Global Energy Drinks Market Size, Share, And COVID-19 Impact Analysis; By Packaging Type (Bottles & Cans), By Product (Drinks, Shots & Mixers), By Distribution Channel (Supermarket/Hypermarket, Convenience Stores, Specialty Stores & Online); By Region (U.S., Canada, Mexico, Rest Of North America, The UK, France, Germany, Italy, Spain, Nordic Countries (Denmark, Finland, Iceland, Sweden, Norway), Benelux Union (Belgium, The Netherlands, Luxembourg), Rest Of Europe, China, Japan, India, New Zealand, Australia, South Korea, Southeast Asia (Indonesia, Thailand, Malaysia, Singapore, Rest Of Southeast Asia), Saudi Arabia, UAE, Egypt, Kuwait, South Africa, Rest Of Middle East & Africa, Brazil, Argentina, Rest Of Latin America) - Global Insights, Growth, Size, Comparative Analysis, Trends And Forecast, 2021-2030

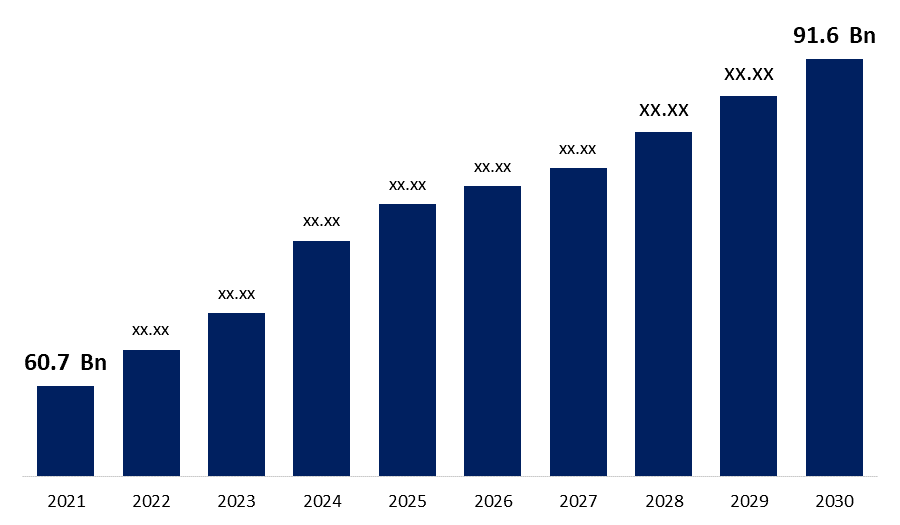

Industry: Food & BeveragesThe Global Energy Drinks Market was valued at USD 60.7 billion in 2021. The market is projected to grow USD 91.6 billion in 2030, at a CAGR of 7.3%. An energy drink is a beverage that contains a high amount of stimulants, such as caffeine, taurine, ginseng, guarana, and other ingredients. It improves physical performance as well as mental acuity. Energy drinks can be carbonated or not. Sports drinks, on the other hand, are used to replenish electrolytes and water during or after physical activity. They're also distinct from tea and coffee, which are brewed, have fewer ingredients, and can be decaffeinated. Energy drink manufacturers claim that their goods boost energy levels. The popularity of energy drinks, which provide quick energy as well as mental and physical stimulation, is one of the main reasons for their market rise. Taurine, another important component, is required for cardiovascular function as well as skeletal muscle development. The global energy drinks market forecast is largely influenced by these factors. Furthermore, rising health awareness, changing consumer lifestyles, and increased awareness of health wellness goods are projected to drive market expansion in the near future. Furthermore, the global industry is growing due to a surge in popularity among youngsters. Caffeine overdose, on the other hand, can cause hypertension, nausea, restlessness, and other health problems, limiting the expansion of the energy drink sector. On the contrary, throughout the projected period, a shift in consumer preferences toward beverage consumption and a healthy lifestyle is expected to generate profitable chances for market advancement.

Get more details on this report -

The outbreak of the COVID-19 disease in 2020 had a moderate Impact on the global energy drinks market. The supply chain disruptions, lack of labor, partial or complete closure of manufacturing facilities, and difficulties in the procurement of raw materials were the major issue faced by the manufacturers during the pandemic

Global Energy Drinks Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2021 |

| Market Size in 2021: | USD 60.7 Billion |

| Forecast Period: | 2021 - 2030 |

| Forecast Period CAGR 2021 - 2030 : | 7.3% |

| 2030 Value Projection: | USD 91.6 Billion |

| Historical Data for: | 2017 - 2020 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 119 |

| Segments covered: | By Packaging Type, By Product, By Distribution Channel, By Region |

| Companies covered:: | Red Bull, Monster Energy, Coca Cola, PepsiCo, AriZona Beverages, National Beverage Corp, Keurig Dr Pepper, Inc, 5-hour ENERGY, The Cloud 9 Energy Drink, Vitale Beverages, Xtreme Energy Group Limited, |

| Growth Drivers: | 1) The cans segment has dominated the market share 2) The shots held the largest market share |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Packaging Type Insights

Based on the product type segment, the global energy drinks market is categorized into bottles & cans. The cans segment has dominated the market share of the global energy drinks market in 2020 owing to the increased demand across the young and old millennials across the world. Easy handling and availability are propelling the growth of the global energy drinks market.

Product Insights

Based on the product segment, the global energy drinks market is categorized into drinks, shots & mixers. The shots held the largest market share in 2020 of the global energy drinks market attributing to the increasing demand for user friendly smart devices in turn growing sales of Shots smart monitors. Easy use and simple design are some of the features which is fueling the growth of the global energy drinks market.

Distribution Channel Insights

Based on the distribution channel segment, the global energy drinks market is categorized into supermarket/hypermarket, convenience stores, specialty stores & online. The convenience stores segment is dominated the market share in 2020 owing to the growing number of retail shops is increasing in both urban and rural locations. Furthermore, the availability of many types of monitors in these convenience stores is a crucial element driving baby monitor sales through convenience stores.

Get more details on this report -

REGIONAL INSIGHTS

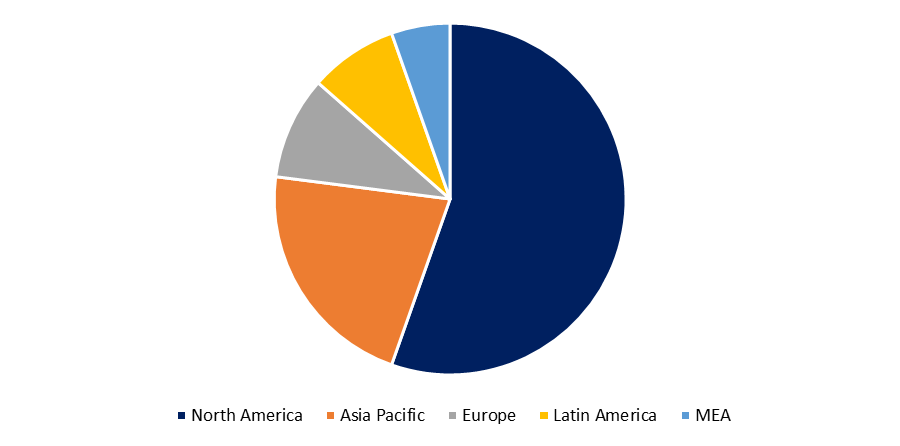

The global energy drinks market is categorized into North America, Europe, Asia-Pacific, Latin America, Middle East and Africa. North America region is dominating the market share of global energy drinks market owing to the high product adoption by consumers and increased consumption of carbonated beverages along with awareness regarding sustainability. Presence of major players and increased consumer awareness in the region is boosting the sales of the global energy drinks market. For instance, in January 2019, Coca-Cola is planning to launch energy drink in the U.S. with the flavor of cherry. However, Asia Pacific is expected to witness highest growth rate during the forecast period of beverage cans market due to the rising population and urbanization activities. Increased number of athletes and the growing popularity of various exercise activities are fueling the growth of the global energy drinks market. According to the Special Olympics, India saw the most growth in 2018, with around 80,000 new child athletes. However, rising middle-class customers with changing lifestyles, particularly in emerging nations like China and India, are driving demand for naturally flavored sports drinks.

INDUSTRY PLAYERS

- Red Bull

- Monster Energy

- Coca Cola

- PepsiCo

- AriZona Beverages

- National Beverage Corp.

- Keurig Dr Pepper, Inc.

- 5-hour ENERGY

- The Cloud 9 Energy Drink

- Vitale Beverages

- Xtreme Energy Group Limited

- Others

MARKET SEGMENTATION

By Packaging Type

- Bottles

- Cans

By Product

- Drinks

- Shots

- Mixers

By Distribution Channel

- Supermarket/Hypermarket

- Convenience stores

- Specialty Stores

- Online

By Region

- North America- U.S., Mexico, Canada

- Europe- UK, France, Germany, Italy

- Asia-Pacific- China, Japan, India

- Latin America- Brazil, Argentina, Colombia

- The Middle East and Africa- United Arab Emirates, Saudi Arabia

Need help to buy this report?