Europe Fish Oil Market Size, Share, and COVID-19 Impact Analysis, By Application (Human Consumption, Aquaculture, Pet Food, and Others), By Species (Traditional Pelagic and Demersal Species, Tuna, Salmon, Pangasius, and Tilapia), and Europe Fish Oil Market Insights, Industry Trend, Forecasts to 2033

Industry: Food & BeveragesEurope Fish Oil Market Insights Forecasts to 2033

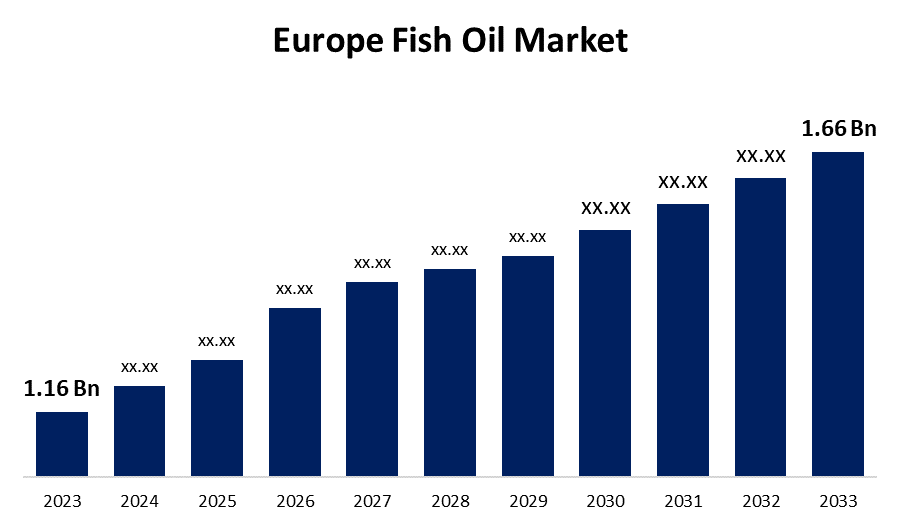

- The Europe Fish Oil Market Size was valued at USD 1.16 Billion in 2023.

- The Market Size is Growing at a CAGR of 3.65% from 2023 to 2033

- The Europe Fish Oil Market Size is Expected to Reach USD 1.66 Billion by 2033

Get more details on this report -

The Europe Fish Oil Market Size is Anticipated to Reach USD 1.66 Billion by 2033, growing at a CAGR of 3.65% from 2023 to 2033.

Market Overview

Fish oil is derived from the tissues of oily fish. It contains omega-3 fatty acids such as eicosapentaenoic acid (EPA) and docosahexaenoic acid (DHA), which are known to reduce inflammation in the body and improve hypertriglyceridemia. The European Union (EU) both produces and imports fish oil and fishmeal for various purposes, including aquaculture feeds for pigs and chickens. The EU's annual fish oil production ranges from 120,000 to 190,000 tons, accounting for approximately 10–15% of the world's total production. Denmark leads in production, contributing 40–50% of the EU's total output. Additionally, the EU imports fish oil from countries such as Peru, Norway, and Chile. In 2018, the EU imported 268,960 tons of fishmeal, with Norway, Iceland, and the Faroes as the top three suppliers. Fish oil and fishmeal are derived from small, oily fish species like blue whiting, sprat, sand eel, and Norway pout, as well as from fish processing trimmings. Moreover, fitness enthusiasts, athletes, and bodybuilders often use fish oil supplements to enhance muscle strength and improve flexibility, driving market growth.

Report Coverage

This research report categorizes the market for the Europe fish oil market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Europe fish oil market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Europe fish oil market.

Europe Fish Oil Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 1.16 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 3.65% |

| 2033 Value Projection: | USD 1.66 Billion |

| Historical Data for: | 2019 - 2022 |

| No. of Pages: | 185 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Application, By Species. |

| Companies covered:: | DSM, BASF SE, Croda International PLC, Omega Protein Corporation, Amway Corporation, Nordic Naturals, Marine ingredients, Pelagia AS, United Laboratories, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Fish oil is obtained from the fat cells of oily fish and contains high levels of omega-3 fatty acids, specifically eicosapentaenoic acid (EPA) and docosahexaenoic acid (DHA). These fatty acids are widely used in various industries such as aquaculture, animal nutrition, pet food, supplements, functional foods, and pharmaceuticals. Omega-3 fatty acids have been shown to benefit cardiovascular and nervous system function and play a vital role in neurological functioning. The increasing demand for EPA and DHA in human diets has had a significant impact on the Europe fish oil industry. Therefore, the development of new techniques in aquaculture is the most crucial factor contributing to the growth of the fish oil market.

Restraining Factors

There are several barriers affecting the European fish oil industry, such as rising prices, government regulations, and sustainability issues. The increase in manufacturing costs has hindered market growth in the European region. One of the main issues faced by the European fish oil industry is maintaining sustainability. This has led to concerns related to the sourcing of fish oil products and has impacted consumer perception and market sustainability.

Market Segmentation

The Europe fish oil market share is classified into application and species.

- The aquaculture segment is expected to hold the largest market share through the forecast period.

The Europe fish oil market is segmented by application into human consumption, aquaculture, pet food, and others. Among these, the aquaculture segment is expected to hold the largest market share through the forecast period. The population of Europe is steadily increasing, leading to a growing demand for protein sources like fishmeal. Aquaculture provides a sustainable and controlled way to meet this demand. Fish oil and fishmeal are valuable due to their high nutritional content, containing over 40 essential nutrients and high levels of polyunsaturated fats. This makes them highly desirable as feed for farmed fish, as it can help increase production yield. As aquaculture expands, the need for fish oil to feed these farmed fish populations is also expected to increase.

- The traditional pelagic and demersal species segment is expected to dominate the Europe fish oil market during the forecast period.

Based on the species, the Europe fish oil market is divided into traditional pelagic and demersal species, tuna, salmon, pangasius, and tilapia. Among these, the traditional pelagic and demersal species segment is expected to dominate the Europe fish oil market during the forecast period. Pelagic species, which live and feed near the water surface, and demersal species, which live and feed near the seabed, are more abundant in oceans compared to other types of fish. This makes them a cost-effective raw material for fish oil production. Additionally, these species naturally have higher oil content in their tissues than other fish varieties. As a result, the extraction process is more efficient, leading to a greater yield of fish oil per unit of fish processed.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Europe fish oil market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- DSM

- BASF SE

- Croda International PLC

- Omega Protein Corporation

- Amway Corporation

- Nordic Naturals

- Marine ingredients

- Pelagia AS

- United Laboratories

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In August 2024, Cien por Cien Natural launched the first omega-3 product in Europe using Aker BioMarine sPL+ technology for improved bioavailability.

Market Segment

This study forecasts revenue at Europe, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Europe Fish Oil Market based on the below-mentioned segments:

Europe Fish Oil Market, By Application

- Human Consumption

- Aquaculture

- Pet Food

- Others

Europe Fish Oil Market, By Species

- Traditional Pelagic and Demersal Species

- Tuna

- Salmon

- Pangasius

- Tilapia

Need help to buy this report?