Global Ferroalloy Market Size, Share, and COVID-19 Impact Analysis, By Product (Ferrochrome, Ferromanganese, Ferro Silico Manganese, Ferrosilicon), By Application (Carbon & Low Alloy Steel, Stainless Steel, Alloy Steel, Cast Iron, Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

Industry: Advanced MaterialsGlobal Ferroalloy Market Insights Forecasts to 2033

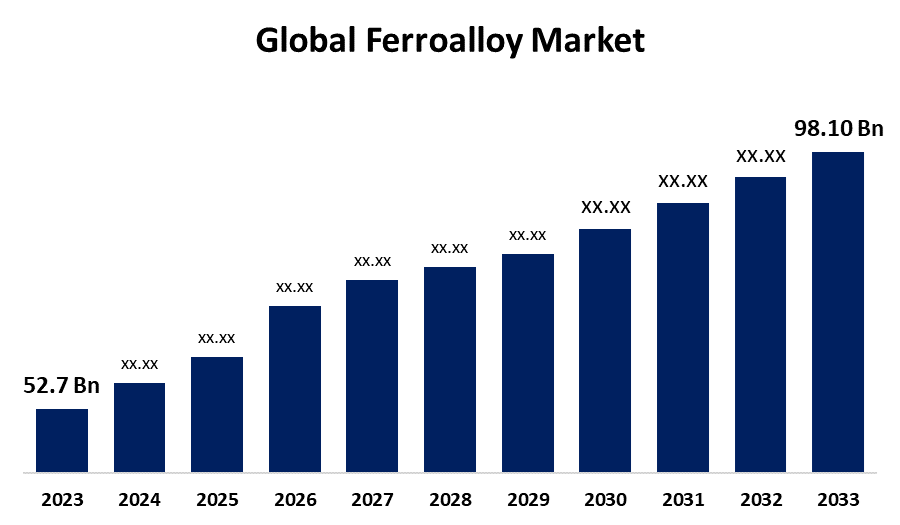

- The Global Ferroalloy Market Size was Valued at USD 52.7 Billion in 2023

- The Market Size is Growing at a CAGR of 6.40% from 2023 to 2033

- The Worldwide Ferroalloy Market Size is Expected to Reach USD 98.10 Billion by 2033

- North America is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Ferroalloy Market Size is Anticipated to Exceed USD 98.10 Billion by 2033, Growing at a CAGR of 6.40% from 2023 to 2033.

Market Overview

Ferroalloys are a crucial component used in the production of special steel and alloys. They are utilized in the production of steel as alloy additives and deoxidizers. The alloys give enhanced tensile strength and hardness at elevated temperatures, improve resistance to wear and abrasion, and boost creep strength, among other benefits. Accordingly, the development of the iron and steel industry, foundry industry, and to some extent the electrode industry are all related to the expansion of the ferroalloys industry. The main ferroalloys are silicon, manganese, and chromium. Ferroalloys are a class of materials that are often used to make steel. They are made of iron and other alloying elements. In the steel industry, ferroalloys are utilized to enhance the unique qualities of steel products. Ferroalloys are added to increase qualities including ductility, corrosion resistance, fatigue strength, and tensile strength. Ferroalloys are essential to the steel industry because they are utilized extensively in the refining, desulphurization, and deoxidation processes that give steel its ideal physical and chemical characteristics. As a result, their impact on the global steel and iron industry is greater.

Report Coverage

This research report categorizes the market for the global ferroalloy market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global ferroalloy market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global ferroalloy market.

Global Ferroalloy Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 52.7 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 6.40% |

| 2033 Value Projection: | USD 98.10 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 190 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Product, By Application and By Region |

| Companies covered:: | Arcelor Mittal S.A., Brahm Group, China Minmetals Group Co. Ltd., Glencore plc, Gulf Ferro Alloys Company (SABAYEK), Jindal Group, Nikopol Ferroalloy Plant, OM Holdings Ltd., SC Feral Srl, Chandrapur Ferro Alloy Plant (CFP) (SAIL), Samancore Chrome Limited, Tata Steel Limited, and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

A major element boosting the demand for steel is the increase in manufacturing activity across the world. The primary purpose of ferroalloys in the steel industry is to impart the unique qualities of steel. Consequently, throughout the course of the projection period, ferroalloy growth will be aided by the global increase in steel demand. The market is expanding as a result of steel's rising appeal across a range of end-use industries. Ferroalloys are growing in popularity due in large part to the expanding construction industry. Growing government programs to build infrastructure, including roads, bridges, and dams, are contributing to the expansion of the construction industry. Rising various government initiatives for the development of infrastructures such as roadways, bridges, and dams, further boosting the growth of the construction sector growth.

Restraining Factors

The scarcity of raw materials has been a problem for ferroalloy manufacturers. Manganese, coke, and chrome ore are raw ingredients needed to produce ferroalloys. Because they are in short supply, many nations must import ferroalloys at a premium from other nations in order to manufacture them. Therefore, throughout the course of the projection period, the market's expansion might be hampered by the lack of raw materials needed to produce ferroalloys.

Market Segmentation

The global ferroalloy market share is classified into product, and application.

- The ferromanganese segment is expected to hold the largest share of the global ferroalloy market during the forecast period.

Based on the product, the global ferroalloy market is divided into ferrochrome, ferromanganese, ferro silico manganese, and ferrosilicon. Among these, the ferromanganese segment is expected to hold the largest share of the global ferroalloy market during the forecast period. Ferromanganese finds primary application in steel-making and foundry industries. The key driver for the demand for ferromanganese in steelmaking is its use as a desulphurizing agent owing to properties such as sulfide and deoxidant former. Manganese combines with sulfur to avoid the formation of iron sulfide, which can result in cracking.

- The stainless-steel segment is expected to hold the largest share of the global ferroalloy market during the forecast period.

Based on the application, the global ferroalloy market is divided into carbon & low alloy steel, stainless steel, alloy steel, cast iron, and others. Among these, the stainless-steel segment is expected to hold the largest share of the global ferroalloy market during the forecast period. As stainless steel resists corrosion and is aesthetically pleasing and durable, it is the primary product that drives demand in this market. In order to provide stainless steel with the appropriate properties for a variety of uses, such as cooking utensils, medical equipment, building materials, automobile parts, ferrochrome, and ferromanganese are essential. The market is supported by the ongoing worldwide growth of these industries, particularly in emerging nations, which is driving up demand for stainless steel.

Regional Segment Analysis of the Global Ferroalloy Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the global ferroalloy market over the predicted timeframe.

Get more details on this report -

Asia Pacific is anticipated to hold the largest share of the global ferroalloy market over the predicted timeframe. As the Asia Pacific area produces a lot of steel and cast iron, it is the region that uses ferroalloys the most. Ferroalloy use worldwide is highest in the Asia Pacific region, which is characterized by high levels of production for both steel and cast iron. A further factor in the market's growth is the number of companies operating in the Asia Pacific region. Due to the government's strong support of industrial growth, the availability of labor and raw materials, and the accessibility of both, this region functions as a hub for industry and consumption. Due to the continued urbanization and development efforts of these emerging nations, there will be a robust and growing demand for their products, which will ensure the region's leadership position in the global market.

North America is expected to grow at the fastest pace in the global ferroalloy market during the forecast period. Canada, the United States, and North America are the major participants in the industry because of their thriving energy, building, and automobile industries. The region's well-established steel industry, which needs a variety for the manufacture of both standard and specialist steel grades, is strongly related to demand in the area. The market is significantly shaped by North America's emphasis on infrastructural development and technology innovation. The demand for stainless steel in the area is being driven by high disposable income and increased spending capacity, which is propelling the expansion of the ferroalloys market. Furthermore, rising stainless steel production to meet the demands of the automotive industry is expected to fuel market expansion throughout the region.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global ferroalloy market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Arcelor Mittal S.A.

- Brahm Group

- China Minmetals Group Co. Ltd.

- Glencore plc

- Gulf Ferro Alloys Company (SABAYEK)

- Jindal Group

- Nikopol Ferroalloy Plant

- OM Holdings Ltd.

- SC Feral Srl

- Chandrapur Ferro Alloy Plant (CFP) (SAIL)

- Samancore Chrome Limited

- Tata Steel Limited

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In April 2022, Tata Steel completed the acquisition of the Steel Authority of India (SAIL)’s stake in S&T Mining. The acquisition is part of Tata Steel Group’s portfolio restructuring and simplification strategy. This is likely to help the company acquire coal blocks, carry out exploration, obtain regulatory approvals, and licenses, and help in the development of mines, extraction, and mining of coal from identified blocks.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global ferroalloy market based on the below-mentioned segments:

Global Ferroalloy Market, By Product

- Ferrochrome

- Ferromanganese

- Ferro Silico Manganese

- Ferrosilicon

Global Ferroalloy Market, By Application

- Carbon & Low Alloy steel

- Stainless Steel

- Alloy Steel

- Cast Iron

- Others

Global Ferroalloy Market, Regional

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Need help to buy this report?