Europe Serine Proteases Market Size, Share, and COVID-19 Impact Analysis, By Application (Soaps & Detergents, Protein Hydrolysate Production, Pharmaceuticals, Others), By Country (UK, Germany, France, Italy, Spain, Others), and Europe Serine Proteases Market Insights Forecasts to 2032.

Industry: Specialty & Fine ChemicalsEurope Serine Proteases Market Insights Forecasts to 2032

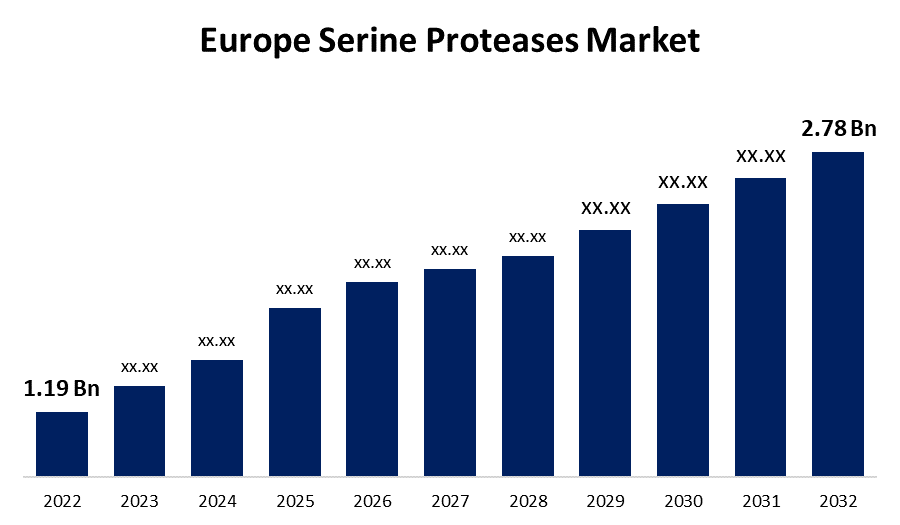

- The Europe Serine Proteases Market Size was valued at USD 1.19 Billion in 2022.

- The Market is Growing at a CAGR of 8.86% from 2022 to 2032.

- The Europe Serine Proteases Market Size is expected to reach USD 2.78 Billion by 2032.

- Europe is expected to grow the fastest during the forecast period.

Get more details on this report -

The Europe Serine Proteases Market Size was valued at USD 1.19 Billion in 2022 and is expected to reach USD 2.78 Billion by 2032, at a CAGR of 8.86% during the forecast period 2022 to 2032. The region's extremely high export of detergents, as well as a rise in demand from end-use sectors such as beverages, food, and pharmaceuticals, are significant factors boosting the Europe serine proteases market growth.

Market Overview

Serine proteases comprise a type of enzyme in the serine hydrolase group. Their inclusion of a serine residue in their active site, which functions as a nucleophile during catalytic processes, distinguishes them. Enzymes such as these regulate a variety of physiological processes in organisms, including digestion, blood coagulation, inflammation, and immunological response. Because of their many roles and possible therapeutic applications, serine proteases are intensively investigated and employed in a variety of industries, including medicine, biotechnology, and food processing. Europe ranks as one of the world's biggest producers of laundry detergent. The widespread use of serine protease in household supplies for cleaning is expected to benefit the regional market. Furthermore, the drugs have a wide range of applications in the treatment of stomach-related problems such as food allergies and gastrointestinal diseases. The rising frequency of such illnesses in countries such as France, Italy, the United Kingdom, and Germany is expected to drive serine proteases market expansion in Europe.

Report Coverage

This research report categorizes the market for Europe Serine Proteases Market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Europe Serine Proteases Market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the Europe Serine Proteases Market.

Europe Serine Proteases Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 1.19 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 8.86% |

| 2032 Value Projection: | USD 2.78 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Application, By Country and Country Statistics (Demand, Price, Growth, Competitors, Challenges) |

| Companies covered:: | Biocatalysts, Novozymes A/S, DSM, Antozyme Biotech Pvt. Ltd., Bioseutica, Sino Biological, Inc., Merck KGaA, Sigma-Aldrich® Solutions, Provencale SA. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Europe serine proteases market is predicted to rise significantly throughout the duration of the forecast as customers' awareness of worsening nutrient deficiencies has increased protein consumption. Furthermore, the expansion of the food and beverage, pharmaceutical, detergent, and chemical end-use sectors across Europe is likely to drive market growth. Additionally, the widespread use of serine protease as an exfoliating ingredient in various home care products is expected to stimulate demand for the product. In recent years, the laundry care business has shown consistent and moderate growth, particularly in Western Europe. Furthermore, the product's use in the pharmaceutical business has been critical since the COVID-19 epidemic. As pharmaceutical spending increased, so did demand for both essential and non-essential products. Moreover, in progress research and developments in enzyme technology development have allowed the production of new serine proteases with better features such as equilibrium, substrate accuracy, and catalytic capability. These improvements open up new avenues for use in a variety of industries.

Market Segment

- In 2022, the soaps & detergents segment is witnessing a higher growth rate over the forecast period.

On the basis of application, the Europe Serine Proteases Market is segmented into soaps & detergents, protein hydrolysate production, pharmaceuticals, and others. Among these, the soaps & detergents segment is witnessing a higher growth rate over the forecast period. This rise can be due to the increased usage of detergents in industrial and home applications. It is utilized to increase the performance of clothing as well as the washing capacity of industrial detergents. Serine Proteases are employed for eliminating protein-based stains from clothing such as body fluids, grass, food grounds, and blood. Protein-degrading components such as highly alkaline serine proteases are employed in detergent compositions. Through significant protein modification, they enhance detergent stability and effectiveness.

- In 2022, the Germany segment accounted for the largest revenue share of more than 32.3% over the forecast period.

On the basis of Country, the Europe Serine Proteases Market is segmented into industrial UK, Germany, France, Italy, Spain, and Others. Among these, the Germany segment dominates the market with the highest revenue share of 32.3% over the forecast period. This is owing to greater knowledge throughout the country's population of health issues, particularly digestive diseases and dietary allergies. Furthermore, Germany is Europe's largest producer of food-related goods, and its food and beverage sector is predicted to grow rapidly during the projection period due to a growing population, expanding surpluses from consumers, and rising consumer desire for healthy food commodities.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Europe Serine Proteases Market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Biocatalysts

- Novozymes A/S

- DSM

- Antozyme Biotech Pvt. Ltd.

- Bioseutica

- Sino Biological, Inc.

- Merck KGaA

- Sigma-Aldrich® Solutions

- Provencale SA

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- On March 2023, Palisade Bio, Inc. has reported that the European Patent Office (EPO) has granted a notice of intention to grant for their patent application titled "Administration of Serine Protease Inhibitors to the Stomach." The applications include allowed claims directed to liquid formulations, as well as additional claims directed to the use of these formulations in treating shock, a potentially fatal complication in trauma situations such as burns, surgery, ischemia, sepsis, and other critical care applications.

- In July 2022, Quoin Pharmaceuticals Ltd. announced that the European Medicines Agency (EMA) has provided detailed and constructive Scientific Advice for the clinical and regulatory development of QRX003 in Europe as a potential treatment for Netherton Syndrome (NS). QRX003 contains a broad-spectrum serine protease inhibitor, whose mechanism of action is designed to reduce the hyperactivity of skin kallikreins, resulting in a more normalized rate of skin shedding.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2021 to 2032. Spherical Insights has segmented the Europe Serine Proteases Market based on the below-mentioned segments:

Europe Serine Proteases Market, By Application

- Soaps & Detergents

- Protein Hydrolysate Production

- Pharmaceuticals

- Others

Europe Serine Proteases Market, By Country

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Rest of Europe

Need help to buy this report?