Global Flat Flexible Cables Market Size, Share, and COVID-19 Impact Analysis, By Copper Wire Thickness (Less than 35 Microns, 35 to 50 Microns, 50 to 100 Microns, more than 100 Microns), By Copper Wire Width (<= 1 mm, 1 to 3 mm, 3 mm <=), By End-Use Applications (Consumer Electronics, Industrial Systems, Medical Devices, Automotive, IT Equipment, Telecommunications, Household Equipment, Aerospace & Defense Electronics, Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 – 2032

Industry: Semiconductors & ElectronicsGlobal Flat Flexible Cables Market Insights Forecasts to 2032

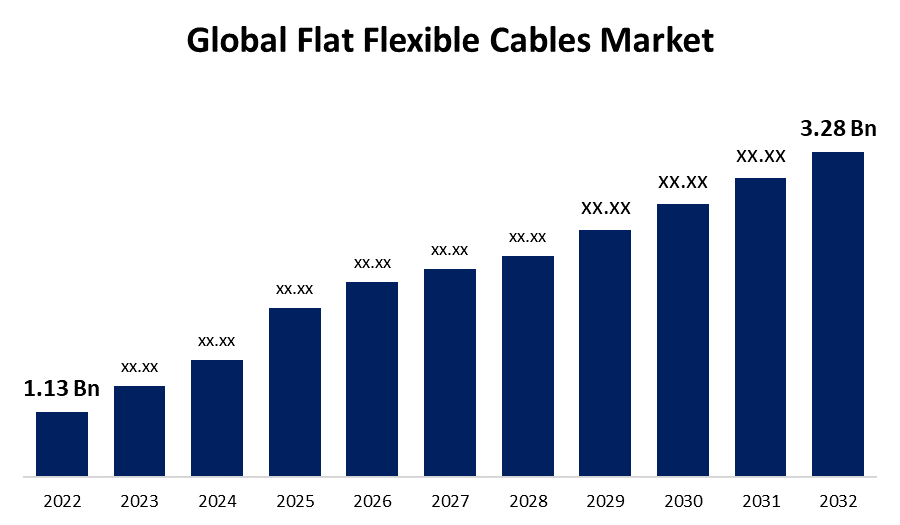

- The Global Flat Flexible Cables Market Size was valued at USD 1.13 Billion in 2022.

- The Market Size is Growing at a CAGR of 11.27% from 2022 to 2032

- The Worldwide Flat Flexible Cables Market Size is expected to reach USD 3.28 Billion by 2032

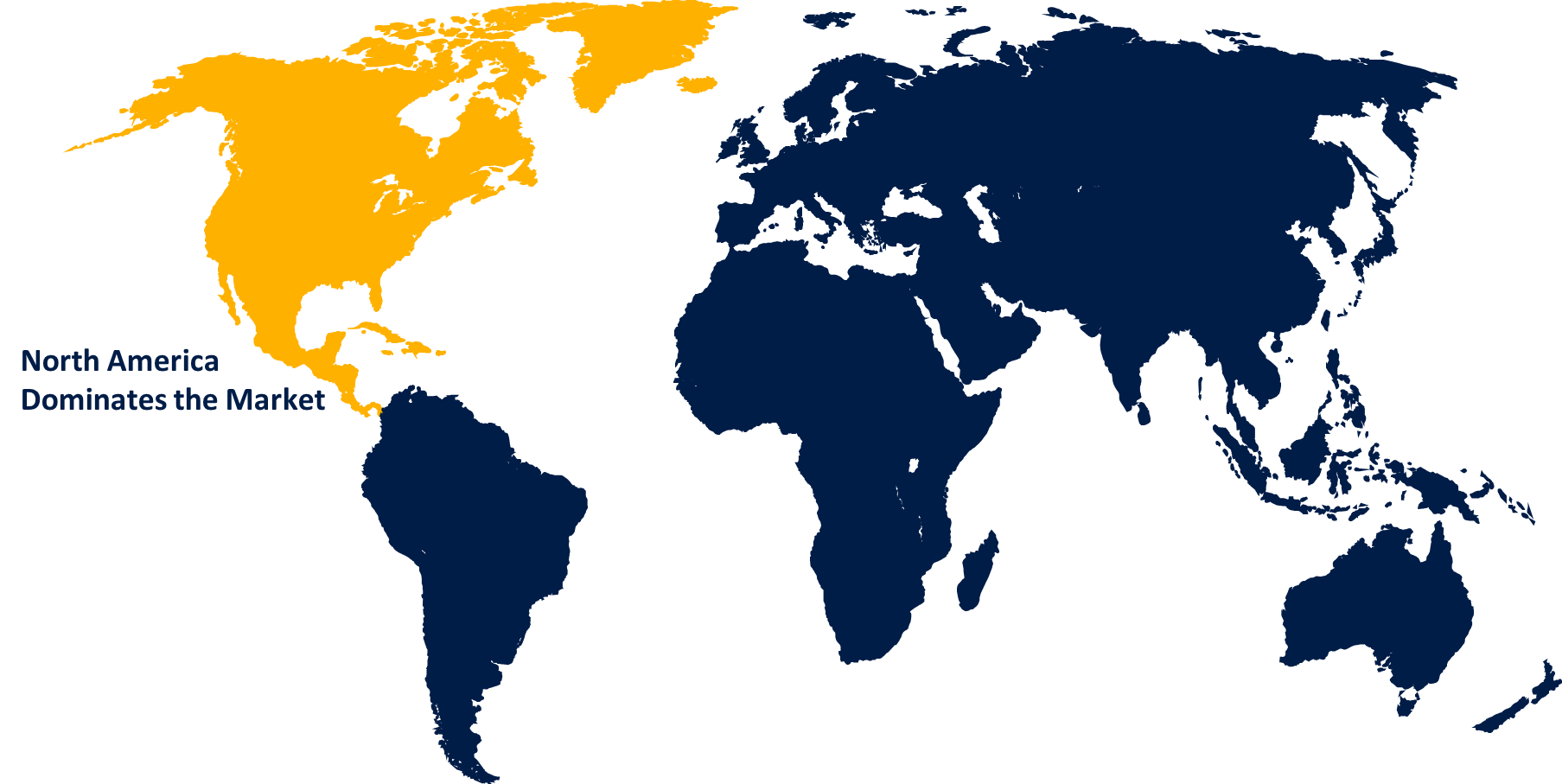

- North America is expected to Grow the fastest during the forecast period

Get more details on this report -

The Global Flat Flexible Cables Market Size is expected to reach USD 3.28 Billion by 2032, at a CAGR of 11.27% during the forecast period 2022 to 2032.

FFC, or flat flexible cable, is any type of electrical conduit that is both flat and flexible, with flattened uniform conductors. Flexible flat cable is an example of flexible electronics. Flat flexible cable is a miniature version of ribbon cable, both of which are flat and flexible. The cable is often made up of a flat, flexible plastic film substrate with several flat metallic conductors connected to one surface. FFCs are typically straight connections with no additional components. They tend to occupy less space than circular cables, and they frequently provide better EMI/RFI suppression and eliminate wire-coupling difficulties. In addition, because the wires are covered individually rather than repeatedly wrapped in different materials as circular cables are, they are less in weight and enable more flexibility. It is commonly found in computers, cell phones, and other high-density electronic devices. Flat flexible cables are now commonly utilized in printer head-to-motherboard connections, plotters, scanners, copiers, stereos, LCD appliances, fax machines, DVD players, signal transmission, and plate board connections. FFC Cables are nearly omnipresent in modern electrical equipment. The downsizing trend in electronics is a major driver of the growing need for flat flexible cable. Traditional wiring connections and bulky connectors are no longer viable for merging with components as electronics become lighter and more compact. Because of their flexibility, they are excellent for applications such as smartphones, tablets, wearable devices, and digital cameras. The electronics sector is a significant contributor to the demand for flat flexible cables. Given its advantageous qualities, such as superior flexibility, dependable connection, lightweight, and the utilization of less space, the product is highly chosen for a variety of electronic devices. As a result, fast growth in the electronic industry is expected to fuel product demand.

Global Flat Flexible Cables Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 1.13 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 11.27% |

| 2032 Value Projection: | USD 3.28 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Copper Wire Thickness, By Copper Wire Width, By End-Use Applications, By Region and COVID-19 Impact Analysis. |

| Companies covered:: | AUK, Samtec, Molex, GCT, Axon Cable, Adam Tech, Würth Elektronik, Quadrangle Products, Alysium-Tech GmbH, Johnson Electric Holdings Ltd., Proterial Cable America, Inc., SUMIDA CORPORATION, O-Flexx Technologies, Hitachi Cable America Inc., Shin-Etsu Polymer Co., Ltd., BizLink Technology, Parlex Corporation, and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The booming expansion of downstream industries such as automobiles, aviation, oil and gas, industrial displays, and the communications sector around the world is likely credited to the prominence of the flat flexible cable industry. In addition, because of their great advantages over traditional counterparts such as circular cables, flat flexible cables are becoming more popular in the transportation business. The product is widely utilized in automobile electronic equipment such as cameras, LCD panels, and navigation systems. The transportation sector is expanding as a result of population growth and increasing incomes per person, both factors are driving up demand for vehicles. The market for specialized and luxury vehicles is also increasing due to shifting consumer choices and interests. As a result, increased vehicle manufacturing throughout the transportation industry will increase the need for electronic equipment, boosting the expansion of the flat flexible cables market.

The continuous development of downsizing in electronic gadgets is a major driving factor for the flat flexible cable market. Traditional wire harnesses and rigid connectors are often unworkable as gadgets become smaller and more lightweight. Flat flexible wires are extremely bendable and can be bent, folded, or twisted without affecting electrical performance. This adaptability facilitates the assimilation and fabrication of complex electrical systems. FFCs are suitable for applications that require steady and uninterrupted performance due to their dependability. Additionally, the development of 5G networks and rising demand for high-speed data transfer create prospects for the flat flexible cable market. FFCs may achieve these standards and enable reliable data transmission in 5G infrastructure, data centers, and telecom equipment because of their outstanding signal integrity and low interference. Furthermore, continuous advances in flat flexible cable technology help to drive market development and growth. Manufacturers are concentrating on boosting the performance as well as durability of the flat flexible cable by combining creative design techniques, leveraging modern materials, and upgrading their production methods.

Market Segmentation

By Copper Wire Thickness Insights

The 50 to 100 microns segment is dominating the market with the largest revenue share over the forecast period.

On the basis of copper wire thickness, the global flat flexible cables market is segmented into the less than 35 microns, 35 to 50 microns, 50 to 100 microns, and more than 100 microns. Among these, the 50 to 100 microns segment is dominating the market with the largest revenue share of 53.6% over the forecast period. Because of their strength and longevity, copper cables with a thickness of 50 to 100 microns are increasingly being used in automotive, aerospace, military, and industrial applications. Given their significant use in these cars, the growing global adoption of electric vehicles is predicted to boost demand for flat flexible cables with a copper wire thickness of 50 to 100 microns. The increasing global deployment of industrial robots for operational efficiency is also driving up demand for these segment types.

By Copper Wire Width Insights

The 3 mm <= segment is expected to hold the largest share of the Global Flat Flexible Cables Market during the forecast period.

Based on the copper wire width, the global flat flexible cables market is classified into <= 1 mm, 1 to 3 mm, and 3 mm <=. Among these, the 3 mm <= segment is expected to hold the largest share of the flat flexible cables market during the forecast period. Flat flexible cables with the above-mentioned width are utilized less frequently than cables with varied copper wire widths due to the expanding manufacture of compact consumer goods equipment for comfort and the growing nanotechnology drive in the electronic industry. Nonetheless, as the machines employed in these industries are heavy and large, this product is utilized in sectors such as automotive, aerospace, and industrial. As such, the width of the cable no longer interferes with the operation of the equipment. As a result, the expansion of the aforementioned industries is likely to drive demand for flat flexible cables with copper wire widths larger than or equal to 3 mm in the future years.

By End-Use Applications Insights

The consumer electronics segment accounted for the largest revenue share of more than 27.3% over the forecast period.

On the basis of end-use applications, the global flat flexible cables market is segmented into consumer electronics, industrial systems, medical devices, automotive, IT equipment, telecommunications, household equipment, aerospace & defense electronics, and others. Among these, the consumer electronics segment is dominating the market with the largest revenue share of 27.3% over the forecast period. Rising purchasing power, higher standard of living, and fast modernization in various established and emerging nations are predicted to fuel the consumer electronics sector, and therefore market for flat flexible cables over the forecast period. The product is flat, it occupies less room, and it is lightweight, contributing to the overall weight of the end items. The increasing demand for such electronic items in Asian countries is likely to drive the market for flat flexible cables even higher throughout the forecast period.

Regional Insights

North America dominates the market with the largest market share over the forecast period.

Get more details on this report -

North America is dominating the market with more than 38.7% market share over the forecast period. North America has a major flat flexible cables market, owing to the existence of numerous key industries such as consumer electronics, automobiles, aviation, and healthcare. Furthermore, the region is well-known for its rapid adoption of cutting-edge technologies and groundbreaking products. Flat flexible cables are widely used in smartphones, tablets, laptops, and other consumer electronics products, which contributes to market growth. The United States is a major market in North America. Additionally, the automotive industry's emphasis on advanced driver assistance systems (ADAS) and in-vehicle connection drives up demand for flat flexible cables in North America.

Asia Pacific, on the contrary, is expected to grow the fastest during the forecast period. The Asia Pacific region is the largest electronics manufacturing hub, and it has developed as a substantial market for flat flexible cables as well. The substantial number of large consumer electronics manufacturers in Asia Pacific, such as smartphone and home appliance manufacturers, stimulates demand for flat flexible cables. The region is also seeing a surge in demand for flat flexible cables in automotive applications, as a result of the rise of electric vehicles and improved multimedia systems.

The Europe market is expected to register a substantial CAGR growth rate during the forecast period. Europe is a further noteworthy market for flat flexible cables, with business sectors such as automotive, aerospace, and industrial automation driving demand. Being that Europe is home to renowned automobile producers and distributors, the automotive sector, in particular, plays a critical role in the need for flat flexible cables.

List of Key Market Players

- AUK

- Samtec

- Molex

- GCT

- Axon Cable

- Adam Tech

- Würth Elektronik

- Quadrangle Products

- Alysium-Tech GmbH

- Johnson Electric Holdings Ltd.

- Proterial Cable America, Inc.

- SUMIDA CORPORATION

- O-Flexx Technologies

- Hitachi Cable America Inc.

- Shin-Etsu Polymer Co., Ltd.

- BizLink Technology

- Parlex Corporation

Key Market Developments

- On August 2023, Nortech Systems Incorporated has received a patent for its Flex Faraday XtremeTM, a flexible printed circuit that transmits high-frequency signals while precisely controlling both crosstalk and impedance, minimizing electromagnetic interference, improving parallel transmission alignment, and increasing data density. Nortech's FFX intelligent transmission lines offer advantages over typical micro coax cables in demanding applications.

- In March 2022, Nicomatic introduced Flat Flexible Cables for Space, a new product line designed for use in spacecraft. The novel flat flexible cable technology enables lighter, more flexible interconnects in satellites and spacecraft in low earth orbit, geosynchronous orbit, and beyond. Flat Flexible Cables for Space manufactured by Nicomatic have already been utilized in satellites, solar arrays, communications, cameras, radar, and simulator equipment in both manned and unmanned systems.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2032. Spherical Insights has segmented the Global Flat Flexible Cables Market based on the below-mentioned segments:

Flat Flexible Cables Market, Copper Wire Thickness Analysis

- Less than 35 Microns

- 35 to 50 Microns

- 50 to 100 Microns

- more than 100 Microns

Flat Flexible Cables Market, Copper Wire Width Analysis

- <= 1 mm

- 1 to 3 mm

- 3 mm <=

Flat Flexible Cables Market, End-Use Applications Analysis

- Consumer Electronics

- Industrial Systems

- Medical Devices

- Automotive

- IT Equipment

- Telecommunications

- Household Equipment

- Aerospace & Defense Electronics

- Others

Flat Flexible Cables Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Need help to buy this report?