Global Feed Yeast Market Size, Share, and COVID-19 Impact Analysis, By Type (Live Yeast and Inactive Yeast), By Livestock (Ruminants, Poultry, Swine, Aquaculture, and Pets), By Form (Dry, Fresh, and Instant), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: AgricultureGlobal Feed Yeast Market Insights Forecasts to 2033

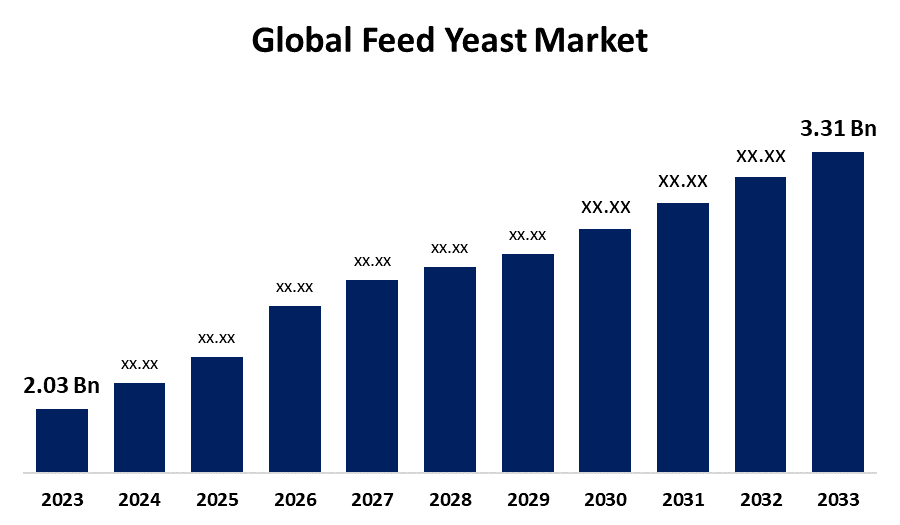

- The Global Feed Yeast Market Size was Valued at USD 2.03 Billion in 2023

- The Market Size is Growing at a CAGR of 5.01% from 2023 to 2033

- The Worldwide Feed Yeast Market Size is Expected to Reach USD 3.31 Billion by 2033

- Europe is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Feed Yeast Market Size is Anticipated to Exceed USD 3.31 Billion by 2033, Growing at a CAGR of 5.01% from 2023 to 2033.

Market Overview

Yeast, an unicellular microbe categorized as a fungus, is widely utilized as a feed additive. Animal feed contains yeast that has undergone fermentation. This mechanism is thought to provide helpful metabolites that boost intestinal health and nutrient utilization in animals. Therefore, feed enriched with yeast is linked to better immune system performance, improved immunity against infections, and improved growth performance. In addition to serving as an excellent source of crucial vitamins and minerals, yeast can also improve the general health and well-being of animals. Feed yeast is a type of nutritional yeast that is utilized as a supplement in animal feeds due to it contains a higher concentration of protein and amino acid, energy, and micronutrients than typical grains and oilseed meals when fed to animals. The most prevalent yeast utilized in dairy diets is Saccharomyces cerevisiae, often known as brewer's or bread yeast. Yeast increases milk output, improves animal digestion, increases plate size, aids in weight gain, particularly in hens, prevents numerous diseases, and improves gut health and farm animal performance. Yeast culture can also aid in fermentation and digestion in the intestines, a ruminant's stomach. Producers boosted their microbial research and development operations, which resulted in the emergence of innovative yeast additives for direct-fed microbiology and higher demand for feed yeast in the feed sector.

Report Coverage

This research report categorizes the market for the global feed yeast market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global feed yeast market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global feed yeast market.

Global Feed Yeast Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 2.03 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 5.01% |

| 2033 Value Projection: | USD 3.31 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Form, By Livestock, By Region |

| Companies covered:: | Archer Daniels Midlands Company, Diamond V, Leiber GmbH, Associated British Foods Plc, Alltech Inc., Cargill, Angel Yeast Company, Chr. Hansen, Lesaffre, Nutreco N.V., Lallemand Inc., Novus International, Zilor (Biorigin), Kerry Group, and other key companies. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis |

Get more details on this report -

Driving Factors

It has been noted that yeasts such as Saccharomyces cerevisiae, Kluyveromyces marxianus, and Candida utilis improve animal health; they supply nutrients to animals and thus are utilized as feed additives. Apart from animal feed, distinct yeast genera have several commercial applications in a variety of industries, including brewing, bakery, food and fragrance, medicinal, and bioethanol manufacturing. Furthermore, the addition of feed yeast to animal diets is thought to promote the growth of healthy gut flora. It is assumed that enhanced gut flora leads to more efficient digestion and nutritional absorption in animals. As a result, livestock-fed yeast supplements may show improved growth rates and general performance. The dissemination of information about the possible benefits of feed yeast for animal health and production is thought critical for market growth. As more livestock producers learn about yeast's benefits for intestinal health, nutritional absorption, and general animal well-being, its adoption rate in the feed yeast market is expected to grow.

Restraining Factors

The main source of yeast generation is molasses, a sugar byproduct. Molasses unavailability is an important issue for the worldwide yeast industry due to the intense competition for these raw materials from many industries such as food, pharmaceuticals, feed, and more. Several factors have contributed to this scarcity, the most significant of which being low sugarcane and sugar beet yield. As a result, its supply is predicted to be limited in yeast ingredient synthesis. With the high demand for brewer's yeast in the baking and alcohol industries, a significant shortage of raw materials for feed yeast production can have a further impact on the end product pricing.

Market Segmentation

The global feed yeast market share is classified into type, livestock, and form.

- The live yeast segment is expected to hold the highest share of the global feed yeast market during the forecast period.

Based on the type, the global feed yeast market is divided into live yeast and inactive yeast. Among these, the live yeast segment is expected to hold the highest share of the global feed yeast market during the forecast period. Live yeasts are utilized as supplements due to they help avoid digestive problems in farm animals, strengthen the microflora in the gut, and improve fiber digestion, which aids in improved food utilization and gut health. Animals need a high-fiber diet for optimal health and vitality.

- The poultry segment is expected to hold the major share of the global feed yeast market during the forecast period.

Based on the livestock, the global feed yeast market is divided into ruminants, poultry, swine, aquaculture, and pets. Among these, the poultry segment is expected to hold the major share of the global feed yeast market during the forecast period. It helps to improve the digestive health of the animal and has a good impact on meat yield. Adding yeast to poultry feed is one approach for enhancing the animal's digestive health and assisting in improved feed conversion ratios, which have a positive impact on meat yield. A combination of yeast and probiotics has been demonstrated to have the best effect on broiler weight gain and productivity.

- The dry segment is expected to hold the largest share of the global feed yeast market during the forecast period.

Based on the form, the global feed yeast market is divided into dry, fresh, and instant. Among these, the dry segment is expected to hold the largest share of the global feed yeast market during the forecast period. Due to its widespread use to improve the nutritional profile of baked foods. The component may be utilized in place of L-cysteine hydrochloride since it functions as a lowering agent. Dry yeast is made from pasteurized and sterilized yeast cream, which kills the yeast and renders it incapable of leavening while keeping its nutritional value and other properties. The yeast is typically held at a constant temperature of 250°F (121 degrees Celsius) for about 20 seconds before getting dried.

Regional Segment Analysis of the Global Feed Yeast Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the highest share of the global feed yeast market over the predicted timeframe.

Get more details on this report -

Asia Pacific is anticipated to hold the highest share of the global feed yeast market over the predicted timeframe. This dominance is linked to variables such as a huge animal population, high feed additive penetration rates, and rising meat consumption in the region. The growing number of feed mills and feed output in countries such as India, China, and Indonesia are important drivers of market expansion. Furthermore, the demand for animal-based protein items such as eggs, meat, milk, and other meat products is rising in this region, which, along with a big population, is driving demand for feed yeast. Furthermore, rising demand for poultry meat and increased knowledge among livestock producers about the benefits of yeast in animal feed are driving the feed yeast market in this region. The region's animal feed and nutrition sectors are growing. The region's feed additives sector is expanding rapidly, which is assisting the expansion of the feed yeast market. Over the previous three years, China has been the region's leading producer of feed yeast.

Europe is expected to grow at the fastest pace in the global feed yeast market during the forecast period. The abundance of bread items and their strong demand have resulted in the biggest use of yeast components in the country's baking and brewing industries. The European Union's tough regulations prohibiting the use of antibiotics in animal feed, combined with rising meat demand, are fueling market development. Farmers have also become more aware of the importance of providing adequate nutrition to farm animals. As a result, feed additives such as yeast are being utilized increasingly frequently to promote animal productivity and health.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global feed yeast market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Archer Daniels Midlands Company

- Diamond V

- Leiber GmbH

- Associated British Foods Plc

- Alltech Inc.

- Cargill

- Angel Yeast Company

- Chr. Hansen

- Lesaffre

- Nutreco N.V.

- Lallemand Inc.

- Novus International

- Zilor (Biorigin)

- Kerry Group

- Other

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In September 2022, Lallemand's inauguration of a new branch in Poland signified the establishment of standards for its presence in the country, allowing it to sell microbial-based animal nutrition and well-being solutions directly.

- In February 2021, ADM declared that it would lead an equity investment in Acies Bio, a biotechnology business based in Slovenia. Acies Bio focuses in research and development, as well as manufacture, of synthetic biology and precision fermentation technologies for use in food, agriculture, and industry.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global feed yeast market based on the below-mentioned segments:

Global Feed Yeast Market, By Type

- Live Yeast

- Inactive Yeast

Global Feed Yeast Market, By Livestock

- Ruminants

- Poultry

- Swine

- Aquaculture

- Pets

Global Feed Yeast Market, By Form

- Dry

- Fresh

- Instant

Global Feed Yeast Market, Regional

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. Which are the key companies that are currently operating within the market?The Global Feed Yeast Market is served by several key players, Archer Daniels Midlands Company, Diamond V, Leiber GmbH, Associated British Foods Plc, Alltech Inc., Cargill, Angel Yeast Company, Chr. Hansen, Lesaffre, Nutreco N.V., Lallemand Inc., Novus International, Zilor (Biorigin), and Kerry Group, and others.

-

2. What is the size of the global feed yeast market?The Global Feed Yeast Market Size is Expected to Grow from USD 2.03 Billion in 2023 to USD 3.31 Billion by 2033, at a CAGR of 5.01% during the forecast period 2023-2033.

-

3. Which region is holding the highest share of the market?Asia Pacific is anticipated to hold the highest share of the global feed yeast market over the predicted timeframe.

Need help to buy this report?