Europe Industrial Maintenance Market Size, By Product Type (Grease, Lubricants and Oils); By Application (Machinery and Equipment Lubrication, Bearings and Gears, Hydraulic Systems and Engine Oils); By End-Use Industry (Manufacturing, Automotive, Aerospace, Energy and Utilities, Marine, Mining and Others); and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2024 – 2033

Industry: Chemicals & MaterialsEurope Industrial Maintenance Market Insights Forecasts to 2033

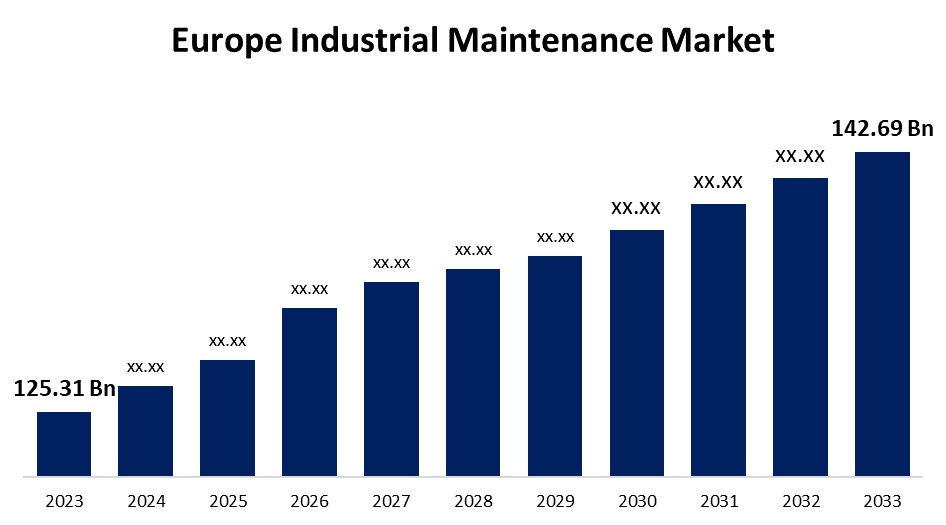

- The Europe Industrial Maintenance Market Size was valued at USD 125.31 Billion in 2023.

- The Market is Growing at a CAGR of 2.05% from 2023 to 2033.

- The Europe Industrial Maintenance Market Size is expected to reach USD 142.69 Billion by 2033.

Get more details on this report -

The Europe Industrial Maintenance Market Size is expected to reach USD 142.69 Billion by 2033, at a CAGR of 2.05% during the forecast period 2023 to 2033.

Industrial maintenance are widely utilized in a variety of industries, including oil and gas, manufacturing, and processing. Manufacturing processes, for instance, include many machine types incorporated into a single process, making them extremely complex. Additionally, industries are constantly operating at maximum capacity due to a rise in end-user demand. In addition, since consumer goods consumption is high and industrial development is strong, the European region has a strong manufacturing base. Due to the strong demand for outsourcing solutions, the market is expanding as a result of the expanding production requirements. Furthermore, the market need for industrial maintenance for operational improvement and maintenance will increase due to the growing adoption of Internet of things (IoT) technology in maintenance operations and the rising demand for preventive maintenance solutions. Moreover, the manufacturing and industrial sectors in Europe will expand. As a result, the main companies in the European economy have seen an improvement in sales. Industrial maintenance in Germany, Italy, and France is expected to increase due to rising industrial output. A number of companies in Europe have adopted integrated service concepts to raise the caliber of equipment and services in critical processes. This strategy also helps industry cut maintenance and repair costs. This trend is anticipated to drive the industrial maintenance market in Europe during the forecast period.

Europe Industrial Maintenance Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 125.31 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 2.05% |

| 2033 Value Projection: | USD 142.69 Billion |

| Historical Data for: | 2019 - 2022 |

| No. of Pages: | 120 |

| Tables, Charts & Figures: | 101 |

| Segments covered: | By Product Type, By Application, By End-Use Industry, By Country and COVID-19 Impact Analysis |

| Companies covered:: | Wurth Group GmbH, Airgas Inc., WESCO International Inc., Schneider Electric, Siemens AG, Sonepar SA, Rohrer Beteiligungs- und Verwaltungs GmbH, W.W. Grainger Inc. and other key vendors. |

Get more details on this report -

Driving Factors

A standard or established approach for operating the industrial mechanisms in industries is more in demand due to the growing benefits of industrial maintenance. Additionally, industrial and operational maintenance include some significant components necessary to produce better results. For example, through early prediction, users can reduce malfunctions and increase machine uptime with specialized and standard maintenance procedures. Throughout the forecast period, these factors will also fuel the growth of the industrial maintenance market in operational improvement and operational maintenance.

Restraining Factors

Since maintenance is becoming better, they still haven't caught up to customer demands, which is restricting market expansion. Various compliance levels hamper market expansion in various areas in Europe.

Market Segmentation

The oils segment dominates the market with the largest revenue share over the forecast period.

On the basis of the product type, the Europe industrial maintenance market is segmented into grease, lubricants, and oils. Among these, the oils segment is dominating the market with the largest revenue share over the forecast period. The oil and gas industry is increasingly adopting cutting-edge technologies such as IoT, AI, and automation. The integration and optimization of these technologies to improve decision-making and operational efficiency are supported by industrial maintenance. To preserve asset integrity and avoid unscheduled downtime, the industry mainly depends on maintaining sophisticated machinery and infrastructure. Specialized maintenance solutions are provided by industrial maintenance providers to ensure the dependability of vital assets.

The machinery and equipment lubrication segment is witnessing significant CAGR growth over the forecast period.

On the basis of application, the Europe industrial maintenance market is segmented into machinery and equipment lubrication, bearings and gears, hydraulic systems, and engine oils. Among these, the machinery and equipment lubrication segment is witnessing significant growth over the forecast period. The real-time monitoring and advanced management algorithms, and applications help to increase security as well as reliability in industrial processes. The proper implementation and continuous safety-critical systems are made possible in part by industrial maintenances. Furthermore, in the food and beverage industry there are large machinery and equipment are there the maintenances of the machinery is important, which will accelerated the market expansion in the forecast period.

The aerospace dominate the market with the largest revenue share over the forecast period.

Based on the end use industry, the Europe industrial maintenance market is segmented into manufacturing, automotive, aerospace, energy and utilities, marine, mining and others. Among these, the aerospace segment is dominating the market with the largest revenue share over the forecast period. Businesses that perform overhauls, rebuilds, part replacements, modifications, or conversions of commercial aircraft are included in the aerospace industry. Companies in this sector manufacture gliders, helicopters, drones, ultra-light aircraft, passenger aircraft, and private jets, among other types of aircraft. For corporate, commercial, and military aircraft, the primary focus is on the maintenance support provided by the industrial maintenance service in the forecast period.

List of Key Market Players

- Wurth Group GmbH

- Airgas Inc.

- WESCO International Inc.

- Schneider Electric

- Siemens AG

- Sonepar SA

- Rohrer Beteiligungs- und Verwaltungs GmbH

- W.W. Grainger Inc.

- Others

Key Market Developments

- In August 2023, Schneider Electric has launched Managed Security Services (MSS) to assist customers in operational technology (OT) environments in managing the increased cyber risk resulting from the demand for remote connectivity and accessibility technologies.

- In February 2023, new services for industrial digital transformation were introduced by Schneider Electric. The specialized global service is intended to assist industrial enterprises in achieving an end-to-end digital transformation that is innovative, sustainable, future-ready, and efficient.

Market Segment

This study forecasts revenue at regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Europe Industrial Maintenance Market based on the below-mentioned segments:

Europe Industrial Maintenance Market, Product Type Analysis

- Grease

- Lubricants

- Oils

Europe Industrial Maintenance Market, Application Analysis

- Machinery and Equipment Lubrication

- Bearings and Gears

- Hydraulic Systems and Engine Oils

Europe Industrial Maintenance Market, End Use Industry Analysis

- Manufacturing

- Automotive

- Aerospace

- Energy and Utilities

- Marine

- Mining and Others

Europe Industrial Maintenance Market, Country Analysis

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

Need help to buy this report?