Europe Vehicle Rental Market Size, Share, and COVID-19 Impact Analysis, By Vehicle (Passenger Car, Light Truck, and Heavy/Medium Truck), By Application (Passenger Transport, Freight & Logistics, Petrochemicals, Construction & Mining, Industry & Food, Healthcare, and Others), and Europe Vehicle Rental Market Insights, Industry Trend, Forecasts to 2033

Industry: Automotive & TransportationEurope Vehicle Rental Market Insights Forecasts to 2033

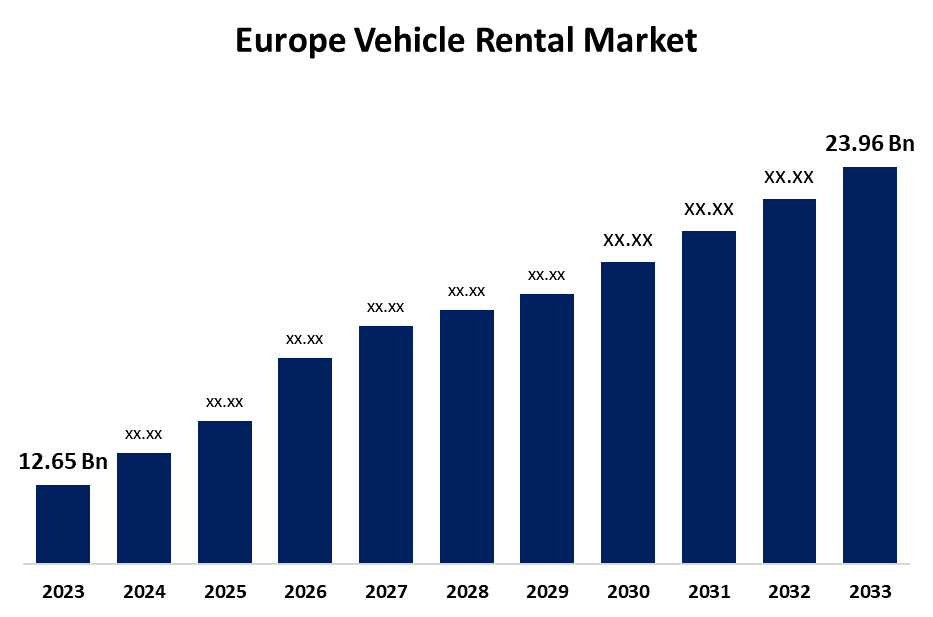

- The Europe Vehicle Rental Market Size was valued at USD 12.65 Billion in 2023.

- The Market Size is Growing at a CAGR of 6.60% from 2023 to 2033

- The Europe Vehicle Rental Market Size is Expected to Reach USD 23.96 Billion by 2033

Get more details on this report -

The Europe Vehicle Rental Market Size is Anticipated to Reach USD 23.96 Billion by 2033, Growing at a CAGR of 6.60% from 2023 to 2033

Market Overview

The business of renting various vehicle types, including cars, vans, lorries, and specialty vehicles, to people and businesses for brief periods is included in the Europe vehicle rental market. The market serves a wide range of clients, such as travelers, business travelers, and people in need of short-term mobility options. Renting a car provides flexible, affordable mobility options without the long-term commitment and maintenance that come with owning a car. The growing need for flexible transportation options, particularly among metropolitan areas and tourists, is one of the main reasons propelling the European car rental business. Increases in both leisure and business travel are major factors driving the market's growth. The rise of shared mobility services like car-sharing and ride-hailing has boosted vehicle rental demand, allowing users to access vehicles on demand. Environmental concerns have led to a demand for electric and hybrid vehicles in rental fleets. Government policies, including incentives and subsidies for electric vehicles, have compelled rental companies to adopt these vehicles. Additionally, regulations for sustainable transportation and infrastructure development, such as charging stations for electric vehicles, have boosted growth and innovation in the European vehicle rental market.

Report Coverage

This research report categorizes the market for the Europe vehicle rental market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Europe vehicle rental market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Europe vehicle rental market.

Europe Vehicle Rental Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023 : | USD 12.65 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 6.60% |

| 2033 Value Projection: | USD 23.96 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 171 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Vehicle, By Application |

| Companies covered:: | Europcar Mobility Group SA, SIXT SE, Petit Forestier, Arval, LeasePlan Corporation, The Hertz Corporation, TIP Trailer Services Group, Heisterkamp Group, Allied Vehicle Rentals Ltd., Enterprise Holdings, Inc., and Others. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

Europe vehicle rental market is influenced by some major drivers. The rise in demand for economical and flexible modes of transport, particularly from tourists, business persons, and urban dwellers, is one of the main drivers. As people increasingly prefer solutions for mobility with convenience at lower costs and not long-term arrangements, car rental services are increasingly becoming popular. Moreover, the growth of shared mobility services, including car-sharing and ride-hailing, has fueled the rental market by providing customers with on-demand access to cars. The drive towards sustainability and environmental awareness also contributes significantly, with most rental firms increasing their fleets with electric and hybrid cars to cater to the growing demand for green transport solutions.

Restraining Factors

Fleet maintenance and management costs, regulatory complexity, and stiff competition can hinder profitability for rental companies. Insurance, maintenance, and infrastructure costs can be high, while differing local laws in European countries can hinder business operations. Competition can lead to lower prices and profit margins. Economic uncertainty and fuel price volatility can also reduce consumer spending, especially during recessions, deterring demand for car rental services.

Market Segmentation

The Europe vehicle rental market share is classified into vehicle and application.

- The passenger car segment accounted for the largest share in 2023 and is expected to grow at a significant CAGR during the forecast period.

The Europe vehicle rental market is segmented by vehicle into passenger cars, light trucks, and heavy/medium trucks. Among these, the passenger car segment accounted for the largest share in 2023 and is expected to grow at a significant CAGR during the forecast period. The surge in demand for passenger vehicles by both leisure and business travelers is largely due to their convenience, affordability, and accessibility. These vehicles are preferred for short-term hire due to their wide range of models, from small cars to luxurious ones, making them a popular choice for both personal and business use.

- The passenger transport segment accounted for the highest share in 2023 and is expected to grow at a significant CAGR during the forecast period.

Based on the application, the Europe vehicle rental market is divided into passenger transport, freight & logistics, petrochemicals, construction & mining, industry & food, healthcare, and others. Among these, the passenger transport segment accounted for the highest share in 2023 and is expected to grow at a significant CAGR during the forecast period. This is significantly spurred by the enormous demand for rental vehicles and other cars by tourists, businesspersons, and city dwellers who require temporary solutions to movement needs. The most common use is passenger transport, with rentals covering short-term movement requirements, which include leisure travel, business travel, and temporary transportation for locals who do not own a car.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Europe vehicle rental market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Europcar Mobility Group SA

- SIXT SE

- Petit Forestier

- Arval

- LeasePlan Corporation

- The Hertz Corporation

- TIP Trailer Services Group

- Heisterkamp Group

- Allied Vehicle Rentals Ltd.

- Enterprise Holdings, Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In January 2023, Hertz and Uber plan to have up to 25,000 electric vehicles (EVs) available to Uber drivers in capital cities around Europe. The goal of this project is to help Uber reach its 2030 demand target of becoming a fully electrified platform in Europe.

Market Segment

This study forecasts revenue at Europe, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Europe vehicle rental market based on the below-mentioned segments:

Europe Vehicle Rental Market, By Vehicle

- Passenger Car

- Light Truck

- Heavy/Medium Truck

Europe Vehicle Rental Market, By Application

- Passenger Transport

- Freight & Logistics

- Petrochemicals

- Construction & Mining

- Industry & Food

- Healthcare

- Others

Need help to buy this report?