Global Farm Equipment Rental Market Size, Share, and COVID-19 Impact Analysis, By Equipment Type (Tractors, Harvesters, Sprayers, Balers, and Other Equipment), By Power Output (<30HP, 31-70HP, 71-130HP, 131-250HP, and >250HP), By Drive (Two-wheel Drive and Four-wheel Drive), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

Industry: AgricultureGlobal Farm Equipment Rental Market Insights Forecasts to 2033

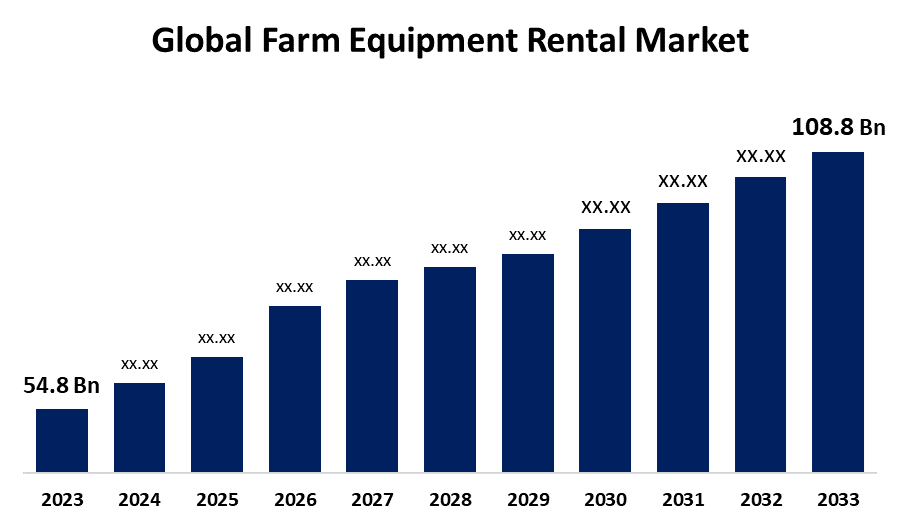

- The Global Farm Equipment Rental Market Size was Valued at USD 54.8 Billion in 2023

- The Market Size is Growing at a CAGR of 7.10% from 2023 to 2033

- The Worldwide Farm Equipment Rental Market Size is Expected to Reach USD 108.8 Billion by 2033

- North America is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Farm Equipment Rental Market Size is Anticipated to Exceed USD 108.8 Billion by 2033, Growing at a CAGR of 7.10% from 2023 to 2033.

Market Overview

The renting of equipment and machinery for agriculture to farmers and agricultural enterprises temporarily is included in the farm equipment rental market. This covers a broad variety of equipment, including cultivators, sprayers, tractors, harvesters, and plows. These rental services address the changing needs of farmers who are looking for affordable ways to minimize the financial burden of equipment ownership, maximize operational efficiency, and satisfy seasonal demand. Farming machinery rental is a service offered by manufacturers and other agricultural equipment firms. The rental service rents out farm equipment such as tractors, harvesters, balers, and sprayers to farmers. Most companies in the market provide equipment on an hourly, weekly, or monthly basis to meet the needs of farmers. Farm equipment rental services have contributed to the rise of small and medium-sized farmers, increasing worldwide agricultural productivity. It extensively minimizes the upfront expenditures of purchasing agricultural machines. Flexibility is provided by renting. Farmers can change the type and amount of equipment according to their changing needs, seasons, or specific jobs. Rental agreements frequently include maintenance services, which reduces the load on farmers to maintain and repair machines. Having the appropriate equipment available when needed increases agricultural profitability and production. Furthermore, renting enables farmers to test new technologies and equipment before making long-term commitments, reducing the risks associated with investing in unfamiliar apparatus.

Report Coverage

This research report categorizes the market for the global farm equipment rental market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global farm equipment rental market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global farm equipment rental market. The government imposes strict rules and restrictions on the application of chemical pesticides which is the key factor for raising the use of farm equipment rentals.

Global Farm Equipment Rental Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 54.8 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 7.10% |

| 2033 Value Projection: | USD 108.8 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Equipment Type, By Power Output, By Drive, By Region |

| Companies covered:: | Deere And Company, AGCO Corporation, Escorts Kubota Limited, Tractors and Farm Equipment Limited, CNH Industrial NV, Kubota Corporation, Mahindra And Mahindra Limited, J.C. Bamford Excavators Limited, Messick Farm Equipment Inc., Pacific Tractor & Implement LLC, Premier Equipment Rentals Inc., Papé Group Inc., JFarm Services (TAFE), Flaman Group of Companies, and other key vendors |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The monetary benefits of renting rather than purchasing outright address the financial issues that farmers, particularly small farmers, experience. Farmers can get crucial machinery without suffering significant upfront costs, allowing them to better manage their cash among different enterprises. Furthermore, the flexibility and adaptability provided by leasing services address the dynamic character of farming. Furthermore, the emphasis on sustainability and environmental issues in modern agriculture highlights the value of equipment sharing through leasing services. Renting helps to reduce the amount of machinery in use and promotes resource conservation, which helps to reduce farming's environmental effects. Renting farm equipment also helps farmers gain market access and reduce risk. Additionally, renting allows farmers to try new equipment or practices before making long-term expenditures. Farmers struggle to commit to long-term financial goals due to fluctuating commodity prices and volatile market conditions. Renting farm equipment is a more flexible and scalable approach that helps farmers adjust their operations in response to market conditions.

Restraining Factors

Concerns about equipment efficiency and dependability stem from variations in the quality of rental machinery, which are influenced by factors such as age, usage history, and rental organizations' maintenance policies. Events of failures or malfunctions brought on by poor maintenance can cause farm activities to be disrupted and rental service trust to be undermined. Furthermore, rental costs continue to be a significant burden for farmers, particularly during peak seasons or when many pieces of equipment are needed at the same time. Farmers have budgeting issues due to fluctuations in rental costs, which are influenced by equipment type, duration, and operational expenses.

Market Segmentation

The global farm equipment rental market share is classified into equipment type, power output, and drive.

- The harvesters segment is expected to grow at the highest CAGR in the global farm equipment rental market during the forecast period.

Based on the equipment type, the global farm equipment rental market is divided into tractors, harvesters, sprayers, balers, and other equipment. Among these, the harvesters segment is expected to grow at the highest CAGR in the global farm equipment rental market during the forecast period. The harvesters are adaptable, self-propelled equipment that can harvest a variety of grain crops efficiently. Reaping, threshing, and winnowing are three distinct harvesting procedures that are merged into a single process utilizing a harvester. Thus, the primary causes of the rise in demand for harvesters in the market for farm equipment rental are high labor prices and a shortage of workers in the harvesting category.

- The 71-130 HP segment is expected to hold the largest share of the global farm equipment rental market during the forecast period.

Based on the power output, the global farm equipment rental market is divided into <30HP, 31-70HP, 71-130HP, 131-250HP, and >250HP. Among these, the 71-130 HP segment is expected to hold the largest share of the global farm equipment rental market during the forecast period. There are few 2WD tractor models in this class, but 4WD tractors make up the majority of the 71–130 HP range. The need for these tractors is rising as nations in the Asia Pacific area work to boost the rates of agriculture mechanization. Due to reasons including high consumption rates, increased food production requirements, higher power requirements in farms, and huge sizes of agricultural holdings, there is a stronger demand for these tractors from industrialized nations.

- The four-wheel-drive segment is expected to hold the highest share of the global farm equipment rental market during the forecast period.

Based on the drive, the global farm equipment rental market is divided into two-wheel drive and four-wheel drive. Among these, the four-wheel-drive segment is expected to hold the highest share of the global farm equipment rental market during the forecast period. Four-wheel-drive tractors are heavy-duty vehicles used mostly in large-scale commercial farming operations spanning 100-2,000 hectares. They feature a high pulling capability, as well as high wheel slip and power capacities.

Regional Segment Analysis of the Global Farm Equipment Rental Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the global farm equipment rental market over the predicted timeframe.

Get more details on this report -

Asia Pacific is anticipated to hold the largest share of the global farm equipment rental market over the predicted timeframe. Farmers in the Asia Pacific region are increasingly growing rice and other crops including palm and cotton. Furthermore, a shift from labor-intensive farming techniques to modern technological equipment in the agricultural sector across Asia Pacific countries has increased demand for tractor rentals as well as other farming equipment such as harvesters, sprayers, and threshing equipment. Investments in diverse agricultural gear have also resulted in higher crop production, notably in developing countries including India, China, Vietnam, and Thailand. Growing knowledge among Asia-Pacific region's mid- and low-income farmers about the advantages of farm mechanization has prompted them to transition from labor-intensive farming techniques to modern technology equipment in the agricultural sector. In the area, there is going to be a rise in demand for tractors and agricultural equipment rentals, including harvesting, spraying, and threshing tools.

North America is expected to grow at the fastest pace in the global farm equipment rental market during the forecast period. Due to increasing technical breakthroughs and the application of various cutting-edge technologies. The introduction of automation in the farming and agriculture industries is reshaping the industry, prompting corporations to spend extensively in it. For instance, in December 2021, GUSS Automation, a US-based manufacturer of mobile autonomous spraying robots for the agricultural industry, introduced a small autonomous sprayer designed to apply agricultural pesticides to crops on its own. Similarly, several other regional players are focused heavily on agricultural autonomy. As a result, the area's autonomous farming is bringing in a new era of agriculture and boosting market sales.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global farm equipment rental market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Deere And Company

- AGCO Corporation

- Escorts Kubota Limited

- Tractors and Farm Equipment Limited

- CNH Industrial NV

- Kubota Corporation

- Mahindra And Mahindra Limited

- J.C. Bamford Excavators Limited

- Messick Farm Equipment Inc.

- Pacific Tractor & Implement LLC

- Premier Equipment Rentals Inc.

- Papé Group Inc.

- JFarm Services (TAFE)

- Flaman Group of Companies

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In May 2023, CNH Industrial signed a contract to include One Smart Spray's spraying system into its line of agricultural equipment. The Raven Industries team will handle the commercial integration of this system onto Case IH and New Holland agricultural machines. This partnership will accelerate the improvement of the equipment's precision and automated spraying capabilities.

- In October 2021, to assist small farmers in India, Tractors and Farm Equipment Limited (TAFE) introduced a free tractor rental program. Between May and July 2021, the program would cover approximately 1,20,000 acres and benefit roughly 50,000 farmers.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global farm equipment rental market based on the below-mentioned segments:

Global Farm Equipment Rental Market, By Equipment Type

- Tractors

- Harvesters

- Sprayers

- Balers

- Other Equipment

Global Farm Equipment Rental Market, By Power Output

- <30HP

- 31-70HP

- 71-130HP

- 131-250HP

- >250HP

Global Farm Equipment Rental Market, By Drive

- Two-wheel Drive

- Four-wheel Drive

Global Farm Equipment Rental Market, By Regional

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Need help to buy this report?