Global Fertility Test Market Size, Share, and COVID-19 Impact Analysis, By Purchase Mode (Direct/Prescription, OTC, and Online Products), By Product (Ovulation Prediction Kit, Fertility Monitor, Male Fertility Testing Products, and Others), By Sample (Saliva, Urine, Blood, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

Industry: HealthcareGlobal Fertility Test Market Insights Forecasts to 2033

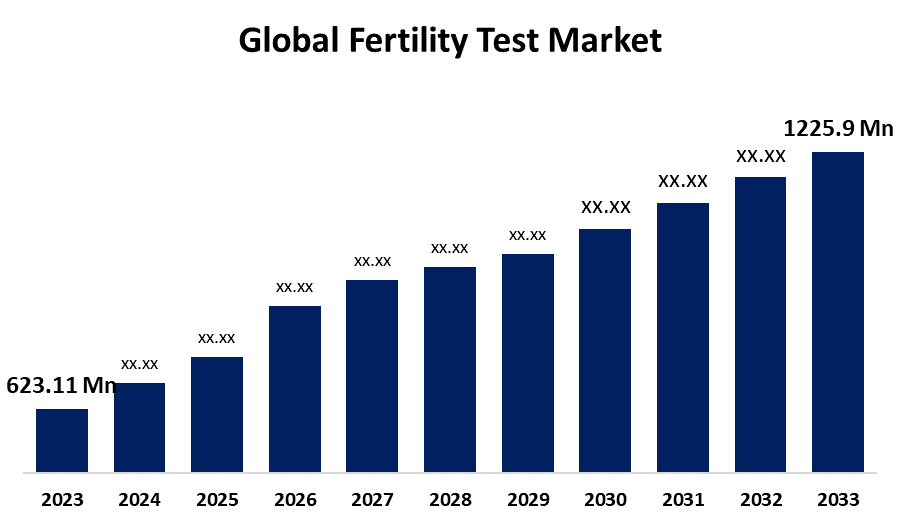

- The Global Fertility Test Market Size was Valued at USD 623.11 Million in 2023

- The Market Size is Growing at a CAGR of 7.26% from 2023 to 2033

- The Worldwide Fertility Test Market Size is Expected to Reach USD 1255.9 Million by 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Fertility Test Market Size is Anticipated to Exceed USD 1255.9 Million by 2033, Growing at a CAGR of 7.26% from 2023 to 2033.

Market Overview

Fertility tests can be used to identify ovulation and infertility, which is the inability to conceive naturally. Men and women both do it to evaluate their fertility and the problems that are related to it. A medical and physical examination called a fertility test examines an individual capacity for naturally becoming pregnant. Growing older is one of the variables that might impair fertility, so if a woman or man is 35 years of age or older and still unable to conceive after six months of trying, they should think about getting tested for fertility. Blood tests, minimally invasive procedures, and a discussion of medical history are all part of the fertility testing process. It mostly includes the ovulation test, which looks for chemicals like progesterone or luteinizing hormone in blood, urine, or saliva. Semen analysis is one of the tests for males to ensure a proper sperm count. The rise in disorders like Polycystic Ovary Syndrome (PCOS), which causes women to ovulate irregularly every month as a result of the ovaries' excessive production of estrogen, is linked to the fertility testing industry boom.

Report Coverage

This research report categorizes the market for the global fertility test market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global fertility test market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global fertility test market.

Global Fertility Test Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 623.11 |

| Forecast Period: | 2023 to 2033 |

| Forecast Period CAGR 2023 to 2033 : | 7.26% |

| 2033 Value Projection: | USD 1255.9 |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 235 |

| Tables, Charts & Figures: | 105 |

| Segments covered: | By Purchase Mode, By Product, By Sample, By Region and COVID-19 Impact Analysis |

| Companies covered:: | Modern Fertility, LetsGetChecked, Proov, Ovuline, YO Home Sperm Test, Roche, Thermo Fisher Scientific, Quest Diagnostics, Fertility Focus, ExSeed Health, learblue, First Response, Mira , and other key vendors |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The expansion of the fertility test industry is connected to an increase in the frequency of conditions like Polycystic Ovary Syndrome (PCOS), which causes women to overproduce estrogen in their ovaries and prevent normal monthly ovulation. The market is growing as a result of a rise in first-time pregnancies among women and a worldwide decrease in fertility rates. Also, the market's growth is helped by rising awareness of fertility testing in both developed and developing nations. Recently, a lot of businesses and groups have organized yearly events and camps to educate individuals about fertility testing. The growing public knowledge of fertility testing equipment is another element propelling the growth of the worldwide market for fertility tests. For example, the population's fertility rate has increased over time as a result of growing knowledge of fertility tests in both developed and developing nations. Several governments and organizations also host activities, such as camps, to educate the public about fertility testing technologies.

Restraining Factors

The high cost of fertility testing monitors is one of the main factors anticipated to impede the growth of the global fertility test market. The fertility monitor is expensive, though. The inability of fertility tests to accurately predict ovulation is another problem impeding the market's expansion. The test finds an increase in LH in the urine, which tells the ovary to start releasing eggs. A precise usage of the monitor can yield 99% accuracy. For women with PCOS, however, the monitor might not provide accurate readings since their levels of the hormones estrogen and LH are either consistently elevated or exhibit several peaks. As a result, the findings might not accurately indicate whether or not the female has ovulated.

Market Segmentation

The global fertility test market share is classified into purchase mode, product, and sample.

- The OTC segment is expected to hold the largest share of the global fertility test market during the forecast period.

Based on the purchase mode, the global fertility test market is divided into direct/prescription, OTC, and online products. Among these, the OTC segment is expected to hold the largest share of the global fertility test market during the forecast Period. The tendency of patients to self-monitor their health issues, the growing number of market participants' efforts to raise awareness about fertility, and the growing desire for test results to be accessible and kept private are all factors contributing to this segment's rapid rise.

- The ovulation prediction kit segment is expected to hold the largest share of the global fertility test market during the forecast period.

Based on the product, the global fertility test market is divided into ovulation prediction kit, fertility monitor, male fertility testing products, and others. Among these, the ovulation prediction kit segment is expected to hold the largest share of the global fertility test market during the forecast period. Ovulation prediction kits are becoming more and more popular among women as a dependable tool to support their family planning journey, as the average age of first-time pregnancies rises and knowledge of fertility testing increases. These kits are widely available in pharmacies, retail establishments, and internet retailers, which contributes to their simplicity of use and market dominance.

- The urine segment is expected to hold the largest share of the global fertility test market during the forecast period.

Based on the sample, the global fertility test market is divided into saliva, urine, blood, and others. Among these, the urine segment is expected to hold the largest share of the global fertility test market during the forecast period. The market is dominated by urine-based tests due to their affordability, ease of use, and broad accessibility. Urine-based fertility tests are in high demand due to the growing trend of ovulation prediction at home and increased knowledge of family planning and reproductive difficulties. Their non-intrusive approach also appeals to a wide spectrum of customers, which strengthens their market dominance.

Regional Segment Analysis of the Global Fertility Test Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the global fertility test market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the global fertility test market over the predicted timeframe. Due to the region's high prevalence of PCOS (Polycystic Ovary Syndrome), a falling fertility rate, rising first-time pregnancy age, and growing use of fertility monitoring devices for contraception, North America is predicted to lead the market. Also, social media, marketing campaigns, and e-commerce sites are contributing to the growing awareness of the advantages of ovulation monitors. North America is the most advanced region in terms of medical developments and the growing need for customized reproductive solutions. Fertility testing has been possible due to the region's exceptional research and healthcare facilities.

Asia Pacific is expected to grow at the fastest pace in the global fertility test market during the forecast period. The Asia-Pacific region is the fastest-growing in this environment, with an exponential rise in the use of fertility testing being driven by a growing population and rising disposable incomes. The Asia-Pacific region is experiencing a massive increase in fertility services, which makes it an exciting and promising location for industry participants. The market is embracing the newest advancements and digital health platforms. These leading and developing areas continue to be at the forefront of the global fertility test market's growth, opening up a plethora of chances and setting the groundwork for improved reproductive health in the future.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global fertility test market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Modern Fertility

- LetsGetChecked

- Proov

- Ovuline

- YO Home Sperm Test

- Roche

- Thermo Fisher Scientific

- Quest Diagnostics

- Fertility Focus

- ExSeed Health

- learblue

- First Response

- Mira

- AVA

- Sema4

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In July 2023, 2San, a reputable global leader in self-diagnostic testing, forged a partnership with Proov to roll out their exclusive, user-friendly at-home fertility tests in handpicked Hy-Vee outlets spanning eight states across the Midwest.

- In August 2023, Trajan Scientific and Medical supplied CE-IVD registered Mitra devices to Fertilly, a German start-up that launched Europe's inaugural At-Home Fertility Test Kits utilizing dried blood microsampling with VAMS technology. Fertilly's kits are medically certified and made accessible to consumers across Europe.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global fertility test market based on the below-mentioned segments:

Global Fertility Test Market, By Purchase Mode

- Direct/Prescription-based products

- OTC-based products

- Online Products

Global Fertility Test Market, By Product

- Ovulation Prediction Kits

- Fertility Monitors

- Male Fertility Testing Products

- Others

Global Fertility Test Market, By Sample

- Saliva

- Urine

- Blood

- Others

Global Fertility Test Market, Regional

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

Which are the key companies that are currently operating within the market?Modern Fertility, LetsGetChecked, Proov, Ovuline, YO Home Sperm Test, Roche, Thermo Fisher Scientific, Quest Diagnostics, Fertility Focus, ExSeed Health, learblue, First Response, Mira, AVA, Sema4, Others.

-

What is the size of the global fertility test market?The global fertility test market is expected to grow from USD 623.11 Million in 2023 to USD 1255.9 Million by 2033, at a CAGR of 7.26% during the forecast period 2023-2033.

-

Which region is holding the largest share of the market?North America is anticipated to hold the largest share of the global fertility test market over the predicted timeframe.

Need help to buy this report?