without extensive on-premises infrastructure, reducing operational costs. Access to real-time analytics from anywhere enhances decision-making processes, allowing for quicker responses to changing conditions. Furthermore, cloud solutions promote collaboration and data sharing among different stakeholders, promoting a more integrated approach to energy management. As more utilities move towards digital transformation and seek agile solutions, the cloud segment is poised to dominate the energy and utilities analytics market.

Regional Segment Analysis of the Energy and Utility Analytics Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the energy and utility analytics market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the energy and utility analytics market over the predicted timeframe. The region's advanced energy infrastructure and significant investments in offshore oil and gas exploration contribute to its dominance. Market growth is further driven by the presence of major industry players and an increased focus on improving energy efficiency. The utilization of high-quality thermal insulation materials is compelled by stringent regulations regarding safety and environmental protection. The region's technological advancements in subsea operations also play a crucial role, with innovative insulation solutions being increasingly adopted to enhance performance and reduce costs. Therefore, North America is well-positioned to lead the energy and utility analytics market.

Europe is expected to grow at the fastest CAGR growth of the energy and utility analytics market during the forecast period. The rapid expansion is a result of the region's strong dedication to sustainability and renewable energy efforts. European governments are putting in place measures that promote the use of advanced analytics to optimize energy consumption and decrease emissions of greenhouse gases. Additionally, the growing utilization of smart meters and grid technologies makes it easier to gather and analyze real-time data, empowering utilities to make better-informed choices. The increase in both pioneering startups and established firms concentrating on energy analytics also contributes to the dynamic growth in this area. As recognition of the advantages of analytic solutions continues to increase, Europe is poised for substantial market growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the energy and utility analytics market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Infor

- Microsoft

- Eaton

- IBM

- SAP

- Intel

- GE

- Schneider Electric

- Siemens

- Cisco

- Oracle

- SAS Institute

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In March 2024, Amperon, an AI-powered energy analytics and forecasting company, announced it is re-platforming its technology onto Microsoft Azure to deliver AI technology for the energy sector. With increasing investments in renewables, increasing pressure from new load growth, and more extreme weather events, this collaboration helps companies successfully navigate the evolving grid to improve reliability, optimize asset economics, and accelerate decarbonization.

- In February 2024, Lumin Announces Pre-Release of Lumin Edge for Utilities, a Revolutionary New Grid Services Platform. The utility-targeted Lumin Edge pre-release focuses on delivering behind-the-meter analytics and superior load management tools.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the energy and utility analytics market based on the below-mentioned segments:

Global Energy and Utility Analytics Market, By Component

- Solutions

- Services

Global Energy and Utility Analytics Market, By Deployment Mode

- Cloud

- On-Premises

Global Energy and Utility Analytics Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Need help to buy this report?