Global Energy Efficient Glass Market Size, Share, and COVID-19 Impact Analysis, By Coating (Hard Coat and Soft Coat), By Glazing (Triple Glazing, Double Glazing, and Single Glazing), By Application (Automotive, Building & Construction, and Solar Panels), By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 - 2032

Industry: Chemicals & MaterialsGlobal Energy Efficient Glass Market Insights Forecasts to 2032

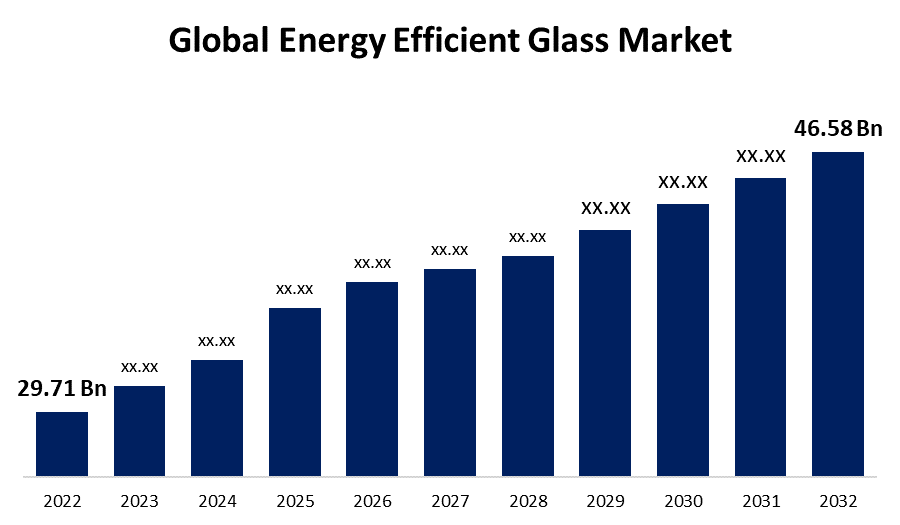

- The Global Energy Efficient Glass Market Size was valued at USD 29.71 Billion in 2022.

- The market Size is Growing at a CAGR of 4.6% from 2022 to 2032

- The Worldwide Energy Efficient Glass Market Size is expected to reach USD 46.58 Billion by 2032

- Asia-Pacific is expected to grow the significant during the forecast period

Get more details on this report -

The Global Energy Efficient Glass Market Size is expected to reach USD 46.58 Billion by 2032, at a CAGR of 4.6% during the forecast period 2022 to 2032.

Market Overview

Energy-efficient glass, also known as low-emissivity (low-e) glass, is a technologically advanced solution designed to enhance energy efficiency in buildings. It incorporates a microscopically thin coating that helps regulate the transfer of heat and light. This specialized coating allows natural light to pass through while minimizing the amount of heat that enters or escapes, reducing the need for artificial lighting and temperature control. Energy-efficient glass reduces energy consumption by improving insulation and preventing heat loss in cold climates or heat gain in warmer regions. It also helps maintain a comfortable indoor environment by reducing glare and blocking harmful UV radiation. By significantly reducing energy usage, energy-efficient glass contributes to lower carbon emissions and energy costs while promoting sustainability in the construction industry.

Report Coverage

This research report categorizes the market for energy efficient glass market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the energy efficient glass market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the energy efficient glass market.

Global Energy Efficient Glass Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022 : | USD 29.71 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 4.6% |

| 2032 Value Projection: | USD 46.58 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 130 |

| Segments covered: | By Coating, By Glazing, By Application, By Region |

| Companies covered:: | Saint-Gobain, AGC, Guardian, Kaphs S.A., Metro Performance Glass, SCHOTT AG, Morley Glass & Glazing, Vitro Architectural Glass, Sisecam Group, Sedak GmbH & Co. Kg |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The energy-efficient glass market is driven by several factors that contribute to its growth and adoption. The stringent government regulations and building codes regarding energy efficiency drive the demand for energy-efficient solutions, including glass, in construction projects. Additionally, rising awareness about the environmental impact of energy consumption and the need to reduce carbon emissions fuel the market's expansion. The increasing focus on sustainable and green building practices further propels the demand for energy-efficient glass. Furthermore, the desire to optimize energy consumption and reduce utility costs drives both residential and commercial sectors to invest in energy-efficient glass solutions. Technological advancements, such as the development of advanced coatings and glazing techniques, also play a vital role in expanding the market by improving the performance and capabilities of energy-efficient glass products.

Restraining Factors

The energy-efficient glass market faces certain restraints that impact its growth. One significant restraint is the higher initial cost of energy-efficient glass compared to conventional glass options. This cost barrier can deter some customers from adopting energy-efficient solutions, particularly in price-sensitive markets. Additionally, the retrofitting challenges associated with replacing existing glass installations with energy-efficient glass can pose a restraint. Limited awareness and knowledge about the benefits and availability of energy-efficient glass among consumers and builders also hinder market growth. Moreover, the complex manufacturing processes and technical requirements for energy-efficient glass can limit its widespread adoption. Overall, fluctuating raw material prices and supply chain disruptions can impact the market's stability and pose challenges for manufacturers.

Market Segmentation

- The hard coat segment is expected to grow at a CAGR of around 4.9% during the forecast period

On the basis of the product type, the global energy efficient glass market is segmented into hard coat and soft coat. The hard coat segment is anticipated to experience significant growth during the forecast period in the energy-efficient glass market. This growth can be attributed to several factors because hard coat technology involves the application of a durable and resilient coating on the glass surface, providing enhanced scratch resistance and durability. The demand for hard coat energy-efficient glass is increasing due to its superior performance and longevity, making it suitable for various applications in the construction industry. Hard coat glass offers improved resistance to abrasion, weathering, and chemical exposure, making it ideal for exterior windows and facades. Additionally, advancements in hard coat technology have resulted in more cost-effective and efficient manufacturing processes, making it more accessible for a wide range of construction projects. The benefits of long-lasting performance, reduced maintenance, and extended lifespan are driving the growth of the hard coat segment in the energy-efficient glass market.

- In 2022, the building & construction segment dominated with more than 38.7% market share

Based on the type of application, the global energy efficient glass market is segmented into automotive, building & construction, and solar panels. The building and construction segment has emerged as the dominant force in the energy-efficient glass market, capturing the largest market share. This dominance can be attributed to various factors, because the building and construction industry is one of the primary consumers of energy-efficient glass, as it plays a crucial role in enhancing the energy efficiency and sustainability of buildings. The sector encompasses residential, commercial, and industrial construction projects, all of which require energy-efficient solutions for windows, facades, and skylights. Additionally, stringent building codes, regulations, and certifications emphasizing energy efficiency have pushed the adoption of energy-efficient glass in construction projects. The demand is further driven by the growing awareness and recognition of the environmental impact of buildings, as well as the desire to reduce energy consumption and operating costs. Moreover, architects, developers, and building owners are increasingly valuing the benefits of energy-efficient glass, such as improved insulation, reduced carbon emissions, enhanced indoor comfort, and potential energy savings, leading to its widespread incorporation in construction designs.

Regional Segment Analysis of the Energy Efficient Glass Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

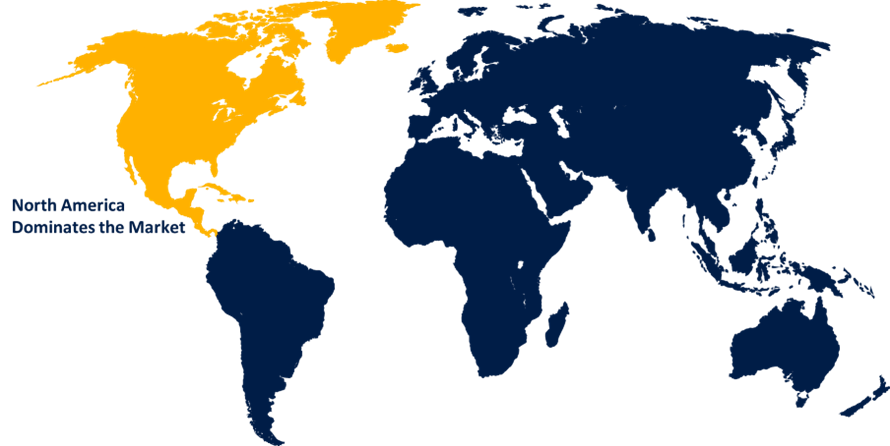

North America dominated the market with more than 45.6% revenue share in 2022.

Get more details on this report -

Based on region, North America has emerged as a dominant player in the energy-efficient glass market, holding the largest market share. This can be attributed to several factors, such as North America has been proactive in implementing stringent energy efficiency regulations and standards for buildings. The region has established robust energy codes and certifications that encourage the use of energy-efficient materials, including glass, in construction projects. Additionally, there is a growing awareness among consumers and businesses about the environmental impact of energy consumption, leading to increased demand for energy-efficient solutions. The presence of major players in the glass industry and their focus on research and development activities to enhance energy-efficient glass technologies also contribute to North America's market dominance. Moreover, government initiatives, such as tax incentives and subsidies, further incentivize the adoption of energy-efficient glass, driving market growth in the region.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global energy efficient glass market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Companies:

- Saint-Gobain

- AGC

- Guardian

- Kaphs S.A.

- Metro Performance Glass

- SCHOTT AG

- Morley Glass & Glazing

- Vitro Architectural Glass

- Sisecam Group

- Sedak GmbH & Co. Kg.

Key Target Audience

- Market Players

- Investors

- End-Users

- Government Authorities

- Consulting and Research Firm

- Venture Capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In January 2023, Yes World Climate Tech Pte Ltd, a Singapore-based company, created the first energy-efficient Windows Solution for residential and commercial buildings. This new line of speciality glass goods is part of the company's SAVE EARTH MISSION, which strives to reduce the carbon impact of the environment.

- In June 2021, Saint Gobain acquired Vi-Lux Building Products, a leading manufacturer of cellular polyvinyl chloride (PVC) moulding. This strategic move by Saint Gobain was driven by the objective of broadening its product portfolio and catering to the diverse requirements of its customers. The acquisition of Vi-Lux Building Products enabled Saint Gobain to enhance its offerings and better meet the demands of a wide range of customers.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2019 to 2032. Spherical Insights has segmented the global energy efficient glass market based on the below-mentioned segments:

Energy Efficient Glass Market, By Coatings

- Hard Coat

- Soft Coat

Energy Efficient Glass Market, By Glazing

- Triple Glazing

- Double Glazing

- Single Glazing

Energy Efficient Glass Market, By Application

- Automotive

- Building & Construction

- Solar Panels

Energy Efficient Glass Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Need help to buy this report?