Global Flex LED Strip Lights Market Size, Share, and COVID-19 Impact Analysis, By Type (5050 LED Light Strips, 3528 LED Light Strips), By Application (High-Voltage LED Strip Lights, Low-Voltage LED Strip Lights), By End-Use (Commercial, Residential), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

Industry: Automotive & TransportationGlobal Flex LED Strip Lights Market Insights Forecasts to 2033

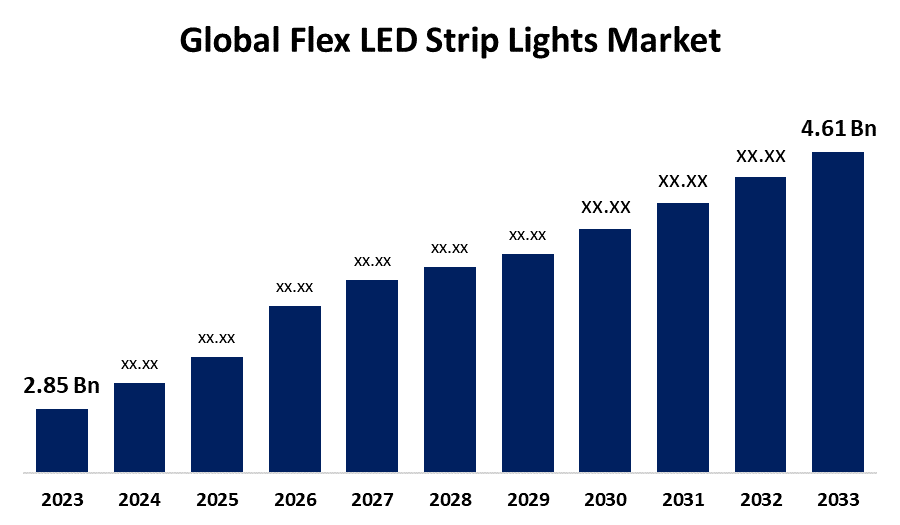

- The Global Flex LED Strip Lights Market Size Was Valued at USD 2.85 Billion in 2023

- The Market Size is Growing at a CAGR of 4.93% from 2023 to 2033

- The Worldwide Flex LED Strip Lights Market Size is Expected to Reach USD 4.61 Billion by 2033

- North America is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Flex LED Strip Lights Market Size is Anticipated to Exceed USD 4.61 Billion by 2033, Growing at a CAGR of 4.93% from 2023 to 2033.

Market Overview

LED strip lights, also called flexible LED strips are lights that can be used in a wide variety of environments, including indoor and outdoor spaces LED strip lights are strips of flexible circuit boards that contain many small LED lights. They typically come in the form of light rolls, which can then be cut to size and attached with a double-sided adhesive. These lighting strips come in a wide range of colors and brightness, and because of the specific application of the light, an individual can easily create lighting effects and displays with one or more rolls of LED strip lighting. These lights are considered to be a simple, inexpensive, and eco-friendly way to custom-light a home or business. LEDs are one of the most efficient light sources on the market, providing up to 50,000 hours of light, or six years of continuous use. As per the data provided by the Department of Energy By 2035, energy savings from LEDs could exceed 569 TWh per year, which is equivalent to more than 921,000 megawatts of power plants in the United States each year.

Report Coverage

This research report categorizes the market for the global flex LED strip lights market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global flex LED strip lights market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global flex LED strip lights market.

Global Flex LED Strip Lights Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 2.85 Billion |

| Forecast Period: | 2023 – 2033 |

| Forecast Period CAGR 2023 – 2033 : | 4.93% |

| 023 – 2033 Value Projection: | USD 4.61 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 225 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Application, By End-Use, By Region |

| Companies covered:: | General Electric Company, Nexlux, HitLights, EnvironmentalLights.com, Foshan Lighting, OSRAM, Eaton Corporation, Environmental Lights, SIRS-E, LEONLITE, Superbrightleds.com, LEDwholesalers, LEDVANCE, LIFX, InStyle LED, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Several factors will contribute to the expansion of the flex LED strip lights market across the globe. These lights are extremely durable and can last up to 100,000 hours compared to fluorescent bulbs. LED strip lights are more energy efficient than other forms of lightning. LED neon flex lights require less maintenance, and no gas refilling, tubing, or glass upkeep. LED strip lights are safer than traditional lighting because they produce less heat and require less energy, reducing the risk of fire. LED strip lights can be installed anywhere, even on a circular surface, and are easy to install.

Restraining Factors

The initial cost of LED light strips is more than traditional lighting options such as incandescent or fluorescent lighting. Additionally, LED lights require specialized technology and materials to manufacture, making them more expensive to manufacture. High ambient temperature, voltage fluctuations, and constant on/off cycling can have an impact on the life of LED lighting strips.

Market Segmentation

The global flex LED strip lights market share is classified into product, application, and end-use.

- The 5050 LED light strips segment is expected to hold the largest share of the global flex LED strip lights market during the forecast period.

Based on the type, the global flex LED strip lights market is divided into 5050 LED light strips and 3528 LED light strips. Among these, the 5050 LED light strips segment is expected to hold the largest share of the global flex LED strip lights market during the forecast period. 5050 LED light strips are known for their excellent brightness and adaptability, as more LED chips can be installed per meter than 3258 light strips. This makes it perfect for a variety of applications, such as commercial lighting, outdoor installations, and decorative applications that require more illumination. The growing need for energy-efficient and flexible lighting solutions in residential and commercial environments is driving the expansion of the range of 5050 LED light strips.

- The low-voltage LED strip lights segment is expected to grow at the fastest CAGR in the global flex LED strip lights market during the forecast period.

Based on the application, the global flex LED strip lights market is divided into high-voltage LED strip lights, and low-voltage LED strip lights. Among these, the low-voltage LED strip lights segment is expected to grow at the fastest CAGR in the global flex LED strip lights market during the forecast period. Low-voltage LED strip lights are preferred due to ease of installation, safety, and energy efficiency. Usually, they operate at 12V or 24V. These lights are used in low-voltage applications in residential and commercial automotive environments. Also, low-wattage LEDs are versatile for use in a variety of environments, such as outdoor furniture, under-cabinet lighting, and accent lighting.

- The residential segment is expected to grow at the fastest CAGR in the global flex LED strip lights market during the forecast period.

Based on the end-use, the global flex LED strip lights market is divided into commercial and residential. Among these, the residential segment is expected to grow at the fastest CAGR in the global flex LED strip lights market during the forecast period. This increase is driven by the growing popularity of LED strip lighting for home design, ambient lighting, and the rise of DIY projects. Homeowners are looking for energy-efficient, customized, and visually appealing lighting solutions to dramatically improve their living spaces. The rise of smart home technology which integrates LED strip lights for mood lighting and automation, is also contributing to the growth of this segment.

Regional Segment Analysis of the Global Flex LED Strip Lights Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

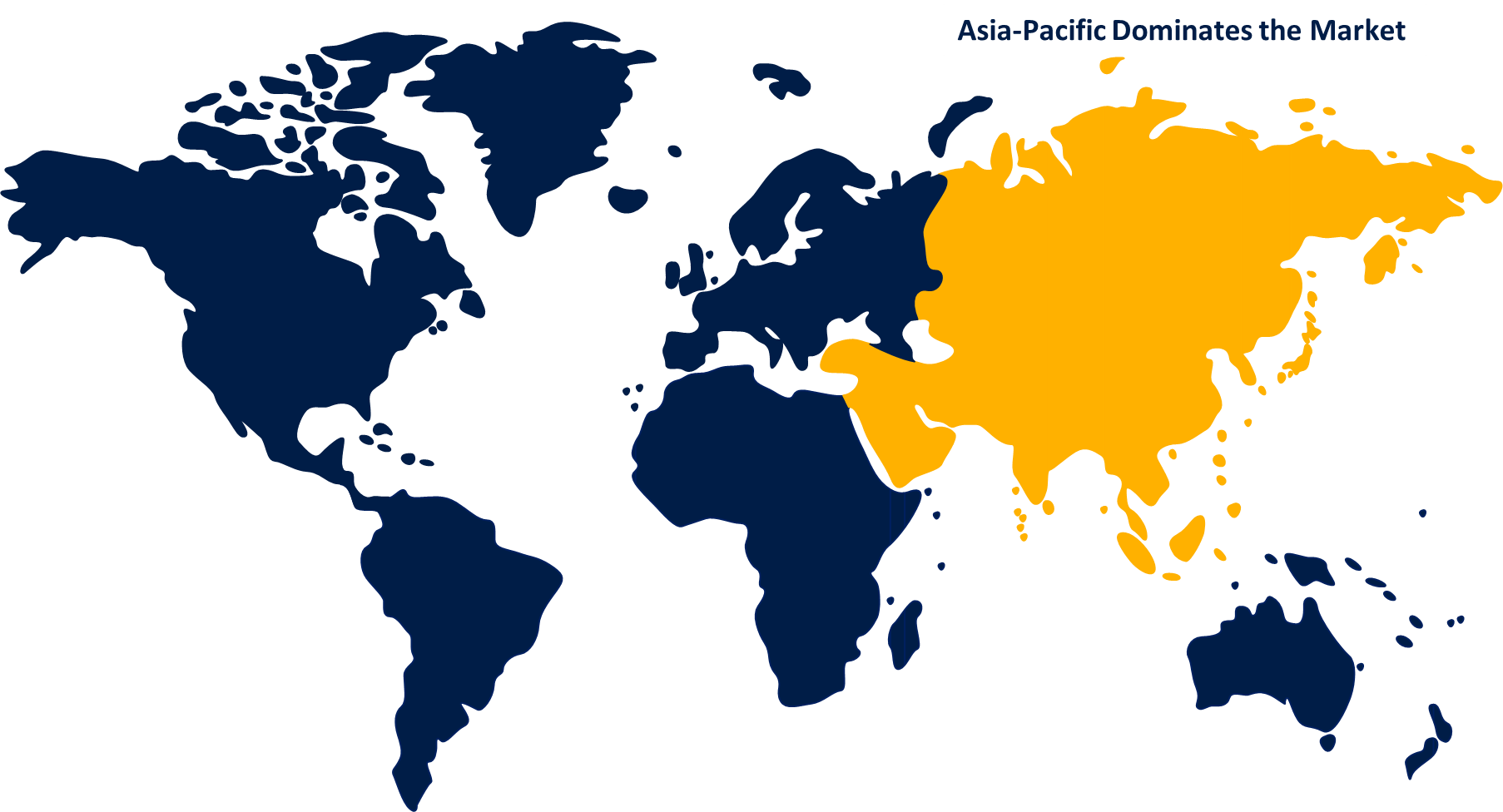

Asia Pacific is anticipated to hold the largest share of the global flex LED strip lights market over the predicted timeframe.

Get more details on this report -

Asia Pacific is anticipated to hold the largest share of the global flex LED strip lights market over the predicted timeframe. This dominance is driven by high regional manufacturing, especially in China, which is an important producer of LED products and lighting products Rapid urbanization and industrial growth in Asia-Pacific, and the rising demand for energy-efficient lighting solutions in both residential and commercial sectors are some key drivers for the rising market share. Moreover, the increasing use of LED lighting in smart cities, coupled with government initiatives promoting energy conservation, is increasing the need for flexible LED lighting strips in the region

North America is expected to grow at the fastest pace in the global flex LED strip lights market during the forecast period. This growth is due to the increasing use of smart home technologies, such as LED strip lighting, which play an important role in improving home aesthetics and energy efficiency. The growing trend towards energy conservation, and replacing traditional lighting with efficient LED devices are important factors driving the market growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global flex LED strip lights market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- General Electric Company

- Nexlux

- HitLights

- EnvironmentalLights.com

- Foshan Lighting

- OSRAM

- Eaton Corporation

- Environmental Lights

- SIRS-E

- LEONLITE

- Superbrightleds.com

- LEDwholesalers

- LEDVANCE

- LIFX

- InStyle LED

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In April 2024, Lepro, a pioneer in AI lighting innovation, proudly introduced the LightGPM technology, a first-of-its-kind Generative Pretrain Model for Lighting for their innovative product Lepro S1 LED Strip Lights.

- In July 2023, Govee, a smart lighting and smart home pioneer unveiled the Gaming Light Strip G1, the industry's first PC color-matching light strip designed to give a fully immersive gaming experience.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global flex LED strip lights market based on the below-mentioned segments:

Global Flex LED Strip Lights Market, By Type

- 5050 LED Light Strips

- 3528 LED Light Strips

Global Flex LED Strip Lights Market, By Application

- High-Voltage LED Strip Lights

- Low-Voltage LED Strip Lights

Global Flex LED Strip Lights Market, By End-Use

- Commercial

- Residential

Global Flex LED Strip Lights Market, Regional

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1.Which are the key companies that are currently operating within the market?General Electric Company, Nexlux, HitLights, EnvironmentalLights.com, Foshan Lighting, OSRAM, Eaton Corporation, Environmental Lights, SIRS-E, LEONLITE, Superbrightleds.com, LEDwholesalers, LEDVANCE, LIFX, InStyle LED, and Others.

-

2.What is the size of the global Flex LED Strip Lights market?The Global Flex LED Strip Lights Market is expected to grow from USD 2.85 Billion in 2023 to USD 4.61 Billion by 2033, at a CAGR of 4.93% during the forecast period 2023-2033.

-

3.Which region is holding the largest share of the market?Asia Pacific is anticipated to hold the largest share of the global flex LED strip lights market over the predicted timeframe.

Need help to buy this report?