Global Ethernet Connector & Transformer Market Size, Share, and COVID-19 Impact Analysis, By Type (ix Connector, M8 Connector, M12 Connector, RJ45 Connector), By Transmission Speed (10Base-T, 100Base-T, 1000 Base-T, 10GBase-T), By Application (Routers, Servo Drives, Control Cabinets, Hubs and Servers, Network Switches, Network Interface Cards, WLAN Access Equipment, Industrial Automation Equipment, Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 - 2032

Industry: Semiconductors & ElectronicsGlobal Ethernet Connector & Transformer Market Insights Forecasts to 2032

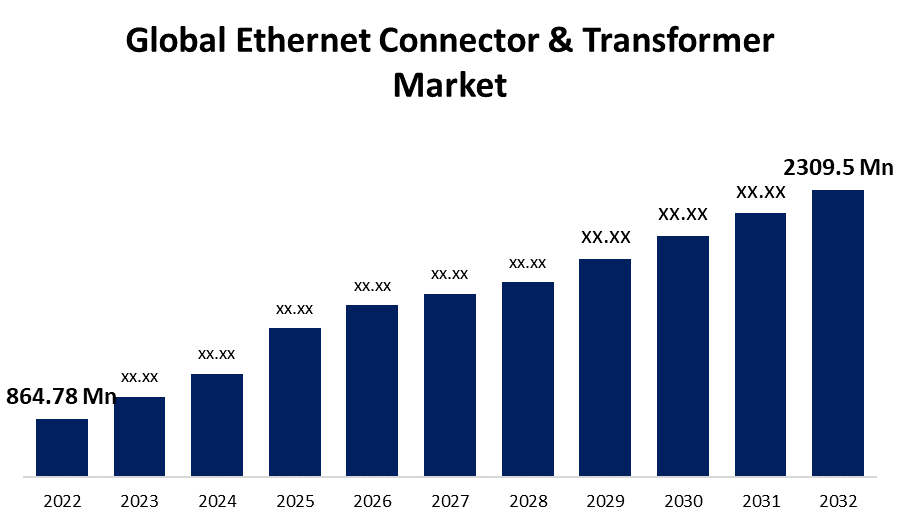

- The Global Ethernet Connector & Transformer Market Size was valued at USD 864.78 Million in 2022.

- The Market is growing at a CAGR of 10.32% from 2022 to 2032

- The Worldwide Ethernet Connector & Transformer Market is expected to reach USD 2309.5 Million by 2032

- North America is expected to grow the fastest during the forecast period

Get more details on this report -

The Global Ethernet Connector & Transformer Market Size is expected to reach USD 2309.5 million by 2032, at a CAGR of 10.32% during the forecast period 2022 to 2032.

The widespread use of Ethernet connections for a wide range of IT (Information Technology) platforms has been extensively recognized. Ethernet connections enable businesses to capitalize on increasing bandwidth demands to accommodate emerging networking and real-time data exchange requirements. As a result, Ethernet-based transformers are increasingly being used in networked telecommunication applications, especially for separation and signal processing. The adoption of high-bandwidth Ethernet allows for the development of complex IoT and interconnected transportation technologies that require greater data transfer rates. The proliferation of these applications is expected to increase the requirement for high-speed transmission in in-vehicle computer networks. Ethernet connectors are required for network-based devices to operate effectively. They are linked to an Ethernet cable, which is plugged into routers, TVs, PCs, laptops, and various other devices. They are typically employed to effectively handle bandwidth capacity and manage transmission speeds.

The major players in the global ethernet connector & transformer market include Eaton Corporation, TE Connectivity, TDK Corporation, Belden Inc., Schneider Electric, Bourns, Inc., Rockwell Automation, and HALO Electronics. The primary goal of these companies is to provide innovative solutions and work with significant contributors as the demand for integrating Ethernet transformers into linked communications applications for electrical isolation and signal processing increases. To extend their presence worldwide and accommodate demand, these organizations focus on consolidation, acquisitions, and introductions of new products.

For example, HALO Electronics, Inc, an established manufacturer of Ethernet Transformers, announced the initial release of the industry's first commercially available IEEE802.3ch compliant 2.5GBASE-T1 transformers in January 2022, providing galvanic isolation for applications requiring a higher level of isolation. One of the many advantages of this galvanic isolation transformer is better system-level CMR performance as a result of the PHY side Center Tap (CT) connecting to the ground, which should be useful in critical high-noise applications such as automotive and aerospace.

Global Ethernet Connector & Transformer Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 864.78 Million |

| Forecast Period: | 2022 – 2032 |

| Forecast Period CAGR 2022 – 2032 : | 10.32% |

| 022 – 2032 Value Projection: | USD 2309.5 Million |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Type , By Transmission Speed, By Application and By Region . |

| Companies covered:: | Bourns, Inc., Belden Inc., HALO Electronics, TE Connectivity, Eaton Corporation, Lapp Gruppe, Schneider Electric, Rockwell Automation, TDK Corporation, Bel Fuse, TT Electronics, Amphenol Corporation, Mentech Technology USA Inc., Wurth Elektronik. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The increasing requirement for rapid and flexible communication standards which enable secure connection is propelling the explosive development of the ethernet connector and transformer market. Increasing expenditure on boosting networking capabilities will likely drive ethernet connector and transformer market growth throughout the forecast period. There is a demand for faster data transfer rates in industrial automation, and iX connectors respond to this demand because they are specifically designed to meet forthcoming industrial demands.

Furthermore, the widespread utilization of Ethernet networking technology by automobile manufacturers, major efforts by developing-country governments to encourage industrial automation, the overwhelming demand for cloud-based services, and growing demand for modular, faster, and dependable communication protocols have contributed to the ethernet connector & transformer market growth. In the robotics industry, automated processes, and smart machine-to-machine communication via faster, more advanced networks are essential to Industrial 4.0. This is made feasible due to high-speed industrial Ethernet connectivity.

Moreover, the growing number of multimedia content from online communities and cloud-based platforms such as YouTube, Facebook, and Twitter, as well as Google, has led to a significant increase in demand for Ethernet communication devices such as Ethernet routers, switches, centers, and servers. These network communication devices use Ethernet connectors and transformers; thus, their market is expected to grow as well. Furthermore, several governments have supported monetary investments for their respective manufacturing facility categories; as a result, manufacturing companies are experiencing a rise in demand for a number of digitization and network communication solutions as they undertake organizational growth in order to promote Industrial 4.0. As a result of their numerous benefits and uses, the adoption of Ethernet solutions is expected to grow.

Restraining Factors

However, because of a rising number of virus attacks and security breaches, the expanding cybersecurity concerns offer a significant issue for industrial communication solution suppliers for adopting ethernet connectors & transformers. These viruses are capable of interfering with critical data in computer networks, causing significant losses to corporations. Given the increase in cyberattacks over the last decade, critical infrastructure cybersecurity has become a top priority for automated manufacturing owners and providers.

Market Segmentation

By Type Insights

The RJ45 connector segment is dominating the market with the largest revenue share over the forecast period.

On the basis of type, the global ethernet connector & transformer market is segmented into the ix connector, M8 connector, M12 connector, and RJ45 connector. Among these, the RJ45 connector segment is dominating the market with the largest revenue share of 38.6% over the forecast period. The RJ45 connectors are most widely utilized for connecting personal computers, laptops, smart TVs, cell phones, games consoles, media servers, printers and copiers, and other devices to the internet in both household and commercial settings. This boosts the ethernet connector & transformer market because they provide faster data transmission rates, fewer delays, fewer security risks, and increased dependability. RJ45 connectors are frequently found in Internet of Things (IoT) applications such as smart lamps, IP cameras, gaming systems, voice-over-IP, television set-top boxes, and many others.

By Transmission Speed Insights

The 100Base-T segment is witnessing significant CAGR growth over the forecast period.

On the basis of transmission speed, the global ethernet connector & transformer market is segmented into 10Base-T, 100Base-T, 1000 Base-T, and 10GBase-T. Among these, 100Base-T is witnessing significant CAGR growth over the forecast period. 100BASE-T is an improved version of Ethernet 10BASE-T and the networking standard used for high-speed data transfers of a maximum of 100 Mbps. Automobile electrical systems have become more sophisticated over time as a result of advancements in infotainment systems, advanced driving assistance systems (ADAS), powertrains, and wearable gadgets. Because linked automotive electronic control units (ECUs) exchange a large amount of real-time data as well as firmware/software, such structures require faster communication networks. Bourns, Inc., Abracon, HALO Electronics, Pulse Electronics, and others are among the major suppliers of 100Base-T Ethernet transformers.

By Application Insights

The routers segment accounted for the largest revenue share of more than 25.2% over the forecast period.

On the basis of application, the global ethernet connector & transformer market is segmented into routers, servo drives, control cabinets, hubs and servers, network switches, network interface cards, WLAN access equipment, industrial automation equipment, and others. Among these, routers are dominating the market with the largest revenue share of 25.2% over the forecast period. 5G wireless networks are being deployed at a quicker rate around the world, while the Internet of Things terminals and smart home items are making their way into thousands of homes, businesses, and organizations. With a rise in wireless terminals, WiFi technology must improve networking bandwidth, access number, delay, and other areas. With the introduction of WiFi 6, firms are also spending on research and development to provide routers that use cutting-edge technologies. Huawei, Cisco, and Arista have all recently introduced networking routers equipped with WiFi 6 technology for faster data transmission and lower latency.

Regional Insights

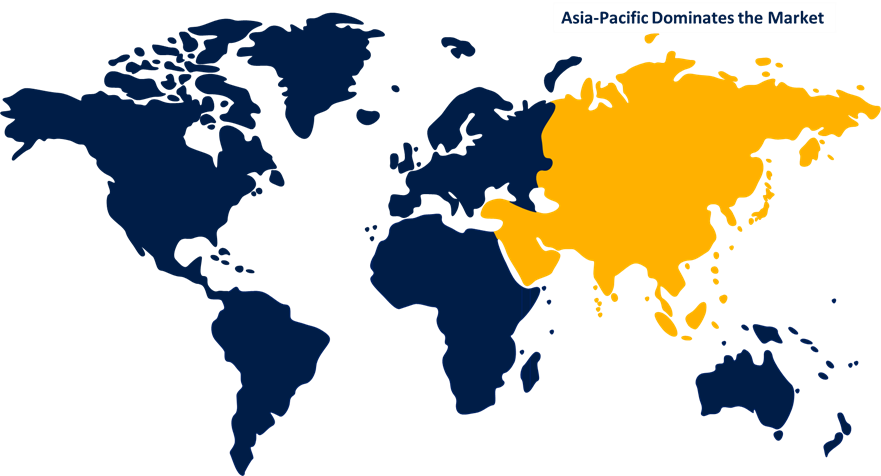

Asia Pacific dominates the market with the largest market share over the forecast period.

Get more details on this report -

Asia Pacific is dominating the market with more than 38.7% market share over the forecast period. The growing popularity of machine-to-machine communication, the Industrial Internet of Things (IoT) sector, the growth of emerging and linked technologies, and government initiatives to assist smart factories can all be credited to this dominance. The governing bodies of many countries in the region are supporting investment within their respective manufacturing sectors. As a result, industrial businesses are increasing their need to use different automation and network communication devices to support Industrial 4.0 strategic development. The demand for Ethernet connections and transformers is likely to rise as the Ethernet market expands.

North America, on the contrary, is expected to grow the fastest during the forecast period. The increase might be ascribed to rising requirements for high-speed data networks, as well as increased investment by telecommunications service providers. Furthermore, the United States and Canada are considerably contributing to market growth for a variety of reasons, including a strong emphasis on the deployment of sophisticated technologies in their IT infrastructure and the existence of leading market participants such as HALO Electronics, Inc. In addition, rising cloud service and IT infrastructure adoption are expected to drive regional demand for the ethernet connector & transformer market over the projection period.

List of Key Market Players

- Bourns, Inc.

- Belden Inc.

- HALO Electronics

- TE Connectivity

- Eaton Corporation

- Lapp Gruppe

- Schneider Electric

- Rockwell Automation

- TDK Corporation

- Bel Fuse

- TT Electronics

- Amphenol Corporation

- Mentech Technology USA Inc.

- Wurth Elektronik

Key Market Developments

- On March 2023, Würth Elektronik has formed a technical collaboration with the Spanish semiconductor company KDPOF. Würth Elektronik's initial project with KDPOF aims to advance multi-gigabit Ethernet through fiber optics in the automobile sector. Würth Elektronik provides knowledge in EMC-safe circuit design as well as power magnetics and EMC components. The next-generation automotive Ethernet from KDPOF offers high-speed connectivity of up to 100 Gb/s over glass optical fibers (GOF). Instead of multiple port components, the new technology provides a complete automobile multi-gigabit system with a single component.

- On June 2022, Bourns has introduced the local area network (LAN) gigabit Ethernet transformer (SM91602L), which contains common mode chokes for noise rejection in Ethernet applications and has an operating temperature range of 0 to +85 °C. It has a 4680 VDC isolation voltage/500 V working voltage/reinforced insulation.

- On March 2023, HALO Electronics Inc., a major producer of Ethernet Transformers, announced the industry's first commercially available IEEE802.3bq certified high-speed transformers. HALO® has achieved the high-speed performance required to meet the OCL, Cross Talk, Insertion Loss, Return Loss, and CDMR requirements for a fully compliant 25G or 40G Ethernet port over copper cables by utilizing the UWBX patent pending technology.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2032. Spherical Insights has segmented the Global Ethernet Connector & Transformer Market based on the below-mentioned segments:

Ethernet Connector & Transformer Market, Type Analysis

- ix Connector

- M8 Connector

- M12 Connector

- RJ45 Connector

Ethernet Connector & Transformer Market, Transmission Speed Analysis

- 10Base-T

- 100Base-T

- 1000 Base-T

- 10GBase-T

Ethernet Connector & Transformer Market, Application Analysis

- Routers

- Servo Drives

- Control Cabinets

- Hubs and Servers

- Network Switches

- Network Interface Cards

- WLAN Access Equipment

- Industrial Automation Equipment

- Others

Ethernet Connector & Transformer Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Ethernet Connector & Transformer market?The Global Ethernet Connector & Transformer Market is expected to grow from USD 864.78 million in 2022 to USD 2309.5 million by 2032, at a CAGR of 10.32% during the forecast period 2022-2032.

-

2. Which are the key companies in the market?Bourns, Inc., Belden Inc., HALO Electronics, TE Connectivity, Eaton Corporation, Lapp Gruppe, Schneider Electric, Rockwell Automation, TDK Corporation, Bel Fuse, TT Electronics, Amphenol Corporation, Mentech Technology USA Inc., Wurth Elektronik

-

3. Which segment dominated the Ethernet Connector & Transformer market share?The routers segment in application type dominated the Ethernet Connector & Transformer market in 2022 and accounted for a revenue share of over 25.2%.

-

4. Which region is dominating the Ethernet Connector & Transformer market?Asia Pacific is dominating the Ethernet Connector & Transformer market with more than 38.7% market share.

-

5. Which segment holds the largest market share of the Ethernet Connector & Transformer market?The RJ45 connector segment based on type holds the maximum market share of the Ethernet Connector & Transformer market.

Need help to buy this report?