Global Exhaust System Market Size, Share, and COVID-19 Impact Analysis, By Fuel Type (Diesel and Gasoline), By Vehicle Type (Commercial Vehicles and Passenger Cars), By Component (Exhaust Manifolds, Catalytic Converters, Mufflers, Exhaust Pipes, and Oxygen Sensors), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

Industry: Automotive & TransportationGlobal Exhaust System Market Insights Forecasts to 2033

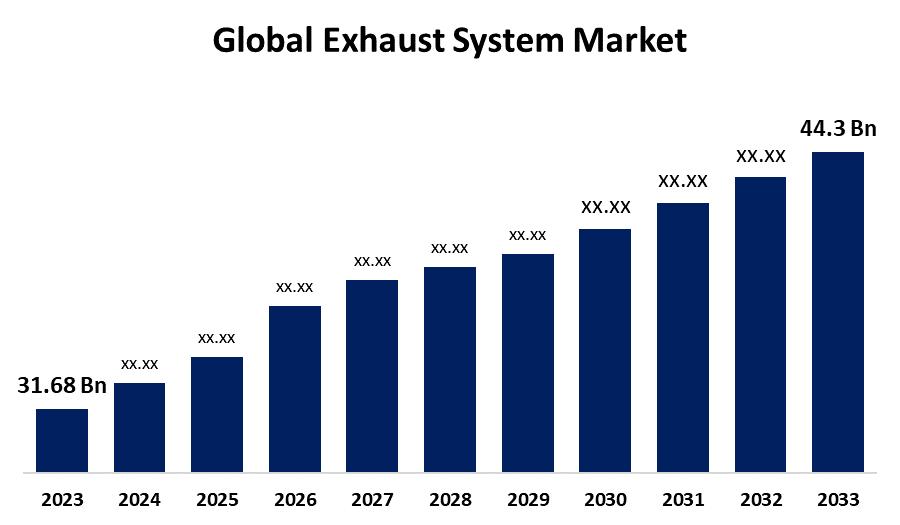

- The Global Exhaust System Market Size was Valued at USD 31.68 Billion in 2023

- The Market Size is Growing at a CAGR of 3.41% from 2023 to 2033

- The Worldwide Exhaust System Market Size is Expected to Reach USD 44.3 Billion by 2033

- Europe is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Exhaust System Market Size is Anticipated to Exceed USD 44.3 Billion by 2033, Growing at a CAGR of 3.41% from 2023 to 2033.

Market Overview

The vehicle's exhaust system collects exhaust gases from the cylinders, filters out impurities, lowers noise levels, and releases the cleaned exhaust gases at a safe distance from the occupants of the car. Depending on the engine, the exhaust system can have one or two channels. To minimize the impact of exhaust backpressure on engine performance, the flow resistance must be chosen carefully. The exhaust system needs to be constructed as a complete to ensure optimal performance. This implies that the design engineers must synchronize their parts according to the particular vehicle and engine.

For Instance, in November 2023, in Vietnam, a catalytic converter ensures a 90% reduction in carbon emissions by converting toxic factory exhaust gases into harmless components. Even though they are inevitable in industrial processes, exhaust gases are bad for the environment. An inexpensive catalytic converter that treats exhaust fumes and transforms them into innocuous components was created by a Vietnamese researcher.

As new trends and technology emerge to satisfy the demands of contemporary automobiles and environmental laws, the world of exhaust systems is always changing. By keeping up with these changes, one may make well-informed selections regarding automobiles, ensuring maximum efficiency, performance, and compliance with pollution regulations. As environmental concerns grow, the automotive industry is moving toward more environmentally friendly exhaust systems. These technologies are made to cut down on emissions, minimizing the impact that automobiles have on the environment and assisting drivers in meeting strict emission regulations.

Report Coverage

This research report categorizes the market for the exhaust system market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the exhaust system market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the exhaust system market.

Global Exhaust System Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 31.68 Billion |

| Forecast Period: | 2023-2033 |

| 2033 Value Projection: | USD 31.68 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 201 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Fuel Type, By Vehicle Type, By Component, By Region |

| Companies covered:: | BASF SE, Benteler International AG, Bosal International N.V., Continental AG, Faurecia S.A., Friedrich Boysen GmbH & Co. KG, Futaba Industrial Co. Ltd., Harbin Airui Automotive Exhaust Systems Co. Ltd., Johnson Matthey, Klarius Products Ltd, Sango Co., Sejong Industrial Co., Tenneco, Umicore, Yutaka Giken Company Limited, and Others |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

The exhaust system's function is to extract hot, burned gases from the diesel engine's combustion chambers and transport them to far-off locations where they will disperse into the atmosphere without endangering people or the environment. It is made up of an exhaust manifold, exhaust pipework, a muffler, and occasionally an expansion and vibration below. An isolated and specialized exhaust system is necessary for diesel engines. This keeps exhaust fumes from recirculating back to the driver air intake and other HVAC (heating, ventilation, and air conditioning) or prime mover air intakes, where they could harm people. Furthermore, it prevents adjacent combustible materials from igniting or interfering negatively with the operation of other surrounding equipment. Furthermore, the primary factor driving up demand worldwide is the fast-rising air pollution caused by the globalization of the automobile industry. The exhaust system business is being driven by the growing development of components including reduced NOx emission, diesel particle filters, and selective catalytic reduction.

For instance. In May 2022, Tokyo - Mitsui O.S.K. Lines, Ltd. announced that MOL has reached an agreement to finance Clean Air Engineering Maritime, Inc. (CAEM; head office: California, U.S.A.), a ship-auxiliary generator exhaust treatment company, to create a new generation marine exhaust treatment system that will be used on MOL-operating car carriers starting in 2025 to prevent air pollution in California, U.S.A.

Restraining Factors

The development and implementation of advanced emission control technologies, essential for meeting stringent environmental regulations, present a significant cost barrier in the exhaust system market. These sophisticated technologies, such as advanced catalytic converters and gasoline particulate filters, involve high material and production costs. the incorporation of precious metals in catalytic converters increases the financial burden on manufacturers and, subsequently, consumers. This high cost can restrain market growth by limiting market entry for new players and reducing consumer affordability, especially in cost-sensitive markets.

Market Segmentation

The exhaust system market share is classified into fuel type, vehicle type, and component.

- The gasoline segment is estimated to hold the highest market revenue share through the projected period.

Based on the fuel type, the exhaust system market is classified into diesel and gasoline. Among these, the gasoline segment is estimated to hold the highest market revenue share through the projected period. The purpose of the gasoline exhaust system is to lessen the quantity of nitrogen oxides that the engine produces as it operates, which typically leads to high combustion temperatures. When combustion temperatures approach the temperature of an adiabatic flame, NOx is produced in large quantities. By circulating tiny volumes of exhaust gases into the intake manifold, where they mix with the incoming air/fuel charge, the EGR system lowers the creation of NOx.

- The passenger car segment is anticipated to hold the largest market share through the forecast period.

Based on the vehicle type, the exhaust system market is divided into commercial vehicles and passenger cars. Among these, the passenger car segment is anticipated to hold the largest market share through the forecast period. It is anticipated that growing passenger car sales in developing nations will propel the market segment's expansion. Throughout the projected period, strong market growth is also anticipated in the light and heavy commercial vehicle sectors. Throughout the forecast period, the expansion of this market segment is anticipated to be driven by car manufacturers' advancements in diesel engine exhaust system technology to minimize fine particles and NOx emissions. As the market for cleaner and more efficient cars grows, automakers are concentrating on creating exhaust systems that meet the legal and regulatory requirements unique to their industry. Among them are the emission limits imposed by different governmental agencies and groups to minimize the number of dangerous pollutants discharged into the atmosphere. As a result, more sophisticated exhaust systems that both enhance vehicle performance and comply with stringent environmental requirements are becoming more and more prevalent in the market.

- The exhaust manifolds segment dominates the market with the largest market share through the forecast period.

Based on the components, the exhaust system market is categorized into exhaust manifolds, catalytic converters, mufflers, exhaust pipes, and oxygen sensors. Among these, the exhaust manifold segment dominates the market with the largest market share through the forecast period. An essential part of the engine system that is critical to maintaining the engine's effective operation is the automobile exhaust manifold. Its primary job is to collect and route exhaust gases that have been burned in the engine cylinders toward the exhaust pipe. The internal combustion chamber and the exhaust system are connected via pipes and tubes in this system.

Regional Segment Analysis of the Exhaust System Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the exhaust system market over the predicted timeframe.

Asia Pacific is anticipated to hold the largest share of the exhaust system market over the predicted timeframe. Growing urbanization, rising GDP, and rising personal disposable income are all contributing reasons to the market's expansion in this region. In addition, a lot of industries are choosing to set up production facilities in this area due to the cheaper labor and resource costs, which will probably accelerate the expansion of the market there. For instance, in January 2024, the renowned deep-drawing expert STUKEN plans to grow its global presence by opening a new facility in Pune, India. India becomes the company's sixth production base, joining its current facilities in Germany, the USA, the Czech Republic, and China. The family business is well-known throughout the world.

Europe is expected to grow at the fastest CAGR growth of the exhaust system market during the forecast period. Automotive manufacturers in this region are being compelled by strict government emission requirements to create advanced exhaust systems. The increasing utilization of low-emission cars in this region, as well as the presence of prominent key players in the region together with, is anticipated to propel the market's expansion in the vicinity. For instance, the 2024 Ford Mustang's New MagnaFlow Exhausts Will Produce Loud V8 Sounds MagnaFlow is a tuner that has lately released a wide range of exhaust options for the 2024 Ford Mustang. Few aftermarket experts make exhaust systems as ballistic as those from MagnaFlow. This exhaust system keeps the car's original exhaust value functionality while adding performance-chambered mufflers and resonators with an internal H-pipe design.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the exhaust system market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- BASF SE

- Benteler International AG

- Bosal International N.V.

- Continental AG

- Faurecia S.A.

- Friedrich Boysen GmbH & Co. KG

- Futaba Industrial Co. Ltd.

- Harbin Airui Automotive Exhaust Systems Co. Ltd.

- Johnson Matthey

- Klarius Products Ltd

- Sango Co.

- Sejong Industrial Co.

- Tenneco

- Umicore

- Yutaka Giken Company Limited

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In July 2024, Exhaust purification in the BMW Group's first paint facility is now electrically powered. Electricity can now be used to generate the high temperatures required for the thermal purification of exhaust from paint booths and drying areas, thanks to a novel technique. This allows for the continuation of manufacturing without the need for natural gas.

- In September 2023, Sawicki Speed introduced the Indian Challenger and Pursuit's new exhaust system. When considering only functionality, the Sawicki Full-Length exhaust system weighs up to 10.4 kg less than the original setup. Furthermore, the firm promises a power increase of 8 horsepower and 13.5 Nm of torque.

- In July 2023, one of the first to introduce an improved high-performance exhaust system for BMW's thrilling M2 Coupé, Milltek Sport, a UK-based company that leads the world in producing performance exhaust systems for an ever-expanding range of vehicles, has unlocked even more potential from the new baby M car.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the exhaust system market based on the below-mentioned segments:

Global Exhaust System Market, By Fuel Type

- Diesel

- Gasoline

Global Exhaust System Market, By Vehicle Type

- Commercial Vehicles

- Passenger Cars

Global Exhaust System Market, By Component

- Exhaust Manifolds

- Catalytic Converters

- Mufflers

- Exhaust Pipes

- Oxygen Sensors

Global Exhaust System Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Need help to buy this report?