Europe Graphite Market Size, Share, and COVID-19 Impact Analysis, By Form (Natural Graphite and Synthetic Graphite), By Application (Electrodes, Refractories, Lubricants, Foundries, Battery Production, and Others), and Europe Graphite Market Insights, Industry Trend, Forecasts to 2033.

Industry: Chemicals & MaterialsEurope Graphite Market Insights Forecasts to 2033

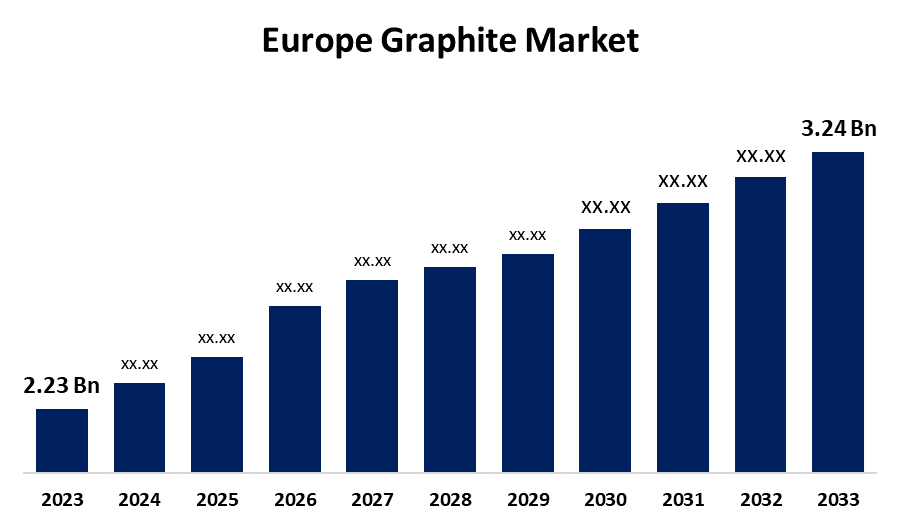

- The Europe Graphite Market Size was valued at USD 2.23 Billion in 2023.

- The Market is Growing at a CAGR of 3.81% from 2023 to 2033

- The Europe Graphite Market Size is Expected to Reach USD 3.24 Billion by 2033

Get more details on this report -

The Europe Graphite Market is Anticipated to Reach USD 3.24 Billion by 2033, growing at a CAGR of 3.81% from 2023 to 2033.

Market Overview

Graphite is a crystalline allotrope of carbon, consisting of many stacked layers of graphene, typically numbering in the hundreds. It occurs naturally and is the most stable form of carbon under standard conditions. Both synthetic and natural graphite are widely used across various critical industries, including refractories (50%), lithium-ion batteries (18%), foundries (10%), lubricants (5%), and other applications (17%). Graphite is classified as a critical raw material (CRM) in many industrial sectors in Europe. The European Commission's Critical Raw Materials Act (CRMA) designates graphite as a strategic material for the EU. Currently, the EU is a net importer of natural graphite, sourcing it mainly from countries such as China, Tanzania, Mozambique, Brazil, India, Canada, and North Korea. The EU's Green Deal and heightened climate ambitions are expected to drive an increase in demand for graphite and carbon products in low-carbon technologies. However, Europe's graphite production is anticipated to fall short of this growing demand. In addition to batteries, graphite is extensively used in the manufacturing of lubricants, refractories, and thermal products. Industries such as steel production, electronics, and manufacturing are increasingly leveraging graphite for its unique properties, further boosting market demand.

Report Coverage

This research report categorizes the market for the Europe graphite based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Europe graphite market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Europe graphite market.

Europe Graphite Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 2.23 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 3.81% |

| 2033 Value Projection: | USD 3.24 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 180 |

| Tables, Charts & Figures: | 104 |

| Segments covered: | By Form, By Application and COVID-19 Impact Analysis |

| Companies covered:: | Triton Minerals, Syrah Resources, NOVONIX, Northern Graphite, Nippon Carbon, Graphite India, AMG Advanced Metallurgical Group, Tokai Carbon Co Ltd and others key players. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The European graphite market is experiencing significant growth due to several key factors. The rise in electric vehicle (EV) production and the demand for efficient energy storage systems have increased the need for high-quality graphite used in lithium-ion batteries. Innovations in graphite processing are creating new applications, including specialized materials for lightweight composites and thermal management systems. The renewable energy sector, especially in wind and solar power, also relies on graphite for various components. This collective push for sustainable energy solutions is driving strong demand for graphite.

Restraining Factors

Graphite production is affected by the prices of raw materials like petroleum coke and natural graphite. Changes in these input prices can impact the profitability of graphite manufacturers and influence overall market growth. Additionally, graphite faces competition from alternative materials such as carbon fibers, ceramics, and other advanced composites. These substitutes often provide comparable or even superior properties and are preferred in specific industries, which in turn limits the demand for graphite.

Market Segmentation

The Europe graphite market share is classified into form and application.

- The synthetic graphite segment is expected to hold the largest market share through the forecast period.

The Europe graphite market is segmented by form into natural graphite and synthetic graphite. Among these, the synthetic graphite segment is expected to hold the largest market share through the forecast period. Synthetic graphite is produced by the heating of carbon-containing products (including petrochemicals, pitch, coal, or acetylene). When super-heated (to temperatures higher than 4000°C) the carbon atoms rearrange into layers to form graphite. That is, synthetic graphite is commercially produced and has greater purity than naturally occurring graphite. It is hence more expensive than natural graphite and the production process is energy-intensive. It is extensively in the production of graphite electrodes for applications such as solar energy storage and electric arc furnaces. It is also extensively used in the production of anodic material for EV batteries.

- The battery production segment is expected to dominate the Europe graphite market during the forecast period.

Based on the application, the Europe graphite market is divided into electrodes, refractories, lubricants, foundries, battery production, and others. Among these, the battery production segment is expected to dominate the Europe graphite market during the forecast period. The increasing demand for lithium-ion batteries is expected to drive the growth of the graphite market in the coming years. This surge in demand is largely fueled by the rising adoption of electric vehicles (EVs) and renewable energy solutions, as graphite plays a crucial role in lithium-ion batteries. Specifically, graphite is a key component in the anode of these batteries, which is essential for energy storage and release.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Europe graphite market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Triton Minerals

- Syrah Resources

- NOVONIX

- Northern Graphite

- Nippon Carbon

- Graphite India

- AMG Advanced Metallurgical Group

- Tokai Carbon Co Ltd

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In September 2024, Aurubis AG a Germany-based company entered into a development agreement with the Australian battery materials and technology company Talga Group Ltd. to create a recycled graphite anode product derived from lithium-ion batteries, according to a press release issued on September 10, 2024. Initial testing of Aurubis materials sourced from lithium-ion batteries in Hamburg has shown promising results. Talga plans to combine its expertise in graphite processing and anode production with Aurubis' proficiency in recycling complex materials. The partners aim to achieve product maturity by 2025.

Market Segment

This study forecasts revenue at Europe, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Europe Graphite Market based on the below-mentioned segments:

Europe Graphite Market, By Form

- Natural Graphite

- Synthetic Graphite

Europe Graphite Market, By Application

- Electrodes

- Refractories

- Lubricants

- Foundries

- Battery Production

- Others

Need help to buy this report?