Global Energy Efficient Motor Market Size, Share, and COVID-19 Impact Analysis, By Type (Super Premium-IE4, Premium-IE3, High-IE2, and Standard-IE1), By Product Type (AC Motor and DC Motor), By Application (Pumps, Fans, Compressed Air, Refrigeration, Material Handling, and Material Processing), By End User (Industrial, Commercial, Residential, Agriculture Sector, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Energy & PowerGlobal Energy Efficient Motor Market Insights Forecasts to 2033

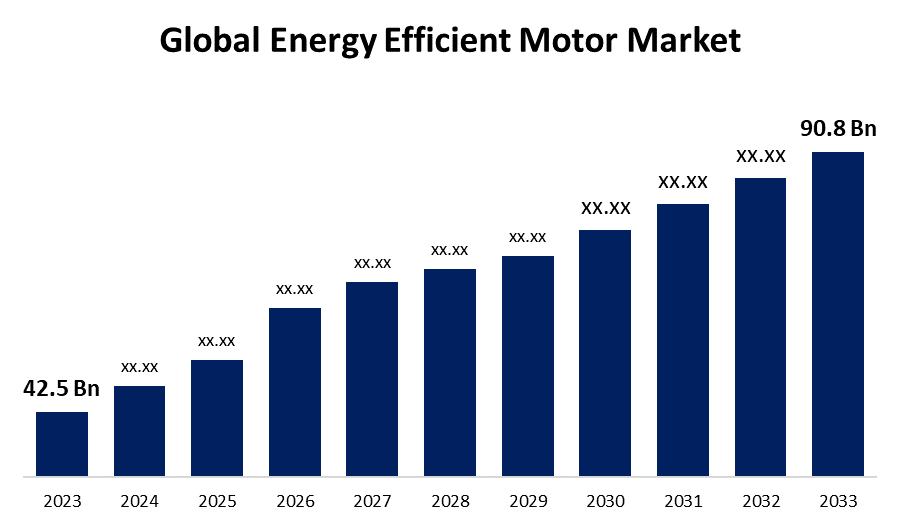

- The Global Energy Efficient Motor Market Size was Valued at USD 42.5 Billion in 2023

- The Market Size is Growing at a CAGR of 7.89% from 2023 to 2033

- The Worldwide Energy Efficient Motor Market Size is Expected to Reach USD 90.8 Billion by 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Energy Efficient Motor Market Size is Anticipated to Exceed USD 90.8 Billion by 2033, Growing at a CAGR of 7.89% from 2023 to 2033.

Market Overview

Electric motors are specially made to run more efficiently than traditional motors, the market for certain types of motors is known as the global energy efficient motor market. Because these motors are designed to maximize energy conversion and minimize energy losses, they use less energy and have a less environmental effect. They also cost less to operate. Numerous sectors and applications, such as HVAC systems, industrial machinery, automotive, aerospace, consumer appliances, and more, use energy-efficient motors. Governments and organizations all around the globe have set strict energy efficiency requirements and rules, which they are made to fulfill or surpass. Companies understood the need for efficient motor systems to decrease energy consumption and operational costs, as distant work and supply chain interruptions became common. Due to the increase in demand for energy-efficient motors, both well-established industries and new arrivals were required to adapt and extend their product lines. Reflecting the changing dynamics of the business, there was also an increasing emphasis on integrating smart and IoT-enabled technologies to improve monitoring and control. Due to its design, which minimizes energy consumption by preventing the motor from being overloaded or underloaded and by using better insulation and more effective cooling to minimize energy loss, energy-efficient motors have seen a sharp increase in demand in recent years.

Report Coverage

This research report categorizes the market for the energy efficient motor market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the energy efficient motor market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the energy efficient motor market.

Global Energy Efficient Motor Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023 : | USD 42.5 Billion |

| Forecast Period: | 2023 – 2033 |

| Forecast Period CAGR 2023 – 2033 : | 7.89% |

| 023 – 2033 Value Projection: | USD 90.8 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 208 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Product, Type By Application, By End User |

| Companies covered:: | ABB, Siemens, Schneider Electric, Eaton, Honeywell, Nidec, WEG, Toshiba Mitsubishi-Electric Industry Systems Corporation (TMEIC), Emerson, Rockwell Automation, Regal Beloit Corporation, United Technologies Corporation, NXP Semiconductors, STMicroelectronics, Texas Instruments, and Others key vendors |

| Pitfalls & Challenges: | Covid-19 Impact, Challenge, Future,Growth and Analysis |

Get more details on this report -

Driving Factors

Governments have the authority to impose minimum energy efficiency criteria on motor manufacturers, compelling them to develop motors that either meet or above certain efficiency thresholds. These guidelines have the potential to push the industry in the direction of more broadly accessible and energy-efficient motors. To increase public understanding of the advantages of energy-efficient motors and how they may be used in a variety of businesses, the government also offers outreach and education initiatives. This can involve public awareness efforts to encourage the adoption of energy-efficient motors as well as training courses for technicians and engineers on how to install and maintain them. Governments can create energy efficiency programs that offer funding and technical support to companies and people wishing to use energy-efficient technology. These programs offer financing choices to assist with the initial expenses of the new equipment, help discover potential for energy savings, and offer direction in choosing the best motor for a certain application.

Restraining Factors

To guarantee their performance, energy-efficient motors frequently need better materials, more sophisticated production techniques, and extra testing and certification. Manufacturers may incur greater manufacturing expenses as a result, raising the final product's price for the consumer. Some consumers may be unaware of the advantages of energy-efficient motors and are unwilling to pay a premium for a technology they don't fully comprehend.

Market Segmentation

The global energy efficient motor market share is classified into type, product type, application, and end user.

- The premium-IE3 segment is anticipated to be rapidly growing in the market during the projected period.

Based on the type, the global energy efficient motor market is divided into super premium-IE4, premium-IE3, high-IE2, and standard-IE1. Among these, the premium-IE3 segment is anticipated to be rapidly growing in the market during the projected period. These motors provide improved energy efficiency, decreased functional cost, and eco-friendly benefits, making them more attractive for businesses focusing on sustainability and cost savings.

- The DC motor segment is anticipated to hold the largest market share during the forecast period.

Based on the product type, the global energy efficient motor market is divided into AC motor and DC motor. Among these, the DC motor segment is anticipated to hold the largest market share during the forecast period. This is because DC motors are ideal for use in vacuums, fabrication and manufacturing equipment, elevators, and material handling equipment because of their faster reaction times and more constant torque and speed levels.

- The fans segment is expected to grow at the fastest pace in the market during the forecast period.

Based on the application, the global energy efficient motor market is divided into pumps, fans, compressed air, refrigeration, material handling, and material processing. Among these, the fans segment is expected to grow at the fastest pace in the market during the forecast period. The adoption of efficient motor technologies for fans has increased due to the increasing awareness about the environment and the government's strict policies. These motors diminish electricity consumption while minimizing greenhouse gas emissions.

- The industrial segment is anticipated to grow fastest in the market during the forecast period.

Based on the end user, the global energy efficient motor market is divided into industrial, commercial, residential, agriculture sector, and others. Among these, the industrial segment is anticipated to grow fastest in the market during the forecast period. The energy-efficient motors play a crucial role in the industrial sector because of their robustness. Energy-efficient motors reduce electricity consumption during the production processes.

Regional Segment Analysis of the Global Energy Efficient Motor Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to dominate the global energy efficient motor market during the forecast period.

Get more details on this report -

North America is anticipated to dominate the global energy efficient motor market during the forecast period. Increased investment in the industrial, commercial, and transportation sectors has led to the rapid growth of the market in this region. In the North American region, countries are trying to concentrate on energy efficiency through various ways such as programs, collaborations, and initiatives. The Industrial Efficiency and Decarbonization Office (IEDO), for example, seeks to raise manufacturers' productivity, competitiveness, and material and energy efficiency throughout the industrial sector.

Asia Pacific region is estimated to be the fastest-growing region during the forecast period. The need for energy-efficient motors has increased due to the establishment of minimum energy performance requirements or labeling programs for electric motors by several Asia-Pacific nations, which is responsible for the rise in the area. The most populated area in the world, Asia-Pacific, is expected to overtake the United States as the world's largest energy user.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global energy efficient motor market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- ABB

- Siemens

- Schneider Electric

- Eaton

- Honeywell

- Nidec

- WEG

- Toshiba Mitsubishi-Electric Industry Systems Corporation (TMEIC)

- Emerson

- Rockwell Automation

- Regal Beloit Corporation

- United Technologies Corporation

- NXP Semiconductors

- STMicroelectronics

- Texas Instruments

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In August 2022, the low-voltage NEMA motor division of Siemens acquired by ABB, was revealed. This purchase offers a respected product range, a loyal customer base in North America, and an experienced operations, sales, and management team. Its production facilities are located in Guadalajara, Mexico.

- In April 2022, SynRA motors with IE4 and IE5 ratings were introduced by Nidec Corporation for use in commercial pumping and HVAC systems.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the global energy efficient motor market based on the below-mentioned segments:

Global Energy Efficient Motor Market, By Type

- Super Premium-IE4

- Premium-IE3

- High-IE2

- Standard-IE1

Global Energy Efficient Motor Market, By Product Type

- AC Motor

- DC Motor

Global Energy Efficient Motor Market, By Application

- Pumps

- Fans

- Compressed Air

- Refrigeration

- Material Handling

- Material Processing

Global Energy Efficient Motor Market, By End User

- Industrial

- Commercial

- Residential

- Agriculture Sector

- Others

Global Energy Efficient Motor Market, Regional

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. Which are the key companies that are currently operating within the market?ABB, Siemens, Schneider Electric, Eaton, Honeywell, Nidec, WEG, Toshiba Mitsubishi-Electric Industry Systems Corporation (TMEIC), Emerson, Rockwell Automation, Regal Beloit Corporation, United Technologies Corporation, NXP Semiconductors, STMicroelectronics, Texas Instruments, and Others

-

2. What is the size of the global energy efficient motor market?The Global Energy Efficient Motor Market Size is Expected to Grow from USD 42.5 Billion in 2023 to USD 90.8 Billion by 2033, at a CAGR of 7.89% during the forecast period 2023-2033.

-

3. Which region is holding the largest share of the market?North America is anticipated to hold the largest share of the global energy efficient motor market over the predicted timeframe.

Need help to buy this report?