Global Financial Auditing Professional Services Market Size, Share, and COVID-19 Impact Analysis, By Type (External and Internal), By Offering (Due Diligence, Employee Benefit Plan Audit, Financial Statement Audit, Service Organization Control (SOC) Audit, and Others), By End-use (BFSI, Government, Manufacturing, Healthcare, Retail & Consumer, IT & Telecommunication, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

Industry: Information & TechnologyGlobal Financial Auditing Professional Services Market Insights Forecasts to 2033

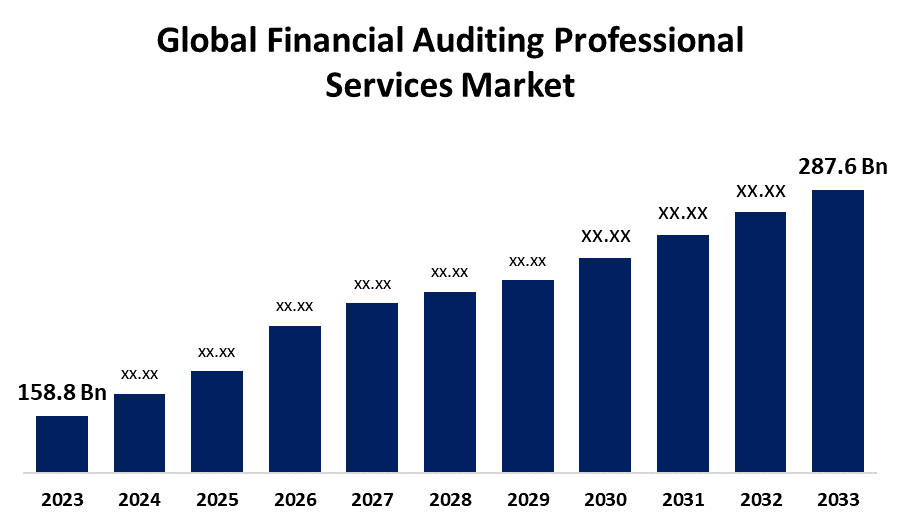

- The Global Financial Auditing Professional Services Market Size Was Estimated at USD 158.8 Billion in 2023

- The Market Size is Expected to Grow at a CAGR of around 6.12% from 2023 to 2033

- The Worldwide Financial Auditing Professional Services Market Size is Expected to Reach USD 287.6 Billion by 2033

- Asia Pacific is Expected to Grow the fastest during the Forecast period.

Get more details on this report -

The Global Financial Auditing Professional Services Market Size is Anticipated to exceed USD 287.6 Billion by 2033, Growing at a CAGR of 6.12% from 2023 to 2033. The market growth is rising due to the complex international transactions, regulatory compliance, and financial fraud risks. Technological advancements and the rising demand for ESG audits further drive the need for specialized auditors and enhanced risk management.

Market Overview

The financial auditing professional services market refers to the industry that offers auditing services to businesses, governments, and other organizations around the world. Auditing is the independent inspection of financial statements, transactions, and internal controls to assure their accuracy, regulatory compliance, and financial reporting integrity.

The global market for professional services related to financial auditing is essential to preserving accountability, transparency, and trust in financial systems around the globe. Auditing services guarantee that businesses adhere to rules, reduce risks, and preserve the accuracy of their financial reporting by offering independent verification of financial statements and internal controls. To make educated judgments, stakeholders, including investors, regulators, and the general public, need these services. High-quality auditing is becoming more and more in demand as organizations deal with more complex financial reporting, which fuels the need for qualified personnel and cutting-edge audit tools.

The market growth is driven by the expanding complexity of financial markets, combined with increased regulatory requirements, which are driving demand for auditing services to ensure compliance and transparency. The surge in financial fraud underlines the importance of robust auditing practices. As global firms grow, auditing specialists play an important role in ensuring financial integrity and complying with foreign rules.

Report Coverage

This research report categorizes the financial auditing professional services market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the financial auditing professional services market. Recent market developments and competitive strategies such as expansion, Type of Software launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the financial auditing professional services market.

Global Financial Auditing Professional Services Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023 : | USD 158.8 Billion |

| Forecast Period: | 2023 – 2033 |

| Forecast Period CAGR 2023 – 2033 : | 6.12% |

| 023 – 2033 Value Projection: | USD 287.6 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 255 |

| Tables, Charts & Figures: | 113 |

| Segments covered: | By Type, By Offering, By End-use |

| Companies covered:: | BDO, Deloitte, Plante Moran, Mazars, PricewaterhouseCoopers, Protiviti, KPMG, McGladrey, Ernst and Young, CohnReznick, Baker Tilly, RSM International, and Others |

| Pitfalls & Challenges: | COVID-19 Impact Analysis and Forecast 2023 - 2033 |

Get more details on this report -

Driving Factors

The financial auditing professional services market is experiencing rapid growth, driven by the complexity of international transactions, the necessity of regulatory compliance, and the growing prevalence of financial fraud. Blockchain and data analytics are two examples of technological innovations that are increasing audit accuracy and efficiency, which is driving market growth. The growing emphasis on sustainability and corporate responsibility is reflected in the rising demand for ESG audits. Specialized auditors are increasingly needed as organizations deal with progressively changing regulatory environments. All things considered, the continuous digital transformation and the requirement for thorough risk management techniques support the sector's expansion.

Restraining Factors

The market growth is hindered by the high costs connected with technological integration might be a deterrent for smaller businesses. The intricacy of ever-changing regulatory compliance adds to the burden, particularly for enterprises operating in numerous jurisdictions. Furthermore, personnel shortages and skill gaps in emerging technologies and data analytics impede businesses' capacity to remain competitive. These issues necessitate continuing investment in resources and skilled individuals to ensure high-quality auditing services.

Market Segmentation

The global financial auditing professional services market is classified into type, offering, and end use.

- The external segment accounted for the largest share in 2023 and is estimated to grow at a remarkable CAGR during the forecast period.

Based on the type, the financial auditing professional services market is categorized into external, internal. Among these, the external segment accounted for the largest share in 2023 and is estimated to grow at a remarkable CAGR during the forecast period. The segmental growth can be attributed to the increasing need for independent financial verification to meet stringent regulatory requirements.

- The financial statement audit segment accounted for the majority of the share in 2023 and is estimated to grow at a remarkable CAGR during the forecast period.

Based on the offering, the financial auditing professional services market is categorized into due diligence, employee benefit plan audit, financial statement audit, service organization control (soc) audit, and others. Among these, the financial statement audit segment accounted for the majority of the share in 2023 and is estimated to grow at a remarkable CAGR during the forecast period. The segmental growth can be attributed to the increasing demand for accurate financial reporting necessitates audits to assure regulatory compliance and stakeholder trust. These audits serve to reduce risks and provide insights into operational improvements. As organizations expand abroad, the complexities of financial reporting highlight the need for independent verification to retain credibility and investor confidence.

- The BFSI segment held the largest share in 2023 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the end use, the financial auditing professional services market is categorized into BFSI, government, manufacturing, healthcare, retail & consumer, it & telecommunication, and others. Among these, the BFSI segment held the largest share in 2023 and is anticipated to grow at a significant CAGR during the forecast period. The segmental growth can be attributed to the financial auditing industry is fueled by stringent regulatory requirements, increased fraud threats, and the complexities of financial transactions. As digital technologies revolutionize the sector, audits are crucial for maintaining compliance and protecting against cyber threats. Proactive auditing measures are critical to ensuring transparency, trust, and regulatory compliance.

Regional Segment Analysis of the Financial Auditing Professional Services Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the financial auditing professional services market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the financial auditing professional services market over the predicted timeframe. The regional growth can be attributed to the existence of international firms and the region's strong regulatory systems. Advanced auditing technologies like artificial intelligence (AI) and data analytics are being used by businesses more and more to guarantee compliance and boost productivity. Additionally, the need for auditing services is driven by the emphasis on risk management and governance, and market expansion is further supported by corporate investments in transparency.

Asia Pacific is expected to grow at the fastest CAGR of the financial auditing professional services market during the forecast period. The rising pace of globalization and economic expansion. Companies must comply with a variety of regulations, which makes expert audits more crucial to ensuring compliance. Additionally, the efficiency and accuracy of audits are increased by the use of digital technologies like blockchain and artificial intelligence.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the financial auditing professional services market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- BDO

- Deloitte

- Plante Moran

- Mazars

- PricewaterhouseCoopers

- Protiviti

- KPMG

- McGladrey

- Ernst and Young

- CohnReznick

- Baker Tilly

- RSM International

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In March 2025, Deloitte announced AI Advantage for CFOs, a platform powered by Amazon Bedrock and Anthropic that aims to transform financial operations. This solution includes Finance Automation Agents, which automate financial operations and collect important insights from a variety of data sources.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the financial auditing professional services market based on the below-mentioned segments

Global Financial Auditing Professional Services Market, By Type

- External

- Internal

Global Financial Auditing Professional Services Market, By Offering

- Due Diligence

- Employee Benefit Plan Audit

- Financial Statement Audit

- Service Organization Control (SOC) Audit

- Others

Global Financial Auditing Professional Services Market, By End-use

- BFSI

- Government

- Manufacturing

- Healthcare

- Retail & Consumer

- IT & Telecommunication

- Others

Global Financial Auditing Professional Services Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the financial auditing professional services market over the forecast period?The financial auditing professional services market is projected to expand at a CAGR of 6.12% during the forecast period.

-

2. What is the market size of the financial auditing professional services market?The Global Financial Auditing Professional Services Market Size is expected to grow from USD 158.8 Billion in 2023 to USD 287.6 Billion by 2033, at a CAGR of 6.12% during the forecast period 2023-2033.

-

3. Which region holds the largest share of the financial auditing professional services market?North America is anticipated to hold the largest share of the financial auditing professional services market over the predicted timeframe.

Need help to buy this report?