Europe Coffee Machines Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Drip/Filter Coffee Machines, Espresso Coffee Machines, Pod/Capsule Coffee Machines), By End User (Residential, Commercial), By Region (Germany, UK, France, Italy, Spain, Russia, Rest of Europe), and Europe Coffee Machines Market Insights Forecast to 2033

Industry: Consumer GoodsEurope Coffee Machines Market Size Insights Forecasts to 2033

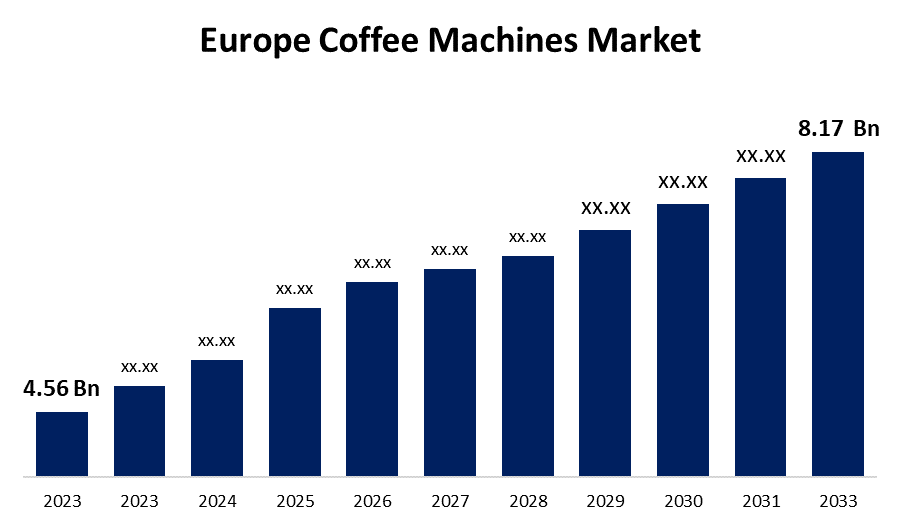

- The Europe Coffee Machines Market Size was valued at USD 4.56 Billion in 2023.

- The Market Size is Growing at a CAGR of 6.00% from 2023 to 2033.

- The Europe Coffee Machines Market Size is Expected to Reach 8.17 Billion by 2033.

Get more details on this report -

The Europe Coffee Machines Market Size is Expected to Reach USD 8.17 Billion by 2033, at a CAGR of 6.00% during the Forecast period 2023 to 2033.

Market Overview

Coffee machines are machines that perform multiple brewing processes. Coffee machines are machines that extract coffee. These machines are commonly used in offices, homes, restaurants, cafes, and other commercial establishments. Companies sell a variety of such vending machines, which differ depending on the coffee brewing method used, such as boiling, filtration, and steeping. Companies also use a variety of coating materials, such as galvanized steel, lexan, acrylic powder coating, and polyurethane insulation, to protect the machine from excess heat during the brewing process. The growing demand for specialty coffee has also contributed significantly to the growth of the coffee machine market. Consumers want high-quality, artisanal coffee experiences, and coffee machines allow them to brew barista-level coffee at home. As such, the demand for espresso machines, drip coffee makers, and other specialty coffee equipment has increased. Another important factor influencing the coffee machine market is European consumers' environmental consciousness. Sustainable coffee machine options, such as those with energy-saving features and eco-friendly materials, are popular among consumers who want to reduce their carbon footprint. Manufacturers are responding by offering environmentally friendly coffee machines that meet this growing consumer demand. The influence of technology and smart features in coffee machines is growing in Europe.

Report Coverage

This research report categorizes the market for Europe coffee machines market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Europe coffee machines market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Europe coffee machines market.

Europe Coffee Machines Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 4.56 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 6.00% |

| 2033 Value Projection: | USD 8.17 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Product Type, By End User, By Region and COVID-19 Impact Analysis. |

| Companies covered:: | Nestle Nespresso SA, Koninklijke Philips N.V., Illycaffe S.p.A., Dualit Limited, AB Electrolux, De' Longhi Appliances S.r.L, BSH Hausgerate GmbH, Schaerer Ltd., WMF-Coffee machines, JURA Elektroapparate AG and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

One of the primary drivers of the European coffee machine market is the region's strong coffee culture. Europe has a long history of coffee consumption, with countries such as Italy and France known for their traditional coffee rituals. Convenience is another key driver in the European coffee machine market. Many European consumers' fast-paced lifestyles have resulted in an increased demand for coffee machines that provide quick and easy brewing. Furthermore, incorporating smart technology into coffee machines has been a game changer. Many modern coffee machines include smartphone apps and connectivity features, allowing users to customize their coffee preferences remotely. In addition, the rise of the Internet of Things (IoT) and connected homes has increased demand for coffee machines that can work seamlessly with other smart appliances. Sustainability is becoming an increasingly important factor in the European coffee machine market. Additionally, manufacturers are investing in more sustainable materials, such as compostable or recyclable coffee pods, in response to European consumers' desire to reduce their carbon footprint. As a consequence, coffee machines with sustainable and eco-friendly features have gained a competitive advantage in the European market.

Restraining Factors

The higher repair and maintenance costs of vending machines are expected to restrain market growth. Furthermore, growing transportation issues, labor shortage problems, and the occurrences of longer delivery times due to the uncertain supply chain disruption in the electronic appliances sector. One of the most significant obstacles for the European coffee machine market is growing concern about sustainability and environmental impact. On the other hand, new entrants face the challenge of breaking into a competitive market and gaining visibility. Another significant challenge in the European coffee machine market is the constantly changing consumer preferences and the rapid pace of technological advancement.

Market Segment

- In 2023, the espresso coffee machines segment accounted for the largest revenue share over the forecast period.

Based on product type, the Europe coffee machines market is segmented into drip/filter coffee machines, espresso coffee machines, and pod/capsule coffee machines. Among these, the espresso coffee machines segment has the largest revenue share over the forecast period. One of the primary factors driving the significant share of espresso coffee machines in the European market is the long-standing preference for espresso-based coffee beverages. Europeans have a strong preference for the quality and flavor of espresso, cappuccino, latte, and other similar coffee beverages. The espresso machine is widely regarded as the preferred tool for creating these traditional and beloved beverages. Espresso is a constant presence, whether in the cozy corners of Italian cafes, the vibrant streets of Paris, or the trendy coffee shops of Berlin, and it is frequently prepared using espresso machines. Espresso machines play an important role in this resurgence because they allow enthusiasts to experiment with different coffee beans, roast levels, and brewing methods. The European market is increasingly dominated by coffee enthusiasts who are willing to invest in premium espresso machines to improve their coffee experiences at home.

- In 2023, the commercial segment is witnessing significant growth over the forecast period.

Based on end users, the Europe coffee machines market is segmented into residential and commercial. Among these, the commercial segment is witnessing significant growth over the forecast period. Several factors contribute to the popularity of commercial coffee machines in Europe. The first and most important driver is the flourishing café culture that has taken hold in many European countries. European consumers are well-known for their love of coffee, from traditional espresso in Italy to café culture in France and the growing specialty coffee scene across the continent. The café culture has increased demand for high-performance and dependable coffee machines capable of consistently producing quality coffee beverages such as espresso, cappuccino, and lattes. Innovation and technological advancements are critical to the expansion of the commercial coffee machine market in Europe. Manufacturers are constantly developing machines with higher performance, energy efficiency, and ease of maintenance. Sustainability is also becoming more important, with many businesses and consumers looking for eco-friendly coffee machines that use less energy and produce less waste.

- United Kingdom is projected to have the largest share of the Europe coffee machines market over the forecast period.

Based on region, the United Kingdom is projected to have the largest share of the Europe coffee machines market over the forecast period. One of the driving forces behind the United Kingdom's dominance in the European coffee machine market is the country's deeply ingrained coffee culture. The UK's café culture, which is defined by a desire for high-quality coffee beverages, has fueled innovation and competition in the coffee machine market. Espresso machines, bean-to-cup machines, and other specialized coffee equipment are in high demand in the café industry. In addition to commercial coffee consumption, there has been a noticeable shift to at-home coffee preparation in the United Kingdom. Furthermore, the United Kingdom's dynamic retail landscape contributes to its large share of the European coffee machine market. As a consequence, there is a growing demand for coffee machines that prioritize sustainable practices, such as energy efficiency, environmentally friendly materials, and responsible disposal and recycling options. Manufacturers have responded by introducing eco-friendly coffee machines to meet changing consumer expectations in the United Kingdom.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Europe coffee machines market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Nestle Nespresso SA

- Koninklijke Philips N.V.

- Illycaffe S.p.A.

- Dualit Limited

- AB Electrolux

- De' Longhi Appliances S.r.L

- BSH Hausgerate GmbH

- Schaerer Ltd.

- WMF-Coffee machines

- JURA Elektroapparate AG

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at regional, and country levels from 2022 to 2033. Spherical Insights has segmented the Europe coffee machines market based on the below-mentioned segments:

Europe Coffee Machines Market, By Product Type

- Drip/Filter Coffee Machines

- Espresso Coffee Machines

- Pod/Capsule Coffee Machines

Europe Coffee Machines Market, By End User

- Residential

- Commercial

Europe Coffee Machines Market, By Region

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

Need help to buy this report?