Global EV Charging Card Market Size, Share, Growth, and Industry Analysis, By EV Charging Infrastructure (Private Charging, Public Charging, and Others), By Application (Household, Commercial, and Other), By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa) and EV Charging Card and Forecast Regional to 2033

Industry: Electronics, ICT & MediaGlobal EV Charging Card Market EV Charging Card Forecasts to 2033

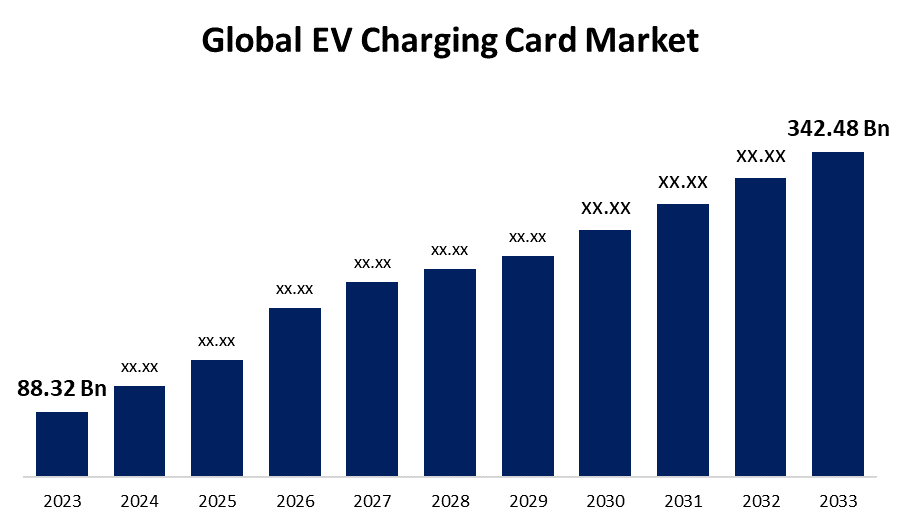

- The Global EV Charging Card Market Size was Valued at USD 88.32 Billion in 2023

- The Market Size is Growing at a CAGR of 14.51% from 2023 to 2033

- The Worldwide EV Charging Card Market Size is Expected to Reach USD 342.48 Billion by 2033

- Asia-Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The EV Charging Card Market Size is Anticipated to Exceed USD 342.48 Billion by 2033, Growing at a CAGR of 14.51% from 2023 to 2033.

EV CHARGING CARD MARKET REPORT OVERVIEW

A specific type of card that uses RFID (Radio-Frequency Identification) technology is an electric vehicle charging card. EV charge cards work similarly to conventional fuel cards for gasoline or diesel vehicles in that they allow drivers to charge their electric cars at participating stations without carrying cash or credit cards. The firms or organizations that oversee access to charging stations are usually the ones that issue EV charge cards. These cards are connected to the user's account, which is often created via the mobile app or website of the operator. The charge for using the EV charge card at a station is automatically charged to the driver's account. In general, drivers may find that charging their electric cars while traveling is more economical and easier with the use of gasoline cards for electric vehicles. Servotech Power Systems, the leading EV charger maker in India has won a sizable contract from the Kerala government's Department of Power, Agency for New and Renewable Energy Research and Technology (ANERT), to build 12 EV charging stations.

The top-rated EV charge cards available connect to a smartphone app so that drivers can locate the charging station and keep an eye on their charging progress. For instance, through the EV Connect app, drivers can quickly locate, access, and safely pay for EV charging using location-based services. The increasing demand for electric vehicles is expected to drive the use of EV charging cards, as would the need for effective and easy charging options. For instance, the Western Australian state electric vehicle strategy and its role in promoting EV adoption spending more than $200 million to help Western Australia's automobiles and buses become electrified.

Report Coverage

This research report categorizes the market for the global EV charging card market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global EV charging card market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global EV charging card market.

Global EV Charging Card Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023 : | USD 88.32 Billion |

| Forecast Period: | 2023 – 2033 |

| Forecast Period CAGR 2023 – 2033 : | 14.51% |

| 023 – 2033 Value Projection: | USD 342.48 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By EV Charging, By Application, By Region |

| Companies covered:: | Allstar, Paua Tech, MobilityPlus, Ecotricity, enodrive zen, Ecogears, VitaeMobility, UTA, Travelcard, Bluedot, ChargeLab, CarPlug, DCI Card, XXImo, UK Fuels, E-Flux, Octopus Energy, Shell Recharge, Zap-Map, Bonnet, Others |

| Pitfalls & Challenges: | Covid-19 Impact, Challenge, Future,Growth and Analysis |

Get more details on this report -

DRIVING FACTORS:

The market is expanding due to the rising number of electric automobiles and the development of EV charging infrastructure.

An increasing focus on green transportation is driving a revolutionary transition in the worldwide automobile industry toward electric vehicles. The unexpected increase in demand for electric vehicle charging stations and related services, such as charge cards is indicative of this change. The businesses are making strategic investments in the construction of more charging stations, and charging cards allow customers to easily access these locations. As a result, it is predicted that the market for EV charging cards could see growth throughout the projection period due to the rising number of electric cars and the development of EV charging infrastructure.

RESTRAINING FACTORS

The high initial cost of EV charging stations could restrict the market growth.

The significant initial expenses for installation and upkeep, protracted charging periods, and the enduring range anxiety problem might be restraining the market growth. It requires a significant financial commitment due to the accumulated costs of ongoing maintenance and operations. Its availability and accessibility may be restricted if small businesses are discouraged from setting up charging infrastructure due to the high expenses. Due to the technological difficulties involved, installing EV charging stations frequently calls for expert assistance. These are some of the barriers involved in restricting the growth of the market.

Market Segmentation

The EV charging card market share is classified into EV charging infrastructure and application.

The public charging station segment has the highest share of the market over the forecast period.

Based on EV charging infrastructure, the EV charging card market is classified into private charging stations, public charging stations, and others. Public charging stations are the most convenient and easy to access among consumers, hence the market share of public charging stations has increased tremendously. The interoperability of the infrastructure supporting public charging is becoming more and more important as the number of chargers increases. The US intends to adopt Tesla's J3400 charging connector as the industry standard throughout the continent. The goal is to make sure that any manufacturer or supplier can use and implement the connector, giving EV drivers in North America. The government's green EV initiatives in different regions have increased the market demand across the world. For instance, Karnataka leads the nation in the number of public electric vehicle (EV) charging stations, with 5,765, according to data recently released by the Union Ministry of Power's Bureau of Energy Efficiency. The rising infrastructure of shopping malls, hospitals, and other services would provide EV charging access to customers can enhance the market potential.

The commercial segment has the highest share of the market throughout the forecast period.

Based on the application, the EV charging card market is classified into household, commercial, and others. The possibility of electrifying commercial vehicles rises in proportion to the availability of infrastructure for charging that is appropriate for these vehicles' needs. Commercial electric cars can offer a new area of growth and investment by implementing V2G technology because of their large battery capacity. With V2G technology, a commercial vehicle can, under certain contracts, supply ancillary services to the electrical grid, such as frequency and voltage regulation. Commercial electric vehicle applications of V2G technology could have positive effects on the environment and the economy.

Regional Segment Analysis of the Global EV Charging Card Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America has the biggest share of the EV charging card market throughout the forecast period.

Get more details on this report -

The key factors such as the mass adoption of electric vehicles and infrastructure for charging stations must be strategically expanded market potential throughout the region. The pioneer in charging electric vehicles along with commercial items, Electrify America has the most public rapid charging stations in the United States. Public EV charging stations are already widely available in the US and Canada, including parks, community centers, and roadside places. This is a result of initiatives to increase EV owners' accessibility and convenience. The Canadian federal government initiative of Canada's zero-emission vehicle substructure program would support over 47,000 EV chargers around the country.

The Asia-Pacific is the fastest-growing region during the projected timeframe.

Asia-Pacific is generally considered as leading the way in terms of technological innovation, the automobile industry, and laws that encourage electric vehicles. The area is therefore making significant investments to provide the infrastructure required to charge electric vehicles. Assortment of strategies and programs are implemented by administrations around the region to encourage the extensive use of electric vehicles.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global EV charging card market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Allstar

- Paua Tech

- MobilityPlus

- Ecotricity

- enodrive zen

- Ecogears

- VitaeMobility

- UTA

- Travelcard

- Bluedot

- ChargeLab

- CarPlug

- DCI Card

- XXImo

- UK Fuels

- E-Flux

- Octopus Energy

- Shell Recharge

- Zap-Map

- Bonnet

- Others

Key Market Developments

- In November 2023, Osprey Charging announced a strategic partnership with Supermarket Income REIT, a real estate investment company. The collaboration intends to install fast charging stations for electric vehicles (EVs) throughout Supermarket Income REIT's network of supermarkets.

- In September 2023, the specialized electric vehicle (EV) division of Octopus Energy Group, Octopus Electric Vehicles, announced a partnership with Co Charger. Through this strategic alliance, the potential of community charging will be fully utilized, improving the overall appeal of electric vehicles to a wider range of consumers.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global EV charging card market based on the below-mentioned segments:

Global EV Charging Card Market, By EV Charging Infrastructure

- Private Charging

- Public Charging

- Others

Global EV Charging Card Market, By Application

- Household

- Commercial

- Others

Global EV charging Card Market, By Regional

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the global EV charging card market over the forecast period?The global EV charging card market size is expected to grow from USD 88.32 Billion in 2023 to USD 342.48 Billion by 2033, at a CAGR of 14.51% during the forecast period 2023-2033.

-

2. Which region is expected to hold the highest share in the global EV charging card market?North America is projected to hold the largest share of the global EV charging card market over the forecast period.

-

3. Who are the top key players in the EV charging card market?Allstar, Paua Tech, MobilityPlus, Ecotricity, enodrive zen, Ecogears, VitaeMobility, UTA, Travelcard, Bluedot, ChargeLab, CarPlug, DCI Card, XXImo, UK Fuels, E-Flux, Octopus Energy, Shell Recharge, Zap-Map, Bonnet, and Others.

Need help to buy this report?