Global Farm Management Software Market Size, Share, and COVID-19 Impact Analysis, By Application (Precision Farming, Livestock, Aquaculture, Forestry, and Smart Greenhouses), By Offering (On-cloud, On-premise, Data Analytics Services), By Farm Size (Small, Medium, and Large), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 - 2032

Industry: AgricultureGlobal Farm Management Software Market Insights Forecasts to 2032

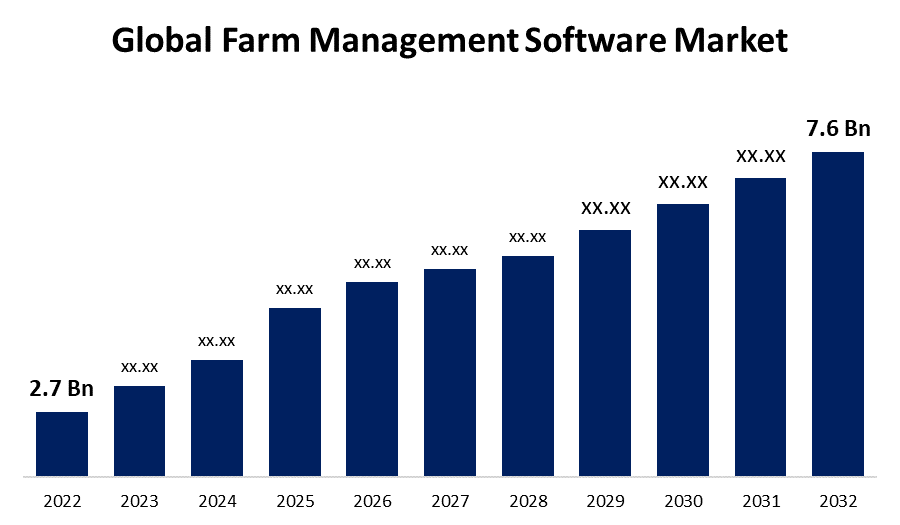

- The Global Farm Management Software Market Size was valued at USD 2.7 Billion in 2022.

- The Market is Growing at a CAGR of 10.9% from 2022 to 2032

- The Worldwide Farm Management Software Market Size is expected to reach USD 7.6 Billion by 2032

- Europe is expected to Grow the fastest during the forecast period

Get more details on this report -

The Global Farm Management Software Market is projected to exceed USD 7.6 Billion by 2032, Growing at a CAGR of 10.9% from 2022 to 2032. The increasing farming operations and the increasing requirement for real-time data for decision-making are fueling the growth of the farm management software market. Precision farming, livestock monitoring, precision aquaculture, smart greenhouse, vertical, as well as indoor farming practises all use artificial intelligence and machine learning. Rapid growth in urbanisation and rising population, combined with water scarcity issues and rising climate change, are driving factors in this market.

Market Overview

The farm management software market is a growing sector within the agriculture industry. Farm management software is a type of computer program that helps farmers manage and track their farming operations. This can include tracking inventory, managing crop yields, monitoring soil conditions, and predicting weather patterns. The market for farm management software is being driven by a number of factors, including the increasing demand for food production, the need for efficient farm management practices, and the growing adoption of precision agriculture techniques. In addition, the rise of IoT (Internet of Things) technologies is enabling farmers to collect and analyze data from their farms in real-time, which is driving demand for more advanced farm management software solutions.

Key players in the farm management software market include AgJunction, AgriSight, Deere & Company, Granular, and Trimble Inc. These companies are focusing on product innovation, strategic partnerships, and acquisitions to gain a competitive advantage in the market. For instance, AGRIVI partnered with Agrowex in January 2023 to provide premium digital agriculture solutions to South African countries. AGRIVI's digital agriculture solutions, combined with AGROWEX's knowledge and presence, are projected to fuel the digital agriculture transformation in countries such as Mozambique, Botswana, South Africa, Namibia, Lesotho, Angola, Zambia, Malawi, Swaziland, and Zimbabwe.

In Addition, governments are also taking steps to encourage the use of modern agricultural technologies. For example, the UK Department for Environment, Food and Rural Affairs (Defra) and UK Research and Innovation collaborated in October 2021 to launch a funding programme aimed at driving the implementation of novel technologies in the farming industry in order to improve farmer profitability.

The farm management software market is expected to continue growing in the coming years, as farmers seek to improve their efficiency and productivity through the use of advanced technologies.

Report Coverage

This research report categorizes the market for the global farm management software market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the farm management software market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the farm management software market.

Global Farm Management Software Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 2.7 Bn |

| Forecast Period: | 2022 – 2032 |

| Forecast Period CAGR 2022 – 2032 : | 10.9% |

| 022 – 2032 Value Projection: | USD 7.6 Bn |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 105 |

| Segments covered: | By Application, By Offering, By Farm Size and By Region. |

| Companies covered:: | Trimble Inc, Deere & Company., Aker Solutions, Reed Business Information Ltd, Farmers Edge Inc, AgJunction, AgriData Incorporated., DICKEY-john., AGRIVI, Raven Industries, AgEagle Aerial Systems Inc., The Climate Corporation, Granular Inc, Topcon, Relex Group, Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

As the world's population continues to grow, the demand for food is increasing rapidly. This is driving farmers to adopt new technologies that can help them increase their crop yields and efficiency. Precision agriculture is a farming technique that uses technology to optimize crop yields and reduce waste. Farm management software is a key component of precision agriculture, as it provides farmers with the data, they need to make informed decisions about planting, fertilizing, and harvesting crops. As farms become larger and more complex, there is a greater need for efficient management practices. Farm management software helps farmers manage their operations more effectively, by providing real-time data on crop yields, soil conditions, weather patterns, and other important factors.

The Internet of Things (IoT) is a network of devices that are connected to the internet and can communicate with each other. IoT technologies are being used in agriculture to collect data from sensors and other devices on the farm. Farm management software helps farmers analyze this data and use it to make better decisions. Governments around the world are providing support for the adoption of advanced farming technologies, including farm management software. This support includes funding for research and development, as well as incentives for farmers to adopt new technologies. These are the primary drivers expected to drive the farm management software market during the forecast period.

Restraining Factors

Farm management solutions, according to the majority of farmers, are not cost-effective, and the costs for hardware, software, and integration services are prohibitively expensive. GPS-enabled devices for navigation and mapping applications are expensive, and integrating guidance and sensing devices with farm management software and databases necessitates significant upfront investment. Because farmlands are fragmented and the number of marginal farmers is high in developing countries such as China, Japan, and India, the impact of this restraining factor is significant. Farmers must pay an additional fee for the integration of software with hardware devices, as well as for additional consultation, in order to use these software solutions, which are complex to use. The expense of farm management devices and software is thus projected to limit the expansion of the farm management software market.

Market Segmentation

The Global Farm Management Software Market share is classified into application, offering, and farm size.

- The precision farming segment is expected to dominate the global farm management software market over the forecast period.

The global farm management software market is classified into precision farming, livestock, aquaculture, forestry, and smart greenhouses. Over the forecast period, the precision farming segment is projected to dominate the global farm management software market. The reason for the increase relates to rising food demand due to the rapid increase in population has led many farmers to turn to farm management software and other precision farming techniques. This segment includes software used to manage precision farming practices such as soil mapping, yield monitoring, crop scouting, variable rate application, and irrigation management. This segment is expected to grow at a significant rate due to the increasing demand for high crop yields and efficient resource management.

- The On-cloud segment is expected to hold the largest share of the global farm management software market during the predicted period.

The global farm management software market is divided into three segments based on their offerings: on-cloud, on-premise, and data analytics services. Among these, the On-cloud segment is expected to hold the largest share of the global farm management software market during the predicted period. The growth in the On-Cloud segment can be attributed to the advantages of cloud deployment such as scalability, cost-effectiveness, and ease of access. This segment includes farm management software that is deployed and hosted on cloud servers. The software can be accessed from anywhere with an internet connection and is maintained by the software provider. This segment is expected to grow due to the increasing demand for remote access and scalability.

- The medium size farms segment is expected to hold the largest share of the global farm management software market over the study period.

Based on the farm size, the global farm management software market is segmented into small, medium, and large. Among these, the medium size farms segment is expected to hold the largest share of the global farm management software market over the study period. The growth in the Medium Size Farms segment can be attributed to the increasing adoption of farm management software among small and mid-sized farmers who are looking to improve their productivity and profitability.

Regional Segment Analysis of the Global Farm Management Software Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

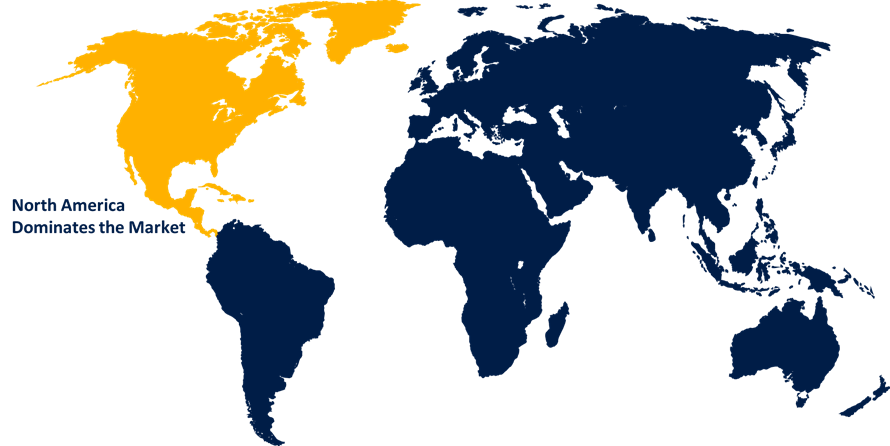

North America is estimated to hold the largest share of the global farm management software market during the predicted timeframe.

Get more details on this report -

The North America is anticipated to hold the largest share of the global farm management software market during the forecast timeframe. The growth in these regions can be attributed to the increasing demand for precision farming practices and the need for sustainable agriculture practices. Region includes the United States and Canada, and it is one of the leading regions in terms of the adoption of advanced technologies in agriculture. The growth in the North American region can be attributed to the increasing demand for precision farming and sustainable agriculture practices.

Europe is expected to grow at the fastest rate in the global farm management software market during the period of study. The growth in the European region can be attributed to the increasing demand for efficient resource management and compliance with environmental regulations. The European Union (EU) has set ambitious targets to reduce greenhouse gas emissions, increase renewable energy, and promote sustainable agriculture practices. This has resulted in the adoption of precision farming practices, which require the use of advanced farm management software. The EU has also provided funding for research and development in precision agriculture, which has boosted the growth of the farm management software market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global farm management software ingredients along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Trimble Inc

- Deere & Company.

- Aker Solutions

- Reed Business Information Ltd

- Farmers Edge Inc

- AgJunction

- AgriData Incorporated.

- DICKEY-john.

- AGRIVI

- Raven Industries

- AgEagle Aerial Systems Inc.

- The Climate Corporation

- Granular Inc

- Topcon

- Relex Group

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In January 2023, Cropin, an agtech company best known for developing the first agricultural industry cloud, has announced that its farm digitization software, Cropin Grow, is now available on the Amazon Web Services (AWS) Marketplace. Cropin Grow intends to use technology to address real-world agricultural issues such as connectivity, climate change, supply chain disruptions, food waste, and food security. Cropin Grow empowers industry stakeholders to manage risks, increase productivity, maximise revenue and profit, and optimise resources by making every farm asset traceable, predictable, and sustainable. This platform is used by businesses, governments, and development organisations to provide value to all stakeholders in the food value chain.

- In March 2023, Bushel Farm, the next generation in farm management software for farmers and their agribusiness partners, has been launched by Bushel Inc., an independently owned software company. The new offering relieves farmers of the burden of manual data entry while also providing valuable grain marketing insights. Bushel Farm, which is based on the company's FarmLogs solution, provides a robust feature set in both mobile and desktop experiences while maintaining an easy-to-use design.

- In December 2022, AKVA Fusion targets to connect all aspects of the sector, both new and old, and to establish an entirely novel standard for cross-platform communication, control, and data collection. The AKVA ecosystem enables a set of APIs that enable seamless integration across industry solutions via AKVA Fusion. The APIs allow AKVA Fishtalk and 4th generation AKVA link to be integrated with other digital solutions.

- In November 2022, AGRIVI introduced Field Ops, a new module designed to provide a comprehensive overview of a farmer's fields, including growth, nutrition, yield, and harvest.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2032. Spherical Insights has segmented the Global Farm Management Software Market based on the below-mentioned segments:

Global Farm Management Software Market, By Application

- Precision Farming

- Livestock

- Aquaculture

- Forestry

- Smart Greenhouses

Global Farm Management Software Market, By Offering

- On-cloud

- On-premise

- Data Analytics Services

Global Farm Management Software Market, By Farm Size

- Small

- Medium

- Large

Global Farm Management Software Market, By Region

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa.

Need help to buy this report?