Europe Battery Production Market Size, Share, and COVID-19 Impact Analysis, By Battery Type (Lithium-Ion, Lead-Acid, Nickel-Metal Hydride, Solid-State, and Others), By Production Type (Battery Recycling, Cell Manufacturing, Battery Materials Production, Battery Pack Assembly, and Others), By Material (Lithium, Cobalt, Nickel, Graphite, Electrolytes, and Others), and Europe Battery Production Market Insights Forecasts 2023 - 2033

Industry: Machinery & EquipmentEurope Battery Production Market Insights Forecasts to 2033

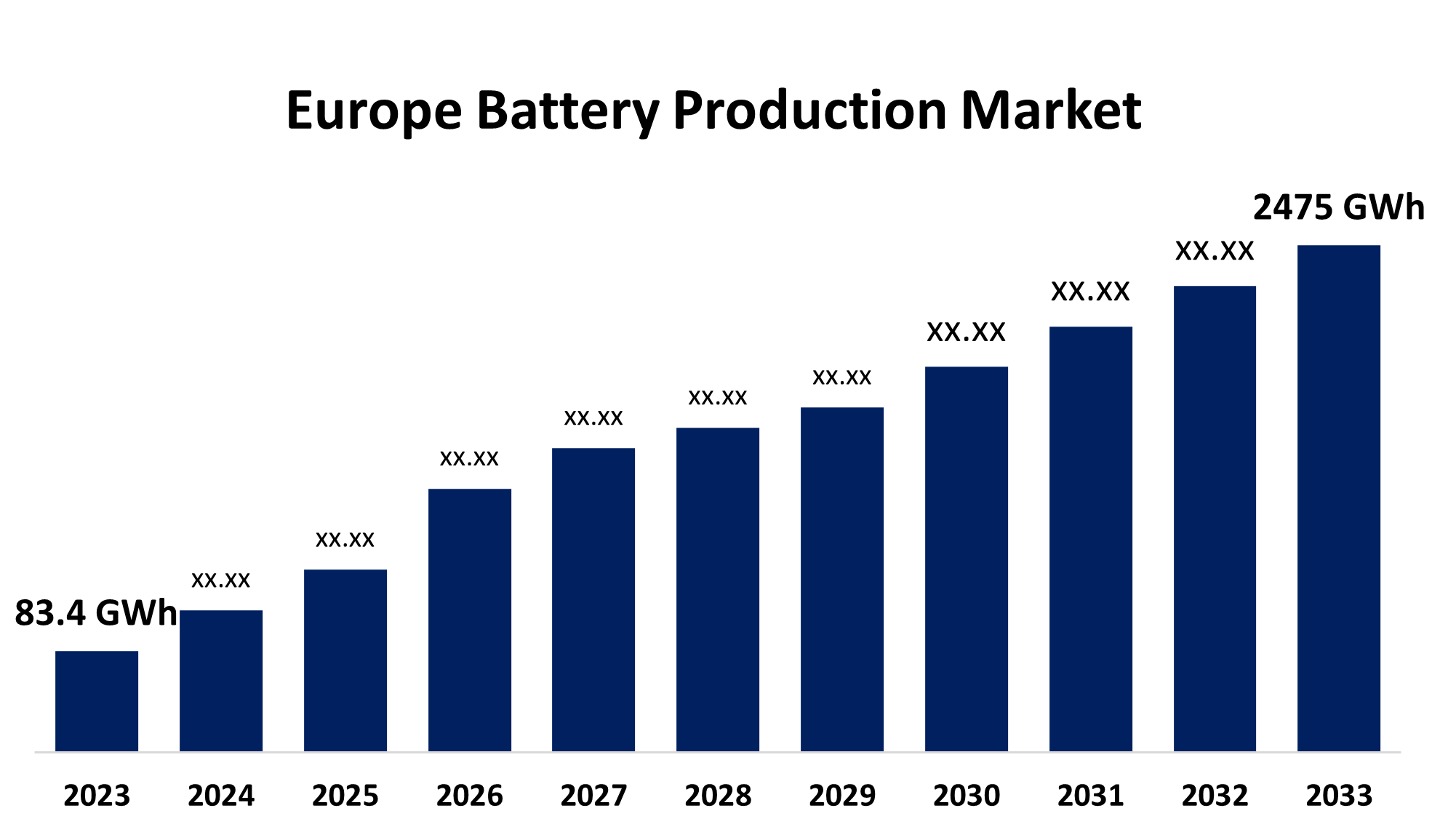

- The Europe Battery Production Market Size was Estimated at 83.4 Gigawatt-hours in 2023

- The Market Size is Growing at a CAGR of 40.36% from 2023 to 2033.

- The Europe Battery Production Market Size is Expected to Reach 2475 Gigawatt-hours by 2033.

Get more details on this report -

The Europe Battery Production Market size is expected to reach 2475 Gigawatt-hours by 2033, at a CAGR of 40.36% during the forecast period 2023 to 2033.

Market Overview

The Europe battery production market includes the production of battery cells, pack assembly, raw material processing, and recycling for use in electric vehicles, energy storage, and consumer electronics. The growing demand for electric mobility and renewable energy is driving investments in gigafactories and regional manufacturing capabilities. Government incentives and technological advancements are fueling market expansion and sustainability initiatives. The Europe battery production market is expected to grow as demand for EVs, energy storage systems, and regional supply chain development increases. Investments in gigafactories, advancements in solid-state batteries, and battery recycling initiatives all boost market potential. The European Battery Alliance (EBA) and the IPCEI on Batteries promote large-scale production and innovation through funding and policy frameworks. For instance, in November 2024, France, Germany, and Sweden urged the incoming European Commission to ensure the future of battery production in Europe rather than relying on China to meet its green transition needs. Furthermore, government incentives, stringent sustainability regulations, and EV subsidies hasten market expansion and technological progress.

Report Coverage

This research report categorizes the market for the Europe battery production market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Europe battery production market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Europe battery production market.

Europe Battery Production Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | 83.4 Gigawatt-hours |

| Forecast Period: | 2023 – 2033 |

| Forecast Period CAGR 2023 – 2033 : | 40.36% |

| 023 – 2033 Value Projection: | 2475 Gigawatt-hours |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 234 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Battery Type, By Production Type, By Material |

| Companies covered:: | Tesla, Inc., Northvolt AB, BMW Group, Volkswagen Group, Umicore, Saft, LG Chem, Samsung SDI, Envision AESC, and Other Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Several key factors are driving up demand for battery production in Europe, most notably the shift toward clean energy and technological advancements. One of the most significant contributors is the rapid adoption of electric vehicles (EVs), as European governments tighten emission regulations and set ambitious targets for the phase-out of internal combustion engines (ICEs). Automakers are ramping up EV production, creating a greater demand for high-performance lithium-ion batteries manufactured locally to reduce reliance on Asian imports. Furthermore, the expansion of renewable energy projects has led to an increase in demand for grid-scale energy storage systems. With the growth of wind and solar power, Europe needs efficient battery solutions to store and balance intermittent energy supplies, ensuring grid stability and improving energy security. This trend is further supported by investments in smart grids and decentralized storage solutions. Furthermore, advances in next-generation battery technologies, such as solid-state and sodium-ion batteries, are speeding up innovation and lowering costs. These factors, combined with strong government support, R&D investments, and sustainability initiatives, are propelling Europe's battery production market to unprecedented levels.

Restraining Factors

The Europe battery production market is constrained by high production costs due to expensive raw materials such as lithium and cobalt. Limited raw material availability and reliance on imports raise supply chain concerns. Furthermore, Asian competition, particularly from China, makes it difficult for European manufacturers to compete on cost. Battery recycling and disposal remain complex and expensive, stifling long-term sustainability efforts.

Market Segment

- The lithium-ion segment held the greatest share in 2023 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the battery type, the Europe battery production market is divided into lithium-ion, lead-acid, nickel-metal hydride, solid-state, and others. Among these, the lithium-ion segment held the greatest share in 2023 and is anticipated to grow at a significant CAGR during the forecast period. This is primarily due to its dominance in electric vehicle (EV) manufacturing, consumer electronics, and energy storage systems. Lithium-ion batteries are preferred due to their high energy density, long cycle life, and lightweight design, making them ideal for applications that require efficient and durable power sources. The growing shift towards sustainable energy solutions, government incentives for EV adoption, and increased investment in renewable energy storage are all driving up demand for lithium-ion batteries in Europe.

- The cell manufacturing segment accounted for the majority of the share in 2023 and is estimated to grow at the fastest CAGR during the projected timeframe.

Based on the production type, the Europe battery production market is divided into battery recycling, cell manufacturing, battery materials production, battery pack assembly, and others. Among these, the cell manufacturing segment accounted for the majority of the share in 2023 and is estimated to grow at the fastest CAGR during the projected timeframe. This is due to the importance of battery cell production in the overall manufacturing process, especially for lithium-ion batteries used in electric vehicles (EVs), consumer electronics, and energy storage systems. Cell manufacturing is at the heart of battery production, and as demand for electric mobility and renewable energy storage solutions grows, so does the demand for high-quality, high-performance battery cells.

- The lithium segment held the largest share in 2023 and is estimated to grow at the fastest CAGR during the predicted timeframe.

Based on the material, the Europe battery production market is divided into lithium, cobalt, nickel, graphite, electrolytes, and others. Among these, the lithium segment held the largest share in 2023 and is estimated to grow at the fastest CAGR during the predicted timeframe. Lithium is an important raw material in the manufacture of lithium-ion batteries, which are widely used in electric vehicles (EVs), energy storage systems, and consumer electronics. As the demand for these applications grows, particularly with Europe's emphasis on sustainability and clean energy, lithium has become a key focus for battery manufacturers. The growing demand for high-performance, energy-dense batteries fuels the market for lithium.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Europe battery production market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Tesla, Inc.

- Northvolt AB

- BMW Group

- Volkswagen Group

- Umicore

- Saft

- LG Chem

- Samsung SDI

- Envision AESC

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In December 2024, The European Commission and the European Investment Bank (EIB) have announced a new partnership to boost investment in the EU's battery manufacturing sector. The EU Innovation Fund will provide a €200 million loan guarantee to the InvestEU programme as part of this partnership. It comes in addition to €1 billion in grants to support electric vehicle battery cell manufacturing projects through the Innovation Fund, which was also announced.

Market Segment

This study forecasts revenue at regional, and country levels from 2022 to 2033. Spherical Insights has segmented the Europe Battery Production Market based on the below-mentioned segments:

Europe Battery Production Market, By Battery Type

- Lithium-Ion

- Lead-Acid

- Nickel-Metal Hydride

- Solid-State

- Others

Europe Battery Production Market, By Production Type

- Battery Recycling

- Cell Manufacturing

- Battery Materials Production

- Battery Pack Assembly

- Others

Europe Battery Production Market, By Material

- Lithium

- Cobalt

- Nickel

- Graphite

- Electrolytes

- Others

Need help to buy this report?