Global Fermentation Bioreactor Market Size, Share, and COVID-19 Impact Analysis, By Type (Single-Use Bioreactors and Multiple-Use Bioreactors), By Application (Biopharmaceutical Companies and Contract Research Organizations), and By Region (North America, Europe, Asia Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Chemicals & MaterialsGlobal Fermentation Bioreactor Market Insights Forecasts to 2033

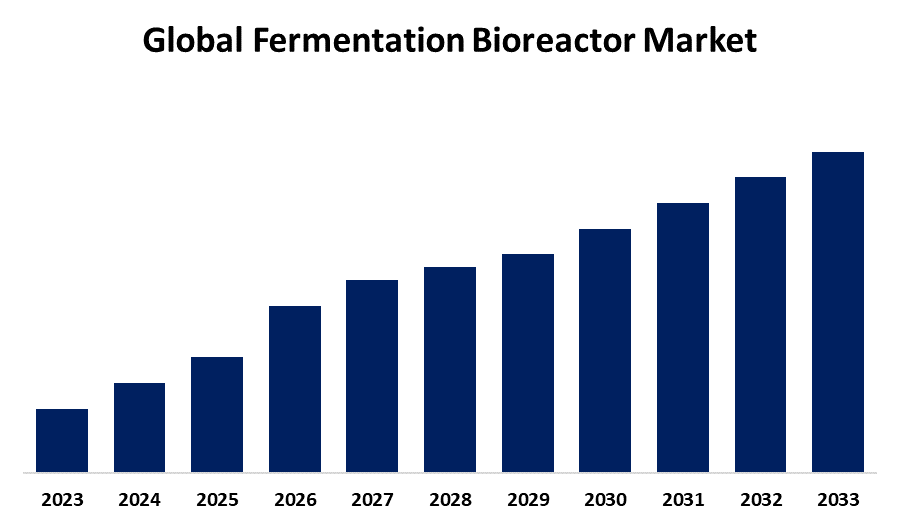

- The Market Size is Growing at a Substantial CAGR 7.9% from 2023 to 2033

- The Worldwide Fermentation Bioreactor Market Size is Expected to Hold a Significant Share by 2033

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

The Fermentation Bioreactor Market is anticipated to hold a significant share by 2033, growing at a substantial CAGR from 2023 to 2033. The global fermentation bioreactor market is growing at a rapid pace due to increasing demand for biopharmaceuticals, biofuels, and food products. Technological advancements related to single-use bioreactors, automation, and process control innovations are driving the growth of the biopharmaceutical and biotechnology sector across emerging regions.

Market Overview

Fermentation bioreactor refers to the industry that manufactures the bioreactor for fermentation processes through the design and supply process. Fermentation bioreactors play a crucial role in manufacturing different products, such as pharmaceuticals, biofuels, food and beverages, and specialty chemicals, through microbial or cell culture processes. Moreover, growth factors for the market include the increased demand for biopharmaceuticals, increased bio-based product production, improvement in bioreactor technologies, and a trend towards sustainable and green manufacturing processes. There is an increasing need for efficient, scalable, and precise fermentation processes that will drive the adoption of advanced bioreactor systems across industries. Furthermore, opportunities will be in the market, including personalized medicine, a surge in the demand for biofuels, and advances in automation and bioprocess control. Trends will include single-use bioreactors, higher biomanufacturing activities being developed in emerging markets, and production approaches that are sustainable.

Report Coverage

This research report categorizes the global fermentation bioreactor market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global fermentation bioreactor market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global fermentation bioreactor market.

Global Fermentation Bioreactor Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 7.9% |

| Historical Data for: | 2021-2022 |

| No. of Pages: | 225 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Type, By Application, By Regional |

| Companies covered:: | Thermo Fisher Scientific, GE Healthcare Life Sciences, Sartorius AG, Danaher Corporation, Merck Group, Eppendorf AG, Bioengineering AG, Finesse Solutions, CPC (Colder Products Company), Applikon Biotechnology, Pall Corporation, Kubota Corporation, Others, and |

| Pitfalls & Challenges: | COVID-19 Impact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Factors driving this market include the global increase in demand for biopharmaceuticals, such as vaccines and monoclonal antibodies; growing biofuels and food & beverage industries; continuous technological improvement of fermentation bioreactors, including automation, more advanced process control, and introduction of single-use bioreactors that benefit efficient, scale-up production; a focus on sustainability and green manufacturing practices; and expanding biomanufacturing capabilities in emerging markets. For instance, in June 2022, ABEC announced that mAbxience will install an additional ABEC 4,000L single-use custom single-run (CSR) bioreactor in their state-of-the-art cGMP facility in León, Spain. Consequently, on account of the aforementioned factors, the segment is expected to experience growth.

Restraints & Challenges

The challenges in the fermentation bioreactor market include high capital and operational costs, complex regulatory requirements, and the need for skilled operators. Otherwise, issues of contamination control and lack of scalability in large-scale production also hold back its mass adoption and growth.

Market Segmentation

The global fermentation bioreactor market share is classified into type and application.

- The manual fermentation bioreactor segment is expected to hold the largest share of the global fermentation Bioreactor market during the forecast period.

Based on type, the global fermentation bioreactor market is categorized as single-use bioreactors and multiple-use bioreactors. Among these, the manual fermentation bioreactor segment is expected to hold the largest share of the global fermentation bioreactor market during the forecast period. This is because of the benefits it offers, such as low risk of cross-contamination, low operational costs, and quicker setup times than multi-use bioreactors. Single-use bioreactors are becoming increasingly popular in biopharmaceutical manufacturing and research because of their flexibility, scalability, and ease of use, thus gaining acceptance on a large scale.

- The biopharmaceutical companies segment is expected to grow at the fastest CAGR during the forecast period.

Based on the application, the global fermentation bioreactor market is categorized as biopharmaceutical companies and contract research organizations. Among these, the biopharmaceutical companies’ segment is expected to grow at the fastest CAGR during the forecast period. This is due to the increase in the demand for biologics such as vaccines, monoclonal antibodies, and gene therapies, which involve highly advanced fermentation processes. Also, the growth of personalized medicine, regulatory approvals, and investment in biopharmaceutical R&D increase the uptake of these companies for fermentation bioreactors.

Regional Segment Analysis of the Global Fermentation Bioreactor Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is projected to hold the largest share of the global fermentation bioreactor market over the forecast period.

Get more details on this report -

North America is projected to hold the largest share of the global fermentation bioreactor market over the forecast period. This is primarily because of the region's high presence of key biopharmaceutical companies, advanced healthcare infrastructure, and significant investments in biotechnology and pharmaceutical R&D. In addition, North America's stringent regulatory frameworks ensure high-quality standards in biomanufacturing, which further drives the adoption of fermentation bioreactors. The growing demand for biologics and biologically derived products in the region also supports market growth. The United States and Canada, two of the largest countries in this region, also spend much on research and development expenses. For instance, in March 2024, research funded by the National Institutes of Health (NIH) generated $2.46 in economic activity for every $1 of funding in 2023, a total of $92.9 billion, according to an annual report (PDF) published March 25 by biomedical research advocacy organization United for Medical Research (UMR). That's nearly $3 billion more than in 2022.

Asia Pacific is expected to grow at the fastest CAGR growth of the global fermentation bioreactor market during the forecast period. This growth is driven by the increasing investments in biotechnology, pharmaceuticals, and healthcare infrastructure in countries like China, India, and Japan. The rapidly expanding biopharmaceutical manufacturing capabilities, growing demand for biologics, and the emergence of contract manufacturing organizations (CMOs) are also driving the adoption of fermentation bioreactors in the region. The region's cost-effective production and large population further enhance the market potential.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global fermentation bioreactor market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Thermo Fisher Scientific

- GE Healthcare Life Sciences

- Sartorius AG

- Danaher Corporation

- Merck Group

- Eppendorf AG

- Bioengineering AG

- Finesse Solutions

- CPC (Colder Products Company)

- Applikon Biotechnology

- Pall Corporation

- Kubota Corporation

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Key Market Developments

- In October 2022, Getinge AB announced that their bioreactors will support the Dutch government's initiative to create animal products like meat and milk proteins directly from animal and microbial cells.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global fermentation bioreactor market based on the below-mentioned segments:

Global Fermentation Bioreactor Market, By Type

- Single-Use Bioreactors

- Multiple-Use Bioreactors

Global Fermentation Bioreactor Market, By Application

- Biopharmaceutical Companies

- Contract Research Organizations

Global Fermentation Bioreactor Market, By Regional

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the global fermentation bioreactor market over the forecast period?The fermentation bioreactor market is anticipated to hold a significant share by 2033, growing at a CAGR of XX% from 2023 to 2033.

-

2. Which region is expected to hold the highest share of the global fermentation bioreactor market?North America is projected to hold the largest share of the global fermentation bioreactor market over the forecast period.

-

3. Who are the top key players in the global fermentation bioreactor market?Thermo Fisher Scientific, GE Healthcare Life Sciences, Sartorius AG, Danaher Corporation, Merck Group, Eppendorf AG, Bioengineering AG, Finesse Solutions, CPC (Colder Products Company), Applikon Biotechnology, Pall Corporation, Kubota Corporation.

Need help to buy this report?