Global Fintech Market Size, Share, and COVID-19 Impact Analysis, By Technology (AI, Blockchain, RPA, and Others), By Application (Fraud Monitoring, KYC Verification, and Compliance and Regulatory Support), By End Use (Banks, Financial Institutions, Insurance Companies, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

Industry: Banking & FinancialGlobal Fintech Market Insights Forecasts to 2033

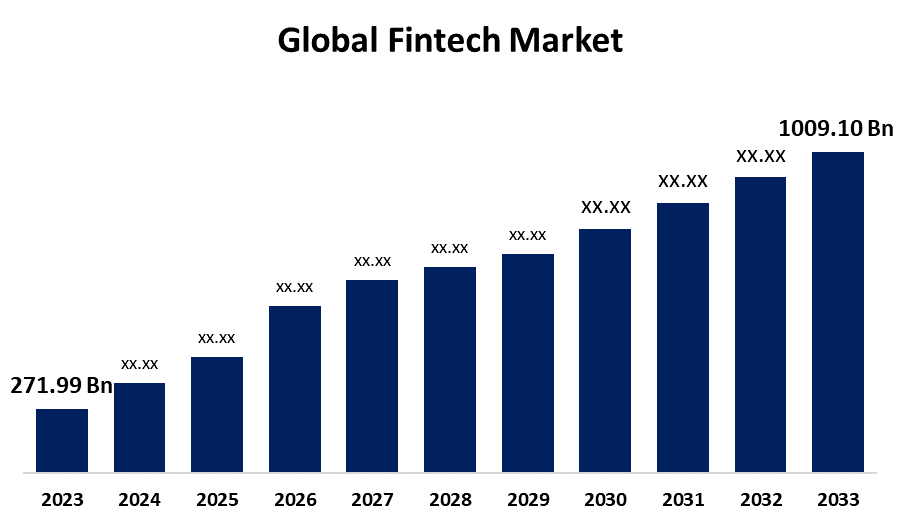

- The Global Fintech Market Size was Valued at USD 271.99 Billion in 2023

- The Market Size is Growing at a CAGR of 14.01% from 2023 to 2033

- The Worldwide Fintech Market Size is Expected to Reach USD 1009.10 Billion by 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Fintech Market Size is Anticipated to Exceed USD 1009.10 Billion by 2033, Growing at a CAGR of 14.01% from 2023 to 2033.

Market Overview

The fintech market raises the connection between financial services and technology. It includes the custom of innovative technologies and digital solutions to provide financial products, services, and processes. Fintech companies influence developments in applications such as mobile apps, artificial intelligence, blockchain, data analytics, and cloud computing to dislocate and advance several features of the financial industry. Fintech companies offer numerous fiscal technology facilities, tools, or solutions to other businesses (B2B) as a service. These services are classically delivered over the cloud, enabling other companies to integrate and utilize financial technology competencies without developing these technologies in-house. Moreover, financial technology providers deliver an extensive range of financial services and technology solutions, encompassing payment processing, peer-to-peer (P2P) lending platforms, fraud detection, blockchain technology, and more solutions. The arrival of open banking and the custom of application programming interfaces (APIs) allows association among fintech companies and traditional financial institutions. This corporation delivers fintech companies with the opportunity to influence traditional banks' data and infrastructure to deliver value-added services, advance innovative solutions, and expand customer experience. In addition, financial technology companies' contribution payment and transaction processing services experienced a growth in demand as e-commerce, contactless payments, and digital wallets became more prevalent during the pandemic. Money transfers and payments play an essential role in the fintech industry, helping as a cornerstone for financial services innovation and digital transformation. Money transfers and payments enable entry to financial services for underserved populations, including the unbanked and underbanked. Fintech innovations in money transfers and payments advance the overall customer experience by providing convenient, efficient, and user-friendly payment solutions.

Report Coverage

This research report categorizes the market for the global fintech market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global fintech market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global fintech market.

Global Fintech Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 271.99 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 14.01% |

| 2033 Value Projection: | USD 1009.10 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 230 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Technology, By Application, By Region, By End Use |

| Companies covered:: | PayPal Holdings, Inc., Block, Inc., Mastercard Incorporated, Envestnet, Inc., Upstart Holdings, Inc., Rapyd Financial Network Ltd., Solid Financial Technologies, Inc., Railsbank Technology Ltd., Synctera Inc., Braintree, Adyen, Plaid Inc., Neo Mena Technologies Ltd., Finastra, and other key companies. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis |

Get more details on this report -

Driving Factors

The formation of innovative fintech solutions has been made conceivable by growths in artificial intellect, blockchain, cloud computing, and big data analytics. The fintech business is growing as a result of these advances, which advance financial services' convenience, security, and efficiency. When it comes to financial services and transactions, customers are becoming more and more contingent on digital platforms. Peer-to-peer lending platforms, robo-advisors, and mobile payment apps are cases of fintech industries that have increased traction owing to customer requirements for easy-to-use, personalized, and manageable financial solutions. New data fortification regulations and open banking programs, among other regulatory developments, have given fintech businesses a chance to challenge traditional financial institutions. The provision of regulations for competition and invention has supported the development of the fintech industry. Underserved groups, such as the unbanked and underbanked, might be able to access financial services. Fintech companies are achieving new market segments and attempting issues associated with the financial enclosure by operating technology to lower prices and increase access. Invention is being propelled and the collection of financial services provided to customers is being extended through partnerships between fintech startups, traditional financial institutions, and technology corporations. Over partnerships and strategic alliances, officers can benefit from startups' access to resources and experience while officers can adventure their fintech expertise

Restraining Factors

Governing guidelines for fintech industries are often complicated and dynamic, and they can vary greatly throughout states. It can be exclusive and time-consuming to fulfill these necessities, specifically for new and smaller industries. Because fintech industries manage private fiscal information, hackers are drawn to them. To protect against fraud, data breaches, and other security risks, it is domineering to keep up strong cybersecurity measures. Acquisition of the beliefs of clients is crucial for fintech corporations, mostly those who offer services related to money management or sensitive fiscal information. Conclusive clients to encirclement innovative fintech solutions and overcoming their cynicism might be quite difficult.

Market Segmentation

The global fintech market share is classified into technology, application, and end-use.

- The blockchain segment is expected to hold the largest share of the global fintech market during the forecast period.

Based on the technology, the global fintech market is divided into AI, blockchain, RPA, and others. Among these, the blockchain segment is expected to hold the largest share of the global fintech market during the forecast period. This is attributed to blockchain providing an enormously secured and absolute ledger, creating it extremely tough for illegal parties to alter or tamper with business information. This advances security in financial transactions, reducing the risk of fraud and data breaches. In addition, transactions recorded on a blockchain are transparent and can be analyzed in real-time by all relevant parties. This transparency improves trust among participants and regulators.

- The fraud monitoring segment is expected to hold the largest share of the global fintech market during the forecast period.

Based on the application, the global fintech market is categorized into fraud monitoring, KYC verification, and compliance and regulatory support. Among these, the fraud monitoring segment is expected to hold the largest share of the global fintech market during the forecast period. This is attributed to fintech solutions offering actual monitoring of financial transactions, allowing the immediate exposure of doubtful events or differences. These services use innovative analytics and machine learning algorithms to identify patterns and trends related to fraudulent activities, enhancing the accuracy of fraud detection. Owing to these features, the segment is projected to retain its dominance during the forecast period.

- The bank segment is expected to hold the largest share of the global fintech market during the forecast period.

Based on the end use, the global fintech market is divided into banks, financial institutions, insurance companies, and others. Among these, the bank segment is expected to hold the largest share of the global fintech market during the forecast period. This is attributed to banks' capability to involve new customers swiftly and smoothly, reducing the time and energy important for account setup. Furthermore, market players are encouragingly contributing with financial technology-qualified banks to provide modern digital payment solutions, as well as mobile wallets and contactless payment, which contributes to the segment's development.

Regional Segment Analysis of the Global Fintech Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the global fintech market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the global fintech market over the predicted timeframe. This is attributed to North America, mostly Silicon Valley is a worldwide center for fintech innovation. Financial technology influences this environment to determine constant innovation in financial services. The increasing demand for customization, regulatory compliance, cross-selling opportunities, and fintech industry trends are some of the crucial factors pouring market growth in the region. North America is home to some of the world's foremost financial centers, including New York City and Silicon Valley, which substitute a vibrant fintech ecosystem. This region boasts a robust infrastructure, innovative technological capabilities, and a highly advanced financial sector, making it an ideal environment for fintech innovation and development. The awareness of venture capital firms, tech startups, and financial institutions in North America delivers a productive ground for developing and implementing FinTech as a service solution. North America has a huge and tech-savvy population that voluntarily encirclements digital financial services. The region's high internet and smartphone saturation rates and a robust culture of online commerce and digital payments make a favorable market for fintech solutions.

Asia Pacific is expected to grow at the fastest pace in the global fintech market during the forecast period. This is attributed to fintech services' increased access to financial products and services, predominantly in underserved and unbanked areas of the Asia Pacific region. Numerous countries in the region, such as China, South Korea, Japan, and India are mobile-first markets, and financial technology facilities provide high mobile saturation, creation financial services more accessible. Asia-Pacific is going through vigorous development and growing demand in the fintech market, obsessed with several key factors. Primarily, the region's swiftly growing digital economy, powered by rising Internet and smartphone saturation, is making a rich ground for fintech innovation and adoption. With a huge population of digitally savvy customers, there is a rising demand for convenient and accessible financial services provided through digital channels.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global fintech market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- PayPal Holdings, Inc.

- Block, Inc.

- Mastercard Incorporated

- Envestnet, Inc.

- Upstart Holdings, Inc.

- Rapyd Financial Network Ltd.

- Solid Financial Technologies, Inc.

- Railsbank Technology Ltd.

- Synctera Inc.

- Braintree

- Adyen

- Plaid Inc.

- Neo Mena Technologies Ltd.

- Finastra

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In January 2024, FIS established the FIS Fintech Hangout Series, an inventiveness to encourage and join fintech startups, FIS professionals, financial institutions, investors, and contributors in the FIS Fintech Accelerator Program. In this series, the corporation shares its best performance and highlights the great work of contributing to fintech companies.

- In March 2023, MANGOPAY and PayPal extended their long-term strategic association to stretch marketplaces' immediate access to PayPal's international payment abilities.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global fintech market based on the below-mentioned segments:

Global Fintech Market, By Technology

- AI

- Blockchain

- RPA

- Others

Global Fintech Market, By Application

- Fraud Monitoring

- KYC Verification

- Compliance and Regulatory Support

Global Fintech Market, By End-Use

- Banks

- Financial Institutions

- Insurance Companies

- Others

Global Fintech Market, Regional

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. Which are the key companies that are currently operating within the market?PayPal Holdings, Inc., Block, Inc., Mastercard Incorporated, Envestnet, Inc., Upstart Holdings, Inc., Rapyd Financial Network Ltd., Solid Financial Technologies, Inc., Railsbank Technology Ltd., Synctera Inc., Braintree, Adyen, Plaid Inc., Neo Mena Technologies Ltd., Finastra, and others.

-

2. What is the size of the global fintech market?The Global Fintech Market is expected to grow from USD 271.99 Billion in 2023 to USD 1009.10 Billion by 2033, at a CAGR of 14.01% during the forecast period 2023-2033.

-

3. Which region is holding the largest share of the market?North America is anticipated to hold the largest share of the global fintech market over the predicted timeframe.

Need help to buy this report?