Europe E-Cigarette Market Size, Share, and COVID-19 Impact Analysis, By Product (Modular E-Cigarette, Rechargeable E-Cigarette, Next-Generation E-Cigarette, Disposable E-Cigarette, Others), By Flavors (Tobacco, Botanical, Fruit, Sweet, Beverage, Others), By Distribution Channel (Online, Retail), By Country (United Kingdom, Germany, Italy, France, Spain, Netherlands, Rest of Europe), and Europe Commercial Greenhouse Market Insights, Industry Trend, Forecasts 2022 - 2032

Industry: Consumer GoodsEurope E-Cigarette Market Size Insights Forecasts to 2032

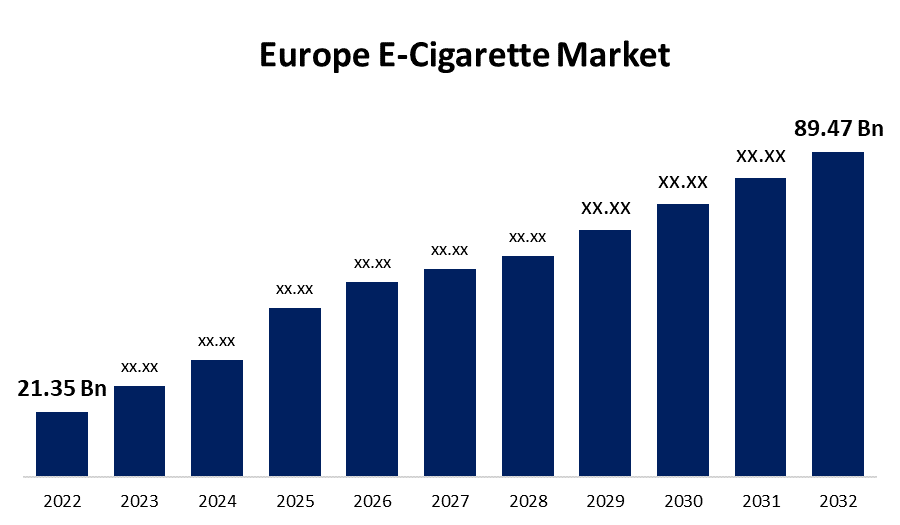

- The Europe E-Cigarette Market Size was valued at USD 21.35 Billion in 2022.

- The Market Size is Growing at a CAGR of 15.41% from 2022 to 2032.

- The Europe E-Cigarette Market Size is expected to reach 89.47 Billion by 2032.

Get more details on this report -

The Europe E-Cigarette Market Size is expected to reach USD 89.47 Billion by 2032, at a CAGR of 15.41% during the forecast period 2022 to 2032.

Market Overview

A vape or electronic cigarette (e-cigarette) is a device that simulates smoking tobacco. It consists of an atomizer, a power source such as a battery, and a liquid-filled container such as a cartridge or tank. The user inhales vapor rather than smoke. It is a safer alternative to traditional cigarettes because it does not burn tobacco, which produces tar and carbon monoxide. Manufacturers' aggressive promotion of e-cigarettes in the European region has attracted a large number of consumers, particularly young adults and adolescents. They're widely available in convenience stores as well as in smoke and vape shops. Furthermore, since the numerous studies conducted by medical institutions and associations, the public's growing understanding of E-cigarettes being safer than traditional cigarettes, particularly among adult, is expected to fuel market growth. Furthermore, the manufacturers' extensive customization options, such as temperature control and nicotine dosages, are expected to boost product demand. Furthermore, in recent years, growing E-cigarette technologies such as pod systems and quonk mods have gained popularity and user adoption. The willingness of individuals to quit smoking and their perception of E-cigarettes as a more healthful alternative to cigarettes and other traditional forms of tobacco consumption drive the European E-cigarette market.

Report Coverage

This research report categorizes the market for Europe E-cigarette market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Europe E-cigarette market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the Europe E-cigarette market.

Europe E-Cigarette Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 21.35 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 15.41% |

| 2032 Value Projection: | 89.47 Billion |

| Historical Data for: | 2020-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Product, By Flavors, By Distribution, By Country |

| Companies covered:: | British American Tobacco PLC, Altria Group Inc., J Well France SARL, Imperial Brands plc, Altria Group, Inc, Nicocig, Aquios Labs, Japan Tobacco Inc., BecoVape, and Others. |

| Pitfalls & Challenges: | Covid-19 Empact,Challenges,Growth, Analysis. |

Get more details on this report -

Driving Factors

With rising consumer awareness of the health risks associated with tobacco use, rechargeable E-cigarettes have gained popularity and are in high demand, owing primarily to their greater flexibility and cost-effectiveness over their single-use counterparts. Online retail channels are creating profitable opportunities for vendors in terms of security and reliability, thereby increasing demand for these products. Furthermore, rising acceptance of E-cigarette technologies such as pod systems and squonk mods, rising sales of atomizers and e-liquids, an increasing number of vape shops where users can visit and taste different E-liquid flavors before purchasing, and the growing popularity of tank e-cigarettes in the UK are all expected to drive the European e-cigarette market in the coming years.

Restraining Factors

Cigarette smoking is one of the most significant preventable causes of disease and premature death in the Western world, and it is becoming an increasingly common cause of cancer and death. Furthermore, stringent regulatory authorities' rules in the European Union are a major factor that can hamper market growth during the forecast period.

Market Segment

- In 2022, the rechargeable e-cigarette segment accounted for the largest revenue share over the forecast period.

Based on the type, the Europe E-cigarette market is segmented into modular e-cigarette, rechargeable e-cigarette, next-generation e-cigarette, disposable e-cigarette and others. Among these, the rechargeable e-cigarette segment has the largest revenue share over the forecast period. Rechargeable devices are expected to gain popularity due to their low cost and ability to eliminate the need for ongoing supply purchases such as cartridges. Consumers who can make their own e-liquid can also avoid purchasing pre-filled cartridges. Buying recharged e-cigarettes is especially cost-effective for seasoned smokers. Rechargeable E-cigarettes are also gaining popularity among young people in many important countries because they emit less smoke and can be charged via a USB port.

- In 2022, the fruit segment accounted for the largest revenue share over the forecast period.

On the basis of flavor, the Europe E-cigarette market is segmented into tobacco, botanical, fruit, sweet, beverage and others. Among these, the fruit segment has the largest revenue share over the forecast period. Fruit flavors reduce the perception that e-cigarettes are harmful. The fruit flavors increase adult product appeal, and this is one of the reasons adults use e-cigarettes. Such factors will boost market growth in the forecast period.

- In 2022, the retail segment is expected to hold the largest share of the Europe E-cigarette market during the forecast period.

Based on the distribution channel, the Europe E-cigarette market is classified into online and retail. Among these, the retail segment is expected to hold the largest share of the Europe E-cigarette market during the forecast period. E-cigarettes were previously sold in retail locations such as vape shops and gas stations. These shops assisted customers in selecting from a wide range of equipment and e-liquids. Vape shops allow customers to try out and test these devices before making a purchase decision, which contributes to the growth of the retail store segment during the forecast period.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Europe E-cigarette market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- British American Tobacco PLC

- Altria Group Inc.

- J Well France SARL

- Imperial Brands plc

- Altria Group, Inc

- Nicocig

- Aquios Labs

- Japan Tobacco Inc.

- BecoVape

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- On March 2023, Aquios Labs, a company based in the United Kingdom, announced a new innovation in which it developed a water-based technology and launched a commercial product in collaboration with Innokin Technology to provide smokers with a better smoking experience.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2021 to 2032. Spherical Insights has segmented the Europe E-cigarette market based on the below-mentioned segments:

Europe E-Cigarette Market, By Type

- Modular E-Cigarette

- Rechargeable E-Cigarette

- Next-Generation E-Cigarette

- Disposable E-Cigarette

- Others

Europe E-Cigarette Market, By Flavors

- Tobacco

- Botanical

- Fruit

- Sweet

- Beverage

- Others

Europe E-Cigarette Market, By Distribution Channel

- Online

- Retail

Europe E-Cigarette Market, By Country

- United Kingdom

- Germany

- Italy

- France

- Spain

- Netherlands

- Rest of Europe

Need help to buy this report?