Global Energy Drink Market Size, Share, and COVID-19 Impact Analysis, By Packaging Type (Bottles, Cans, Others), By Product (Shots, Drinks, Mixers), By Distribution Channel (Supermarkets/Hypermarkets, Specialty Stores, Convenience Stores, Online Retail Stores, Others), By Type (Conventional, Organic), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 – 2032

Industry: Food & BeveragesGlobal Energy Drink Market Insights Forecasts to 2032.

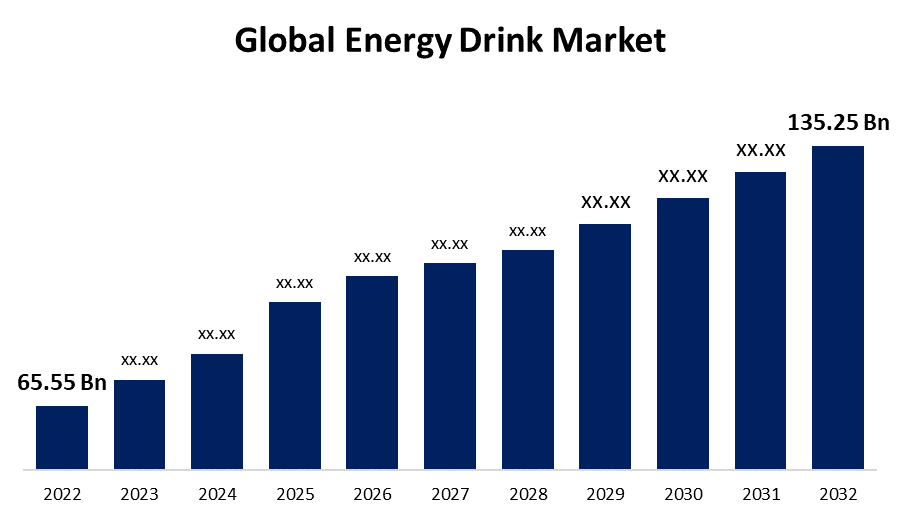

- The Global Energy Drink Market Size was valued at USD 65.55 Billion in 2022.

- The Market Size is Growing at a CAGR of 7.5% from 2022 to 2032.

- The Worldwide Energy Drink Market Size is expected to reach USD 135.25 Billion by 2032.

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

The Global Energy Drink Market Size is expected to reach USD 135.25 Billion by 2032, at a CAGR of 7.5% during the forecast period 2022 to 2032.

A high concentration of stimulants, including caffeine, taurine, ginseng, guarana, and others, can be found in energy drinks. It improves both mental and physical performance. Energy drinks can have carbonation or not. They are distinct from energy drinks, which are used before or after physical activity to replenish electrolytes and water. Additionally, they differ from tea and coffee, as they're brewed, have fewer ingredients, and sometimes contain decaffeinated versions. Energy drink producers assert that their goods increase vigor. The popularity of energy drinks, which offer immediate energy as well as mental and physical stimulation, is one of the main factors driving the market growth for energy drinks. Another crucial element, taurine, is also required for the development of muscles in the skeleton and the circulatory system. These factors account for the majority of the forecast for the global energy drink market. In the upcoming years, market expansion is projected to be fueled by rising consumer lifestyle modifications, rising health consciousness, and expanding consumer awareness of health and wellness products. Additionally, the popularity of products among teens is fueling the expansion of the global industry. However, a caffeine overdose may result in hypertension, nausea, agitation, and other health problems that restrict the growth of the energy drink market. On the other hand, it is projected that throughout the projection period, a shift in customer preference toward beverage consumption and a healthy lifestyle would open up lucrative potential for market advancement.

Global Energy Drink Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 65.55 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 7.5% |

| 2032 Value Projection: | USD 135.25 Billion |

| Historical Data for: | 2019-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | COVID-19 Impact Analysis, By Packaging Type, By Product, By Distribution Channel, By Type, and By Region |

| Companies covered:: | Red Bull, PepsiCo. Inc, The Coco-Cola Company, Lucozade, Xyience Energy, Taisho Pharmaceutical Co. Ltd., Monster Energy, Amway, AriZona Beverages, Living Essentials LLC, 5-hour ENERGY, The Cloud 9 Energy Drink, Vitale Beverages, Keurig Dr Pepper, Others, and key venders |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

As urbanization, disposable money, and health awareness among consumers all rose, so did the demand for energy drinks. Energy drinks are popular among teenagers because they claim to improve performance, endurance, and attentiveness. Long, unpredictable work hours and a rise in social activities are both driving customers to purchase energy drinks. People were also influenced to choose drinks that are healthy and sugar-free by the increased prevalence of diseases associated with a lack of physical activity, an increase in the number of health-conscious customers, and consumer awareness of active lifestyles. A rise in promotional and marketing techniques is also expected to result in a growth in consumer demand for energy drinks. While this is true, the global market for energy drinks is expected to rise due to consumers' growing knowledge of sugar-free beverages. Customers are becoming more aware of the value of proper nutrition and an active lifestyle as a result of the rising prevalence of diabetes. Consumers are embracing low-calorie, low-sugar, or sugar-free eating habits in foods and beverages as a result of growing health concerns and increased efforts to curb the spread of lifestyle illnesses. In drinking beverages, consumers favor stevia and other natural sweeteners. Companies including Coca-Cola and PepsiCo have pledged to cut back on sugar and eliminate artificial ingredients in their products. Furthermore, in response to shifting consumer tastes for sugar-free or low-sugar beverages, beverage makers developed new products.

Restraining Factors

The likelihood of components like illegal colors and additives, drug residues, industrial chemicals, hidden allergens, and heavy metals is causing consumers more and more concern. Likely the market for energy drinks won't grow due to the detrimental effects on health caused by ingesting these residues.

Market Segmentation

By Packaging Insights

The Cans segment dominates the market with the largest revenue share over the forecast period.

Based on packaging type, the global energy drink market is segmented into bottles, cans, and others. Among these, the cans segment is dominating the market with the largest revenue share of 50% over the forecast period. Cans are expected to maintain their dominance during the period of projection. Customers are increasingly opting for these drinks over wine that is bottled and other spirits as a result of changing customer preferences and choices. Young clients prefer metal cans since they are more lightweight and aren't damaged like glass. The demand for the product in cans has significantly increased as an outcome of the closure of bars, pubs, and restaurants due to the coronavirus pandemic, and is expected to continue to rise throughout the foreseeable time.

By Product Insights

The drinks segment held the largest revenue share of over 50% over the forecast period.

Based on product type, the global energy drink market is segmented into shots, drinks, and mixers. Among these, the drinks segment is witnessing significant CAGR growth over the forecast period. Drinks are becoming more and more popular with consumers since they instantly hydrate consumers and provide substantial nutrients for the body's health. Furthermore, due to the variety of these beverages, drinks have a wider consumer base. Customers are free to drink these beverages during work, after exercise, and while partaking in leisure activities because of their beneficial character, which increases product demand. Throughout the projection period, the mixers segment is expected to experience significant expansion. The segment has been driven by the product's expanding availability as a mixer. Additionally, consumers are choosing mixers to create specialty cocktails and alcoholic beverages. To draw in new customers, several firms have also begun experimenting with novel tastes in mixers. When alcohol is consumed frequently and in large quantities with caffeinated mixers, particularly energy drinks or cola, the negative effects of alcohol are reported to be much less severe than when alcohol is consumed alone.

By Distribution Channel Insights

The Supermarkets/Hypermarkets segment is expected to hold the largest share of the Global energy drink Market during the forecast period.

Based on the distribution channel, the global energy drink market is classified into supermarkets/hypermarkets, specialty stores, convenience stores, online retail stores, and others. Among these, the supermarkets/hypermarkets segment is expected to hold the largest share of the global energy drink market during the forecast period. The off-trade category, which continues to be the principal market for the product, generated the biggest revenue share. The rise in the use of energy drinks is what is behind a rise in product sales. These products are purchased by customers after they physically inspect the brands, ingredients, and product quality, which in turn propels product sales via off-trade channels. The bulk of the big market players provide their whole product selection through supermarkets and hypermarkets due to the vast customer bases of these outlets. Several well-known brick-and-mortar retailers in the US, including Walmart, Walgreens, CVS Pharmacy, Target Brands, Kroger, and Safeway, sell the product. Walmart carries goods from numerous brands.

By Type Insights

The Conventional segment accounted for the largest revenue share of more than 60% over the forecast period.

Based on type, the global energy drink market is segmented into conventional and organic. Among these, the Conventional segment dominates the market with the largest revenue. Over 60% of the total revenue came from the conventional category, which is anticipated to continue to lead throughout the projection period. Over the foreseeable period, it will be expected that low consumer awareness of organic products will help the conventional segment grow. The organic sector is still in its infancy, and consumer awareness of the advantages of functional drinks made from organic ingredients is notably low. Additionally, because conventional drinks include different components, they are often less expensive than their organic equivalents. Because conventional beverages offer a higher profit per square inch of shelf space, retailers tend to favor them over organic drinks.

Regional Insights

North America dominates the market with the largest market share over the forecast period.

Get more details on this report -

North America is dominating the market with more than 30% market share over the forecast period. The rise in disposable income, the development of various indigenous brands, and the rise in marketing and advertising campaigns for product growth are further factors contributing to the region's expanding product consumption. Due to changing demographics, consumer preferences, and drinking behaviors, North Americans use more energy beverages than any other region in the world. Market globalization and the issue of migration both helped consumers change their drinking patterns as alcohol was gradually brought into their lives. This has created new chances for market participants to diversify their portfolios of drinks.

Asia Pacific market is expected to register a substantial CAGR rate as well as fastest growing region during the forecast period. This is primarily due to the customer readiness to try new flavors and the high demand from immigrants living in the country who show interest in a variety of beverages, the market is anticipated to experience significant growth in the economies of various countries. The demand for products in the region has been fueled by product launches that aim to target and attract a wide range of consumers.

List of Key Market Players

- Red Bull

- PepsiCo. Inc

- The Coco-Cola Company

- Lucozade

- Xyience Energy

- Taisho Pharmaceutical Co. Ltd.

- Monster Energy

- Amway

- AriZona Beverages

- Living Essentials LLC

- 5-hour ENERGY

- The Cloud 9 Energy Drink

- Vitale Beverages

- Keurig Dr Pepper

- Others

Key Market Developments

- On July 2023- PepsiCo India, the beverage with the fastest growth rate for PepsiCo India is the energy drink Sting. Energy drink producer PepsiCo's Sting has overtaken all of the business's other decade-old products, including Pepsi cola and Mountain Dew, as its fastest-growing brand.

- On March 2023- Red Bull introduced a new Juneberry-flavored energy drink as part of their summer edition collection. According to the brand, major shops across the country have begun carrying Juneberry drinks in both single- and multipack versions.

- In January 2022- Anheuser-Busch Companies LLC, planning to launch energy drinks in India as the energy drinks category is primarily driven by millennials and affluent consumers across key urban cities in the country.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2032. Spherical Insights has segmented the global energy drink market based on the below-mentioned segments:

Energy Drink Market, Packaging Analysis

- Bottles

- Cans

- Others

Energy Drink Market, Product Analysis

- Shots

- Drinks

- Mixers

Energy Drink Market, Distribution Channel Analysis

- Supermarkets/Hypermarkets

- Specialty Stores

- Convenience Stores

- Online Retail Stores

- Other

Energy Drink Market, Type Analysis

- Conventional

- Organic

Energy Drink Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Need help to buy this report?