Global Enhanced Oil Recovery Market Size, Share, and COVID-19 Impact Analysis, By Technology (Thermal Injection, Gas Injection, Chemical Injection, and Others), By Application (Onshore and Offshore), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

Industry: Energy & PowerGlobal Enhanced Oil Recovery Market Insights Forecasts to 2033

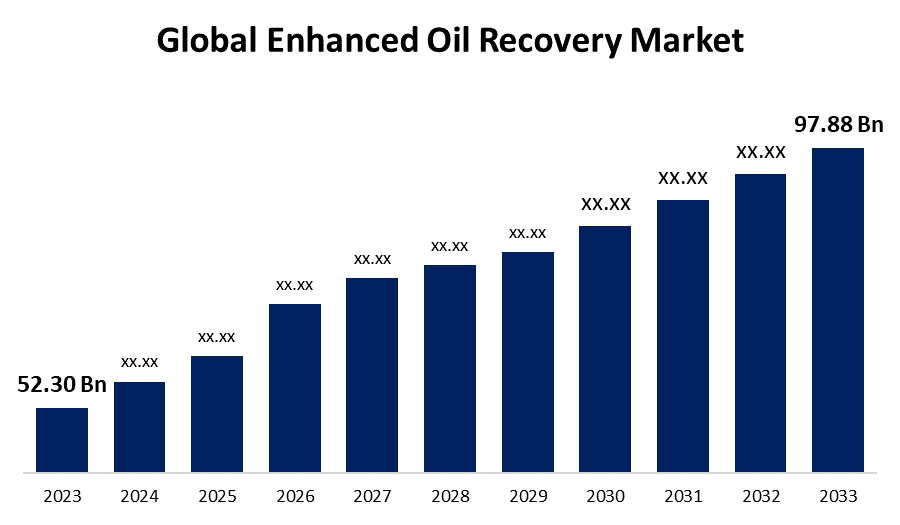

- The Global Enhanced Oil Recovery Market Size was Valued at USD 52.30 Billion in 2023

- The Market Size is Growing at a CAGR of 6.47% from 2023 to 2033

- The Worldwide Enhanced Oil Recovery Market Size is Expected to Reach USD 97.88 Billion by 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period

Get more details on this report -

The Global Enhanced Oil Recovery Market Size is Anticipated to Exceed USD 97.88 Billion by 2033, Growing at a CAGR of 6.47% from 2023 to 2033.

Market Overview

Tertiary recovery, also known as enhanced oil recovery (EOR), is the process of mobilizing residual oil that can't be extracted using primary or secondary recovery techniques. An expanding number of EOR techniques, such as thermal, gas, and chemical injection, are being used by the oil industry because conventional procedures frequently leave large amounts of oil underground. When it comes to oil extraction from reservoirs, the current production method offers several benefits, both technologically and economically. The tertiary method, also known as improved oil recovery, or EOR, targets immobile oil, which cannot be produced because of capillary and viscous forces. Primary and secondary methods have historically been used to target mobile oil in the reservoir. The highly technical and site-specific enhanced oil recovery techniques take into account variables like fluid composition, reservoir characteristics, and economic viability. The utilization of tertiary recovery in the production of liquid hydrocarbons through the implementation of diverse procedures is anticipated to serve as a principal catalyst for market growth in the forecast period. The main reasons driving the market expansion are the depletion of oil reserves, rising energy consumption, government incentives, fluctuations in oil prices, technical cooperation, geopolitical factors, and improved recovery policies.

Report Coverage

This research report categorizes the market for the global enhanced oil recovery market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global enhanced oil recovery market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global enhanced oil recovery market.

Global Enhanced Oil Recovery Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 52.30 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 6.47% |

| 2033 Value Projection: | USD 97.88 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 220 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Technology, By Application, By Region |

| Companies covered:: | Basf Se, Halliburton Corporation, Royal Dutch Shell Plc, Schlumberger Ltd., Chevron Phillips Chemical Corporation, Praxair Inc., Secure Energy Services Inc., ExxonMobil Corporation, Chevron Corporation, Xytel Corporation, Equinor ASA, BP Plc, China Petroleum & Chemical Corporation (Sinopec), and other key companies. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

The businesses are resolute in increasing output from the mature fields due to the growing demand for gas and oil. A Halliburton assessment indicates that around 70% of the world's oil and gas output comes from mature fields. Because of this, businesses are now concentrating on using EOR technology to increase recovery and prolong the life of mature assets, surpassing output levels in the process, which will drive the enhanced oil recovery market. The maximum oil recovery from the reservoir is provided by EOR, increasing total production. Additionally, by removing the need to drill a new well which is expected to drive the market it optimizes production costs.

Restraining Factors

Enhanced oil recovery has always depended on government subsidies or innovative investment strategies due to the high cost of technology. In comparison with conventional methods, the operation is inherently complex. The deployment of enhanced oil recovery necessitates highly skilled workers, a slow and deliberate integration of R&D, dedication, and the capacity to take risks, all of which restrict market growth.

Market Segmentation

The global enhanced oil recovery market share is classified into technology and application.

- The thermal injection segment is expected to hold the largest share of the global enhanced oil recovery market during the forecast period.

Based on the technology, the global enhanced oil recovery market is divided into thermal injection, gas injection, chemical injection, and others. Among these, the thermal injection segment is expected to hold the largest share of the global enhanced oil recovery market during the forecast period. A considerable amount of the original oil in place, occasionally even more than 50%, can be recovered using thermal injection-enhanced oil recovery techniques. Due to its substantial improvement in oil recovery over primary and secondary recovery methods, thermal injection enhanced oil recovery is a viable solution for operators seeking to optimize production from their current reservoirs.

- The onshore segment is expected to hold the largest share of the global enhanced oil recovery market during the forecast period.

Based on the application, the global enhanced oil recovery market is divided into onshore and offshore. Among these, the onshore segment is expected to hold the largest share of the global enhanced oil recovery market during the forecast period. Onshore oil fields are typically surrounded by well-maintained infrastructure, including pipelines, storage, and processing facilities. The current infrastructure can generate more revenue by reducing total production costs and improving the financial sustainability of onshore enterprises.

Regional Segment Analysis of the Global Enhanced Oil Recovery Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the global enhanced oil recovery market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the global enhanced oil recovery market over the predicted timeframe. Due to the widespread use of the technology in the US, the EOR market is mostly centered in North America. To boost production, the US Department of Energy is collaborating with several businesses to build EOR projects. To further support its dominance in this market share, the US provides several incentives, such as the US Section tax credit, which reduces taxes on CO2 stored in EOR activities by 12 years. The US price of crude oil drops to a 17-year low during the pandemic epidemic, casting doubt on the hydrocarbon industry's survival.

Asia Pacific is expected to grow at the fastest pace in the global enhanced oil recovery market during the forecast period. China manufacturing, electronics, and automotive sectors are primarily is driving the market growing growth in oil demand. The Chinese national oil corporations are promoting a number of initiatives to increase domestic production and lessen reliance on foreign oil. In a same vein, East Asian nations like India and Southeast Asia are putting EOR projects into action to raise domestic production and expand the Asia Pacific market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global enhanced oil recovery market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Basf Se

- Halliburton Corporation

- Royal Dutch Shell Plc

- Schlumberger Ltd.

- Chevron Phillips Chemical Corporation

- Praxair Inc.

- Secure Energy Services Inc.

- ExxonMobil Corporation

- Chevron Corporation

- Xytel Corporation

- Equinor ASA

- BP Plc

- China Petroleum & Chemical Corporation (Sinopec)

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In February 2023, HiPACT, a high-pressure regenerative CO2 capture device, was launched by Basf Se. By releasing CO2 off the gas at atmospheric pressure, the technique effectively absorbs CO2 from hydrogen production process gas utilizing natural gas as feedstock, lowering capture costs. Its absorption performance and durability at high temperatures are impressive. Effective Carbon Capture and Storage (CCS) is promoted by the recovered CO2, which improves gas recovery in depleted fields via CCUS.

- In June 2023, An agreement on industry-leading well construction automation technology was announced by Halliburton Corporation. Through the combination of Halliburton's subsurface knowledge and Nabors' drilling process automation and digital solutions, this cooperation seeks to achieve well construction efficiencies through repeatable and consistent results.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global enhanced oil recovery market based on the below-mentioned segments:

Global Enhanced Oil Recovery Market, By Technology

- Thermal Injection

- Gas Injection

- Chemical Injection

- Others

Global Enhanced Oil Recovery Market, By Application

- Onshore

- Offshore

Global Enhanced Oil Recovery Market, Regional

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. Which are the key companies that are currently operating within the market?Basf Se, Halliburton Corporation, Royal Dutch Shell Plc, Schlumberger Ltd., Chevron Phillips Chemical Corporation, Praxair Inc., Secure Energy Services Inc., ExxonMobil Corporation, Chevron Corporation, Xytel Corporation, Equinor ASA, BP Plc, China Petroleum & Chemical Corporation (Sinopec), and Others.

-

2. What is the size of the global enhanced oil recovery market?The global enhanced oil recovery market is expected to grow from USD 52.30 Billion in 2023 to USD 97.88 Billion by 2033, at a CAGR of 6.47% during the forecast period 2023-2033.

-

3. Which region is holding the largest share of the market?North America is anticipated to hold the largest share of the global enhanced oil recovery market over the predicted timeframe.

Need help to buy this report?