Global Flare Monitoring Market Size, Share, and COVID-19 Impact Analysis, By Mounting Method (In-process and Remote), By Industry (Refineries, Petrochemicals, Onshore Oil & Gas Production Sites, Landfills, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

Industry: Information & TechnologyGlobal Flare Monitoring Market Insights Forecasts to 2033

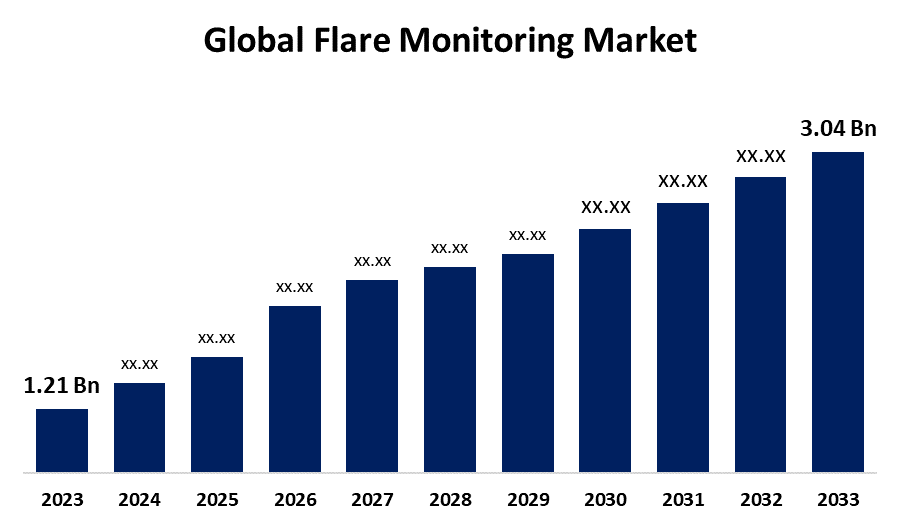

- The Global Flare Monitoring Market Size Was Estimated at USD 1.21 Billion in 2023

- The Market Size is Expected to Grow at a CAGR of around 9.65% from 2023 to 2033

- The Worldwide Flare Monitoring Market Size is Expected to Reach USD 3.04 Billion by 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Flare Monitoring Market Size is anticipated to exceed USD 3.04 Billion by 2033, Growing at a CAGR of 9.65% from 2023 to 2033. The market growth is rising due to the stricter environmental regulations and technological advancements. Enhanced efficiency, predictive maintenance, and regulatory compliance are driving widespread adoption across various industries.

Market Overview

The flare monitoring market refers to the sector that offers systems, methods, and solutions for tracking and evaluating flare systems utilized in industrial operations. Flare systems are crucial for properly burning off excess gases using flare stacks, which are frequently found in refineries, chemical plants, and natural gas facilities. The tools that track vital data, including gas composition, flame temperature, pressure, and emissions in real time, are the main focus of the flare monitoring market.

The main function of the global flare monitoring market is to oversee and control flare systems in sectors including refineries, petrochemicals, and oil and gas. By identifying gas flaring occurrences and emissions, these systems are crucial for maintaining operational efficiency, safety, and compliance. Flare monitoring helps businesses limit their impact on the environment, optimize their use of resources, and cut costs related to excessive flaring by giving them real-time data on flare activity. The need for sophisticated flare monitoring systems keeps increasing as environmental restrictions become more stringent. The market for flare monitoring is being driven by tighter environmental restrictions and the increasing requirement for precise waste gas combustion management. The market is also expanding as a result of improvements in wireless networks and their use in the petrochemical, gas, and oil industries.

Report Coverage

This research report categorizes the flare monitoring market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the flare monitoring market. Recent market developments and competitive strategies such as expansion, Type of Software launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the flare monitoring market.

Global Flare Monitoring Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023 : | USD 1.21Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 9.65% |

| 2033 Value Projection: | USD 3.04 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 250 |

| Tables, Charts & Figures: | 114 |

| Segments covered: | By Mounting Method, By Industry, |

| Companies covered:: | Ametek Inc., Advanced Energy, Emerson Electric Co., Fluenta, John Zink Company, LLC, Honeywell International Inc., Thermo Fisher Scientific Inc., Zeeco, Inc., Teledyne FLIR LLC, Baker Hughes Company, and Others |

| Pitfalls & Challenges: | COVID-19 Impact Analysis and Forecast 2023 - 2033 |

Get more details on this report -

Driving Factors

The flare monitoring market is experiencing rapid growth, driven by stricter environmental restrictions, and the requirement for exact control over waste gas combustion is driving growth in the flare monitoring industry. Efficiency and dependability are increasing due to technological developments like more precise sensors and remote monitoring features. Increasingly, investments in sophisticated monitoring technologies are being driven by the need to comply with revised laws, such as those issued by the EPA. Businesses can reduce downtime by using predictive maintenance with the use of advanced analytics integration. Flare monitoring systems are becoming widely adopted throughout sectors as a result of these trends.

Restraining Factors

The market growth is hindered by the high expenses of installing and maintaining flare maintenance systems. Infrared cameras and continuous emission monitoring systems (CEMS) are examples of advanced technologies that come with a high upfront cost and continuing maintenance requirements. Additionally, these systems are frequently set up in difficult-to-reach places, including high altitudes or dangerous areas, which raises the complexity and deployment costs. Furthermore, issues with data dependability and correctness may make market expansion much more difficult.

Market Segmentation

The global Flare Monitoring market is classified into mounting method and industry.

- The in-process segment accounted for the largest share in 2023 and is estimated to grow at a remarkable CAGR during the forecast period.

Based on the mounting method, the flare monitoring market is categorized into in-process and remote. Among these, the in-process segment accounted for the largest share in 2023 and is estimated to grow at a remarkable CAGR during the forecast period. The segmental growth can be attributed to the need for real-time data collecting, which provides instantaneous insights regarding flare performance. Miniaturization and sensor technology advancements have made it easier to include high-precision monitoring devices into current systems. By improving operational efficiency and monitoring accuracy, these elements are helping the segment grow.

- The refineries segment held the largest share in 2023 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the industry, the flare monitoring market is categorized into refineries, petrochemicals, onshore oil & gas production sites, landfills, and others. Among these, the refineries segment held the largest share in 2023 and is anticipated to grow at a significant CAGR during the forecast period. The segmental growth can be attributed to the refineries' processes and refining petroleum products, which are subject to strict restrictions and substantial operational risks with their flare systems. Refineries must have efficient flare monitoring to maximize flare performance, avoid hazardous emissions, and guarantee compliance with environmental standards. Significant investment in flare-monitoring devices is driven by the need for accurate, ongoing monitoring to prevent operational disruptions and reduce the possibility of expensive fines.

Regional Segment Analysis of the Flare Monitoring Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

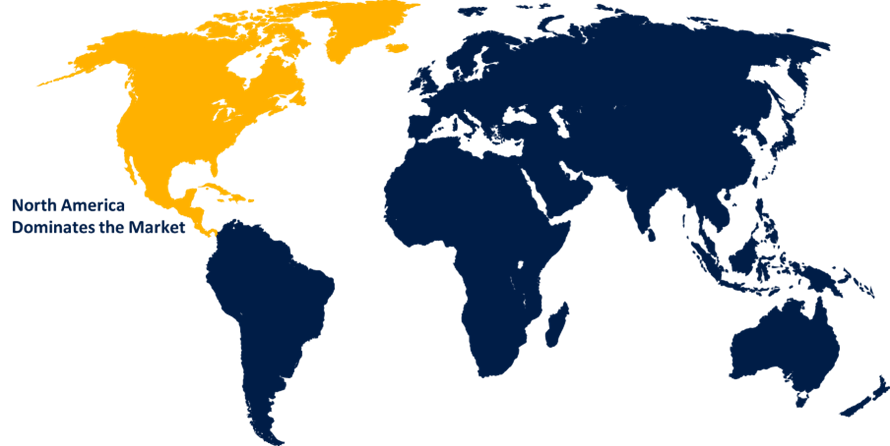

North America is anticipated to hold the largest share of the flare monitoring market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the flare monitoring market over the predicted timeframe. The regional growth can be attributed to the need for flare monitoring systems in North America is being driven by strict environmental restrictions and an emphasis on technical improvements. The adoption of these systems is further supported by the region's sustainability initiatives and improvements in energy infrastructure. Consequently, North America is at the forefront of the worldwide flare monitoring industry.

Asia Pacific is expected to grow at the fastest CAGR of the flare monitoring market during the forecast period. The region's growth is being driven by growing industrial activity and heightened regulatory attention to environmental protection are the main drivers of the market's expansion. With sizable oil, gas, and petrochemical industries, nations like China, Japan, and India are making large investments in cutting-edge flare monitoring equipment to meet new rules and address growing environmental concerns. The requirement for efficient emissions control systems is fueled by the region's fast industrialization and economic expansion, which in turn propels market expansion.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the flare monitoring market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Ametek Inc.

- Advanced Energy

- Emerson Electric Co.

- Fluenta

- John Zink Company, LLC

- Honeywell International Inc.

- Thermo Fisher Scientific Inc.

- Zeeco, Inc.

- Teledyne FLIR LLC

- Baker Hughes Company

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In July 2024, JP3 Measurement, a wholly owned subsidiary of Flotek Industries that provides unique analytical measurement solutions, announced today that the Environmental Protection Agency (EPA) has approved its system for compliance with the most recent flare standards. This cutting-edge optical device was designed to accurately detect Net Heating Values (NHV) in flare gases. This certification helps the oil and gas industry achieve more efficient and greener operations.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the flare monitoring market based on the below-mentioned segments

Global Flare Monitoring Market, By Mounting Method

- In-process

- Remote

Global Flare Monitoring Market, By Industry

- Refineries

- Petrochemicals

- Onshore Oil & Gas Production Sites

- Landfills

- Others

Global Flare Monitoring Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the flare monitoring market over the forecast period?The flare monitoring market is projected to expand at a CAGR of 9.65% during the forecast period.

-

2. What is the market size of the flare monitoring market?The Global Flare Monitoring Market Size is expected to grow from USD 1.21Billion in 2023 to USD 3.04 Billion by 2033, at a CAGR of 9.65% during the forecast period 2023-2033.

-

3. Which region holds the largest share of the flare monitoring market?North America is anticipated to hold the largest share of the flare monitoring market over the predicted timeframe.

Need help to buy this report?