Global Flame Retardant Market Size, Share, and COVID-19 Impact Analysis, By Type (Aluminum Trihydrate, Antimony Oxide, Brominated), By Application (Epoxy, Polyolefin, Unsaturated Polyester), By End-Use (Building & Construction, Electronics & Appliances), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Chemicals & MaterialsGlobal Flame Retardant Market Size Insights Forecasts to 2033.

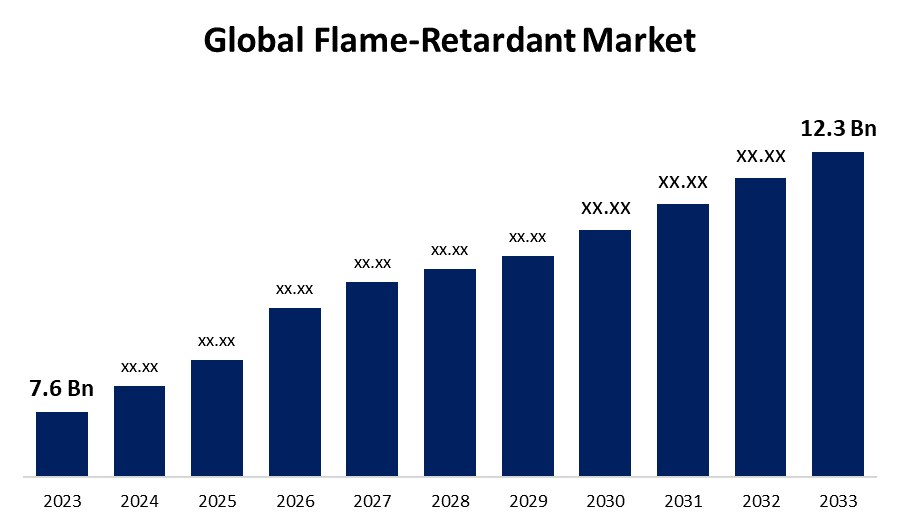

- The Global Flame Retardant Market Size was Valued at USD 7.6 Billion in 2023.

- The Market Size is Growing at a CAGR of 4.93% from 2023 to 2033.

- The Worldwide Flame Retardant Market Size is Expected to Reach USD 12.3 Billion by 2033.

- Europe is expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Flame Retardant Market Size is Anticipated to Exceed USD 12.3 Billion by 2033, Growing at a CAGR of 4.93% from 2023 to 2033.

Market Overview

Flame retardants are substances that are added to combustible materials such as clothing, plastics, and coatings to either prevent or slow the spread of fires. These are a range of chemicals with various molecular arrangements and unique physical and chemical characteristics. These substances are incorporated as copolymers or as additives to the products during the polymerization process. To make textiles flame-resistant, flame retardants are added to polyester, nylon, and polypropylene fabrics. Flame-retardant wire and cable jacketing, small appliances, lawn and garden tools, furniture parts, toys, and kitchenware are all made of polypropylene. By the restriction of hazardous substances (RoHS), flame retardants are added to thermoplastic vulcanizate elastomers in smaller amounts to increase the material's heat resistance to ignition and reduce the rate at which a flame spreads. The use of flame retardants as additives throughout the process keeps little fires from turning into catastrophic disasters. The need for a wide range of electrical and electronic equipment increased due to technological breakthroughs and R&D activity. The plastic shells of electronic devices sometimes contain flame retardants, which improve product safety by averting short circuits and component overheating. This is one of the main factors propelling the market for flame retardants upward. In addition, the building and construction industry has experienced a notable expansion due to factors including population growth, urbanization, and increased government spending.

Report Coverage

This research report categorizes the market for the global flame retardant based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global flame retardant. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global flame retardant market.

Global Flame Retardant Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023 : | USD 7.6 Billion |

| Forecast Period: | 2023 – 2033 |

| Forecast Period CAGR 2023 – 2033 : | 4.93% |

| 023 – 2033 Value Projection: | USD 12.3 Billion |

| Historical Data for: | 2019 - 2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Application, By End-Use, By Region |

| Companies covered:: | Aluminum trihydrate (ATH), Antimony Oxide, Brominated, Chlorinated, Phosphorus, Nitrogen, Albemarle Corporation, ICL, LANXESS, CLARIANT, Italmatch Chemicals S.p.A, Huber Engineered Materials, BASF SE, THOR, DSM, FRX Innovations, DuPont, and Others Key Vendors |

| Pitfalls & Challenges: | Covid-19 Impact, Challenge, Future,Growth and Analysis |

Get more details on this report -

Driving Factors

The demand for flame retardants across a variety of industries is, in fact, significantly fueled by strict fire safety norms and laws. The use of flame retardants in specific applications is required by strict fire safety guidelines and regulations that are frequently established by government organizations and industry-specific regulatory bodies. To guarantee the security of their goods and business practices, companies and manufacturers need to abide by these regulations. Regulations about fire safety and building standards are especially crucial to the construction industry. The fire performance requirements for building materials are outlined in these standards, which typically mandate the use of flame-retardant materials in vulnerable areas such as wiring, insulation, and structural components. The global market for flame retardants is driven by all these factors.

Restraining Factors

The environment and public health have been connected to traditional flame retardants, particularly those that use bromine or chlorine. These chemicals can build up within living things, persist in the environment, and disrupt ecosystems. Concerns about these harmful effects on the environment have led to regulation limitations and a shift towards more environmentally friendly solutions.

Market Segmentation

The global flame-retardant share is classified into type, application, and end-use.

- The alumina trihydrate segment is expected to hold the highest market share of the global flame retardant during the forecast period.

Based on the type, the global flame retardant is divided into aluminum trihydrate, antimony oxide, and brominated. Among these, the alumina trihydrate segment is expected to hold the highest market share of the global flame retardant during the forecast period. This is attributed to the excellent flame retardant and smoke-suppressive qualities of alumina trihydrate, which are due to its thermodynamic properties, make it ideal for fire retardancy applications in a variety of end-use industries, such as electronics and chemicals, where processing temperatures are below 220°C. This element hastened the segment's rise in the worldwide market.

- The polyolefin segment is expected to hold the largest market share of the global flame retardant during the forecast period.

Based on the application, the global flame retardant is divided into epoxy, polyolefin, and unsaturated polyester. Among these, the polyolefin segment is expected to hold the largest share of the global flame retardant during the forecast period. This is attributed to industries such as the production of machinery and equipment, where fire safety is an issue. In the energy and utilities sector, flame-retardant polyolefins are used in power cables and insulating materials to ensure the safe transport of electricity. The market for flame retardants in polyolefin applications is driven by the growing demand for wires and cables in the end-use industry.

- The electronics segment is expected to hold the largest market share of the global flame retardant during the forecast period.

Based on the end use, the global flame retardant is divided into building & construction, electronics & appliances. Among these, electronics is expected to hold the largest market share of the global flame retardant during the forecast period. This is attributed to growing public demand for the newest electronic products, such as laptops, tablets, smartphones, and others, where flame retardants are employed in the manufacturing process to prevent chemicals from leaking into the environment or perhaps harming consumers' health.

Regional Segment Analysis of the Global flame retardant

- North America (U.S., Canada, Mexico)

- Europe (Global, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia-Pacific is anticipated to hold the largest share of the global flame retardant over the predicted timeframe.

Get more details on this report -

Asia-Pacific is anticipated to hold the largest share of the global flame retardant over the predicted timeframe. Regulatory agencies and governments around the Asia Pacific region are enforcing and implementing stricter environmental and safety regulations. These regulations usually mandate flame retardants for a wide range of products and industries. The need for flame-retardant materials in common consumer items has been driven by rising public knowledge of fire safety and the possible risks associated with non-flame-retardant products. The need for flame retardants in the Asia-Pacific area is generally closely tied to the region's rapid industrialization, urbanization, and increased emphasis on safety and regulatory compliance across numerous industries.

Europe is expected to grow the fastest during the forecast period. Rising automotive product demand and benevolent government policies drive the expansion of the sector. The market in Europe will grow because of the presence of significant automakers and national laws that emphasize the usage of fire retardants in-vehicle components.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global flame retardant along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Aluminum trihydrate (ATH)

- Antimony Oxide

- Brominated

- Chlorinated

- Phosphorus

- Nitrogen

- Albemarle Corporation

- ICL

- LANXESS

- CLARIANT

- Italmatch Chemicals S.p.A

- Huber Engineered Materials

- BASF SE

- THOR

- DSM

- FRX Innovations

- DuPont

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In September 2022, LANXESS introduced novel flame retardants based on phosphorus that are compatible with engineering plastics and have special qualities including mechanical and thermal stability.

- In July 2022, THOR GmBH, a firm specializing in firefighting products, and BASF SE cooperated. The non-halogenated flame retardant additive product line will be strengthened by this calculated approach.

Market Segment

This study forecasts revenue at regional, and country levels from 2022 to 2033. Spherical Insights has segmented the global flame retardant based on the below-mentioned segments:

Global Flame Retardant, By Type

- Aluminum Trihydrate

- Antimony Oxide

- Brominated

Global Flame Retardant, By Application

- Epoxy

- Polyolefin

- Unsaturated Polyester

Global Flame Retardant, By End-Use

- Building & Construction

- Electronics & Appliances

Global Flame Retardant, By Region

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the flame retardant?Chemicals known as flame retardants are added to flammable materials, including fabrics, plastics, and coatings, to either extinguish a fire or delay its spread. These are a range of chemicals with various molecular arrangements and unique physical and chemical characteristics. These substances are incorporated as copolymers or as additives to the products during the polymerization process.

-

2. What are the segments of the flame-retardant market?The Global Flame Retardant Market is segmented into type, application, and end-use.

-

3. What is the value of the market in 2023?In 2023, the global market for flame-retardant was estimated to be worth USD 7.6 billion.

Need help to buy this report?