Global Exterior Insulation and Finish System (EIFS) Market Size, Share, and COVID-19 Impact Analysis, By Insulation Type (Polymer-based (PB) and Polymer-modified (PM)), By Insulation material (EPS, MW, Others), By Application (Non-residential and Residential), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 - 2032

Industry: Construction & ManufacturingGlobal Exterior Insulation and Finish System (EIFS) Market Insights Forecasts to 2032

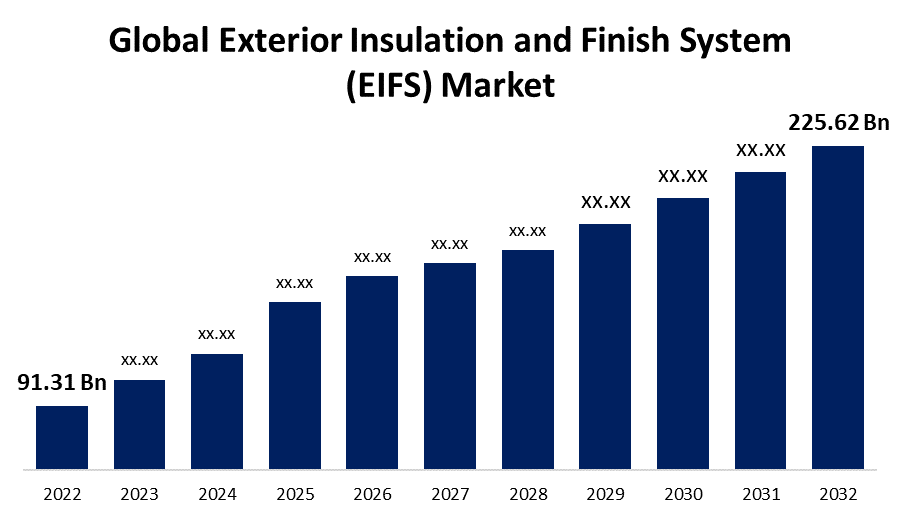

- The Global Exterior Insulation and Finish System (EIFS) Market Size was valued at USD 91.31 Billion in 2022.

- The Market is growing at a CAGR of 9.47% from 2022 to 2032

- The Worldwide Exterior Insulation and Finish System (EIFS) Market Size is expected to reach USD 225.62 Billion by 2032

- Europe is expected to grow the fastest during the forecast period

Get more details on this report -

The Global Exterior Insulation and Finish System (EIFS) Market Size is expected to reach USD 225.62 Billion by 2032, at a CAGR of 9.47% during the forecast period 2022 to 2032.

The Exterior Insulation Finishing System (EIFS), also referred to as External Thermal Insulation Composite Systems (ETICS), is a form of cladding system that delivers an insulated finished surface and waterproofing in an interwoven composite materials system to the exterior walls. EIFS is now one of the most widely utilized exterior finishes in the construction industry. It is designed to provide continual insulation, giving architects the design latitude and aesthetics, they seek while also helping to fulfill the new energy requirements. The polymer-based (PB) system has become the most popular type of exterior insulation finishing system. The appealing characteristics of EIFS emerge due to its insulating properties, which minimize heat loads on the outer building wall, as well as its lightweight, inexpensive price and ability to be molded into forms and designs to achieve various aesthetically pleasing outcomes.

The growing popularity of exterior insulation finishing systems can be attributed to the perception that few, or they exist, competing materials provide such a diverse variety of desirable product features. Superior energy efficiency and practically limitless design flexibility are two of the most important features. EIFS finish coatings are available in a wide range of textures and colors similar to stucco. Because the base coats are thin, especially in PB systems, they are vulnerable to impact damage.

The major key players in the Global Exterior Insulation Finishing System (EIFS) Market include Wacker Chemie AG, BASF SE, Saint-Gobain, Owen Corning, Dryvit Systems, Terraco Group, Master Wall, Parex USA, Rmax, and Durabond Products Limited. Some of the major approaches implemented by these key companies to strengthen their positions in the external insulation and finish system market include several new product launches. Furthermore, to increase their market position and gain a wide client base, market players are spending on R&D and implementing strategic growth initiatives such as expansion, product launches, agreements, partnerships, acquisitions, and mergers.

For instance, On February 2023, Trinseo, a developer of specialty material solutions, announced the North American introduction of LIGOSTM C 9375, the Company's first all-acrylic latex binder for Building and Construction applications. C 9375's performance benefits set a new standard for high alkaline applications, delivering superior strength, weather ability, and workability. It is specifically intended for cementitious applications in the Building and Construction sector. Hydraulic cement mixes, exterior insulation and finishing systems (EIFS), cementitious repair, ornamental overlays, tile grout, and sprayable and patching mortars/stuccos are also feasible choices.

Global Exterior Insulation and Finish System (EIFS) Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 91.31 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 9.47% |

| 2032 Value Projection: | USD 225.62 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 215 |

| Tables, Charts & Figures: | 130 |

| Segments covered: | By Insulation Type, By Insulation material, By Application, By Region, and COVID-19 Impact Analysis |

| Companies covered:: | Dryvit Systems, STO Corp., BASF Wall Systems, Master Wall, Parex, Wacker Chemie AG, Saint-Gobain, Owen Corning, Terraco Group, Rmax, Durabond Products Limited, Adex Systems, Sika Ag, Virginia Stucco Co, Shingobee Builders Inc., Knauf Insulation GmbH, Omega Products International, DurockAlfacing International Limited. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growing construction sector and infrastructure investment are major drivers of the worldwide and regional exterior insulation finishing system market. Major construction and infrastructure spending are likely to increase dramatically during the coming decade. The rapid growth of urbanization in emerging nations like China, India, Brazil, Malaysia, and Southeast Asia drives up investment in critical infrastructure sectors including the hospitality industry, healthcare, the retail industry, and transportation. The exterior insulation finishing system market is predicted to be driven by rising wealth in these growing regions. The expansion in the overall number of building regulatory standards, as well as the rise in population and per capita income, are predicted to promote the growth of the EIFS market.

Furthermore, the increased emphasis on greenhouse gas reduction has resulted in the rise of the EIFS market throughout the projection period. likewise, the construction industry's emphasis on environmentally friendly alternatives is a driving force in the exterior insulation finishing system market. Additionally, continual increases in government expenditures for residential and non-residential development are important potential for EIFS market expansion. Moreover, a boost of preference for energy-efficient insulation in the residential and non-residential construction industries, as well as an expansion in the introduction of green building standards and reimbursements and tax credit programs for EIFS, is another key opportunity for the exterior insulation finishing system market. Major construction and infrastructure spending are likely to increase dramatically in market expansion over the projection period. In addition, the authorities have stated their intention to implement various energy efficiency criteria for new homes and buildings, including insulation systems. All of these activities present opportunities for the global exterior insulation and finish system market.

Restraining Factors

Exterior insulation and finish systems use traditional components such as stone wool, glass fiber, and plastic foam, among others. Furthermore, Hemp Crete, a green insulation material comprised of hemp fibers and a cement-like binder, has grown available. This is the primary impediment to the expansion of the EIFS market.

Furthermore, a lack of knowledge about exterior insulation and finish systems is a key barrier for the market. Furthermore, increasing costs of materials owing to shifts in supply and demand, as well as production costs, are among the primary variables influencing worldwide external insulation and finish system sales. The increasing competition among companies in the sector as a result of the huge number of regional and international manufacturers is also a major impediment to the industry's growth.

Market Segmentation

By Insulation Type Insights

The polymer-based (PB) segment is dominating the market with the largest revenue share over the forecast period.

On the basis of insulation type, the global exterior insulation and finish system (EIFS) market is segmented into the polymer-based (PB) and polymer-modified (PM). Among these, the polymer-based (PB) segment is dominating the market with the largest revenue share of 57.3% over the forecast period. The market for external insulation has increased over the past decade due to its qualities such as ease of installation, affordable prices, and the resilience to humidity and heat of polymer-based insulation. Polymer-based materials are typically composed of closed-expanded polystyrene (EPS) and can either be manually or adhesively attached to the protective coating. To achieve stronger impact resistance, the PB External Insulation and Finish System might contain numerous layers of base coat and reinforcing mesh.

By Insulation Material Insights

The EPS segment is witnessing significant CAGR growth over the forecast period.

On the basis of insulation material, the global exterior insulation and finish system (EIFS) market is segmented into EPS, MW, and others. Among these, the EPS segment is witnessing significant CAGR growth over the forecast period. This expansion is likely due to EPS's low cost, durability, water resistance, superior thermal insulation, minimal upkeep, and dependability. Because of its tightly packed cell structure, which contains over 98% air, EPS has exceptionally high thermal insulation. It is also non-hygroscopic, meaning it does not readily absorb moisture from the surrounding environment. Exterior insulation and finish systems utilizing EPS insulating material are most commonly used in North America and Europe.

By Application Insights

The non-residential segment accounted for the largest revenue share of more than 57.2% over the forecast period.

On the basis of application, the global exterior insulation and finish system (EIFS) market is segmented into non-residential and residential. Among these, the non-residential segment is dominating the market with the largest revenue share of 57.2% over the forecast period. EIFS is commonly used in non-residential buildings such as schools, hospitals, industrial work spaces, and offices. Increasing government concerns and greater investment in commercial and institutional development have also boosted the non-residential market for exterior insulation and finish systems. Housing repair and remodeling activities, rising green building standards, and an increasing emphasis on energy-efficient buildings in developed nations are driving the growth of the non-residential exterior insulation and finish system market. Furthermore, the current trend illustrates that the market share of exterior insulation and finish system in the non-residential construction industry has significantly increased in recent years and is anticipated to increase further in the coming years.

Regional Insights

North America dominates the market with the largest market share over the forecast period.

Get more details on this report -

North America is dominating the market with more than 43.7% market share over the forecast period. Exterior insulation and finish system (EIFS) mouldings, also known as stucco mouldings, are available in a wide range of shapes and sizes. They are commonly utilized in residential and commercial constructions in North America and are gaining favor globally. EIFS accounts for roughly 10% of the commercial wall cladding market in the United States. In North America, there are over a hundred EIFS manufacturers. Some companies operate nationwide, while others operate on a localized scale. The various system components (adhesives, coatings, etc.) are sold by EIFS manufacturers to specialty building supply distributors, who then resell the components to local EIFS installers. The top five EIFS manufacturers account for over 90% of the United States marketplace. Dryvit Systems, STO Corp., BASF Wall Systems, Master Wall, and Parex are among these manufacturers. Furthermore, growing population density, shifting consumer preferences, and high monetary resources are pushing the region's exterior insulation and finish system market.

Europe, on the contrary, is expected to grow the fastest during the forecast period. The growing market demand, broad market extent, and government support have prompted numerous corporations, individuals, and independent government entities to spend extensively on thermal insulation R&D. Furthermore, market expansion throughout Europe can be attributable to a renewed emphasis on energy-efficient buildings, increasing construction activity, and external insulation and finish system standards.

The Asia Pacific market is expected to register a substantial CAGR growth rate during the forecast period. This expansion can be ascribed to rapid growth in urbanization, increased construction activity, and a growing awareness of the importance of energy efficiency. The developing nations in the region, such as China and India, are experiencing a rise in infrastructural growth and development projects, fuelling demand for exterior insulation and finish system market.

List of Key Market Players

- Dryvit Systems

- STO Corp.

- BASF Wall Systems

- Master Wall

- Parex

- Wacker Chemie AG

- Saint-Gobain

- Owen Corning

- Terraco Group

- Rmax

- Durabond Products Limited

- Adex Systems

- Sika Ag

- Virginia Stucco Co

- Shingobee Builders Inc.

- Knauf Insulation GmbH

- Omega Products International

- DurockAlfacing International Limited

Key Market Developments

- On January 2023, The EIFS Industry Members Association (EIMA) announced that ADEX Systems has joined the association as a manufacturer member. ADEX Systems has been a leading Canadian manufacturer of quality architectural coatings and EIFS for over 30 years. The company's innovation and expertise within the EIFS industry - combined with its focus on customer service - have been ideally suited to address the demands of the design community and building professionals in Canada.

- On March 2023, Wacker Chemie AG displayed three new polymeric binders at the European Coatings Show in Nuremberg, Germany; the binders are designed to be used in the production of tile adhesives and mortars for exterior insulation and finish systems (EIFS). When added to dry-mix mortars, the VINNAPAS 4419 E, VINNAPAS 8819 E, and VINNAPAS 4449 E produce an extraordinarily creamy consistency, making the end product easier for customers to process. They also improve wetness and slide resistance.

- On January 2022, Natural Polymers, LLC, a Cortland, Illinois-based maker of spray polyurethane foam insulation for building and construction applications, was bought by Owens Corning. Natural's tried-and-true technology will enable the company to provide clients with a varied range of insulating products as well as long-term, sustainable solutions.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2032. Spherical Insights has segmented the Global Exterior Insulation and Finish System (EIFS) Market based on the below-mentioned segments:

Exterior Insulation and Finish System (EIFS) Market, Insulation Type Analysis

- Polymer-based (PB)

- Polymer-modified (PM)

Exterior Insulation and Finish System (EIFS) Market, Insulation Material Analysis

- EPS

- MW

- Others

Exterior Insulation and Finish System (EIFS) Market, By Component Analysis

- Adhesives

- Insulation boards

- Base coats

- Reinforcement mesh

Exterior Insulation and Finish System (EIFS) Market, By Thickness Analysis

- 1-2 inches

- 3-6 inches

- More than 6 inches

Exterior Insulation and Finish System (EIFS) Market, Application Analysis

- Non-residential

- Residential

Exterior Insulation and Finish System (EIFS) Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Frequently Asked Questions (FAQ)

-

What is the market size of the Exterior Insulation and Finish System (EIFS) market?The Global Exterior Insulation and Finish System (EIFS) Market is expected to grow from USD 91.31 billion in 2022 to USD 225.62 billion by 2032, at a CAGR of 9.47% during the forecast period 2022-2032.

-

Which are the key companies in the market?Dryvit Systems, STO Corp., BASF Wall Systems, Master Wall, Parex, Wacker Chemie AG, Saint-Gobain, Owen Corning, Terraco Group, Rmax, Durabond Products Limited, Adex Systems, Sika Ag, Virginia Stucco Co, and Shingobee Builders Inc.

-

Which segment dominated the Exterior Insulation and Finish System (EIFS) market share?The non-residential segment in application type dominated the Exterior Insulation and Finish System (EIFS) market in 2022 and accounted for a revenue share of over 57.2%.

-

What are the elements driving the growth of the Exterior Insulation and Finish System (EIFS) market?The increased investments in the construction industry and tight laws to reduce greenhouse gas emissions are the primary drivers affecting the growth of the Exterior insulation and finish system market.

-

Which region is dominating the Exterior Insulation and Finish System (EIFS) market?North America is dominating the Exterior Insulation and Finish System (EIFS) market with more than 43.7% market share.

-

Which segment holds the largest market share of the Exterior Insulation and Finish System (EIFS) market?The polymer-based (PB) segment based on type holds the maximum market share of the Exterior Insulation and Finish System (EIFS) market.

Need help to buy this report?