Europe Seeds Market Size, Share, and COVID-19 Impact Analysis, By Type (Hybrid, Genetically Modified, Varietal), By Seed Type (Cereals & Grains, Oilseeds & Pulses, Cotton, Fruits & Vegetables, Others), By Traits (Herbicide-Tolerant (HT), Insecticide-Resistant (IR), Other Stacked Traits), By Country (Germany, UK, France, Italy, Spain, Russia, Rest of Europe), and Europe Seeds Market Insights Forecast to 2033

Industry: AgricultureEurope Seeds Market Size to Insights Forecasts to 2033

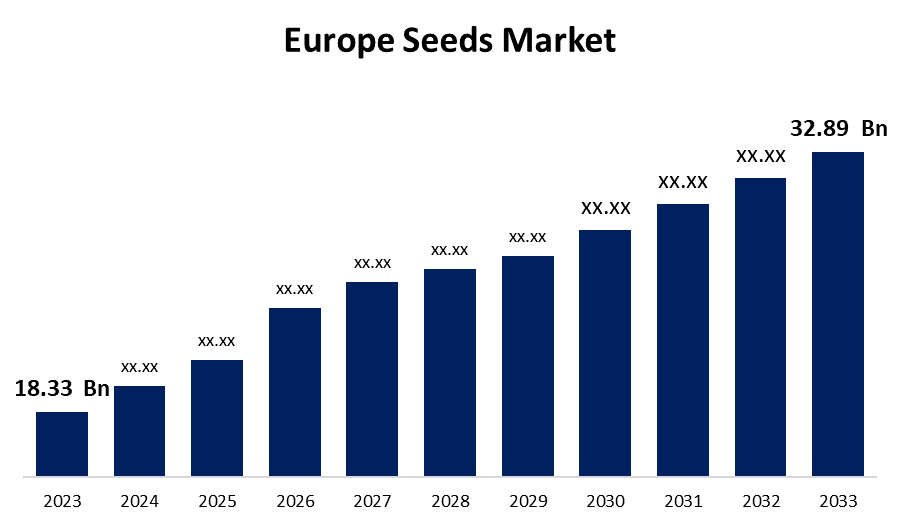

- The Europe Seeds Market Size was valued at USD 18.33 Billion in 2023

- The Market Size is Growing at a CAGR of 6.02% From 2023 to 2033.

- The Europe Seeds Market Size is Expected to Reach 32.89 Billion by 2033.

Get more details on this report -

The Europe Seeds Market size is Expected to Reach USD 32.89 Billion by 2033, at a CAGR of 6.02% during the Forecast period 2023 to 2033.

Market Overview

A seed is a unit used to reproduce various plants. It has a covering known as a seed coat. It is an embryo used to create new plants for agriculture. It is an input used in agriculture and farming applications. Seeds can be both conventional and genetically modified. Conventional seeds are primarily used in organic farming, which is gaining popularity in the current situation. Genetically modified seeds are used when high nutritional value is required and water is scarce for agricultural purposes. The European seeds market is poised for promising growth, driven by a variety of factors, including rising demand for biofuel extraction and the prevalence of both conventional and genetically modified (GM) seeds. The growing popularity of urban farming and rooftop gardening is driving up demand for seeds suitable for small-scale cultivation in constrained spaces. Furthermore, the increasing use of vertical farming techniques is driving Europe seeds market growth. Vertical farming involves growing crops in controlled indoor environments, necessitating the use of seeds that are specifically designed for these conditions. Additionally, growing concerns about plant diseases and pathogens are driving demand for more disease-resistant seeds. Furthermore, the incorporation of smart agriculture technologies such as sensors, drones, and data analytics has promoted a positive market outlook.

Report Coverage

This research report categorizes the market for the Europe seeds market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Europe seeds market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Europe seeds market.

Europe Seeds Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | 18.33 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 6.02% |

| 2033 Value Projection: | 32.89 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Type, By Traits, By Country, and COVID-19 Impact Analysis |

| Companies covered:: | Bayer AG, Syngenta Crop Protection AG, Limagrain GmbH, KWS SAAT SE & Co., Takii Europe B.V., Sakata EMEA, Land O Lakes, Inc., Others, and |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Increasing disposable income leads to increased consumption of fruits and vegetables, which is expected to boost market growth during the forecast period. Also, the rapid growth of the organic farming sector is a major Europe seeds market driver. Increasing awareness and government policies are expected to drive the Europe seeds market during the forecast period. Furthermore, R&D investments and technological advancements in hybrid crop production and agricultural process development are expected to provide significant opportunities for Europe seeds market players. Furthermore, rising demand for functional crops in the pharmaceutical and nutraceutical industries is driving Europe seeds market growth.

Restraining Factors

The high cost of agricultural equipment and pesticides is expected to impede market growth, while a lack of skilled farmers and government initiatives are major factors that could hamper market growth during the forecast period. The commercialization of fake hybrid seeds and counterfeit products, in addition to the high cost of seed due to high R&D expenses on quality seed advancement, will be major obstacles to Europe seeds market growth.

Market Segment

- In 2023, the hybrid segment accounted for the largest revenue share over the forecast period.

Based on type, the Europe seeds market is segmented into hybrid, genetically modified, and varietal. Among these, the hybrid segment has the largest revenue share over the forecast period. One of the primary reasons for hybrid seeds' dominance is their significant contribution to increased crop yield. Hybrid seeds produce offspring that frequently inherit desirable traits from both parents by leveraging the power of cross-pollination between two distinct but related plants. These characteristics can include not only higher yields, improved disease resistance, and greater adaptability to environmental conditions, but also other beneficial characteristics such as increased nutritional content or superior taste profiles. Biotechnology advancements have had a positive impact on the development of new and improved hybrid seeds.

- In 2023, the cereals & grains medium segment is witnessing the largest growth over the forecast period.

Based on seed type, the Europe seeds market is segmented into cereals & grains, oilseeds & pulses, cotton, fruits & vegetables, and others. Among these, the cereals & grains segment is witnessing the largest growth over the forecast period. Cereals and grains, such as wheat and corn, are essential staple foods for a large proportion of the European population. These crops not only provide essential nutrients but also serve as the foundation for a variety of diets throughout Europe. Cereals and grains have become a dominant force in the European seeds market due to their widespread consumption, resulting in high demand. The cereals and grains industry has been transformed by remarkable advances in breeding technology, particularly hybrid technology. Furthermore, the demand for cereals and grains goes beyond human consumption because they are widely used in animal feed. This increases the overall demand for these crops in the agricultural sector.

- In 2023, the herbicide-tolerant (HT)medium segment is witnessing the largest growth over the forecast period.

Based on traits, the Europe seeds market is segmented into herbicide-tolerant (HT), insecticide-resistant (IR), and other stacked traits. Among these, the herbicide-tolerant (HT)segment is witnessing the largest growth over the forecast period. Herbicide-tolerant seeds are genetically modified to withstand specific herbicides, allowing for targeted weed control while minimizing crop damage. This trait improves weed management efficiency, lowers labor costs, and promotes environmentally friendly practices by limiting herbicide use.

- Germany is projected to have the largest share of the Europe seeds market over the forecast period.

Based on country, Germany is projected to have the largest share of the Europe seeds market over the forecast period. Germany has established itself as an agricultural powerhouse due to its emphasis on advanced farming practices. Farmers in the country have eagerly embraced cutting-edge technologies such as hybrid seeds and innovative seed technologies, which provide numerous benefits such as increased yields and disease resistance. This enthusiastic adoption of new technologies has driven Germany to the forefront of the European seed market while also cementing its reputation as a leader in agricultural innovation. Furthermore, Germany's unwavering commitment to agricultural research and development has played a significant role in its success. The country is home to numerous prestigious agricultural research institutions and universities that are constantly working to improve seed varieties and refine farming techniques.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Europe seeds market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Bayer AG

- Syngenta Crop Protection AG

- Limagrain GmbH

- KWS SAAT SE & Co.

- Takii Europe B.V.

- Sakata EMEA

- Land O Lakes, Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at regional, and country levels from 2022 to 2033. Spherical Insights has segmented the Europe seeds market based on the below-mentioned segments:

Europe Seeds Market, By Type

- Hybrid

- Genetically Modified

- Varietal

Europe Seeds Market, By Seed Type

- Cereals & Grains

- Oilseeds & Pulses

- Cotton

- Fruits & Vegetables

- Others

Europe Seeds Market, By Seed Type

- Herbicide-Tolerant (HT)

- Insecticide-Resistant (IR)

- Other Stacked Traits

Europe Seeds Market, By Country

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

Need help to buy this report?