Global Feminine Hygiene Products Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Menstrual Care Products and Cleaning & Deodorizing Products), By Distribution Channel (Hypermarkets/Supermarkets, Convenience Stores, Drugs Stores, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Consumer GoodsGlobal Feminine Hygiene Products Market Insights Forecasts to 2033

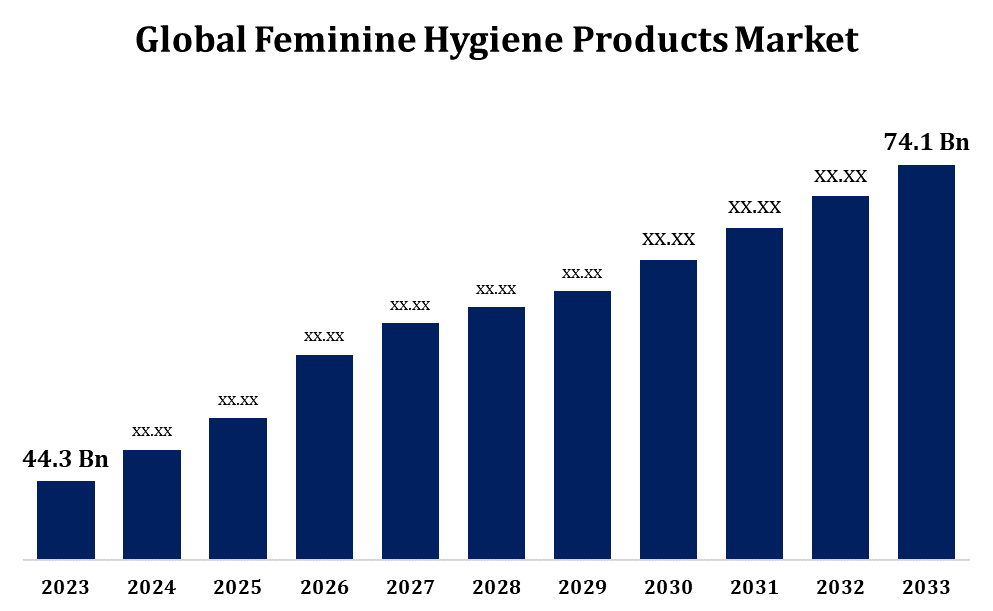

- The Feminine Hygiene Products Market was valued at USD 44.3 Billion in 2023.

- The Market Size is Growing at a CAGR of 5.28% from 2023 to 2033.

- The Worldwide Feminine Hygiene Products Market Size is Expected to reach USD 74.1 Billion by 2033.

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Feminine Hygiene Products Market Size is Expected to reach USD 74.1 billion by 2033, at a CAGR of 5.28% during the forecast period 2023 to 2033.

The feminine hygiene products market is witnessing significant growth, driven by increasing awareness around menstrual health and hygiene, especially in emerging economies. With rising female workforce participation and an emphasis on personal wellness, products like sanitary pads, tampons, and menstrual cups are experiencing higher demand. The market is also benefiting from increased governmental and non-governmental initiatives promoting menstrual hygiene. Innovations, such as organic and biodegradable options, reflect a shift towards sustainable choices. However, cultural taboos and limited accessibility in rural areas remain challenges. Major brands are focusing on expanding their product portfolios with eco-friendly and skin-safe solutions, while direct-to-consumer brands are gaining traction online. As a result, the global feminine hygiene market is projected to grow steadily, catering to a diverse, health-conscious audience.

Feminine Hygiene Products Market Value Chain Analysis

The feminine hygiene products market value chain encompasses raw material suppliers, manufacturers, distributors, retailers, and end consumers. Raw materials, such as cotton, synthetic fibers, and absorbent gels, are sourced for production, with a growing trend towards organic and biodegradable inputs to meet eco-friendly demand. Manufacturers design, produce, and package sanitary pads, tampons, menstrual cups, and panty liners, often incorporating innovations in comfort and sustainability. Products are then distributed through multiple channels, including wholesalers, online platforms, pharmacies, and supermarkets, enabling broader reach. Retailers play a crucial role in accessibility, with prominent placements to ensure visibility. The value chain concludes with consumers, who increasingly seek quality, affordability, and sustainability in products. Key players emphasize product differentiation and streamlined supply chains to cater to the evolving expectations of a diverse, global consumer base.

Feminine Hygiene Products Market Opportunity Analysis

The feminine hygiene products market presents significant growth opportunities, particularly through innovations in eco-friendly and sustainable options. With growing environmental awareness, there is a rising demand for biodegradable and reusable products, such as organic cotton pads and menstrual cups, appealing to a sustainability-conscious audience. Additionally, increasing urbanization and female workforce participation in emerging markets drive demand for convenient, discreet solutions. Expansion into underserved rural areas also offers potential, as educational campaigns and government initiatives promote menstrual health awareness, encouraging product adoption. Digital marketing and e-commerce provide avenues for direct-to-consumer sales, empowering niche brands to reach global audiences. Health-centric product variations, such as hypoallergenic and fragrance-free options, cater to sensitive skin needs, further expanding the market. Collectively, these trends are creating new opportunities in both developed and developing regions.

Global Feminine Hygiene Products Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023 : | USD 44.3 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 5.28% |

| 2033 Value Projection: | USD 74.1 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 215 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product Type, By Distribution Channel, By Region |

| Companies covered:: | Edgewell Personal Care Company, First Quality Enterprises, Incorporation, Hengan International Group Co. Limited, Johnson & Johnson, Kao Corporation, Kimberly-Clark Corporation, Procter & Gamble Company, Svenska Cellulosa Aktiebolaget, Unicharm Corporation and Unilever plc, and Others |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Market Dynamics

Feminine Hygiene Products Market Dynamics

Growing Rate of Menstrual Literacy to Fuel Market Expansion

The rise in menstrual literacy is significantly boosting the feminine hygiene products market, as awareness about menstrual health drives product adoption and reduces stigma. Educational programs, largely led by NGOs, governments, and social media influencers, are helping normalize menstruation discussions, especially in previously underserved regions. This growing knowledge base is encouraging young women to seek high-quality, safe menstrual products, expanding the market’s reach. Improved access to information empowers consumers to make informed choices, which increases demand for innovative, health-focused products, including organic, chemical-free, and biodegradable options. Schools and workplaces are also increasingly supportive, providing sanitary products and facilities, further encouraging adoption. As awareness and education continue to grow, demand for a variety of menstrual hygiene solutions is set to increase, fueling global market expansion and diversifying product offerings.

Restraints & Challenges

The feminine hygiene products market faces several challenges, including cultural stigma, affordability, and environmental impact. In many regions, menstruation remains a taboo subject, limiting open discussion and education about hygiene options. This lack of awareness affects product adoption and impedes access, especially in rural and low-income areas. Affordability is another significant barrier, as high-quality products can be costly, making them inaccessible to economically disadvantaged women and girls. Furthermore, traditional sanitary products contribute to environmental waste, as single-use pads and tampons often contain non-biodegradable plastics, creating disposal challenges. Addressing these issues requires not only innovative product solutions, such as eco-friendly and affordable alternatives, but also continued efforts in education, policy reform, and subsidization to make feminine hygiene products accessible and acceptable worldwide.

Regional Forecasts

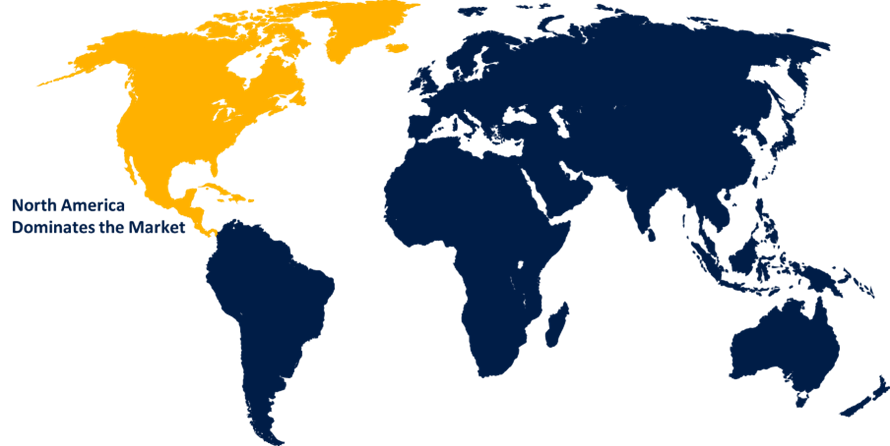

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Feminine Hygiene Products Market from 2023 to 2033. In the U.S. and Canada, awareness around menstrual health is widespread, and consumers actively seek products that prioritize comfort, health, and environmental responsibility. This demand has led to a rise in organic and biodegradable options, including reusable menstrual cups, organic tampons, and cotton-based pads. The presence of major players and a well-established retail network, coupled with growing e-commerce platforms, ensures widespread accessibility. Moreover, progressive policies, such as tax exemptions on menstrual products, support market growth by making hygiene products more affordable. This mature market also sees a growing trend in health-centric product customization, catering to various skin sensitivities and preferences, fueling further product diversification and market expansion.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. Growing education around menstrual health, driven by NGOs and government initiatives, is reducing stigma and boosting product adoption in countries like India, China, and Indonesia. Economic growth in these regions has increased women’s purchasing power, leading to higher demand for quality hygiene products. However, affordability remains a challenge, particularly in rural areas, prompting a need for cost-effective solutions. The market is seeing a surge in biodegradable and reusable options to address environmental concerns. With e-commerce gaining traction, consumers have better access to a wide range of products. Local and global brands are focusing on innovations tailored to cultural preferences and affordability, driving further market growth in this highly diverse region.

Segmentation Analysis

Insights by Product Type

The menstrual care products segment accounted for the largest market share over the forecast period 2023 to 2033. Products like sanitary pads, tampons, and menstrual cups dominate the segment, but emerging trends favor eco-friendly and health-focused options. Demand for organic cotton, biodegradable, and chemical-free products is rising as consumers prioritize sustainability and skin sensitivity. Reusable products, such as menstrual cups and washable pads, are also gaining popularity, offering cost-effective and environmentally friendly alternatives. With growing menstrual literacy, more consumers are exploring diverse options tailored to their comfort and lifestyle needs. E-commerce platforms further fuel growth by enabling access to a variety of brands, while educational initiatives help normalize product usage, particularly in underserved markets, driving continuous segment expansion globally.

Insights by Distribution Channel

The hypermarkets/supermarket segment accounted for the largest market share over the forecast period 2023 to 2033. The hypermarket and supermarket segment plays a crucial role in the growth of the feminine hygiene products market, as these retail channels offer wide accessibility and convenience for consumers. With extensive shelf space and strategic product placement, hypermarkets and supermarkets enhance visibility for sanitary pads, tampons, menstrual cups, and other menstrual care products, making them more accessible to a broad customer base. Many consumers prefer in-store purchases, where they can physically evaluate products, compare options, and take advantage of discounts or bundled offers. Additionally, major retailers are increasingly catering to demand for sustainable products by stocking organic and eco-friendly menstrual items. In emerging economies, the expansion of hypermarkets and supermarkets into suburban and rural areas is also increasing product reach, supporting overall market growth and encouraging broader adoption of menstrual care products.

Recent Market Developments

- On January 2024, Compass Diversified (CODI), a publicly traded company, invested USD 380 million to acquire The Honey Pot Company, a feminine care brand based in Atlanta, U.S., with a presence in over 33,000 retail stores nationwide. This partnership will enable the brand to expand its product reach across the United States.

Competitive Landscape

Major players in the market

- Edgewell Personal Care Company

- First Quality Enterprises

- Incorporation

- Hengan International Group Co. Limited

- Johnson & Johnson

- Kao Corporation

- Kimberly-Clark Corporation

- Procter & Gamble Company

- Svenska Cellulosa Aktiebolaget

- Unicharm Corporation and Unilever plc

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Feminine Hygiene Products Market, Product Type Analysis

- Menstrual Care Products

- Cleaning & Deodorizing Products

Feminine Hygiene Products Market, Distribution Channel Analysis

- Hypermarkets/Supermarkets

- Convenience Stores

- Drugs Stores

- Others

Feminine Hygiene Products Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Feminine Hygiene Products Market?The global Feminine Hygiene Products Market is expected to grow from USD 44.3 billion in 2023 to USD 74.1 billion by 2033, at a CAGR of 5.28% during the forecast period 2023-2033.

-

2. Who are the key market players of the Feminine Hygiene Products Market?Some of the key market players of the market are Edgewell Personal Care Company, First Quality Enterprises, Incorporation, Hengan International Group Co. Limited, Johnson & Johnson, Kao Corporation, Kimberly-Clark Corporation, Procter & Gamble Company, Svenska Cellulosa Aktiebolaget, Unicharm Corporation and Unilever plc.

-

3. Which segment holds the largest market share?The hypermarkets/supermarket segment holds the largest market share and is going to continue its dominance.

-

4. Which region dominates the Feminine Hygiene Products Market?North America dominates the Feminine Hygiene Products Market and has the highest market share.

Need help to buy this report?