Global Fatty Amines Market Size, Share, and COVID-19 Impact Analysis, By Type (Primary Amine, Secondary Amine, and Tertiary Amine), By Application (Agrochemicals, Oilfield Chemicals, Chemical Processing, Water Treatment, and Asphalt Additives), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

Industry: Chemicals & MaterialsGlobal Fatty Amines Market Insights Forecasts to 2033

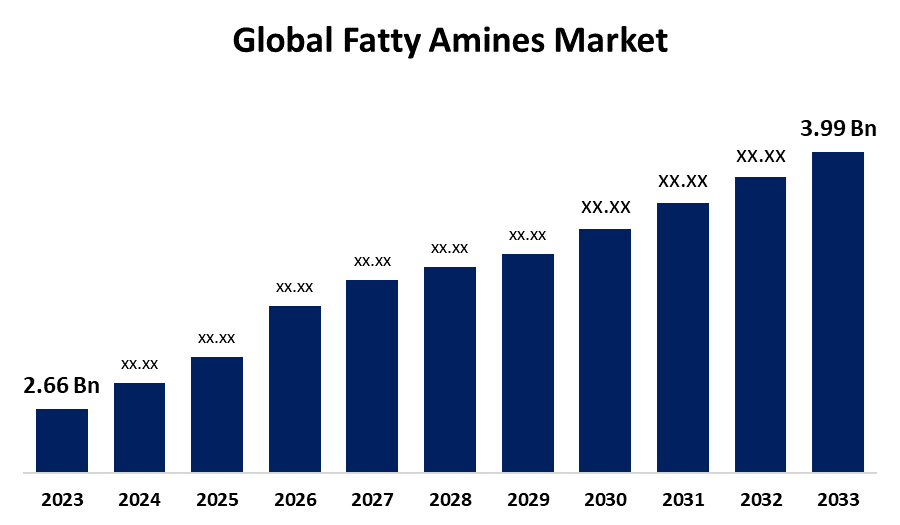

- The Global Fatty Amines Market Size was Valued at USD 2.66 Billion in 2023

- The Market Size is Growing at a CAGR of 4.14% from 2023 to 2033

- The Worldwide Fatty Amines Size is Expected to Reach USD 3.99 Billion by 2033

- North America is expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Fatty Amines Market Size is Anticipated to Exceed USD 3.99 Billion by 2033, Growing at a CAGR of 4.14% from 2023 to 2033.

Market Overview:

Fatty amines are organic substances made from fatty acids that can be utilized for a variety of industrial uses, including surfactants, barriers to corrosion, and drifting agents. They can be classified into three types: primary, secondary, and tertiary amines. Primary amine serves as a key raw material in the manufacturing of secondary and tertiary amine, which will contribute to market growth in the coming years.

The surfactant product derived from fatty amine is applied as a fiber lubricant and dying to assist in the textile industry which can help to boost the growth of the fatty amines market. Fatty amine is widely used in the agrochemical industry to develop agrochemical products such as herbicides and insecticides to promote plant growth and higher yield. The increasing necessity for the agrochemical division is expected to drive the growth of the fatty amine market. The expanding acceptance of liquid detergents and fabric softeners in progressive economies is expected to the growth of the fatty amines market.

The Oleylamine derived from fatty amine is frequently employed in the synthesis of specialty surfactants for the production of nanoparticles and emulsions in the pharmaceutical and personal care industries. The growing acceptance of pharmaceutical and cosmetic industries can enhance the growth of the market.

Report Coverage:

This research report categorizes the market for the global fatty amines market based on various segments and regions forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global fatty amines market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global fatty amines market.

Global Fatty Amines Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 2.66 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 4.14% |

| 2033 Value Projection: | USD 3.99 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 220 |

| Tables, Charts & Figures: | 95 |

| Segments covered: | By Type, By Application, By Region and COVID-19 Impact Analysis |

| Companies covered:: | Solvay S.A., E.I. du Pont de Nemours & Co., Procter & Gamble Company, Lonza Group Ltd, Indo Amine Ltd, Sterling Auxiliaries Pvt. Ltd., Wuxi Zhufeng Fine Chemical Co., Ltd., NOF CORPORATION, Nouryon, Clariant AG, Albemarle Corporation, Akzo Nobel N.V., Evonik Industries AG, Kao Corporation, Arkema S.A., Eastman Chemical Company, and Others key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors:

The fatty amines frequently applied in the paints and coating industry that can act as an epoxy curing agent are projected to drive the growth of the fatty amines market. Rising investment in construction in developing nations can support the growth of the fatty amines market. The growing use of fatty amines in cosmetics and toiletries due to their conditioning implications can drive the growth of the fatty amines market. Fatty amines have been used in gas purification and corrosion inhibition in the oil and gas industry, which is expected to fuel the growth of the fatty amines market.

Restraining Factors:

The availability of economic alternatives could hinder market expansion. The presence of stringent government laws is one of the factors that might impede market expansion during the projected period.

Market Segmentation:

The global fatty amines market share is classified into type and application.

- The tertiary amine segments have the largest share of the market throughout the forecast period.

Based on the type, the global fatty amines market is categorized into primary amine, secondary amine, and tertiary amine. Among these, the tertiary amine segments have the largest share of the market throughout the forecast period. The tertiary amine can be accredited to its higher need in several businesses for different applications such as ore flotation, corrosion inhibitors, and chemical intermediates. Tertiary amines are directly employed as intermediates for the synthesis of numerous chemicals such as gasoline, cosmetics, citric acid, and surfactants, as well as metal extracting agents, preservatives, and fungicides.

- The agrochemicals segment has the biggest share of the market during the forecast period.

Based on the application, the global fatty amines market is categorized into agrochemicals, oilfield chemicals, chemical processing, water treatment, and asphalt additives. Among these, the agrochemicals segment has the biggest share of the market during the forecast period. The growing population and limited amount of agricultural land are resulting in a demand-supply mismatch for grains. As a result, higher crop vulnerability, along with rising food demand, is driving agrochemical demand upward.

Regional Segment Analysis of the Global Fatty Amines Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia-Pacific is projected to hold the largest share of the global fatty amines market over the forecast period.

Get more details on this report -

Asia-Pacific is projected to hold the largest share of the global fatty amines market over the forecast period. The upsurge growth of the agrochemical sector throughout the region has a significant impact on the growth of the fatty amines market. The improved petrochemical modifications and regulations are expected to drive up product demand over the projected period. Furthermore, consumption of personal care and home products has been progressively increasing in Japan and developing countries such as China and India over the past few decades, and this trend is expected to contribute growth of the market. Tertiary fatty amines are in high demand in Asia Pacific, where they account for the majority of the market due to their wide range of uses and adaptability.

The North America region is expected to fastest CAGR growth during the forecast period. This could be ascribed to the fact that various detergent and surfactant manufacturers are involved in this business, and their contributions to its growth are significant. The main companies are more likely to add unique things to capitalize on untapped potential, which is also expected to fuel development.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global fatty amines market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies:

- Solvay S.A.

- E.I. du Pont de Nemours & Co.

- Procter & Gamble Company

- Lonza Group Ltd

- Indo Amine Ltd

- Sterling Auxiliaries Pvt. Ltd.

- Wuxi Zhufeng Fine Chemical Co., Ltd.

- NOF CORPORATION

- Nouryon

- Clariant AG

- Albemarle Corporation

- Akzo Nobel N.V.

- Evonik Industries AG

- Kao Corporation

- Arkema S.A.

- Eastman Chemical Company

- Others

Key Market Developments:

- In September 2022, Global Amines announced the successful start-up of its new fatty amines production facility in Surabaya, Indonesia. The new factory delivers fatty amines to clients in Southeast Asia and across the world, supplementing the assistance provided by Global Amines' current manufacturing sites in China, Europe, and America.

- In August 2022, Global Amines Company Pte. Ltd., a 50-50 joint venture between Clariant and Wilmar, has inked a formal deal to buy Clariant's Global Quats and Esterquats business. The transaction is subject to regulatory approval and is scheduled to conclude in the first half of 2023. The acquisition price, subject to usual closing conditions, is USD 113 million.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global fatty amines market based on the below-mentioned segments:

Global Fatty Amines Market, By Type

- Primary Amine

- Secondary Amine

- Tertiary Amine

Global Fatty Amines Market, By Application

- Agrochemicals

- Oilfield Chemicals

- Chemical Processing

- Water Treatment

- Asphalt Additives

Global Fatty Amines Market, By Regional

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the global fatty amines market over the forecast period?The global fatty amines market size is expected to grow from USD 2.66 Billion in 2023 to USD 3.99 Billion by 2033, at a CAGR of 4.14 % during the forecast period 2023-2033.

-

2. Which region is expected to hold the highest share in the global fatty amines market?Asia-Pacific is projected to hold the largest share of the global fatty amines market over the forecast period.

-

3. Who are the top key players in the fatty amines market?Solvay S.A, E.I. du Pont de Nemours & Co, Procter & Gamble Company, Lonza Group Ltd, Indo Amine Ltd, Sterling Auxiliaries Pvt. Ltd, Wuxi Zhufeng Fine Chemical Co., Ltd, NOF CORPORATION, Nouryon, Clariant AG, Albemarle Corporation, Akzo Nobel N.V, Evonik Industries AG, Kao Corporation, Arkema S.A, Eastman Chemical Company, and Others.

Need help to buy this report?