Europe Testing Inspection and Certification (TIC) Market Size, Share, and COVID-19 Impact Analysis, By Sourcing Type (In-House and Outsourced), By Service Type (Testing, Inspection, and Certification), By Application (Agriculture & Food, Construction, and Others), and Europe Testing Inspection and Certification (TIC) Market Insights Forecasts 2023 - 2033

Industry: HealthcareEurope Testing Inspection and Certification (TIC) Market Insights Forecasts to 2033

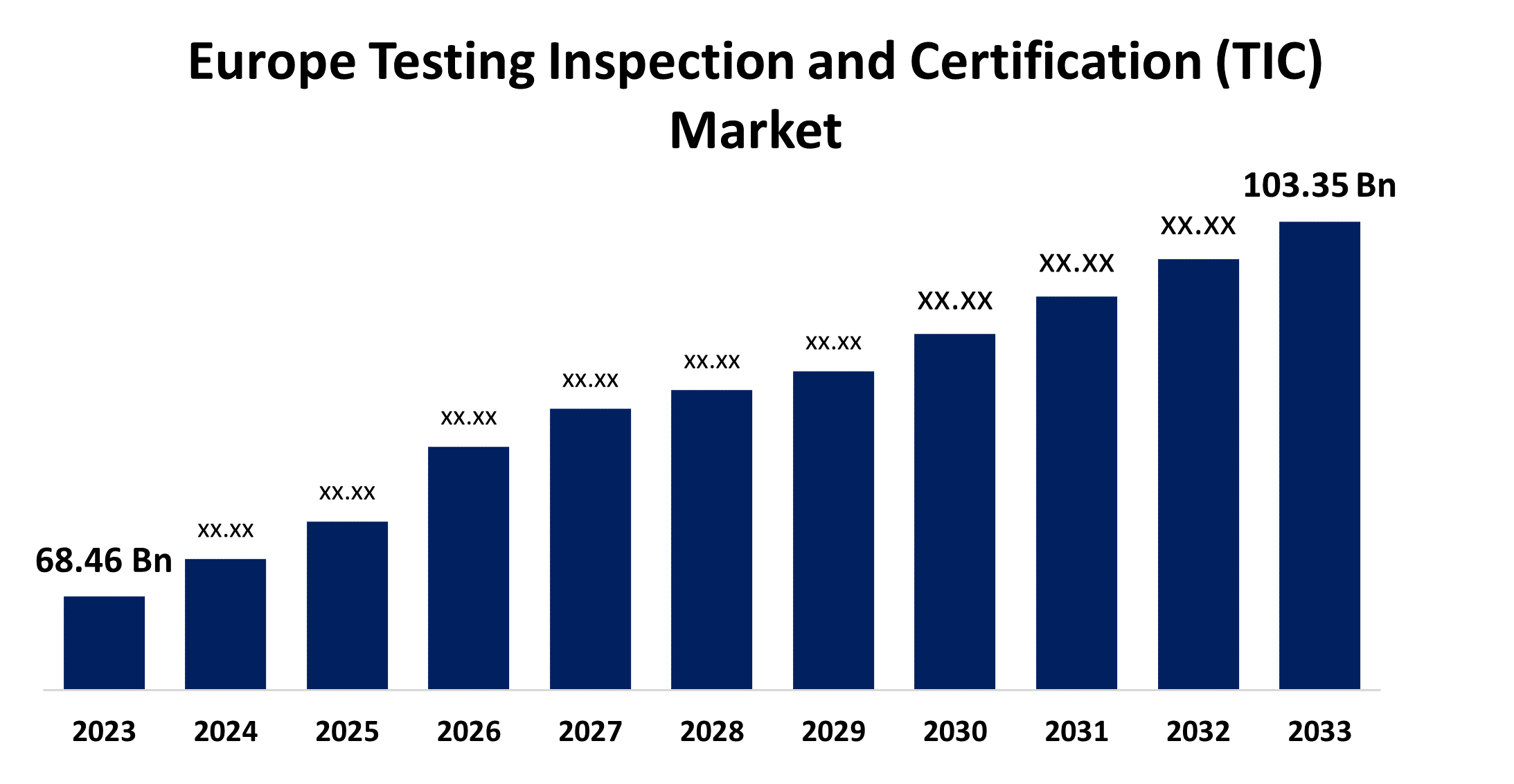

- The Europe Testing Inspection and Certification (TIC) Market Size was valued at USD 68.46 Billion in 2023

- The Market Size is Growing at a CAGR of 4.20% from 2023 to 2033.

- The Europe Testing Inspection and Certification (TIC) Market Size is Expected to Reach USD 103.35 Billion by 2033.

Get more details on this report -

The Europe Testing Inspection and Certification (TIC) Market Size is Expected to reach USD 103.35 Billion by 2033, at a CAGR of 4.20% during the forecast period 2023 to 2033.

Market Overview

Testing, Inspection, and Certification (TIC) refers to the services that go into assessing various products and services to make sure they meet industry standards and regulatory requirements. The market provides a range of services, including building and vehicle inspections, software, mechanical, and electrical equipment testing, as well as certification of products, processes, and management systems. These services are offered by the industry sector operating in the Europe region in the TIC market. Testing is the term used to describe a variety of experiments and tests that are carried out to evaluate the dependability, performance, and usefulness of systems or products. Inspection is the process of measuring, checking, and visually inspecting goods, procedures, or installations to make sure they adhere to standards and specifications. The process of officially issuing documents or certificates to indicate that a system, product, or service satisfies the necessary requirements and standards is known as certification. Furthermore, the automobile, aerospace, medical, and food safety industries are among the numerous industries covered by the extensive regulatory framework of the European Union. These regulations must be followed by businesses in order to operate in the European market. These regulations were put in place to ensure quality and security. The need for TIC services has grown as businesses attempt to guarantee compliance with these rules.

Report Coverage

This research report categorizes the market for the Europe testing inspection and certification (TIC) market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Europe testing inspection and certification (TIC) market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Europe testing inspection and certification (TIC) market.

Europe Testing Inspection and Certification (TIC) Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 68.46 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 4.20% |

| 2033 Value Projection: | USD 103.35 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 216 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Sourcing Type, By Service Type, By Application |

| Companies covered:: | Applus+, TÜV SÜD AG, Intertek Group plc, Eurofins Scientific, SGS SA, DEKRA SE, and Others Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Europe has set strict regulations for a number of industries, including consumer goods, automotive, healthcare, food, and energy. The need for TIC services is driven by these stringent laws and standards, as businesses endeavor to comply with the requirements. TIC companies are essential in helping organizations comply with the required standards and navigate the many laws. In addition, the European Union plays a major role in world trade, and the growth of international trade has raised the demand for TIC services. Businesses that export must abide by international regulations and norms, which can vary from country to country. To ensure that these rules and regulations are followed and to enable companies to export their products to different markets, TIC services are necessary.

Restraining Factors

Harmonization is a key barrier for TIC service providers operating in Europe because it may increase costs and lengthen lead times for their services. Although the European Union has sought to standardize standards and regulations among its members, considerable discrepancies remain, particularly in product safety and environmental rules. As a result, international enterprises might find it challenging to comply with norms and regulations.

Market Segment

- In 2023, the outsourced segment accounted for the largest revenue share over the forecast period.

Based on sourcing type, the Europe testing inspection and certification (TIC) market is segmented into In-house and outsourced. Among these, the outsourced segment has the largest revenue share over the forecast period. This is attributed to the creative and advanced testing and inspection services provided by third-party TIC service providers, which instill trust and reliability in the manufacturer. Furthermore, the government considers the results published by third-party service providers because they are not biased and are accurate.

- In 2023, the inspection segment is witnessing significant growth over the forecast period.

Based on service type, the Europe testing inspection and certification (TIC) market is segmented into testing, inspection, and certification. Among these, the inspection segment is witnessing significant growth over the forecast period. This is due to thorough evaluations of facilities, processes, and products in order to reduce risks and increase operating efficiency.

- In 2023, the construction segment is witnessing significant growth over the forecast period.

Based on application, the Europe testing inspection and certification (TIC) market is segmented into agriculture & food, construction, and others. Among these, the construction segment is witnessing significant growth over the forecast period. The construction business requires rigorous testing, inspection, and certification to ensure that safety and quality standards are met in construction projects.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Europe testing inspection and certification (TIC) market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Applus+

- TÜV SÜD AG

- Intertek Group plc

- Eurofins Scientific

- SGS SA

- DEKRA SE

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at regional, and country levels from 2022 to 2033. Spherical Insights has segmented the Europe Testing Inspection and Certification (TIC) Market based on the below-mentioned segments:

Europe Testing Inspection and Certification (TIC) Market, By Sourcing Type

- In-House

- Outsourced

Europe Testing Inspection and Certification (TIC) Market, By Service Type

- Testing

- Inspection

- Certification

Europe Testing Inspection and Certification (TIC) Market, By Application

- Agriculture & Food

- Construction

- Others

Need help to buy this report?