Europe Bread Mix Market Size, Share, and COVID-19 Impact Analysis, By Nature (Organic, Conventional, and Others), By Distribution Channel (Foodservice, Retail, and Others), and Europe Bread Mix Market Insights, Industry Trend, Forecasts to 2033

Industry: Food & BeveragesEurope Bread Mix Market Insights Forecasts to 2033

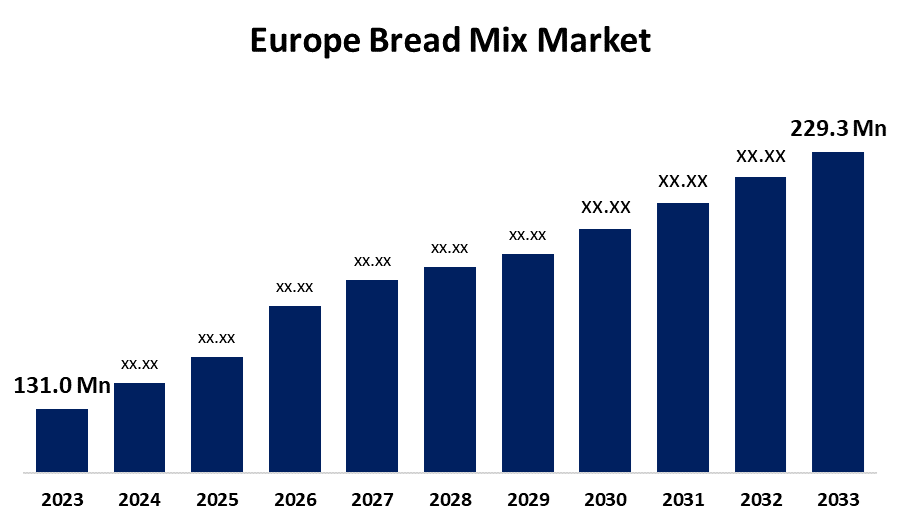

- The Europe Bread Mix Market Size was valued at USD 131.0 Million in 2023.

- The Market is Growing at a CAGR of 5.76% from 2023 to 2033

- The Europe Bread Mix Market Size is Expected to Reach USD 229.3 Million by 2033

Get more details on this report -

The Europe Bread Mix Market Size is Anticipated to Reach USD 229.3 Million by 2033, Growing at a CAGR of 5.76% from 2023 to 2033.

Market Overview

Bread mix is a combination of ingredients used to make bread, a baked food usually made from flour or a meal. Typically, bread mixes contain flour, baking powder, baking soda, yeast, sugar, salt, and other ingredients. Gluten-free mixes often use rice flour in place of wheat flour. There are many European bread mixes available, including those designed for specific types of bread, gluten-free options, and blends of grains and seeds. Some mixes are tailored for particular bread styles, such as focaccia, rye, or baguettes. Additionally, there are gluten-free mixes that allow to creation of light and airy breads. Some blends incorporate various grains and seeds, such as a multigrain mix, which can be used for making bread, rolls, baguettes, and buns. Furthermore, a factor that drives the market is a growing demand among consumers for natural, functional bakery ingredients rather than synthetic ones. Bread mixes also have a longer shelf life compared to fresh ingredients, which helps reduce food waste. Finally, Europe boasts a well-established food and beverage industry, along with a rising number of bakeries.

Report Coverage

This research report categorizes the market for the Europe bread mix based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Europe bread mix market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Europe bread mix market.

Europe Bread Mix Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 131.0 Million |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 5.76% |

| 2033 Value Projection: | USD 229.3 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Nature, By Distribution Channel and COVID-19 Impact Analysis. |

| Companies covered:: | Associated British Foods Plc, Campbell Soup Co., Dr Schar AG, Groupo Bimbo SAB de CV, ADM, Lesaffre, Bakels Group, PURATOS, Allied Pinnacle Pty. Ltd., Intermix, Rich Products Corp., and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The bread mix market in Europe is influenced by several factors. First, bread is a staple food in many households and is consumed for breakfast and throughout the day. Consumers are increasingly opting for bread and rolls as breakfast options. Europe offers a wide variety of bread types, and bread mixes provide a convenient way to replicate traditional recipes or try new varieties. These mixes simplify the baking process by including pre-measured ingredients and clear instructions. Furthermore, there is a growing demand among consumers for natural, functional bakery ingredients rather than synthetic ones. Bread mixes also have a longer shelf life compared to fresh ingredients, which helps reduce food waste. Finally, Europe boasts a well-established food and beverage industry, along with a rising number of bakeries.

Restraining Factors

The increase in inflation and rising conflicts between nations may impede the growth of the European bread market. Additionally, the increase in tax rates is another factor that hinders this market, as it heavily depends on the production of raw materials and ingredients, such as wheat and agricultural goods.

Market Segmentation

The Europe bread mix market share is classified into nature and distribution channels.

- The conventional segment is expected to hold the largest market share through the forecast period.

The Europe bread mix market is segmented by nature into organic and conventional. Among these, the conventional segment is expected to hold the largest market share through the forecast period. Conventional bread mixes are available in a variety of types and flavors, catering to a wide range of consumer preferences. Whether you prefer basic white bread, whole wheat, multigrain, or flavored options, these mixes provide versatile baking choices that suit different tastes and dietary needs.

- The foodservice segment is expected to dominate the Europe bread mix market during the forecast period.

Based on the distribution channel, the Europe bread mix market is divided into foodservice, retail, and others. Among these, the foodservice segment is expected to dominate the Europe bread mix market during the forecast period. Foodservice establishments, including restaurants, cafes, and bakeries, depend on consistent product quality to meet customer expectations. Bread mixes offer a standardized solution that ensures uniform texture, flavor, and appearance of bread across multiple locations. This reduces the variability that often occurs when making bread from scratch.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations companies involved within the Europe bread mix market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Associated British Foods Plc

- Campbell Soup Co.

- Dr Schar AG

- Groupo Bimbo SAB de CV

- ADM

- Lesaffre

- Bakels Group

- PURATOS

- Allied Pinnacle Pty. Ltd.

- Intermix

- Rich Products Corp.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In December 2022, After 115 years of supplying high-quality and nutritious ingredients to the bakery industry, British Bakels—one of the UK's leading manufacturers and distributors of ingredients for bread, pastry, cake, and confectionery—is launching a new direct-to-consumer venture. They are excited to introduce the Ta-Da! baking mix range for the very first time.

Market Segment

This study forecasts revenue at Europe, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Europe Bread Mix Market based on the below-mentioned segments:

Europe Bread Mix Market, By Nature

- Organic

- Conventional

- Others

Europe Bread Mix Market, By Distribution Channel

- Foodservice

- Retail

- Others

Need help to buy this report?