Global Flanges Market Size, Share, and COVID-19 Impact Analysis, By Type (Slip-on, Socket Weld, Threaded), By Material (Carbon Steel, Aluminium, Stainless Steel, Others), By End Use Industry (Automotive, Oil & Gas, Manufacturing, HVAC, Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 – 2032.

Industry: Construction & ManufacturingGlobal Flanges Market Insights Forecasts to 2032

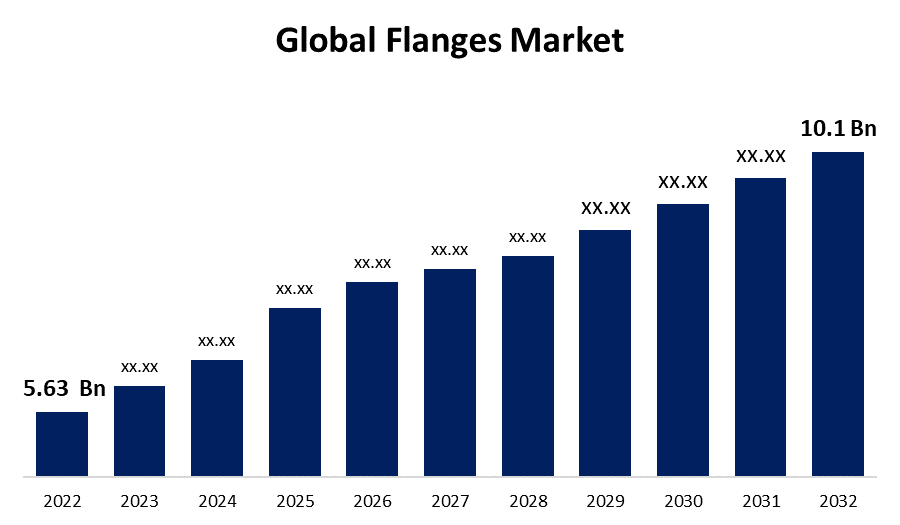

- The Global Flanges Market Size was valued at USD 5.63 Billion in 2022.

- The Market is Growing at a CAGR of 6.1% from 2022 to 2032

- The Worldwide Flanges Market Size is expected to reach USD 10.1 Billion by 2032

- North America is expected to Grow the fastest during the forecast period

Get more details on this report -

The Global Flanges Market Size is expected to reach USD 10.1 Billion by 2032, at a CAGR of 6.1% during the forecast period 2022 to 2032.

Flanges, or rims, are symmetrical disc-like components used to join or connect pipes, containers, or fixed-shaft mechanical parts. These disc-shaped parts are most commonly found in plumbing and are usually used in pairs. They connect piping connections to different pieces of machinery as a sort of safety system. The second most widely used connecting method available today, flanges, has several advantages for the system in which they are used. Its composition varies depending on where it will be used, but it can include brass, copper, and iron. One of them is that it facilitates pipe system maintenance by allowing for adaptability. With the increase in energy production activities, the global flanges market has been growing steadily in the past few years. Furthermore, solar energy and hydroelectricity are the two major factors driving the power generation industry's continuous growth. The increasing rate of urbanization and population, as well as the resulting need to invest in water infrastructure to ensure adequate drinking water and wastewater management, will influence flange demand. According to UNICEF, over two billion people are living in countries with insufficient water supply. Rising use of pipe joining to facilitate easy installation, maintenance, and disassembly in wastewater systems to meet the growing need for regular inspection and repair will contribute to market development.

Global Flanges Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 5.63 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 6.1% |

| 2032 Value Projection: | USD 10.1 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Type, By Material, By End Use, By Region and COVID-19 Impact Analysis |

| Companies covered:: | General Flange & Forge LLC, Mass Global Group, Metalfar Prodotti Industriali S.P.A., Outokumpu Armetal Stainless Pipe Co. Ltd (OASP), Pro-Flange, Sandvik Ab, Texas Flange, AFG Holdings, Inc., Coastal Flange, Inc., Flanschenwerk Bebitz Gmbh, SSI Technologies, Inc, Kerkau Manufacturing,, Qontrol Devices, Inc., Kohler Corporation, and Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Global industrial production growth is one of the primary factors of the flanges market growth. Many countries' economies depend heavily on industrial production. As a result, flanges are in high demand across all industries. Furthermore, the expansion of oil and gas exploration activities around the world boosted market growth. According to Urge Wald’s latest data project, the Global Oil & Gas Exit List (GOGEL), 512 oil and gas companies are currently taking active measures to bring 230 billion containers of oil equivalent of untapped resources into production before 2030. Additionally, the petrochemical sector, power generation, and mining are projected to rise rapidly because the use of flanges in this sector can provide many advantages to valve metering devices as well as separate segments of piping. To reduce overall vehicle mass, new manufacturing techniques and novel materials are being used to create lightweight flanges.

Restraining Factors

Even though flanges are used in a wide range of industries, numerous factors are impeding the growth of the global flanges market. The most common issue with flanges is leakage. This occurs when the load on the gasket falls below the minimum seal pressure. Flanges are required to be leak-free and to maintain a leak rate of 500 PPM or less under EPA regulations for fugitive emissions. Furthermore, flange producers might find it difficult to keep up with changing industry standards and regulations. Companies must constantly adjust their production methods and specifications for goods to meet changing needs as pipeline safety, environmental impact, and product quality regulations change.

Market Segmentation

By Type Insights

The socket weld segment dominates the market with the largest revenue share over the forecast period.

On the basis of type, the global flanges market is segmented into slip-on, socket weld, and threaded. Among these, the socket weld segment is dominating the market with the largest revenue share over the forecast period. Socket welds the less stringent dimensional requirements, and socket weld fittings are less expensive to install than others. Typically used on smaller-diameter high-pressure pipes and connect pipes by inserting the pipe into the socket end and sealing the top with fillet welding. This allows for a smooth bore and better fluid or gas flow within the pipe.

By Material Insights

The stainless-steel segment is witnessing significant CAGR growth over the forecast period.

On the basis of material, the global flanges market is segmented into carbon steel, aluminum, stainless steel, and others. Among these, the stainless-steel segment is witnessing significant growth over the forecast period. Water, oil and gas, food and beverage, and transportation industries all rely on stainless steel flanges. Stainless steel flanges also have several advantages, including corrosion and stain resistance. Stainless steel flanges are resistant to corrosion in a wide range of atmospheric surroundings and corrosive media.

By End Use Industry Insights

The oil & gas segment is expected to hold the largest share of the Global Flanges Market during the forecast period.

Based on the end-use industry, the global flanges market is classified into automotive, oil and gas, manufacturing, HVAC, and others. Among these, the oil & gas segment is expected to hold the largest share of the Flanges market during the forecast period. Flanges are becoming more popular in oil and gas applications because they are necessary components for connecting valves and pipes to create a secure and leak-proof connection between different sections of vessels, pipelines, or other infrastructure. The increasing use of forged flanges in oil and gas pipelines will drive segment growth.

Regional Insights

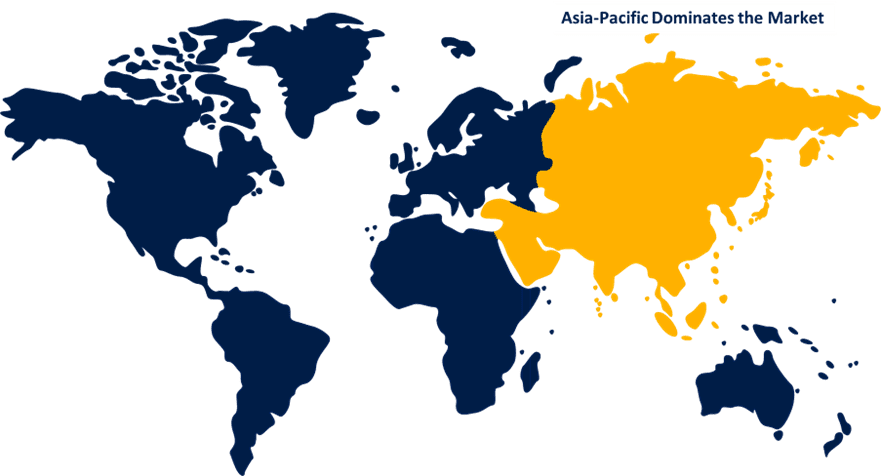

Asia Pacific dominates the market with the largest market share over the forecast period.

Get more details on this report -

Asia Pacific is dominating the market with the largest market share over the forecast period. One of the primary factors for the demand for market growth is the presence of several key flange manufacturers all over the region. Countries such as India and China are rapidly industrializing, which is increasing the demand for energy and power. As a result, there is an increase in demand for energy and power industry accessories such as flanges. In addition, the region's construction sector is expanding as a result of the region's rapidly growing population, urbanization, and infrastructure development. Flanges, which are used in pipes, tanks, and other equipment, were among the many components required by the construction industry.

North America is expected to grow the fastest during the forecast period. A robust expansion and growth of the petrochemical industry in the United States, fuelled by increased crude oil exploration and production in the country and the food & processing segment also has the largest consumers for flanges in this region. These factors play an important role in influencing crude oil demand in the region. The flange replacements and rehabilitation in the oil industry for processing crudes will also boost the industry expansion. The transformation in the oil refinery process of the crudes will further drive the flanges market growth over the forecast period.

The Europe market is expected to register a substantial growth rate during the forecast period. Increasing emphasis is placed on infrastructure development and construction activities, particularly in emerging economies, which necessitate extensive pipeline networks, fuelling demand for flanges.

List of Key Market Players

- General Flange & Forge LLC

- Mass Global Group

- Metalfar Prodotti Industriali S.P.A.

- Outokumpu Armetal Stainless Pipe Co. Ltd (OASP)

- Pro-Flange

- Sandvik Ab

- Texas Flange

- AFG Holdings, Inc.

- Coastal Flange, Inc.

- Flanschenwerk Bebitz Gmbh

- SSI Technologies, Inc

- Kerkau Manufacturing,

- Qontrol Devices, Inc.

- Kohler Corporation

Key Market Developments

- In June 2021, AFG Holdings, Inc. purchased Maass Global Group's North American assets, including its businesses in Canada and Mexico, to offer combined bundling opportunities through a unified supply chain at a lower cost.

- In May 2021, Hitachi Metals debuted Class150, a new flanged double offset ball valve for solids such as wastewater, powders, slurry, and ashes.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2032. Spherical Insights has segmented the Global Flanges Market based on the below-mentioned segments:

Flanges Market, Type Analysis

- Slip-on

- Socket Weld

- Threaded

Flanges Market, Material Analysis

- Carbon Steel

- Aluminium

- Stainless Steel

- Others

Flanges Market, End-Use Industry Analysis

- Automotive

- Oil and Gas

- Manufacturing

- HVAC

- Others

Flanges Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Need help to buy this report?