Europe Electric Forklift Market Size, Share, and COVID-19 Impact Analysis, By Type (Counterbalanced Forklift, Pallet Trucks Forklift, Reach Trucks Forklift, Pallet Stackers Forklift, Others), By Battery Type (Lithium-ion, Lead-acid, Hydrogen Fuel Cell, Others), By End-Use Application (Chemical, Food & Beverage, Industrial, Logistics, Retail & E-commerce, Others), By Country (UK, Germany, France, Italy, Spain, Others), and Europe Electric Forklift Market Insights Forecasts to 2032.

Industry: Machinery & EquipmentEurope Electric Forklift Market Insights Forecasts to 2032

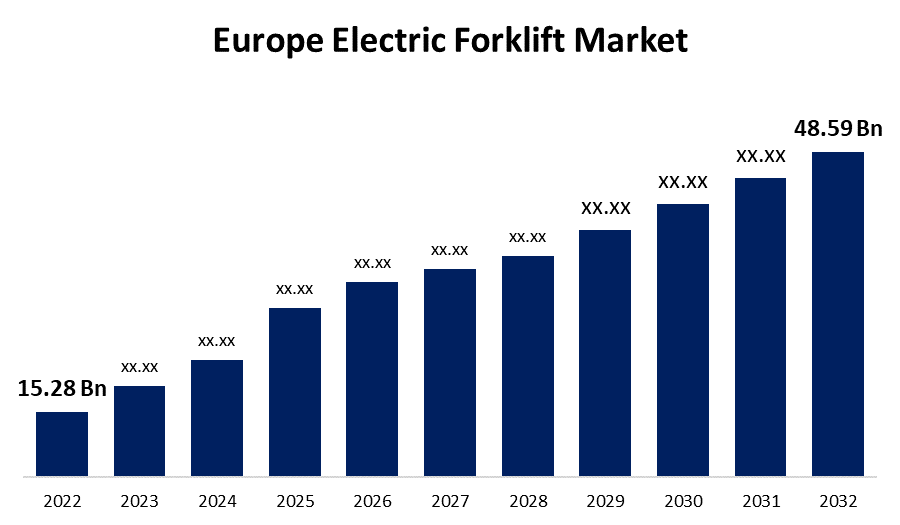

- The Europe Electric Forklift Market Size was valued at USD 15.28 Billion in 2022.

- The Market is Growing at a CAGR of 12.26% from 2022 to 2032.

- The Europe Electric Forklift Market Size is expected to reach USD 48.59 Billion by 2032.

- Europe is expected to grow the fastest during the forecast period.

Get more details on this report -

The Europe Electric Forklift Market Size is expected to reach USD 48.59 Billion by 2032, at a CAGR of 12.26% during the forecast period 2022 to 2032.

Market Overview

Electric forklifts operate on battery-operated either lead acid batteries or fuel cells. Forklift trucks are among some of the most versatile and valuable instruments in any industry. They seamlessly, easily, and safely reduce task time and eliminate repetitive operations. Forklifts of the present day enable access to the most elevated shelf in a storage facility without harming equipment or workers. They are capable of lifting the largest objects and placing them precisely and easily. Forklift outputs vary from slightly more than a ton to more than 12 tons, allowing consumers to choose the best forklift for the circumstances and workloads.

Forklift truck electric motors are able to operate direct or alternating current, and they are able to run on batteries or fuel cells. To work at peak efficiency, they must be recharged for eight hours. Though electric forklifts are more expensive at first, they require relatively little upkeep and might operate for a period of time exceeding five years. They are more maneuverable than gas-powered forklifts and feature a quiet start-up. The growing demand for electric forklifts for transporting material operations in the chemical, food & beverage, and logistics industries is likely to drive demand. Furthermore, technical advances have resulted in the production of more complex electric forklifts with attributes such as increased battery capacity, higher performance, and improved operator safety.

Report Coverage

This research report categorizes the market for Europe Electric Forklift Market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Europe Electric Forklift Market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the Europe Electric Forklift Market.

Driving Factors

With a growing customer base for sustainable and inexpensive material handling solutions, the Europe electric forklift market has been steadily growing. Stringent pollution restrictions, the requirement for operating efficiency, and the growing emphasis on sustainability are driving the industry in Europe. Major manufacturers are always spending on scientific and technological research operations in order to introduce revolutionary electric forklift models. Furthermore, in countries such as the United Kingdom, Germany, and France, there is a growing demand for construction equipment for lifting and transporting objects from one area to the next. As a result, a boost in building projects in the region is expected to enhance the expansion of the electric forklift market throughout the forecast.

Moreover, the booming e-commerce industry in Europe is driving up the need for new warehouses, which is anticipated to be a positive development for the widespread utilization of electric motorized hand trucks like reach trucks and narrow aisle trucks. Electric forklifts operate quietly, which makes them ideal for noisy locations like storage facilities and distribution services. Furthermore, when compared with traditional forklifts, electric forklifts have superior efficiency and reduced maintenance costs, which drives their popularity.

Market Segment

- In 2022, the portable segment is expected to hold the largest share of the Europe Electric Forklift market during the forecast period.

Based on the type, the Europe Electric Forklift Market is classified into counterbalanced forklifts, pallet trucks forklifts, reach trucks forklifts, pallet stackers forklifts, and others. Among these, the portable segment is expected to hold the largest share of the Europe Electric Forklift market during the forecast period. Pallet trucks are maneuverable and powerful machines that are utilized for lifting, steering, and dropping pallets in warehouses and production facilities. As a result, rising demand for compact pallet trucks with optimum mobility in warehouses is likely to drive the expansion of the segment. Additionally, companies are extensively spending on R&D operations and launching new products with high productivity and usability.

- In 2022, the lithium-ion segment is witnessing a higher growth rate over the forecast period.

On the basis of battery type, the Europe Electric Forklift Market is segmented into lithium-ion, lead-acid, hydrogen fuel cell, and others. Among these, the lithium-ion segment is witnessing a higher growth rate over the forecast period. To reduce the environmental impact of conventional lead-acid battery technology, the government has prohibited its usage. Lead-acid batteries are promptly being phased out in favor of lithium-ion batteries, which are predicted to take precedence over the period of forecasting. Furthermore, rising R&D spending on materials and chemicals is a major driver for the rapid drop in Li-ion battery prices. As a result, falling Li-ion battery prices are likely to benefit manufacturers in the launch of higher-efficiency and low-cost forklifts. Such low-cost, high-efficiency forklifts are projected to draw prospective potential customers, supporting the expansion of the European market.

- In 2022, the industrial segment accounted for the largest revenue share of more than 42.3% over the forecast period.

On the basis of end-use application, the Europe Electric Forklift Market is segmented into chemical, food & beverage, industrial, logistics, retail & e-commerce, and others. Among these, the industrial segment dominates the market with the highest revenue share of 42.3% over the forecast period. Forklifts are utilized in industrial applications such as loading and unloading, elevators, tractors & trailers, straight trucks, and railway carriages. Industries are focusing on energy-efficient solutions, which are projected to improve operational efficiency and reduce environmental impact. Electric-driven forklifts provide several advantages, including lightweight, relatively quiet operation, and easy upkeep. These characteristics are projected to boost the need for them in industries like manufacturing.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Europe Electric Forklift Market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Hyster-Yale Materials Handling, Inc.

- Crown Equipment Corporation

- Mitsubishi Logisnext Co., Ltd.

- Hangcha Group Co., Ltd.

- Anhui Heli Co., Ltd.

- Jungheinrich AG

- KION Group AG

- Komatsu Ltd.

- Clark

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- On March 2023, Li-Cycle has announced a new agreement with KION in France to provide recycling of lithium-ion batteries to the forklift and industrial vehicle industries. Li-Cycle will recycle lithium-ion batteries from KION's global brands, according to the two firms. Li-Cycle anticipates supporting both KION's recycling needs and KION's capacity to comply with EU battery standards.

- On January 2022, VisionNav Robotics, an industry leader in driverless, vision-guided industrial vehicles, announced that it will introduce its fully automated, vision-guided forklift trucks and intelligent operating systems to the European market. VisionNav's product line includes driverless counterbalanced forklift trucks, reach trucks, stackers, and tow tractors, and the business is looking to hire distribution partners throughout Europe as part of its global marketing strategy.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2021 to 2032. Spherical Insights has segmented the Europe Electric Forklift Market based on the below-mentioned segments:

Europe Electric Forklift Market, By Type

- Counterbalanced Forklift

- Pallet Trucks Forklift

- Reach Trucks Forklift

- Pallet Stackers Forklift

- Others

Europe Electric Forklift Market, By Battery Type

- Lithium-ion

- Lead-acid

- Hydrogen Fuel Cells

- Others

Europe Electric Forklift Market, By End-Use Application

- Chemical

- Food & Beverage

- Industrial

- Logistics

- Retail & E-commerce

- Others

Europe Electric Forklift Market, By Country

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Rest of Europe

Need help to buy this report?