Europe Biofuel Enzyme Market Size, Share, and COVID-19 Impact Analysis, By Type (Cellulase, Amylase, Xylanase, Lipase, Other), By Application (Biodiesel, Corn-Based Ethanol, Lignocellulosic Ethanol), By Region (Germany, UK, France, Italy, Spain, Russia, Rest of Europe), and Europe Biofuel Enzyme Market Insights Forecast to 2033

Industry: Chemicals & MaterialsEurope Biofuel Enzyme Market Insights Forecasts to 2033

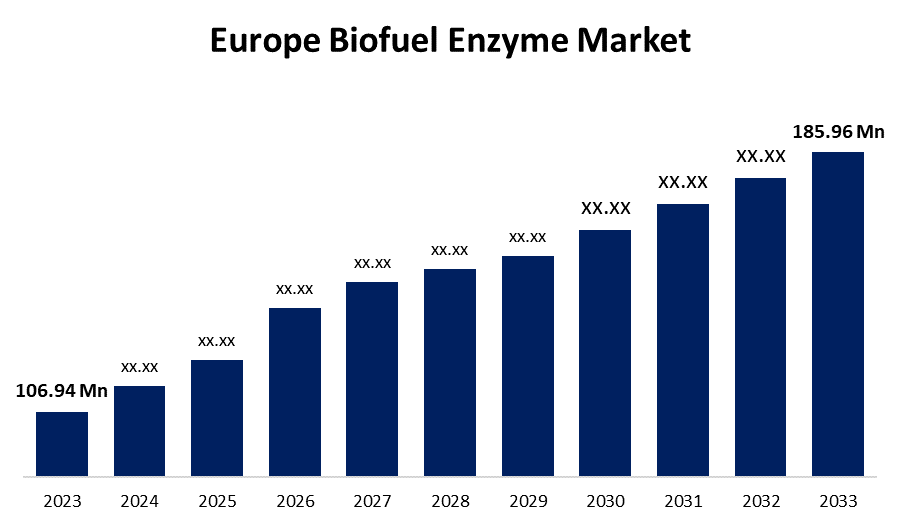

- The Europe Biofuel Enzyme Market Size was valued at USD 106.94 Million in 2023

- The Market Size is Growing at a CAGR of 5.69% from 2023 to 2033.

- The Europe Biofuel Enzyme Market Size is Expected to Reach USD 185.96 Million by 2033.

Get more details on this report -

The Europe Biofuel Enzyme Market size is expected to reach USD 185.96 Million by 2033, at a CAGR of 5.69% during the forecast period 2023 to 2033.

Market Overview

Biofuel enzymes are a type of catalyst that facilitates the conversion of biomass into biofuels. They speed up the chemical reactions that break down complex organic materials into simpler components, which can then be converted into various types of biofuels, including ethanol and biodiesel. Biofuel enzymes are essential in the production process because they increase efficiency, lower costs, and reduce environmental impact. The biofuel enzyme market in Europe is expanding rapidly, owing largely to the region's commitment to renewable energy and carbon reduction. European countries, with their strict environmental regulations, actively promote the use of biofuels. Photosynthesis is the process by which plants convert solar energy and carbon into carbohydrates. Furthermore, carbohydrate found in plants, such as lignocellulose, has a high potential for conversion into biofuels using thermally stable enzymes. Furthermore, these thermostable enzymes catalyze biofuel production by depolarizing lignocellulosic feedstock. In addition, biofuel enzymes are used to produce two commercial biofuels: bioalcohols and biodiesel. For instance, bioalcohols such as ethanol, methanol, and butanol are produced through sugar fermentation by microbes, also known as first-generation biomass second-generation biomass, or lignocellulosic biomass. The increased demand for efficient and sustainable biofuel production has resulted in a growth in the biofuel enzyme market. Key players in Europe are focusing on R&D to improve the efficiency of biofuel enzymes and broaden their applications.

Report Coverage

This research report categorizes the market for the Europe biofuel enzyme market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Europe biofuel enzyme market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Europe biofuel enzyme market.

Europe Biofuel Enzyme Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 106.94 Million |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 5.69% |

| 2033 Value Projection: | USD 185.96 Million |

| Historical Data for: | 2019 - 2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Application, By Region and COVID-19 Impact Analysis. |

| Companies covered:: | AB Enzymes GmbH, Novozymes A/S, Verenium Corporation, Enzyme Europe Limited, Du Pont de Nemours & Co., BASF Europe GmbH, Koninklijke DSM N.V., Advanced Enzymes Europe BV (AEE), and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Growing concerns about climate change and the need for sustainable energy solutions are driving up demand for biofuels. Furthermore, government initiatives and policies promoting the use of biofuels are creating a favorable market environment, while advances in enzyme engineering and biotechnology improve the efficiency and stability of biofuel enzymes. Rising oil prices and the depletion of fossil fuel reserves are also encouraging the search for alternative energy sources, while increased investment in R&D is driving technological advancements in the biofuel enzymes market. Furthermore, biofuels derived in this manner are ideal and clean energy sources, with the former producing both environmentally friendly and sustainable forms of energy. This will make an important boost to the Europe market's earnings growth.

Restraining Factors

High production costs for biofuel enzymes hamper the widespread adoption of biofuel production technologies, and the scarcity of feedstocks suitable for biofuel production limits market growth. Furthermore, regulatory barriers and policy uncertainties in some countries hamper the market's growth potential. Market growth is hampered by a lack of awareness and infrastructure for biofuel production in Europe.

Market Segment

- In 2023, the amylase segment accounted for the largest revenue share over the forecast period.

Based on type, the Europe biofuel enzyme market is segmented into cellulase, amylase, xylanase, lipase, and others. Among these, the amylase segment has the largest revenue share over the forecast period. This is primarily due to its broad application in efficiently converting complex starches into simpler sugars, which is a critical step in biofuel production. With its exceptional efficiency and cost-effectiveness, it has emerged as the preferred choice among various industrial sectors involved in biofuel production. Its versatility and effectiveness in breaking down starch molecules have transformed the biofuel industry, providing a sustainable and environmentally friendly alternative to energy production. The Amylase enzyme's ability to catalyze the conversion process at a rapid pace has not only aided biofuel production but has also paved the way for advances in other fields such as food processing and pharmaceuticals. This remarkable enzyme continues to play an important role in driving innovation and sustainability in a variety of industries, making it an essential component of modern manufacturing processes.

- In 2023, the biodiesel segment is witnessing significant growth over the forecast period.

Based on application, the Europe biofuel enzyme market is segmented into biodiesel, corn-based ethanol, and lignocellulosic ethanol. Among these, the biodiesel segment is witnessing significant growth over the forecast period. Enzymes are used in the production process, allowing renewable resources to be converted into a sustainable and environmentally friendly fuel. Biodiesel, which uses organic materials like vegetable oils or animal fats, provides a viable alternative to traditional fossil fuels while lowering greenhouse gas emissions and promoting a cleaner energy future. With strong regulatory support and incentives encouraging the use of biofuels throughout Europe, biodiesel maintains a significant market share over other alternatives such as corn-based ethanol and lignocellulosic ethanol.

- Germany is projected to have the largest share of the Europe biofuel enzyme market over the forecast period.

Based on region, the Germany is projected to have the largest share of the Europe biofuel enzyme market over the forecast period. The country's forward-thinking approach and comprehensive renewable energy policies have set the stage for unprecedented growth and success. Germany's robust and technologically advanced industrial sector, which includes cutting-edge research facilities and state-of-the-art manufacturing plants, has been critical in driving innovation and boosting the country to the forefront of the biofuel enzyme industry. With a strong emphasis on R&D, Germany continues to push the boundaries of biofuel technology, investing heavily in new avenues and refining existing processes. Furthermore, Germany's commitment to sustainability extends beyond its industrial prowess. The nation has implemented a comprehensive framework of environmental regulations and initiatives, encouraging a culture of responsible production and consumption. The remarkable growth of the biofuel enzyme market is owing to Germany's unwavering commitment to sustainability, scientific innovation, and industrial leadership. As the driving force behind this industry, Germany continues to shape the biofuel landscape, inspiring the Europe region to join the quest for a more sustainable and environmentally friendly future.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Europe biofuel enzyme market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- AB Enzymes GmbH

- Novozymes A/S

- Verenium Corporation

- Enzyme Europe Limited

- Du Pont de Nemours & Co.

- BASF Europe GmbH

- Koninklijke DSM N.V.

- Advanced Enzymes Europe BV (AEE)

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at regional, and country levels from 2022 to 2033. Spherical Insights has segmented the Europe biofuel enzyme market based on the below-mentioned segments:

Europe Biofuel Enzyme Market, By Type

- Cellulase

- Amylase

- Xylanase

- Lipase

- Other

Europe Biofuel Enzyme Market, By Application

- Biodiesel

- Corn-based Ethanol

- Lignocellulosic Ethanol

Europe Biofuel Enzyme Market, By Region

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

Need help to buy this report?