Global Flexible Workspace Market Size, Share, and COVID-19 Impact Analysis, By Type (Collaborative, Serviced Office, Workspace, Manufacturing Space, Virtual Office, Others), By Organization (Small & Medium Enterprises, Large Enterprises), By End User (Automotive, BFSI, Real Estate, Retail, IT & Telecommunication, Others), By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 – 2032.

Industry: Electronics, ICT & MediaGlobal Flexible Workspace Market Insights Forecasts to 2032

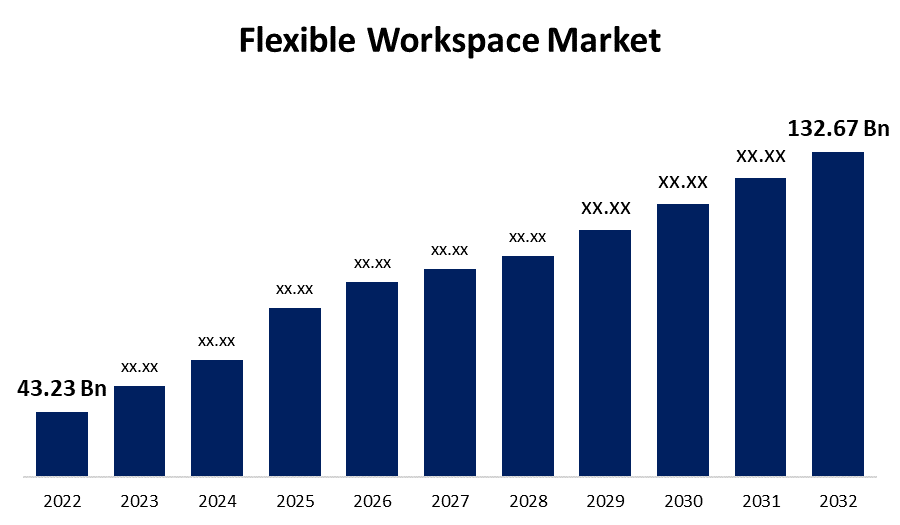

- The Global Flexible Workspace Market Size was valued at USD 43.23 Billion in 2022.

- The Market is growing at a CAGR of 11.87% from 2022 to 2032.

- The Worldwide Flexible Workspace Market is expected to reach USD 132.67 Billion by 2032.

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

The Flexible workspace Market Size is expected to grow from USD 43.23 Billion in 2022 to USD 132.67 Billion by 2032, at a CAGR of 11.87% during the forecast period 2022-2032.

Market Overview

A flexible workplace is additionally referred to as a flexible office space or flexispace. It is related to an office space that includes numerous unique desk arrangements designed to give a dynamic workspace with minimal set-up time and no set-up expenses. These workspaces are completely outfitted with necessary office equipment such as desks, chairs, laptops, and the Internet to boost workers' mobility and flexibility. It also gives employees a choice of different spaces and ways to work, combining classic office with current technology.

The increasing adoption of remote work culture, the rising need for flexible and cost-effective office solutions, and the expanding trend of co-working spaces are all driving market expansion. Furthermore, the market is growing as a result of an increasing number of small businesses and startups seeking temporary office solutions, as well as the government's increasingly beneficial regulations that encourage startups. If the company is developing and has a lot of part-time employees or adopting alternative work rules like hot-desking, and hoteling, in addition to including common areas and multi-use furniture, this can maximize spatial efficiency and decrease expenses. Collaborative Workspace, Serviced Offices, Manufacturing Spaces, and Virtual Offices are instances of flexible workplaces.

Global Flexible Workspace Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 43.23 Bn |

| Forecast Period: | 2022 – 2032 |

| Forecast Period CAGR 2022 – 2032 : | 11.87% |

| 022 – 2032 Value Projection: | USD 132.67 Bn |

| Historical Data for: | 2020-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 150 |

| Segments covered: | By Type, By Organization, By End User, By Region. |

| Companies covered:: | WeWork, Workspace, Awfis, SMARTWORKS, BizSpace, Servcorp, IWG, Garage Society, The Great Room, Pacific Workplaces, and Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

A surge in commercial flexible workspaces, expansion strategies of small, medium, and large enterprises, the evolving corporate landscape around the world, surging strategic alliances, and increasing penetration of technology and digital platforms in several countries are the major factors driving the growth of the global flexible workspace market. For instance, a Belgian company reached a franchise agreement with the Adams Group in Australia to open ten new co-working spaces under the Regus label. The surge in self-employment, with freelancing industry growth gaining momentum in recent years, is expected to increase the market's scope. Furthermore, a significant amount of demand for flexible offices from large multinational organizations is likely to have a significant impact on market expansion over the projection period. Apparently, business firms are looking for flexible premises and are attempting to rent out flexible areas.

Restraining Factor

Compressed work weeks that result in unavailability of services to clients, staff perceptions of unfairness, and other such factors might hinder the market's growth. However, there is a downside to the market. Flexible workplaces do not guarantee data security because there are no such safeguards in place. In addition to a lack of data protection, significant operational costs reduce profit margin. Because such a workplace is available to people of many cultures, there is a chance that a risk-averse culture will penetrate, resulting in a cultural conflict.

COVID-19 Impact Analysis

During the COVID-19 pandemic outbreak in 2020, a dramatic decrease in the global economy has been detected. The cost of raw materials has risen, labor has become scarce, and many companies' production facilities have shut down. Because of these characteristics, a wide range of organizations are shifting towards flexible workspace design. The COVID-19 epidemic is projected to have a beneficial impact on the worldwide flexible workspace market's growth rate shortly, as many new entrants and consumers are utilizing these creative workplace designs.

Market Segmentation

By Type Insight

The collaborative segment is expected to hold the largest share of the flexible workspace market during the forecast period.

On the basis of type segment, the flexible workspace market is classified into collaborative, serviced office, workspace, manufacturing space, virtual office, and others. Among these, the collaborative segment is anticipated to grow at rapid pace during the forecast period. The increased emphasis on a collaborative workplace, as well as increased funding and investment in new businesses working to provide collaborative workspace at reasonable pricing, are credited to the segmental expansion.

By Organization Insight

The small & medium enterprises segment is anticipated to grow at the fastest pace during the forecast period.

On the basis of organization, the flexible workspace market is classified into small & medium enterprises, large enterprises. Among these, the small & medium enterprises segment is anticipated to grow at the fastest pace during the forecast period, as a result of the growing number of startups and SMEs that just require a few staff to operate. The major drivers include increasing fast-track digital data and gaining insight into user behavior, which encourages market development.

By End User Insight

The IT & telecommunication segment is expected to hold the highest share of the flexible workspace market during the forecast period.

On the basis of end user segment, the flexible workspace market is sub-segmented into automotive, BFSI, real estate, retail, IT & telecommunication, others. Among these, the IT & telecommunication segment is anticipated to have the largest market share during the forecast period, due to the huge need for such office space options, an assortment of small service providers have developed, advertising their products through free web channels and serving local customers.

By Region Insight

North America dominates the flexible workspace market with the largest market share throughout the forecast period.

Get more details on this report -

North America dominates the largest market share over the forecast period. Organizations in North American countries such as the United States and Canada have increasingly adopted flexible workspaces. Because of the pandemic, several businesses have abandoned traditional workplaces entirely. Because of the ease of management that this model provides, many corporations are migrating to flexible workspaces.

The Asia Pacific flexible workspace market is expected to grow fastest during the forecast period, due to the growing number of small enterprises and freelancers in this region, as well as the increase in workspace providers. A surge in co-working by many firms, the adoption of open workplaces, an increase in the number of startups and small businesses, and the application of smart office designs are among the major growth factors.

List of Key Market Players

- WeWork

- Workspace

- Awfis

- SMARTWORKS

- BizSpace

- Servcorp

- IWG

- Garage Society

- The Great Room

- Pacific Workplaces

Key Market Developments

- On June 2021, 91Springboard, India's pioneering coworking community, collaborates with Google for Startups (GfS) to launch 'Startup Sprint,' a virtual program that enables startups and entrepreneurs across India to scale up and expand their businesses online by teaching them modern digital business tools.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2022 to 2032. Spherical Insights has segmented the flexible workspace market based on the below-mentioned segments:

Flexible Workspace Market, Type Analysis

- Collaborative

- Serviced Office

- Workspace

- Manufacturing Space

- Virtual Office

- Others

Flexible Workspace Market, Organization Analysis

- Small & Medium Enterprises

- Large Enterprises

Flexible Workspace Market, End User Analysis

- Automotive

- BFSI

- Real estate

- Retail

- IT & Telecommunication

- Others

Flexible Workspace Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- Rest of Middle East & Africa

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Need help to buy this report?