Global Ethanol Market Size, Share, and COVID-19 Impact Analysis, By Type (Synthetic, Biobased), By Source (Second Generation, Grain-based), By Purity (Denatured, Undenatured), By Application (Fuel, Industrial Solvent, Food & Beverages, Chemicals, Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Chemicals & MaterialsGlobal Ethanol Market Insights Forecasts to 2033

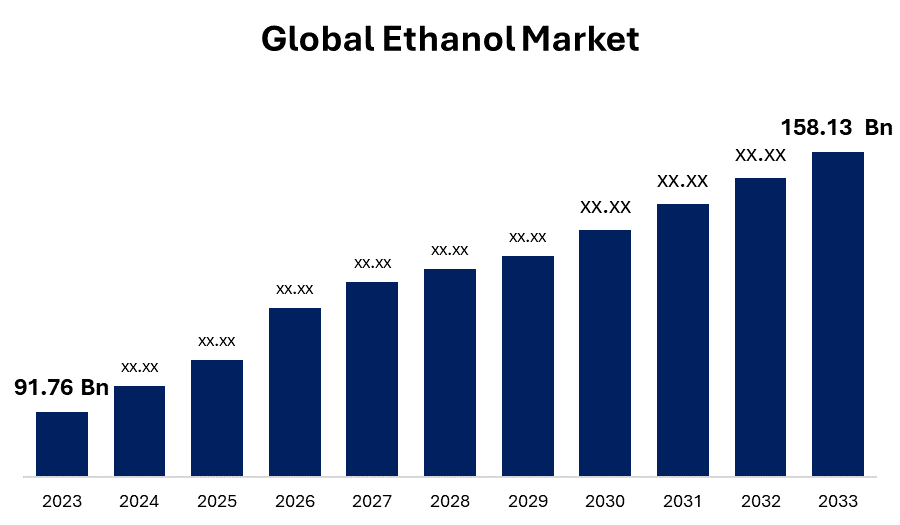

- The Global Ethanol Market Size was Valued at USD 91.76 Billion in 2023.

- The Market Size is Growing at a CAGR of 5.59% from 2023 to 2033.

- The Worldwide Ethanol Market is expected to reach USD 158.13 Billion by 2033.

- Latin America is expected to grow the fastest during the forecast period.

Get more details on this report -

The Global Ethanol Market Size is expected to reach USD 158.13 Billion by 2033, at a CAGR of 5.59% during the forecast period 2023 to 2033.

A colourless chemical substance with a pleasant taste and smell is ethanol, additionally referred to as ethyl alcohol. It is generated naturally via the fermentation of biological materials based on sugar and starch as well as cellulosic feedstock, such as wood, sugarcane, barley, corn, and wheat. The product is made synthetically using ethylene, natural gas, and coal. The market is anticipated to grow due to growing product demand from beverages, fuel and fuel additives, and solvents, as well as increased product advancement to make products more sustainable. During the forecast period, it is anticipated that the market will experience a surge due to the increasing government regulations aimed at producing eco-friendly products and the high demand for disinfectant applications. For instance, in March 2024, the US-based company Red Trail Energy LLC made history by being the first ethanol production facility to produce carbon removal credits and enter the voluntary carbon market (VCM). This project is the largest long-term carbon removal project currently registered under the prestigious Puro Standard. In addition, the aviation industry benefited as well from the opportunity to experiment with ethanol blending, resulting in significant advances in fuel innovation. Because the raw materials are widely available, producing ethanol is a cost-effective process. It is possible to replace a significant amount of crude oil imported from countries like India, where abundant raw materials are produced.

Report Coverage

This research report categorizes the market for the global ethanol market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global Ethanol market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global ethanol market.

Report Coverage

This research report categorizes the market for global ethanol market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global Ethanol market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the global ethanol market.

Ethanol Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 91.76 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 5.59% |

| 2033 Value Projection: | USD 158.13 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Type, By Source, By Purity, By Application, By Region |

| Companies covered:: | BioGasol ApS, Petrobras Biocombustível SA, Archer Daniels Midland Company, Green Plains Inc., Valero Energy Corporation, Cosan S.A., Southwest Iowa Renewable Energy LLC, Aemetis Inc., Marquis Energy LLC, POET LLC, Pacific Ethanol Inc., CropEnergies AG, The Andersons Inc., Flint Hills Resources LP, Abengoa Bioenergy SA, Raízen S.A., Tereos S.A., BP plc, Royal Dutch Shell plc, Cargill Inc., and other key companies. |

| Pitfalls & Challenges: | Covid-19 Empact,Challenges,Growth, Analysis. |

Get more details on this report -

Driving Factors

Ethanol's use as a biofuel is a major market driver. Over the past few years, the automobile industry has experienced rapid growth and numerous challenges in managing air pollution. Up to 10% and 15% of gasoline is blended with ethanol to address the issue of rising air pollution brought on by cars. Major benefits from adding ethanol include better fuel economy, higher thermal efficiency, and assistance with cold starts in the winter. When it comes to the use of ethanol as a biofuel, the United States and Brazil are at the top of the global market.

Restraining Factors

One of the major impediments to the global ethanol market's expansion is increasing prices for raw materials, which might market expansion. The impact of this limitation is anticipated to be moderate over the estimated period due to variations in raw material production. It is demeaning to limit imports while restricting the supply chain.

Market Segmentation

By Type Insights

The synthetic segment dominates the market with the largest revenue share over the forecast period.

Based on type, the global ethanol market is segmented into synthetic, and biobased. Among these, the synthetic segment is dominating the market with the largest revenue share over the forecast period. Synthetic product manufacturing with petroleum-based raw materials is a well-established process that lowers production costs when compared to renewable product manufacturing. Products made of biobased materials are now a viable substitute for manufactured goods. Due to the growing need for sustainable products to prevent pollution and fight rising carbon footprints, they are expected to see a significant increase in demand soon.

By Source Insights

The grain-based segment is witnessing significant CAGR growth over the forecast period.

Based on source, the global ethanol market is segmented into second-generation and grain-based. Among these, the grain-based engine segment is witnessing significant growth over the forecast period. Dry milling is the primary method for producing grain-based ethanol, with one bushel of maize yielding 2.86 gallons of denatured ethanol. worldwide corn production is expected to decline as manufacturers deal with concerns about yields and saturation of demand. Sugar mills are currently one of the primary methods used worldwide to produce ethanol. The acceptance of ethanol made from molasses is expanding globally, and developing countries are leading the way in this trend. The characteristics of coalescence and disinfection are driving demand. When low-carbon fuel requirements are implemented, molasses will be used more frequently as a feedstock for ethanol production.

By Purity Insights

The denatured dominate the market with the largest revenue share over the forecast period.

Based on the purity, the global ethanol market is segmented into denatured, and undenatured. Among these, the denatured segment is dominating the market with the largest revenue share over the forecast period. Expanding demand from consumers for household chemicals and fuel. It is possible to combine it with other substances to produce the required properties. It is mostly utilized in cleaning and disinfecting solutions for both indoor and outdoor areas. Since denatured alcohol is primarily produced from natural sources like corn starch and cereals, it is perfect for use in household settings. Two more important factors that promote growth are the growing awareness of the importance of interior hygiene and the harmful effects of synthetic substances.

By Application Insights

The fuel segment is expected to hold the largest share of the global ethanol market during the forecast period.

Based on the application, the global ethanol market is classified into fuel, industrial solvent, food & beverages, chemicals, and others. Among these, the fuel segment is expected to hold the largest share of the global ethanol market during the forecast period. Demand for ethanol, which is used to make gasoline additives to improve fuel economy, is increasing as both vehicle fuel demand and air pollution regulations evolve. Industrial solvents are used extensively in significant end-use sectors, which is one reason why their applications are continuously growing.

Regional Insights

North America dominates the market with the largest market share over the forecast period.

Get more details on this report -

North America is dominating the market with the largest market share over the forecast period. North America's government regulations supporting ethanol production, the use of ethanol as a biofuel, and the growing awareness of the need to reduce environmental pollution caused by using conventional fuels are the main factors contributing to the region's dominance over the market.

Latin America is expected to grow the fastest during the forecast period. The rise is a result of the automotive industry's growing need for bioethanol as a substitute for petroleum-derived from fossil fuels. Brazil boasts the largest fleet of automobiles in the world that run on ethyl alcohol produced from sugarcane instead of fossil fuels derived from petroleum, according to the Rapid Transitions Alliance Organization. Hence, the supportive government initiatives and increasing the manufacturing of bio-products will fuel the market growth in Latin America.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global ethanol market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market

List of Key Market Players

- BioGasol ApS

- Petrobras Biocombustível SA

- Archer Daniels Midland Company

- Green Plains Inc.

- Valero Energy Corporation

- Cosan S.A.

- Southwest Iowa Renewable Energy LLC

- Aemetis Inc.

- Marquis Energy LLC

- POET LLC

- Pacific Ethanol Inc.

- CropEnergies AG

- The Andersons Inc.

- Flint Hills Resources LP

- Abengoa Bioenergy SA

- Raízen S.A.

- Tereos S.A.

- BP plc

- Royal Dutch Shell plc

- Cargill Inc.

- Others

Key Market Developments

- On February 2024, Wärtsilä and Raízen have reached an extensive arrangement to focus on decarbonization modelling for new and increased buildings. Developing and executing a fleet-wide decarbonization plan is the main goal, and ethanol exploration as a potential marine fuel is highly desirable. This cooperative project investigates the effects of ethanol as a marine fuel to reduce greenhouse gas emissions and offer environmentally friendly fuel options to maritime industry clients.

- In April 2022, In Bihar, the country's first greenfield ethanol plant based on grains was inaugurated. This plant has zero liquid discharge and is entirely environmentally friendly because it was constructed with the most recent technologies and appropriate waste disposal facilities.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Global Ethanol Market based on the below-mentioned segments:

Ethanol Market, Type Analysis

- Synthetic

- Biobased

Ethanol Market, Source Analysis

- Second Generation

- Grain-based

Ethanol Market, Purity Analysis

- Denatured

- Undenatured

Ethanol Market, Application Analysis

- Fuel

- Industrial Solvent

- Food & Beverages

- Chemicals

- Others

Ethanol Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Global Ethanol Market?The Global Ethanol Market is expected to grow from USD 91.76 Billion in 2023 to USD 158.13 Billion by 2033, at a CAGR of 5.59% during the forecast period 2023-2033.

-

2. Which region is dominating the Global Ethanol Market?North America is dominating the market with the largest market share over the forecast period.

-

3. Which are the key companies in the market?BioGasol ApS, Petrobras Biocombustível SA, Archer Daniels Midland Company, Green Plains Inc., Valero Energy Corporation, Cosan S.A., Southwest Iowa Renewable Energy LLC, Aemetis Inc., Marquis Energy LLC, POET LLC, Pacific Ethanol Inc., CropEnergies AG, The Andersons Inc., Flint Hills Resources LP, Abengoa Bioenergy SA, Raízen S.A., Tereos S.A., BP plc, Royal Dutch Shell plc, Cargill Inc., and Others

Need help to buy this report?