Europe Soup Market Size, Share, and COVID-19 Impact Analysis, By Packaging Type (Canned (Metal Cans, Aluminum Cans, Composite Cans), Non-canned (Tetra Pak, Pouches, Cartons, Bowls, Cups)), By Product Type (Vegetable Soup, Chicken Soup, Beef Soup, Seafood Soup, Tomato Soup, Creamy Soup, Specialty Soups) By Distribution Channel (Supermarkets/Hypermarkets, Convenience Stores, Online Retail, Specialty Stores, On-the-Go Channels, Vending Machines, Petrol Stations), and Europe Soup Market Insights Forecast 2023 – 2033

Industry: Food & BeveragesEurope Soup Market Insights Forecasts to 2033

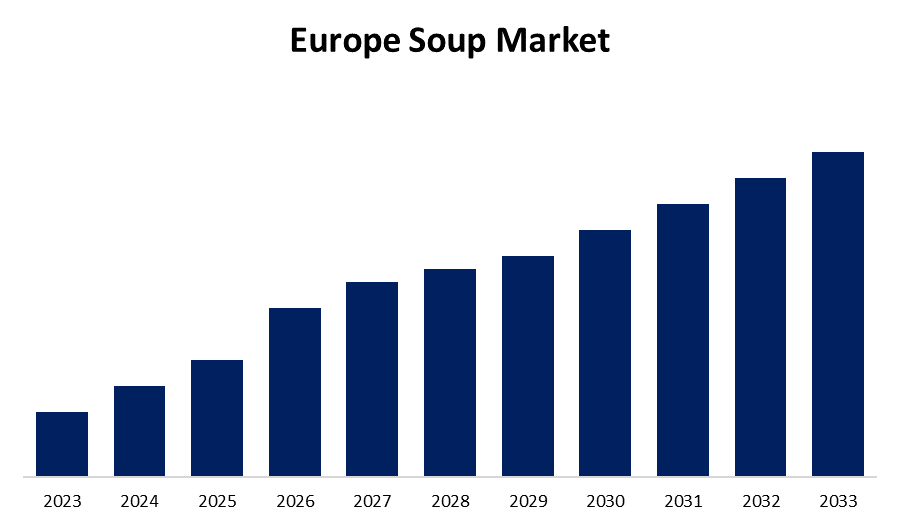

- The Market Size is Growing at a 3.7% CAGR from 2023 to 2033.

- The Europe Soup Market Size is Expected to Reach a Significant Share by 2033.

Get more details on this report -

The Europe Soup Market Size is Expected to Reach a Significant Share by 2033, Growing at a 3.7% CAGR from 2023 to 2033.

Market Overview

Soup is a liquid-based dish that combines vegetables, meats, legumes, grains, and spices with broth or stock. It provides an enjoyable gastronomic experience with a variety of aromas, textures, and consistency. It is a healthy dinner option because it contains a variety of vegetables rich in minerals, vitamins, and antioxidants. Nutrient retention is another benefit of slow cooking. It is a tasty treat that is versatile and nourishing, and it is enjoyed in many different cultures and cuisines. It can be had as a main course, an appetizer, a light dinner, or both. Soup market share in Europe is mostly driven by changing lifestyles, rising disposable incomes, and nutritional concerns. The rising number of working women boosts sales in the European soup industry. Processed and packaged meals are well-known across Europe, especially in France and Russia. In the European soup sector, modern clients increasingly demand packaged items with long shelf lives. Consumers are becoming more aware of the nutritional value and substances in food products. As a result, European consumers are actively seeking healthier food options, such as soups that contain less fat, sodium, and artificial additives.

Report Coverage

This research report categorizes the market for the Europe soup market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Europe soup market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Europe soup market.

Europe Soup Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 3.7% |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 120 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Packaging Type, By Product Type, By Distribution Channel and COVID-19 Impact Analysis. |

| Companies covered:: | The Campbell Soup Company, Nestlé S.A, Baxters Food Group Limited, General Mills, Inc, Conagra Brands, Inc., Premier Foods Group Limited, The Kraft Heinz Company, Hindustan Unilever Limited, Ottogi Co., Ltd, Associated British Foods plc, and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The rise in individual's hectic lifestyles has made room for a rise in foods that are quick to prepare and lightweight, like soups. The European soup industry has grown due to the growing sophistication of markets about the desire for value-added products, such as functional soups with health-promoting qualities in addition to being natural, safe, nourishing, and having a homemade appearance. In addition, during the projection period, the major European countries like France, the United Kingdom, Russia, and Germany, among others should see a rise in the demand for soups due to growing consumer preference for healthier food items and Western cuisine. Furthermore, the growing popularity of lightweight, biodegradable soup pouch packaging is also contributing to the market's expansion. Aegg, a packaging firm based in the United Kingdom, has created a new line of fresh soup and pasta sauce pots with a tear-back cover and an integrated pouring spout.

Restraining Factors

There are many established and new competitors fighting for market share in the fiercely competitive European soup market. For newcomers attempting to make a name for themselves in the European soup industry, this fierce competition presents obstacles.

Market Segment

- In 2023, the canned segment accounted for the largest revenue share over the forecast period.

Based on packaging type, the Europe soup market is segmented into canned (metal cans, aluminum cans, composite cans), and non-canned (tetra pak, pouches, cartons, bowls, cups). Among these, the canned (metal cans, aluminum cans, composite cans) segment has the largest revenue share over the forecast period. This is anticipated by the canned food is widely consumed in Europe's developed countries, including the United Kingdom and Germany. Because of their hectic work schedules, the consumers in these countries prefer ready-to-eat products. Manufacturers are focusing on developing new flavors and products that have health benefits.

- In 2023, the vegetable soup segment is witnessing significant growth over the forecast period.

Based on product type, the Europe soup market is segmented into vegetable soup, chicken soup, beef soup, seafood soup, tomato soup, creamy soup, and specialty soups. Among these, the vegetable soup segment is witnessing significant growth over the forecast period. This is a result of the various methods that veggies were preserved to give consumers an abundance of food throughout the long winter. In Russia, Individuals can fast for up to 180-200 days a year and do not consume meat during that time. This will propel the vegetable soup segment in Europe soup market. Moreover, soup is a staple meal in France. Though the French tend to eat sparingly at dinner, it's more likely to be served as the main course. The most popular is a "purée" a vegetable soup. These few variables are causing the vegetable soup category in the European soup market to grow at the fastest rate.

- In 2023, the supermarkets/hypermarkets segment is witnessing significant growth over the forecast period.

Based on the distribution channel, the Europe soup market is segmented into supermarkets/hypermarkets, convenience stores, online retail, specialty stores, on-the-go channels, vending machines, and petrol stations. Among these, the supermarkets/hypermarkets segment is witnessing significant growth over the forecast period. This increase can be attributed to several factors, such as the growing demand from consumers for convenient and ready-to-eat foods, which has increased the purchase of instant noodle soups, and the widespread availability of packaged soups in huge amounts at supermarkets.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Europe soup market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- The Campbell Soup Company

- Nestlé S.A

- Baxters Food Group Limited

- General Mills, Inc

- Conagra Brands, Inc.

- Premier Foods Group Limited

- The Kraft Heinz Company

- Hindustan Unilever Limited

- Ottogi Co., Ltd

- Associated British Foods plc

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In January 2023, Heinz UK introduced vegan versions of Creamy Tomato Soup and Beanz & Sausages, two of its best-selling tinned products. Fermented soy is used to make the soup instead of dairy as it was in the original recipe.

Market Segment

This study forecasts revenue at regional, and country levels from 2022 to 2033. Spherical Insights has segmented the Europe Soup Market based on the below-mentioned segments:

Europe Soup Market, By Packaging Type

- Canned

- Metal Cans

- Aluminum Cans

- Composite Cans

- Non-canned

- Tetra Pak

- Pouches

- Cartons

- Bowls

- Cups

Europe Soup Market, By Product Type

- Vegetable Soup

- Chicken Soup

- Beef Soup

- Seafood Soup

- Tomato Soup

- Creamy Soup

- Specialty Soups

Europe Soup Market, By Distribution Channel

- Supermarkets/Hypermarkets

- Convenience Stores

- Online Retail

- Specialty Stores

- On-the-Go Channels

- Vending Machines

- Petrol Stations

Need help to buy this report?