Global Feed Binders Market Size, Share, and COVID-19 Impact Analysis, By Type (Lignosulfonates, Plant Gums & Starches, Gelatin & Other Hydrocolloids, Clay, Molasses, & Others), By Livestock (Poultry, Cattle, Swine, Aquatic Animals, & Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

Industry: Food & BeveragesGlobal Feed Binders Market Insights Forecasts to 2033.

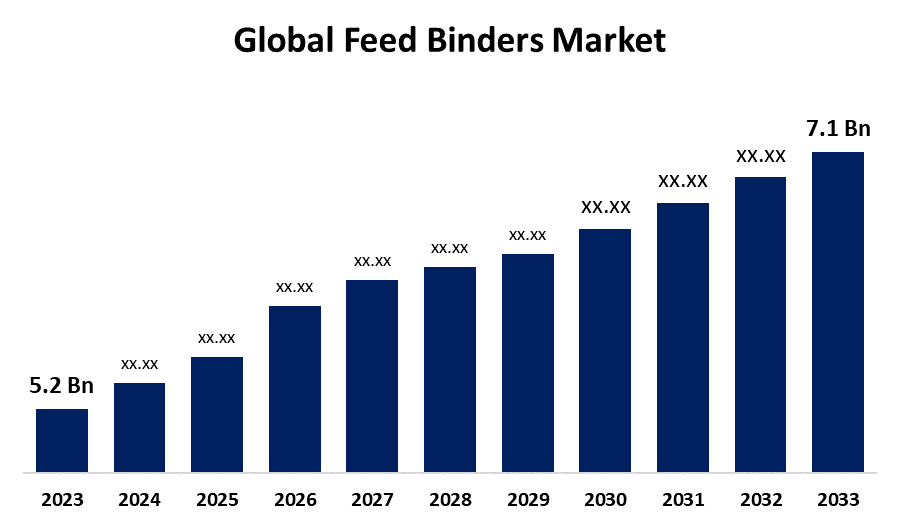

- The Global Feed Binders Market Size was Valued at USD 5.2 Billion in 2023.

- The Market Size is Growing at a CAGR of 3.16% from 2023 to 2033.

- The Worldwide Feed Binders Market Size is Expected to Reach USD 7.1 Billion by 2033.

- North America is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Feed Binders Market Size is Anticipated to Exceed USD 7.1 Billion by 2033, Growing at a CAGR of 3.16% from 2023 to 2033.

Market Overview

Feed binders are used to keep a consistent feed shape and bind different feed components together. The feed industry is significantly impacted by the feed binder product market. Feed binders are foods that, by preventing loss during in-transfer, can both suggestively improve the integrity of the product and increase the livestock's ability to acquire nutrients. Feed binders are utilized in animal nutrition to improve the feed's prominence. In addition to growing awareness of the importance of meat quality and the negative effects of using antibiotics as feed additives on the health of both humans and animals, there is a growing demand for meat products high in protein. The primary driving force behind the market is anticipated to be a shift in consumer preferences for pelleted feed on a global scale, binders are used to keep a consistent feed shape and bind different feed components together. brought about by growing awareness of animal nutrition. Over the course of the projection period, a major element expected to continue driving this market demand is the significantly rising meat consumption around the world.

Report Coverage

This research report categorizes the market for the global feed binders market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global feed binders market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global feed binders market.

Global Feed Binders Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 5.2 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 3.16% |

| 2033 Value Projection: | USD 7.1 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Livestock, By Region |

| Companies covered:: | Jinan Tiantianxiang Co., Ltd., FMC Corporation, Stillwater milling company, Darling ingredients inc., Huzhimpexinternationall ltd, Avebe U.A, London letter File company, NutriFeedCompany, Panay Mineral Product Resources Corp., Dilly manufacturing company, Juon presentation products, Blue seal feeds, and Others Key Vendors |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

The global feed binders market is driven by various factors, including the growth of the animal meat market. The USDA reports that the amount of animal flesh consumed has been steadily increasing. It went up from 224.9 pounds in 2021 to 227 pounds in 2022. The market need for feed binders has surged as a result of issues with animal health and expanding worldwide meat consumption. Furthermore, the feed sector is critical to solving global food and agricultural problems. According to FAO predictions, the yearly demand for compound feed will be about 1 billion tons. According to the International Feed Industry Federation (IFIF), the need for animal protein is steadily rising globally due to the growth of the fish, dairy, and poultry industries. According to FAO projections, there will be a 60% rise in global food demand by 2050, accompanied by an annual increase in animal protein consumption of 1.7%. The need for feed and feed additives like binders is therefore predicted to increase.

Restraining Factors

The rising cost of feed binders' raw materials is expected to have an unfavorable impact on the global feed binders market growth. Binding substances such as carrageenan, guar gum, agar, corn starch, and gelatin are quite costly to add to feed, despite being very powerful binders.

Market Segmentation

The global feed binders market share is classified into type and livestock.

- The lignosulfonates segment is expected to hold the largest share of the global feed binders market during the forecast period.

Based on the type, the global feed binders market is divided into lignosulfonates, plant gums and starches, gelatin and other hydrocolloids, clay, molasses, and others. Among these, the lignosulfonates segment is expected to hold the largest share of the global feed binders market during the forecast period. Because of their ability to emulsify, disperse, and bind, lignosulphonates are being used more often to provide structural integrity in the production of feed products, which is driving the segment's expansion. Because it allows more steam to be added to the compressed pellet production process than hemicellulose, it increases productivity. In addition, these materials are easily digested by ruminants, such as sheep, goats, and cattle.

- The poultry segment is witnessing significant CAGR growth of the global feed binders market during the forecast period.

Based on the livestock, the global feed binders market is divided into poultry, cattle, swine, aquatic animals, and others. Among these, the poultry segment is witnessing significant CAGR growth of the global feed binders market during the forecast period. The increase in focus on achieving feed conversion ratios in chicken feed in developing nations such China and India to developed nations can be attributed to the growth. South Korea and Japan both showed steady development. The decline in productivity in the courtyard contributed to the increasing use of compound feed by livestock players.

Regional Segment Analysis of the Global Feed Binders Market

- North America (U.S., Canada, Mexico)

- Europe (Global, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the global feed binders market over the predicted timeframe.

Get more details on this report -

Asia Pacific is anticipated to hold the largest share of the global feed binders market over the predicted timeframe. The increasing need for a diet high in protein as a result of various nutrient inadequacies is pushing up the consumption of meat and feed binders for animals. Feed binders are seeing rapid market expansion due to rising disposable incomes, rising dairy product consumption, and the rising craze for extreme diets like the keto diet.

North America is expected to grow at a fastest CAGR growth during the forecast period. Primarily because feed binding technology is becoming more widely used in industrial applications. The primary end users of feed binders for health in North America are the feed and fertilizer industries.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global feed binders’ market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Jinan Tiantianxiang Co., Ltd.

- FMC Corporation

- Stillwater milling company

- Darling ingredients inc.

- Huzhimpexinternationall ltd

- Avebe U.A

- London letter File company

- NutriFeedCompany

- Panay Mineral Product Resources Corp.

- Dilly manufacturing company

- Juon presentation products

- Blue seal feeds

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In November 2021, an Indian company called Avitech Nutrition introduced TriSorb, a high-end toxin binder, to the animal nutrition feed industry.

- In April 2021, for an undisclosed sum, 3F Feed & Food was purchased by Eastman Chemical, a US-based specialty materials company.

Market Segment

This study forecasts revenue at regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global feed binders market based on the below-mentioned segments:

Global Feed Binders Market, By Type

- Lignosulfonates

- Plant Gums and Starches

- Gelatin and Other Hydrocolloids

- Clay

- Molasses

- Others

Global Feed Binders Market, By Livestock

- Poultry

- Cattle

- Swine

- Aquatic Animals

- Others

Global Feed Binders Market, By Region

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What are the feed binders?Feed binders are foods that, by preventing loss during in-transfer, can both suggestively improve the integrity of the product and increase the livestock's ability to acquire nutrients.

-

2. What are segments of the global feed market?The global feed binders market share is classified into type and livestock.

-

3. What is the value of the global feed binders in 2023?In 2023, the size of the global feed binder market was estimated to be USD 5.2 billion.

-

1. What are the feed binders?Feed binders are foods that, by preventing loss during in-transfer, can both suggestively improve the integrity of the product and increase the livestock's ability to acquire nutrients.

-

2. What are segments of the global feed market?The global feed binders market share is classified into type and livestock.

-

3. What is the value of the global feed binders in 2023?In 2023, the size of the global feed binder market was estimated to be USD 5.2 billion.

Need help to buy this report?