Global Energy-Efficient Window Market Size, Share, and COVID-19 Impact Analysis, By Component (Glass, Frame, and Hardware), By Application (New Construction and Renovation & Reconstruction), By End-Use Sector (Residential and Non-Residential), By Glazing Type, and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 – 2032

Industry: Construction & ManufacturingGlobal Energy-Efficient Window Market Insights Forecasts to 2032

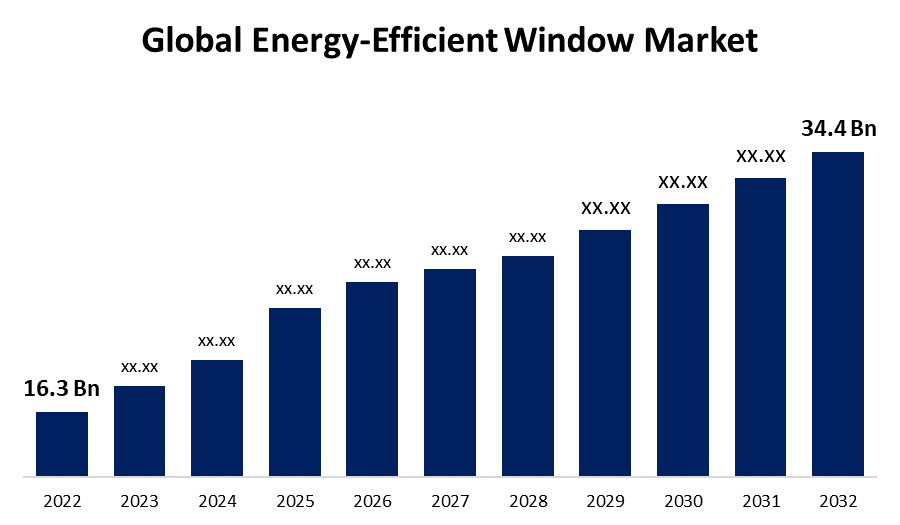

- The Global Energy-Efficient Window Market Size was valued at USD 16.3 Billion in 2022.

- The Market is Growing at a CAGR of 7.8% from 2022 to 2032

- The Worldwide Sports Technology Market Size is expected to reach USD 34.4 Billion by 2032

- Europe is expected to grow the fastest during the forecast period.

Get more details on this report -

The Global Energy-Efficient Window Market Size is expected to reach USD 34.4 Billion by 2032, at a CAGR of 7.8% during the forecast period 2022 to 2032.

The Global Energy-efficient Windows Market is being driven by an increase in development around the world, as well as the acceptance of green buildings and an increase in demand for energy-efficient infrastructure for buildings and green buildings are becoming increasingly popular in the commercial construction sector of developing countries. Additionally, the rising standard of living of consumers has contributed to market expansion. The market is comprehensively evaluated in the study on the global energy-efficient windows.

Energy-efficient windows prevent the air from inside the room from leaving the room, and energy-efficient windows help to reduce the wasteful use of electricity. As a result, the room's temperature is maintained and artificial air heating and cooling are reduced, which in turn promotes the expansion of the sector for energy-efficient windows. The governments have also imposed restrictions for lowering the carbon footprint of households as a result of greater awareness about environmental sustainability as a result of the recognition of climate change on a worldwide scale. To put such measures in place, governments frequently provide various subsidies for the replacement of aging windows and furnaces, which waste energy. As a result of these subsidies, there is a greater demand for energy-efficient windows to replace older ones, which in turn boosts the industry's growth.

Furthermore, according to the National Fenestration Rating Council (NFRC) of the United States, every energy-efficient window product is recognized based on SHGC and U-factor, certifying it for the Energy Star Rating. The market demand is being fueled by the rising acceptance of cost- and environmentally friendly energy-efficient windows. The adoption of energy-efficient windows, which reduces energy consumption and air conditioning expenses, is a key factor in the growth of the market for energy-efficient products.

Global Energy-Efficient Window Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 16.3 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 7.8% |

| 2032 Value Projection: | USD 34.4 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Component, By Application, By End-Use Sector, By Glazing Type, By Region and COVID-19 Impact Analysis. |

| Companies covered:: | YKK AP, Inc., Builders First Source, Inc., Deceuninck NV, PGT, Inc., Asahi Glass Co. Ltd., Nippon Sheet Glass Co. Ltd., Central Glass Co. Ltd., Masco Corporation, Builders First Source Inc., Jeld-Wen Holding Inc., VKR Holding A/S and YKK Corporation., Andersen Corporation., Apogee Enterprises Inc., Asahi Glass Co. Ltd., Saint-Gobain SA, Central Glass Co. Ltd. and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

There are several driving factors of energy efficient windows, energy savings, environmental concern, rising energy cost and others. One of the primary driving factors is the potential for significant energy savings. Energy-efficient windows are designed to minimize heat loss during cold weather and prevent heat gain during hot weather, reducing the need for heating and cooling systems. This directly translates into lower energy bills for homeowners and businesses. Growing awareness of environmental issues and the need to reduce carbon emissions have prompted the adoption of energy-efficient technologies. Energy-efficient windows contribute to lowering greenhouse gas emissions by decreasing the energy demand for heating, cooling, and lighting. Building codes and energy efficiency standards set by governments and regulatory bodies encourage or even mandate the use of energy-efficient windows in new construction and renovation projects. Compliance with these codes is a significant factor driving the demand for such windows.

Restraining Factors

Energy-efficient windows often come with a higher upfront cost compared to standard windows. This initial cost can deter budget-conscious consumers, especially in markets where cost is a significant consideration. The effectiveness of energy-efficient windows can vary depending on the climate of the region. In milder climates, the energy savings might not be as immediately noticeable, which can impact the perceived value.

Market Segmentation

By Type Insights

The double-glazing segment is dominating the market with the largest revenue share over the forecast period.

Based on type, the energy-efficient Window market is segmented into double-glazed, triple-glazed, and others. Among these, the double glazing segment is the largest market share and the highest projected CAGR in the global energy-efficient windows market, double glazing currently dominates the industry. Because It has two windows that are divided by a gas or vacuum-filled gap to lessen heat transfer. Increasing the requirement to keep room temperature in residential and commercial buildings by restricting outside heat flows may drive demand. The double-glazing segment is expected to hold the largest market share during the forecast period due to its lower cost, efficiency, and noise-reduction properties

By Component Insights

The glass segment is witnessing significant CAGR growth over the forecast period.

Based on components, the energy-efficient Window market is segmented into glass, frame, hardware others. Among these, the increased awareness about climate change, and the glass segment are expected to lead the market over the projection period. Energy is crucial for both powering homes and running companies. The majority of the energy generated on the planet comes from non-renewable sources, which increases the production of greenhouse gases (GHGs). People are implementing cutting-edge technology to lower energy consumption; as a result, they are integrating energy-efficient windows into their residential and commercial structures. Transparent glass is used, which helps to block UV and infrared radiation and keep a comfortable temperature in the home or structure.

By Application Insights

The commercial segment is expected to hold the largest share of the Energy-Efficient Window Market during the forecast period.

Based on application, The commercial sector is anticipated to hold the largest market share during the anticipated time range. The expansion of this market might be attributable to more companies realizing the financial benefits of energy-efficient windows. Energy-efficient windows can dramatically lower the cost of cooling systems in a commercial complex.

Regional Insights

North America dominates the market with the largest market share over the forecast period.

Get more details on this report -

North America is dominating the market with more than 49.20% market share over the forecast period. North America's economy is predicted to expand at the fastest rate due to ongoing government funding. In 2022, the non-residential sector dominated the North American market in terms of end-use. The market in the area is dominated by the US. Energy-efficient windows have begun to be used in Canada and Mexico, but it will take some time for them to become widely used. The allocation of new projects to the construction industry has drastically decreased as a result of the COVID-19 epidemic. However, thanks to government assistance and the revival, recovery is expected.

Given the surge in residential building energy efficiency, Europe is predicted to experience significant growth in the market for energy-efficient window. Additionally, it is projected that the region's market for energy-efficient glass will rise in the next years due to rigorous regulatory compliance about energy saving and rising disposable income.

The Asia-Pacific market for energy-efficient windows is estimated to grow at the greatest CAGR throughout the anticipated time frame. The construction sector in this area is beginning to recognize the advantages of energy-efficient windows, including enhanced thermal and lighting performance, less condensation, and reduced fading of interior furnishings. China, Japan, Australia, India, and South Korea are ranked 4, 6, 10, 11, and 12 for having the most energy-efficient economy, according to the American Council for an Energy-Efficient Economy (ACEEE). The market for energy-efficient windows in this area has benefited from government attempts to create smart cities. For instance, the government of India intends to invest US $6.5 billion in the construction of 4,000 smart communities by the end of 2023.

List of Key Market Players

- YKK AP, Inc.

- Builders First Source, Inc.

- Deceuninck NV

- PGT, Inc.

- Asahi Glass Co. Ltd.

- Nippon Sheet Glass Co. Ltd.

- Central Glass Co. Ltd.

- Masco Corporation

- Builders First Source Inc.

- Jeld-Wen Holding Inc.

- VKR Holding A/S and YKK Corporation.

- Andersen Corporation.

- Apogee Enterprises Inc.

- Asahi Glass Co. Ltd.

- Saint-Gobain SA

- Central Glass Co. Ltd.

Key Market Developments

- In January 2022, Ubiquitous Energy received a strategic investment from Andersen Corporation. The UE Power™ technology from Ubiquitous Energy is the first patented and transparent photovoltaic glass coating that harnesses solar power to generate electricity while looking almost indistinguishable from traditional windows.

- In June 2021, JELD-WEN expanded its geographical footprint by investing a huge amount in its Quebec-based manufacturing facilities. Quebec is a premium production location for Hybrid and Vinyl windows. This development has further broadened the growth opportunity for the energy-efficient windows industry in North America.

- In January 2021, Builders First Source Inc. completed the merger of BMC Stock Holdings to become the country’s premier supplier of a wide variety of building materials and services.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2032. Spherical Insights has segmented the Energy-Efficient Window Market based on the below-mentioned segments:

Energy-Efficient Window Market, Type Analysis

- Double Glazed

- Triple Glazed

- Others

Energy-Efficient Window Market, Component Analysis

- Glass

- Frame

- Hardware

Energy-Efficient Window Market, Application Analysis

- New Construction

- Renovation & reconstruction

Energy-Efficient Window Market, End-user Analysis

- Residential

- Non-Residential

Energy-Efficient Window Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Need help to buy this report?